Question

Please include the explanations . Thank you. 1) Scavenger Company, a manufacturer of recycling bins, began operations on January 1 of the current year. During

Please include the explanations. Thank you.

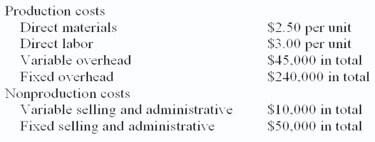

1) Scavenger Company, a manufacturer of recycling bins, began operations on January 1 of the current year. During this time, the company produced 60,000 units and sold 55,000 units at a sales price of $15 per unit. Cost information for this year is shown in the following table:  Given the Scavenger Company data, what is net income using absorption costing?

Given the Scavenger Company data, what is net income using absorption costing?

a. $201,250

b. $181,250

c. $150,000

d. $177,600

e. $276,250

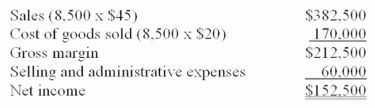

2) Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the company produced 10,000 leaf blowers and sold 8,500. At year-end the company reported the following income statement using absorption costing:  Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

a. $146,500

b. $158,500

c. $237,500

d. $206,500

e. $246,500

3) Fomtech, Inc. had net income of $750,000 based on variable costing. Beginning and ending inventories were 50,000 units and 48,000 units, respectively. Assume the fixed overhead per unit was $.75 for both the beginning and ending inventory. What is net income under absorption costing?

a. $751,500

b. $676,500

c. $823,500

d. $748,500

e. $750,000

Production costs Direct materials Direct labor Variable overhead Fixed overhead $2.50 per unit S3.00 per unit $45.000 in total $240.000 in total Nonproduction costs Variable selling and administrative Fixed selling and administrative S10,000 in total $50,000 in totalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started