Please include the step by step explanation.

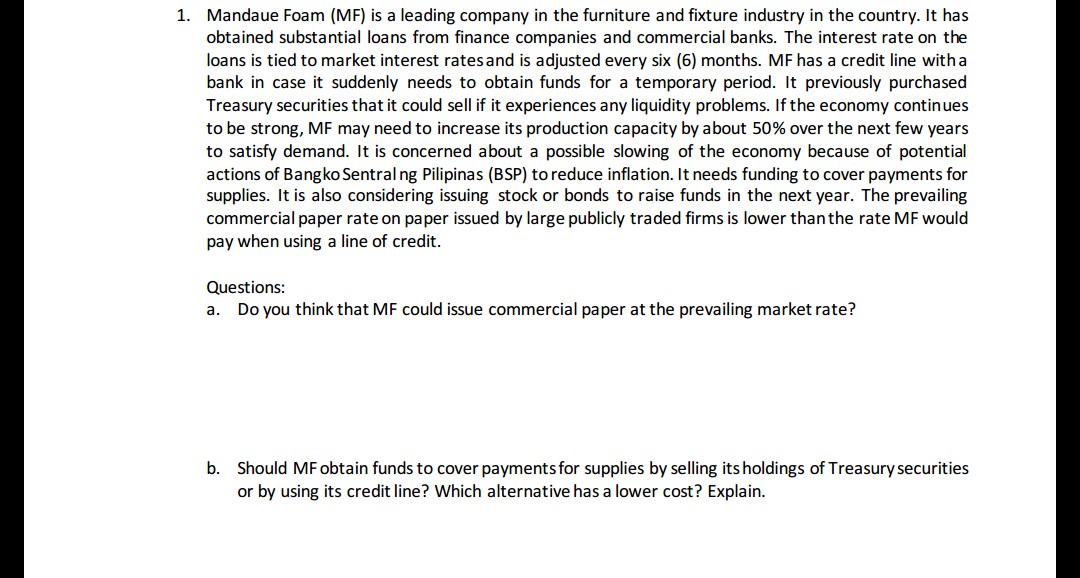

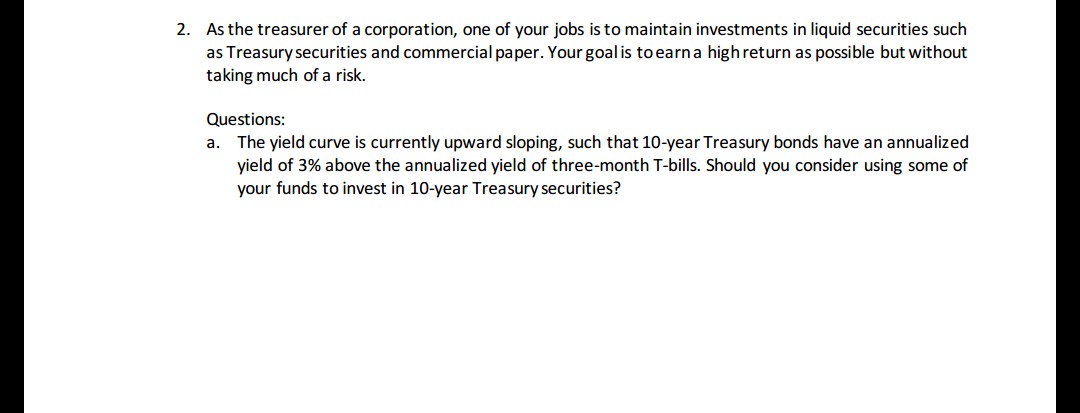

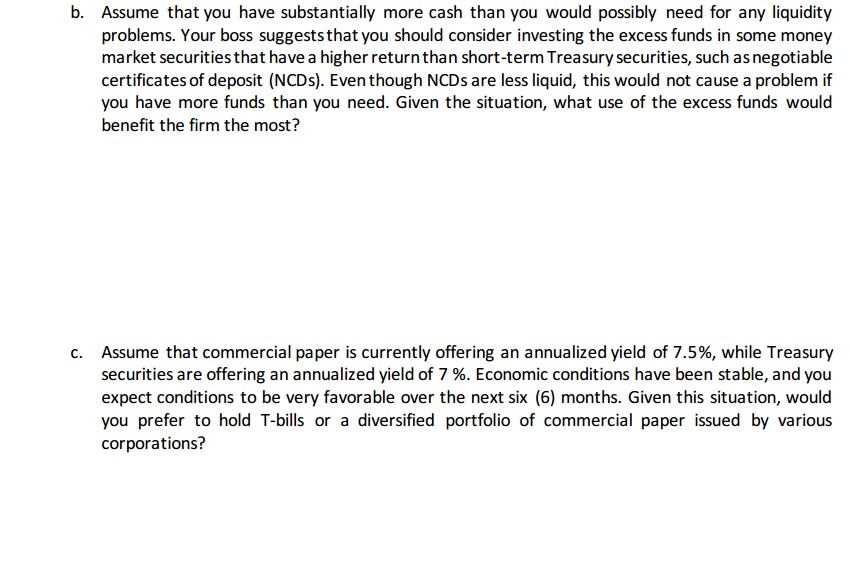

1. Mandaue Foam (MF) is a leading company in the furniture and fixture industry in the country. It has obtained substantial loans from finance companies and commercial banks. The interest rate on the loans is tied to market interest rates and is adjusted every six (6) months. MF has a credit line with a bank in case it suddenly needs to obtain funds for a temporary period. It previously purchased Treasury securities that it could sell if it experiences any liquidity problems. If the economy continues to be strong, MF may need to increase its production capacity by about 50% over the next few years to satisfy demand. It is concerned about a possible slowing of the economy because of potential actions of Bangko Sentral ng Pilipinas (BSP) to reduce inflation. It needs funding to cover payments for supplies. It is also considering issuing stock or bonds to raise funds in the next year. The prevailing commercial paper rate on paper issued by large publicly traded firms is lower than the rate MF would pay when using a line of credit. Questions: a. Do you think that MF could issue commercial paper at the prevailing market rate? b. Should MF obtain funds to cover payments for supplies by selling its holdings of Treasury securities or by using its credit line? Which alternative has a lower cost? Explain.2. As the treasurer of a corporation, one of your jobs is to maintain investments in liquid securities such as Treasury securities and commercial paper. Your goal is to earn a high return as possible but without taking much of a risk. Questions: a. The yield curve is currently upward sloping, such that 10-year Treasury bonds have an annualized yield of 3% above the annualized yield of three-month T-bills. Should you consider using some of your funds to invest in 10-year Treasury securities?b. Assume that you have substantially more cash than you would possibly need for any liquidity problems. Your boss suggests that you should consider investing the excess funds in some money market securities that have a higher return than short-term Treasury securities, such as negotiable certificates of deposit (NCDs). Even though NCDs are less liquid, this would not cause a problem if you have more funds than you need. Given the situation, what use of the excess funds would benefit the firm the most? c. Assume that commercial paper is currently offering an annualized yield of 7.5%, while Treasury securities are offering an annualized yield of 7 %. Economic conditions have been stable, and you expect conditions to be very favorable over the next six (6) months. Given this situation, would you prefer to hold T-bills or a diversified portfolio of commercial paper issued by various corporations