Answered step by step

Verified Expert Solution

Question

1 Approved Answer

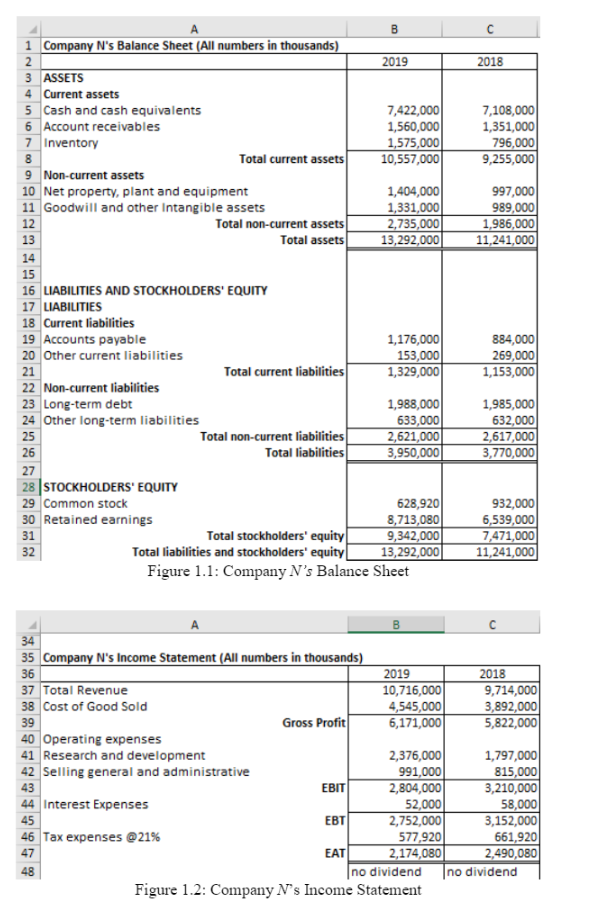

Please indicate the workings and formulas step by step for proper flow of presentation of answers. Thank You. B 2018 7,108,000 1,351,000 796,000 9,255,000 997,000

Please indicate the workings and formulas step by step for proper flow of presentation of answers. Thank You.

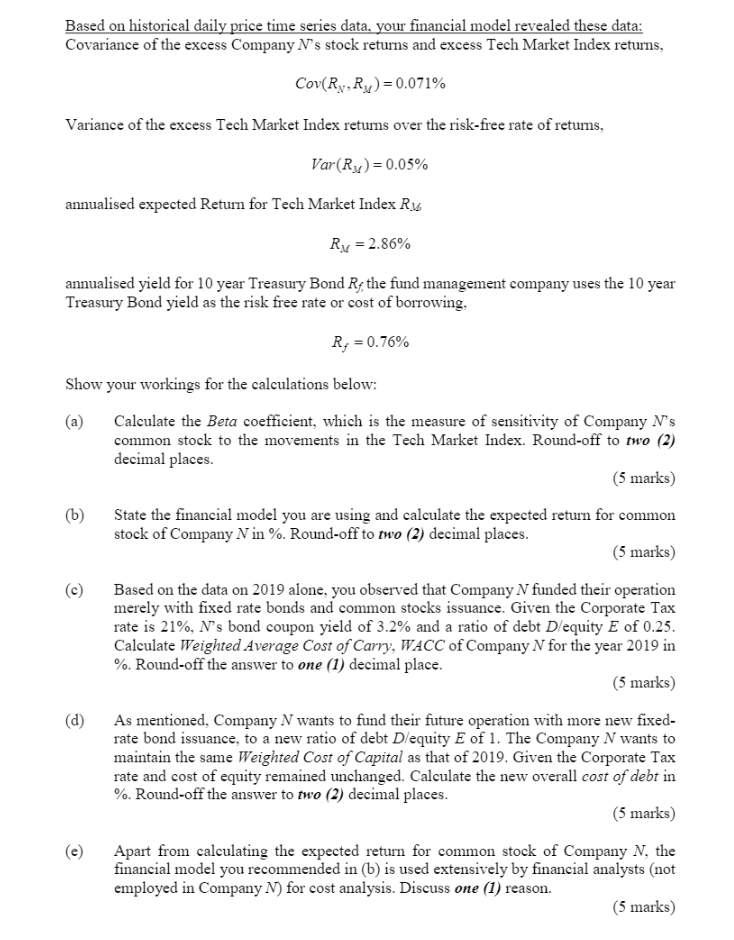

B 2018 7,108,000 1,351,000 796,000 9,255,000 997,000 989,000 1,986,000 11,241,000 1 Company N's Balance Sheet (All numbers in thousands) 2 2019 3 ASSETS 4 Current assets 5 Cash and cash equivalents 7,422,000 6 Account receivables 1,560,000 7 Inventory 1,575,000 8 Total current assets 10,557,000 9 Non-current assets 10 Net property, plant and equipment 1,404,000 11 Goodwill and other Intangible assets 1,331,000 12 Total non-current assets 2,735,000 13 Total assets 13,292,000 14 15 16 LIABILITIES AND STOCKHOLDERS' EQUITY 17 LIABILITIES 18 Current liabilities 19 Accounts payable 1,176,000 20 Other current liabilities 153,000 21 Total current liabilities 1,329,000 22 Non-current liabilities 23 Long-term debt 1,988,000 24 Other long-term liabilities 633,000 25 Total non-current liabilities 2,621,000 26 Total liabilities 3,950,000 27 28 STOCKHOLDERS' EQUITY 29 Common stock 628,9201 30 Retained earnings 8,713,080 31 Total stockholders' equity 9,342,000 32 Total liabilities and stockholders' equity 13,292,000 Figure 1.1: Company N's Balance Sheet 884,000 269,000 1,153,000 1,985,000 632,000 2,617,000 3,770,000 932,000 6,539,000 7,471,000 11,241,000 34 35 Company N's Income Statement (All numbers in thousands) 36 2019 2018 37 Total Revenue 10,716,000 9,714,000 38 Cost of Good Sold 4,545,000 3,892,000 39 Gross Profit 6,171,000 5,822,000 40 Operating expenses 41 Research and development 2,376,000 1,797,000 42 Selling general and administrative 991,000 815,000 43 EBIT 2,804,000 3,210,000 44 Interest Expenses 52,000 58,000 45 EBT 2,752,000 3,152,000 46 Tax expenses @21% 577,920 661,920 47 EAT 2,174,080 2,490,080 48 no dividend no dividend Figure 1.2: Company N's Income Statement Based on historical daily price time series data, your financial model revealed these data: Covariance of the excess Company N's stock returns and excess Tech Market Index returns, Cov(Ry, Ry)=0.071% Variance of the excess Tech Market Index retums over the risk-free rate of retums, Var(Rx)=0.05% annualised expected Return for Tech Market Index Ry Ry = 2.86% annualised yield for 10 year Treasury Bond Rf the fund management company uses the 10 year Treasury Bond yield as the risk free rate or cost of borrowing, R; = 0.76% Show your workings for the calculations below: (a) Calculate the Beta coefficient, which is the measure of sensitivity of Company N's common stock to the movements in the Tech Market Index. Round-off to two (2) decimal places. (5 marks) (b) State the financial model you are using and calculate the expected return for common stock of Company N in %. Round-off to two (2) decimal places. (5 marks) (c) Based on the data on 2019 alone, you observed that Company N funded their operation merely with fixed rate bonds and common stocks issuance. Given the Corporate Tax rate is 21%, N's bond coupon yield of 3.2% and a ratio of debt Dlequity E of 0.25. Calculate Weighted Average Cost of Carry, WACC of Company N for the year 2019 in %. Round-off the answer to one (1) decimal place. (5 marks) (d) As mentioned, Company N wants to fund their future operation with more new fixed- rate bond issuance, to a new ratio of debt D/equity E of 1. The Company N wants to maintain the same Weighted Cost of Capital as that of 2019. Given the Corporate Tax rate and cost of equity remained unchanged. Calculate the new overall cost of debt in %. Round-off the answer to two (2) decimal places. (5 marks) Apart from calculating the expected return for common stock of Company N, the financial model you recommended in (b) is used extensively by financial analysts (not employed in Company N) for cost analysis. Discuss one (1) reason

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started