Answered step by step

Verified Expert Solution

Question

1 Approved Answer

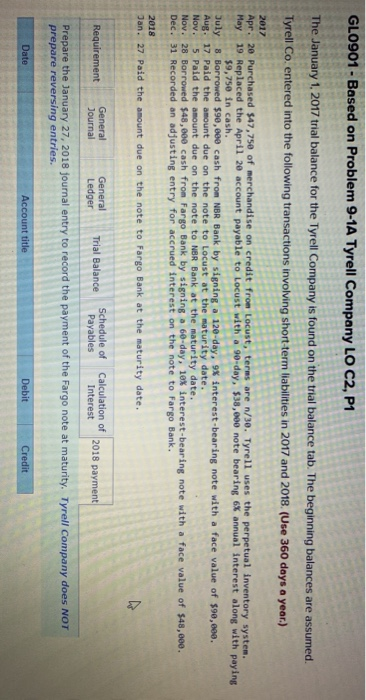

please indicate which company on the aacount payable.... thank you in advance. GL0901 - Based on Problem 9-1A Tyrell Company LO C2, P1 The January

please indicate which company on the aacount payable.... thank you in advance.

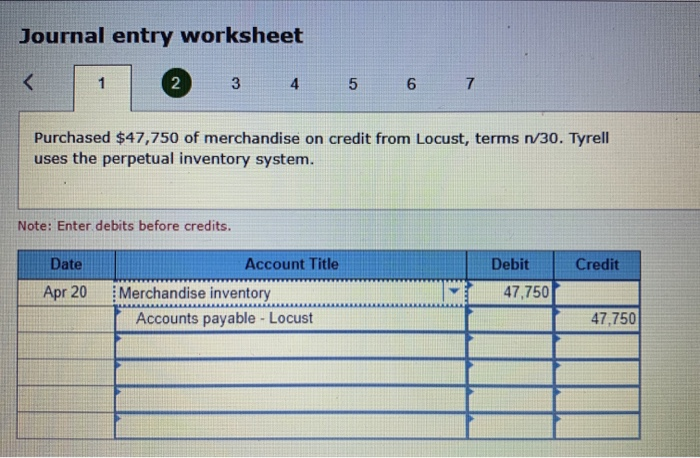

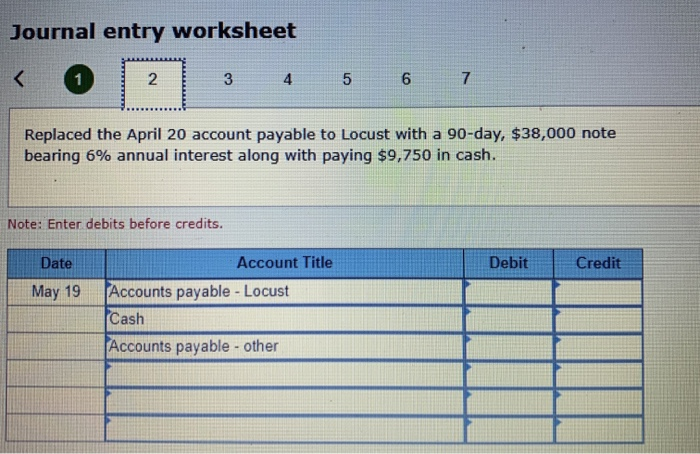

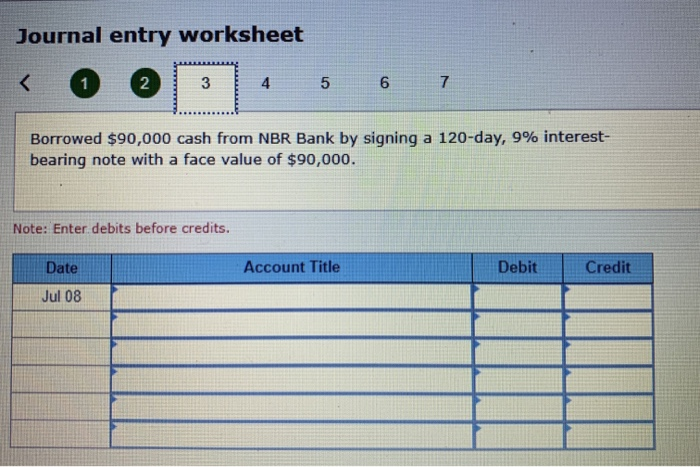

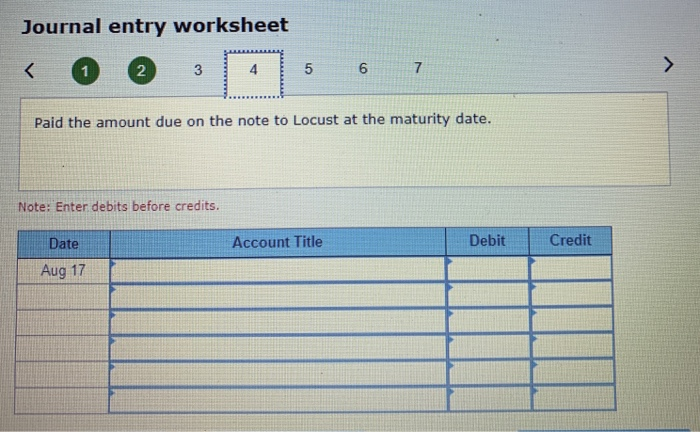

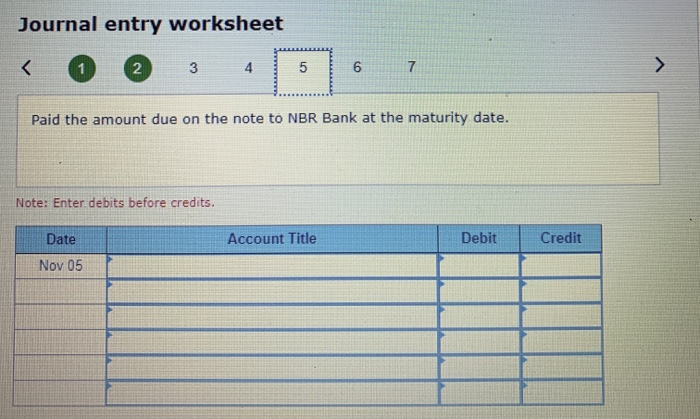

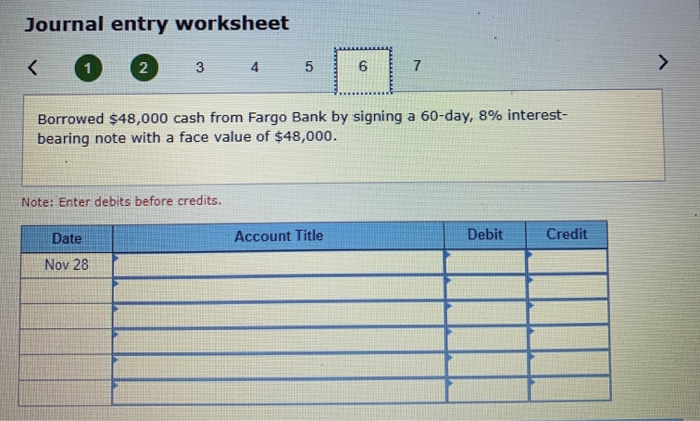

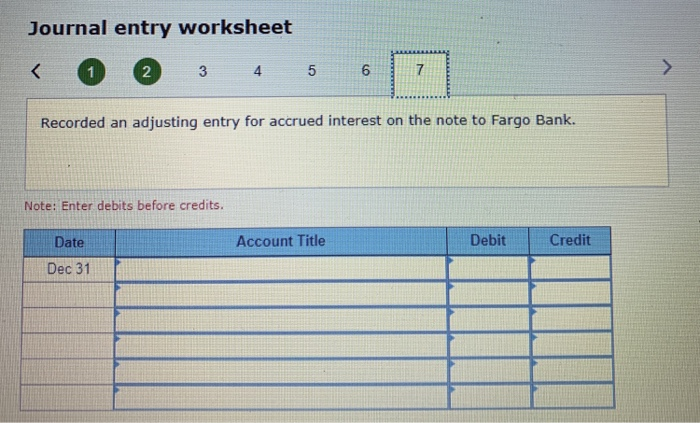

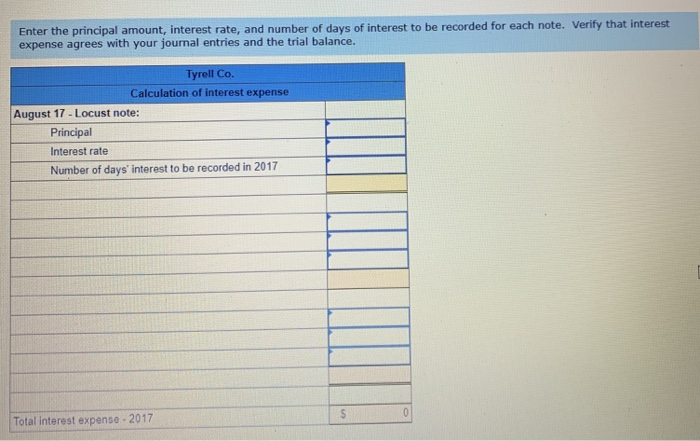

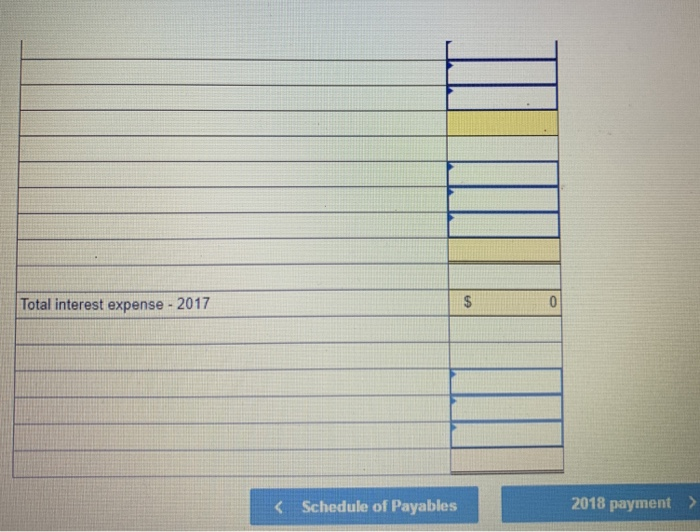

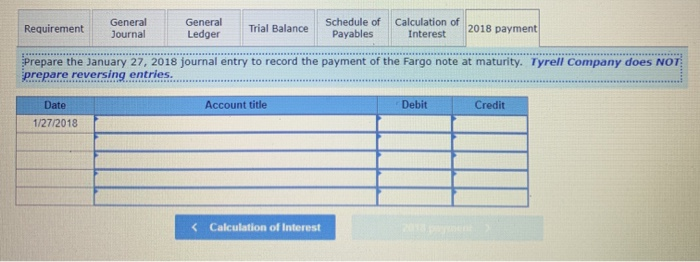

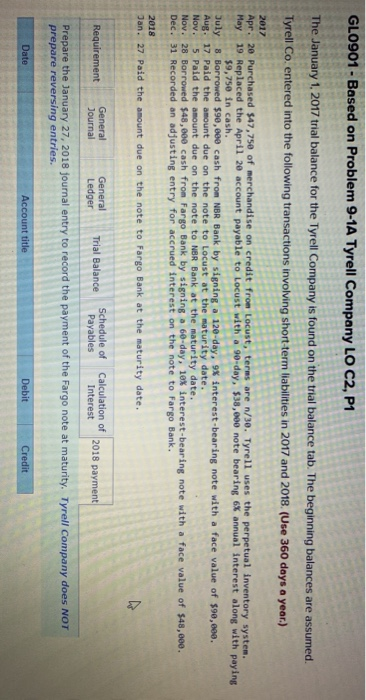

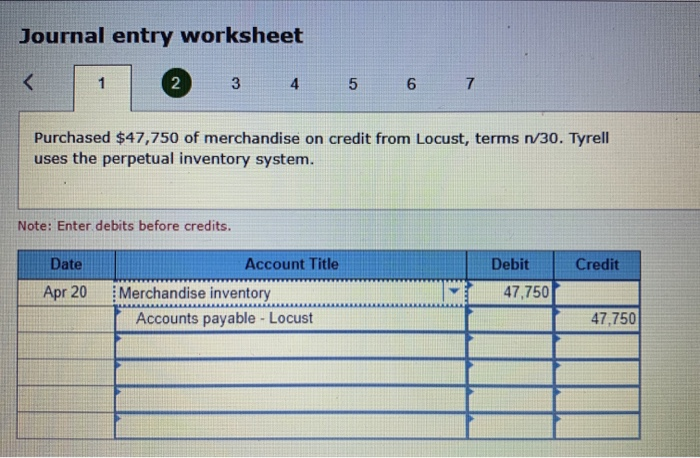

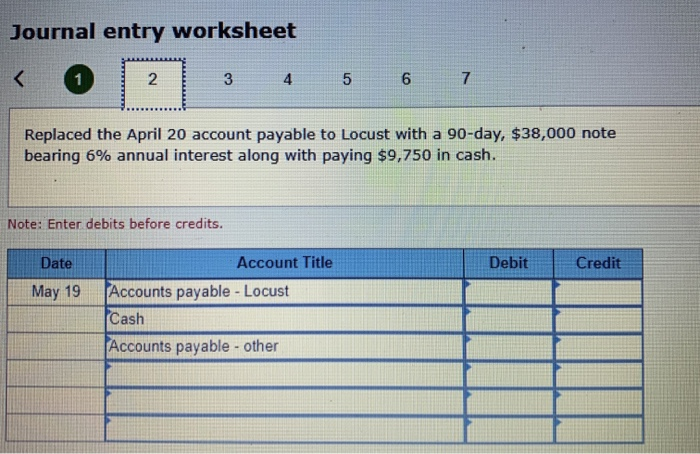

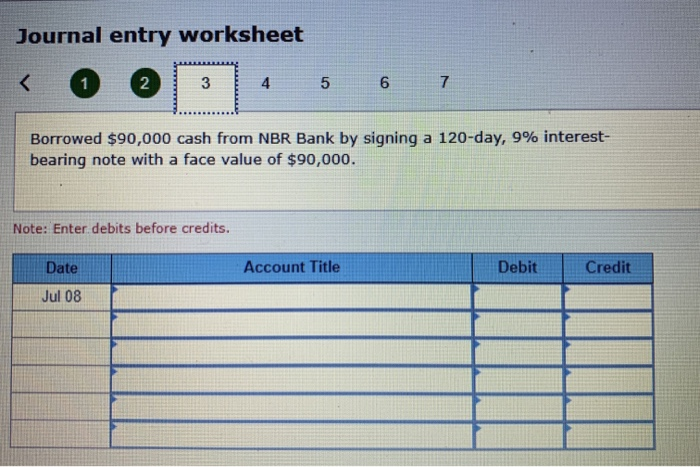

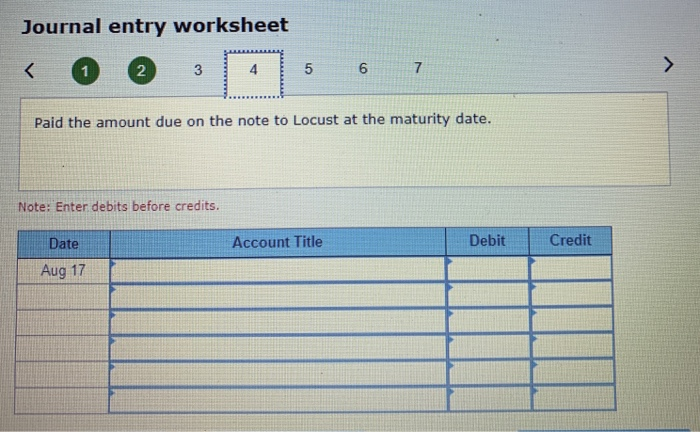

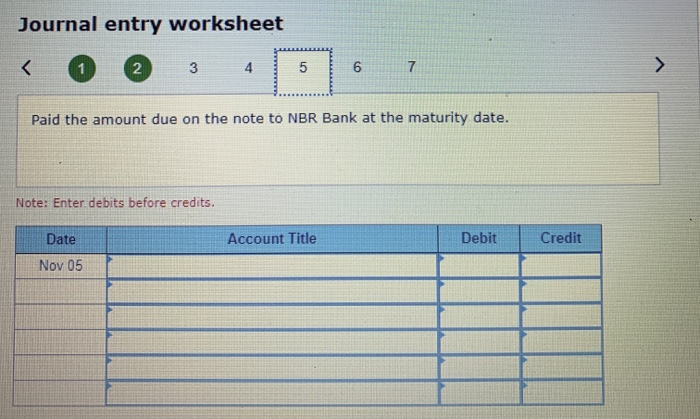

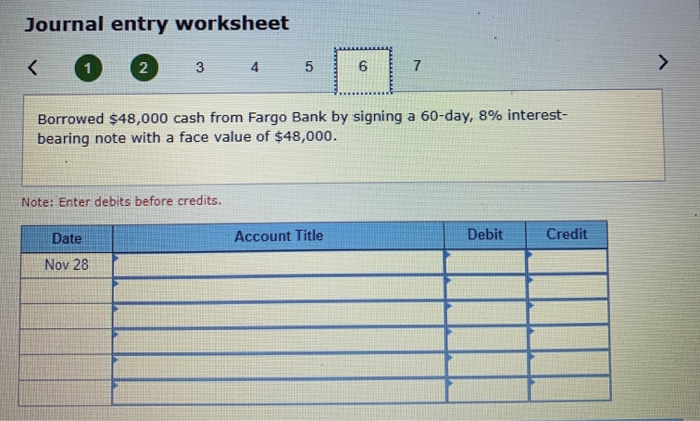

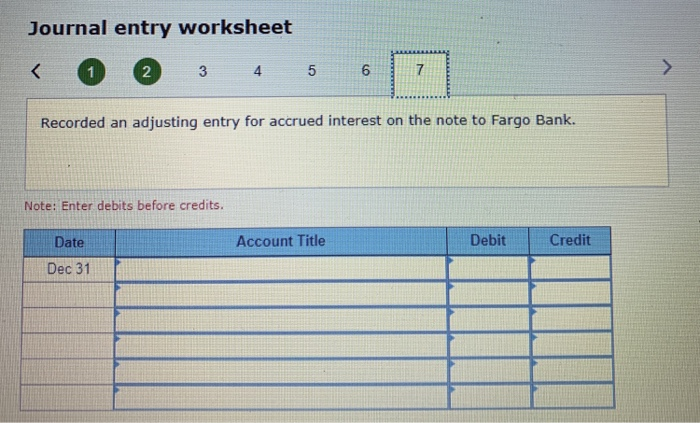

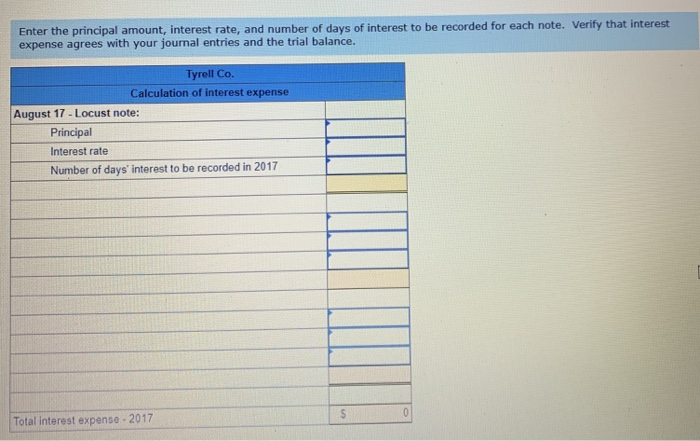

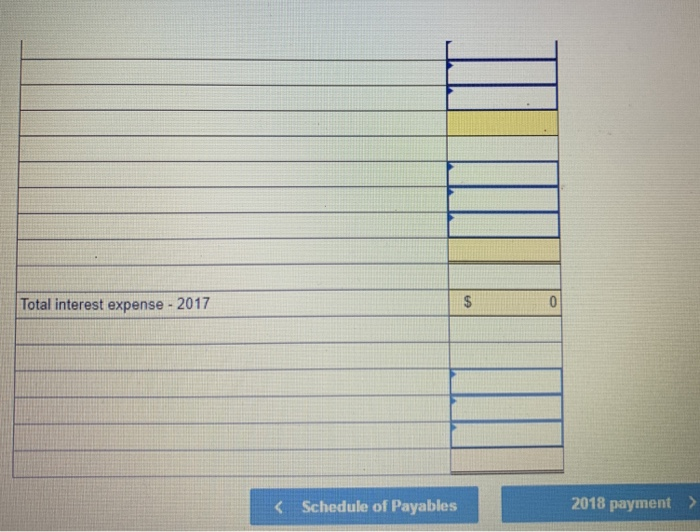

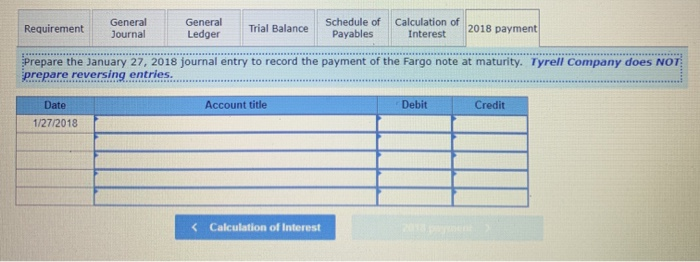

GL0901 - Based on Problem 9-1A Tyrell Company LO C2, P1 The January 1, 2017 trial balance for the Tyrell Company is found on the trial balance tab. The beginning balances are assumed. Tyrell Co. entered into the following transactions involving short-term liabilities in 2017 and 2018. (Use 360 days a year.) 2017 Apr. 20 Purchased $47,750 of merchandise on credit from Locust, terms are n/30. Tyrell uses the perpetual inventory system. May 19 Replaced the April 20 account payable to locust with a 90-day, $38,000 note bearing 6% annual interest along with paying $9,750 in cash. July 8 Borrowed $90,000 cash from NBR Bank by signing a 120-day, 9% interest-bearing note with a face value of $90,000. Aug. 17 Paid the amount due on the note to Locust at the maturity date. Nov. 5 Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $48,000 cash from Fargo Bank by signing a 60-day, 10% interest-bearing note with a face value of $48,000. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. 2018 Jan. 27 Paid the amount due on the note to Fargo Bank at the maturity date. Requirement General Journal General Trial Balance Ledger Schedule of Payables Calculation of Interest 2018 payment Prepare the January 27, 2018 journal entry to record the payment of the Fargo note at maturity. Tyrell Company does NOT prepare reversing entries. Date Account title Debit Credit Journal entry worksheet 3 4 5 6 7 Purchased $47,750 of merchandise on credit from Locust, terms 1730. Tyrell uses the perpetual inventory system. Note: Enter debits before credits. Credit Date Apr 20 Account Title Merchandise inventory Accounts payable - Locust Debit 47,750 47,750 Journal entry worksheet 3 4 5 6 7 Replaced the April 20 account payable to Locust with a 90-day, $38,000 note bearing 6% annual interest along with paying $9,750 in cash. Note: Enter debits before credits. Debit Credit Date May 19 Account Title Accounts payable - Locust Cash Accounts payable - other Journal entry worksheet Requirement General Journal General Ledger Trial Balance Schedule of Payables Calculation of Interest 2018 payment Prepare the January 27, 2018 journal entry to record the payment of the Fargo note at maturity. Tyrell Company does NOT prepare reversing entries. Account title Debit Credit Date 1/27/2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started