please input what you would type into each cell to get the answer

please input what you would type into each cell to get the answer

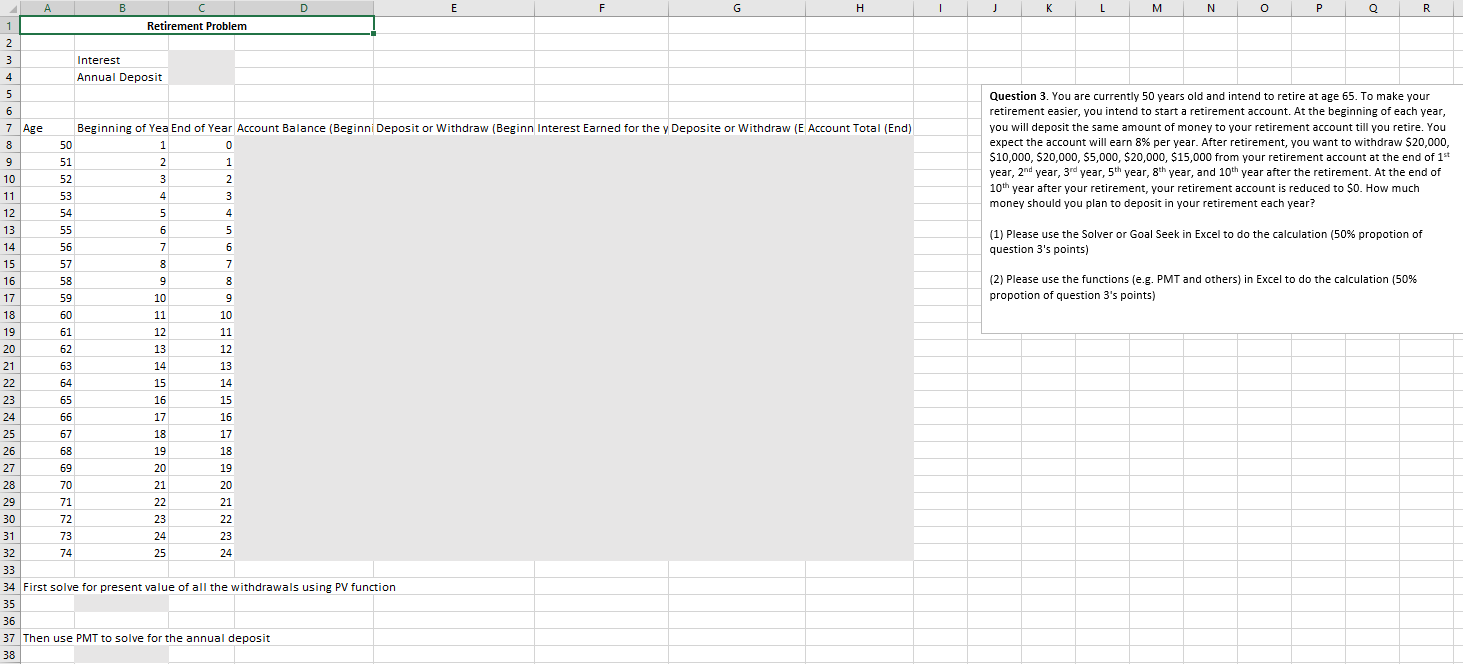

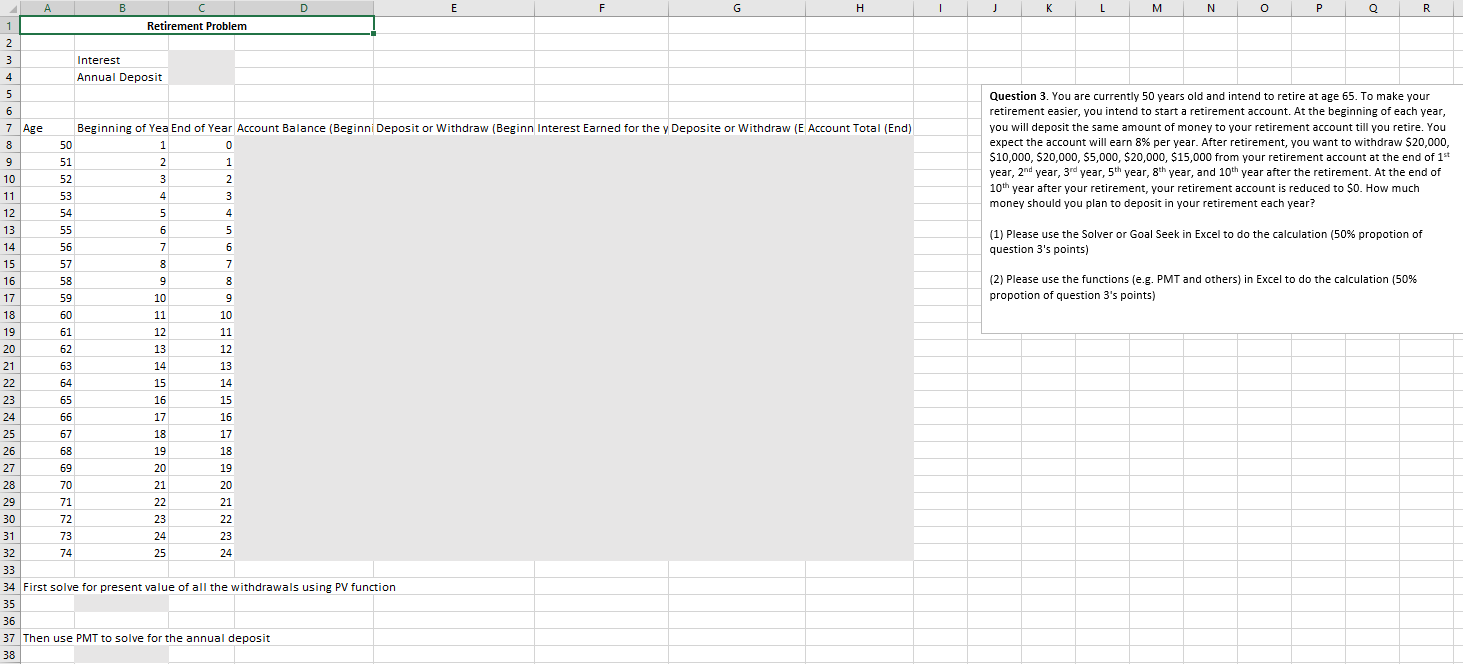

1 J K L M N o P o R 7 Age Question 3. You are currently 50 years old and intend to retire at age 65. To make your retirement easier, you intend to start a retirement account. At the beginning of each year, you will deposit the same amount of money to your retirement account till you retire. You expect the account will earn 8% per year. After retirement, you want to withdraw $20,000, $10,000, $20,000, S5,000, $20,000, $15,000 from your retirement account at the end of 1st year, 2nd year, 3rd year, 5th year, 8th year, and 10th year after the retirement. At the end of 10th year after your retirement, your retirement account is reduced to $0. How much money should you plan to deposit in your retirement each year? (1) Please use the Solver or Goal Seek in Excel to do the calculation (50% propotion of question 3's points) (2) Please use the functions (e.g. PMT and others) in Excel to do the calculation (50% propotion of question 3's points) B D E F H 1 Retirement Problem 2 2 3 Interest 4 Annual Deposit 5 6 Beginning of Yea End of Year Account Balance (Beginni Deposit or Withdraw (Beginn Interest Earned for the y Deposite or Withdraw (E Account Total (End) 8 50 1 0 9 51 2 1 10 52 3 2 11 53 4 3 12 54 5 4 13 55 6 5 14 56 7 6 15 57 8 7 16 58 9 8 17 59 10 9 9 18 60 11 10 19 61 12 11 20 62 13 12 21 63 14 13 22 64 15 14 23 65 16 15 24 66 17 16 25 67 18 17 26 68 19 18 27 69 20 19 28 70 21 20 29 71 22 21 30 72 23 22 31 73 24 23 32 74 25 24 33 34 First solve for present value of all the withdrawals using PV function 35 36 37 Then use PMT to solve for the annual deposit 38 1 J K L M N o P o R 7 Age Question 3. You are currently 50 years old and intend to retire at age 65. To make your retirement easier, you intend to start a retirement account. At the beginning of each year, you will deposit the same amount of money to your retirement account till you retire. You expect the account will earn 8% per year. After retirement, you want to withdraw $20,000, $10,000, $20,000, S5,000, $20,000, $15,000 from your retirement account at the end of 1st year, 2nd year, 3rd year, 5th year, 8th year, and 10th year after the retirement. At the end of 10th year after your retirement, your retirement account is reduced to $0. How much money should you plan to deposit in your retirement each year? (1) Please use the Solver or Goal Seek in Excel to do the calculation (50% propotion of question 3's points) (2) Please use the functions (e.g. PMT and others) in Excel to do the calculation (50% propotion of question 3's points) B D E F H 1 Retirement Problem 2 2 3 Interest 4 Annual Deposit 5 6 Beginning of Yea End of Year Account Balance (Beginni Deposit or Withdraw (Beginn Interest Earned for the y Deposite or Withdraw (E Account Total (End) 8 50 1 0 9 51 2 1 10 52 3 2 11 53 4 3 12 54 5 4 13 55 6 5 14 56 7 6 15 57 8 7 16 58 9 8 17 59 10 9 9 18 60 11 10 19 61 12 11 20 62 13 12 21 63 14 13 22 64 15 14 23 65 16 15 24 66 17 16 25 67 18 17 26 68 19 18 27 69 20 19 28 70 21 20 29 71 22 21 30 72 23 22 31 73 24 23 32 74 25 24 33 34 First solve for present value of all the withdrawals using PV function 35 36 37 Then use PMT to solve for the annual deposit 38

please input what you would type into each cell to get the answer

please input what you would type into each cell to get the answer