Answered step by step

Verified Expert Solution

Question

1 Approved Answer

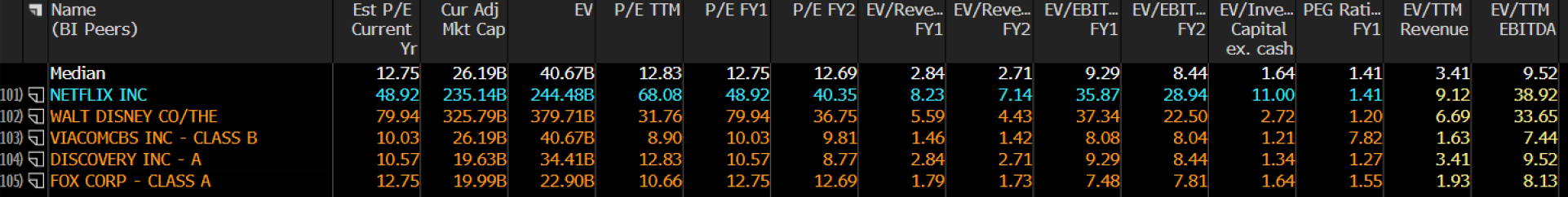

PLEASE, IS URGENT 1.- With the table of comparables, answer the following 5 items. Justify your answer in each of them. i) In which company

PLEASE, IS URGENT

1.- With the table of comparables, answer the following 5 items. Justify your answer in each of them.

i) In which company would you suggest a short position? ii) In which company would you suggest a long position?

iii) Only with that information- What position will you take on Netflix?

iv) Which company is the most leveraged?

v) Calculate the PEG ratio FY2?

EV Cur Adj Mkt Cap P/E TTM 7 Name (BI Peers) P/E FY1 EV/TTM Revenue EV/TTM EBITDA Est P/E Current Yr 12.75 48.92 79.94 10.03 10.57 12.75 Median 101) 7 NETFLIX INC 102) WALT DISNEY CO/THE 103) VIACOMCBS INC - CLASS B 104 DISCOVERY INC - A 105) FOX CORP - CLASS A 3.41 9.12 26.19B 235.14B 325.79B 26.19B 19.63B 19.99B 40.67B 244.48B 379.71B 40.67B 34.41B 22.90B 12.83 68.08 31.76 8.90 12.83 10.66 P/E FY2 EV/Reve.. EV/Reve... EV/EBIT... EV/EBIT... EV/Inve... PEG Rati... FY1 FY2 FY1 FY2 Capital FY1 ex. cash 12.69 2.84 2.71 9.29 8.44 1.64 1.41 40.35 8.23 7.14 35.87 28.94 11.00 1.41 36.75 5.59 4.43 37.34 22.50 2.72 1.20 9.81 1.46 1.42 8.08 8.04 1.21 8.77 2.84 2.71 9.29 8.44 1.34 1.27 12.69 1.79 1.73 7.48 7.81 1.64 1.55 12.75 48.92 79.94 10.03 10.57 12.75 6.69 9.52 38.92 33.65 7.44 9.52 8.13 7.82 1.63 3.41 1.93 EV Cur Adj Mkt Cap P/E TTM 7 Name (BI Peers) P/E FY1 EV/TTM Revenue EV/TTM EBITDA Est P/E Current Yr 12.75 48.92 79.94 10.03 10.57 12.75 Median 101) 7 NETFLIX INC 102) WALT DISNEY CO/THE 103) VIACOMCBS INC - CLASS B 104 DISCOVERY INC - A 105) FOX CORP - CLASS A 3.41 9.12 26.19B 235.14B 325.79B 26.19B 19.63B 19.99B 40.67B 244.48B 379.71B 40.67B 34.41B 22.90B 12.83 68.08 31.76 8.90 12.83 10.66 P/E FY2 EV/Reve.. EV/Reve... EV/EBIT... EV/EBIT... EV/Inve... PEG Rati... FY1 FY2 FY1 FY2 Capital FY1 ex. cash 12.69 2.84 2.71 9.29 8.44 1.64 1.41 40.35 8.23 7.14 35.87 28.94 11.00 1.41 36.75 5.59 4.43 37.34 22.50 2.72 1.20 9.81 1.46 1.42 8.08 8.04 1.21 8.77 2.84 2.71 9.29 8.44 1.34 1.27 12.69 1.79 1.73 7.48 7.81 1.64 1.55 12.75 48.92 79.94 10.03 10.57 12.75 6.69 9.52 38.92 33.65 7.44 9.52 8.13 7.82 1.63 3.41 1.93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started