Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please it is urgent Kindly solve Question 5 The managing director of Havila Limited is considering undertaking a one-off contract and has asked her inexperienced

Please it is urgent

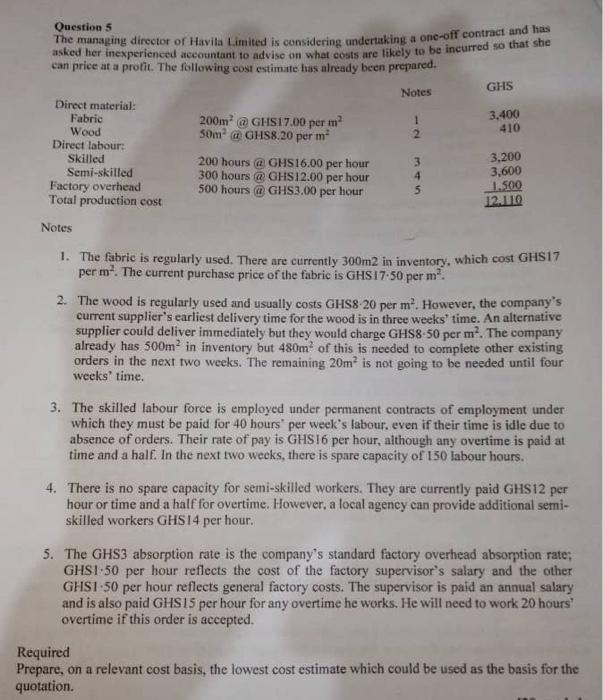

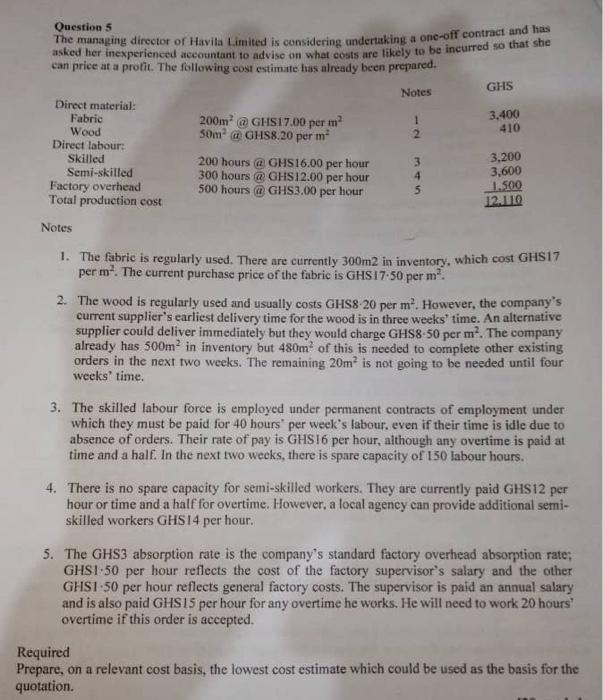

Question 5 The managing director of Havila Limited is considering undertaking a one-off contract and has asked her inexperienced accountant to advise on what costs are likely to be incurred so that she can price at a protic. The following cost estimate has already been prepared. Notes 1. The fabric is regularly used. There are currently 300m2 in inventory, which cost GHS17 per m2. The current purchase price of the fabric is GHSI7.50 per m2. 2. The wood is regularly used and usually costs GHS8.20 per m2. However, the company's current supplier's earliest delivery time for the wood is in three weeks' time. An alternative supplier could deliver immediately but they would charge GHS8.50 per m2. The company already has 500m2 in inventory but 480m2 of this is needed to complete other existing orders in the next two weeks. The remaining 20m2 is not going to be needed until four weeks' time. 3. The skilled labour force is employed under permanent contracts of employment under which they must be paid for 40 hours' per week's labour. even if their time is idle due to absence of orders. Their rate of pay is GHSI 6 per hour, although any overtime is paid at time and a half. In the next two weeks, there is spare capacity of 150 labour hours. 4. There is no spare capacity for semi-skilled workers. They are currently paid GHS12 per hour or time and a half for overtime. However, a local agency can provide additional semiskilled workers GHSI4 per hour. 5. The GHS3 absorption rate is the company's standard factory overhead absorption rate; GHSI .50 per hour reflects the cost of the factory supervisor's salary and the other GHS1.50 per hour reflects general factory costs. The supervisor is paid an annual salary and is also paid GHS15 per hour for any overtime he works. He will need to work 20 hours" overtime if this order is accepted. Required Prepare, on a relevant cost basis, the lowest cost estimate which could be used as the basis for the quotation Kindly solve

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started