Answered step by step

Verified Expert Solution

Question

1 Approved Answer

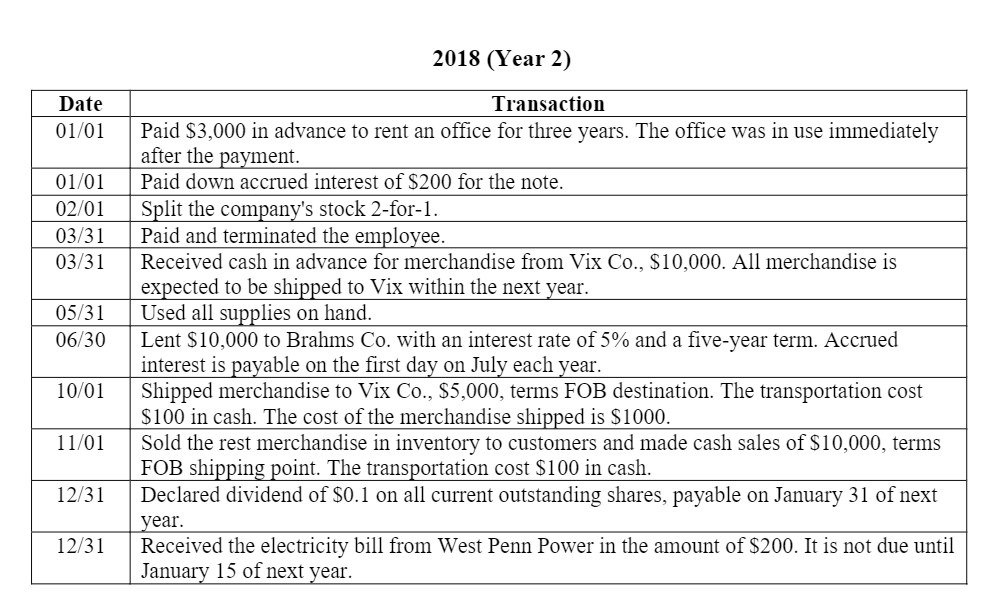

Please journalize all transactions (including adjusting and closing entries) in 2018. Prepare the income statement and balance sheet for the year ended 12/31/2018. You do

Please journalize all transactions (including adjusting and closing entries) in 2018. Prepare the income statement and balance sheet for the year ended 12/31/2018. You do not need to prepare the statement of changes in shareholders equity and the cash flow statement. All adjusting entries should only be made on 12/31 instead of monthly entries.

(I.E:

Journal entries that take place in 2018 along with the t-tables, balance sheet, and income statement for 2018. )

2018 (Year 2) Date 01/01 01/01 02/01 03/31 03/31 05/31 06/30 Transaction Paid $3,000 in advance to rent an office for three years. The office was in use immediately after the payment. Paid down accrued interest of $200 for the note. Split the company's stock 2-for-1. Paid and terminated the employee. Received cash in advance for merchandise from Vix Co., $10,000. All merchandise is expected to be shipped to Vix within the next year. Used all supplies on hand. Lent $10,000 to Brahms Co. with an interest rate of 5% and a five-year term. Accrued interest is payable on the first day on July each year. Shipped merchandise to Vix Co., $5,000, terms FOB destination. The transportation cost $100 in cash. The cost of the merchandise shipped is $1000. Sold the rest merchandise in inventory to customers and made cash sales of $10,000, terms FOB shipping point. The transportation cost $100 in cash. Declared dividend of $0.1 on all current outstanding shares, payable on January 31 of next year. Received the electricity bill from West Penn Power in the amount of $200. It is not due until January 15 of next year. 10/01 11/01 12/31 12/31 2018 (Year 2) Date 01/01 01/01 02/01 03/31 03/31 05/31 06/30 Transaction Paid $3,000 in advance to rent an office for three years. The office was in use immediately after the payment. Paid down accrued interest of $200 for the note. Split the company's stock 2-for-1. Paid and terminated the employee. Received cash in advance for merchandise from Vix Co., $10,000. All merchandise is expected to be shipped to Vix within the next year. Used all supplies on hand. Lent $10,000 to Brahms Co. with an interest rate of 5% and a five-year term. Accrued interest is payable on the first day on July each year. Shipped merchandise to Vix Co., $5,000, terms FOB destination. The transportation cost $100 in cash. The cost of the merchandise shipped is $1000. Sold the rest merchandise in inventory to customers and made cash sales of $10,000, terms FOB shipping point. The transportation cost $100 in cash. Declared dividend of $0.1 on all current outstanding shares, payable on January 31 of next year. Received the electricity bill from West Penn Power in the amount of $200. It is not due until January 15 of next year. 10/01 11/01 12/31 12/31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started