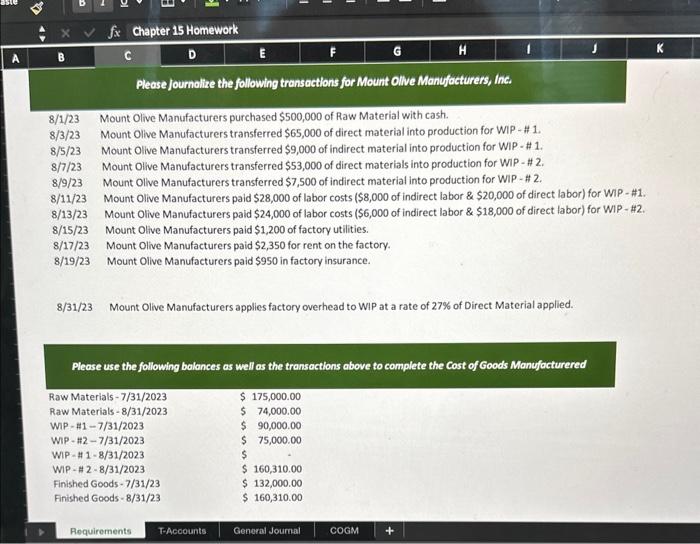

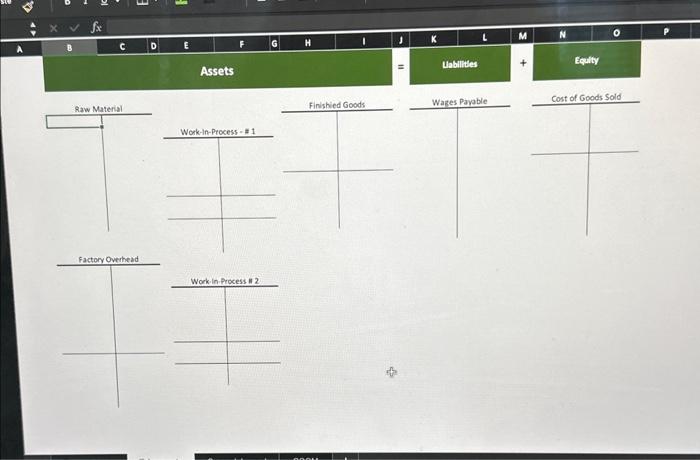

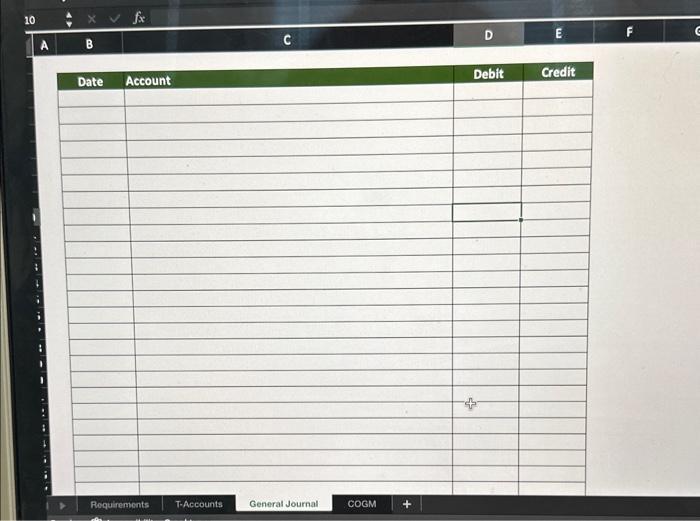

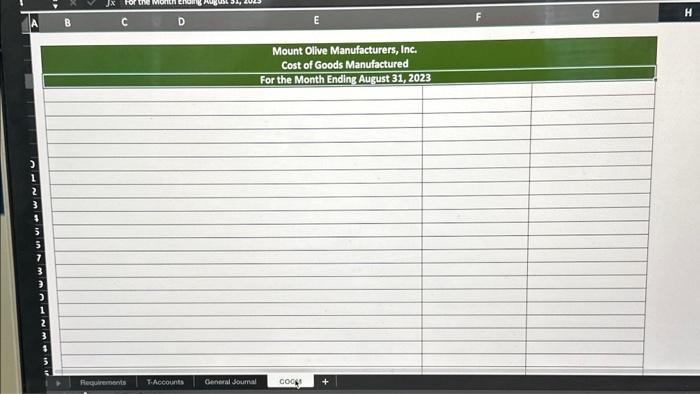

Please Journolize the following transactions for Mount Ollve Manufocturers, Inc. 8/1/23 Mount Olive Manufacturers purchased $500,000 of Raw Material with cash. 8/3/23 Mount Olive Manufacturers transferred $65,000 of direct material into production for WIP - \# 1. 8/5/23 Mount Olive Manufacturers transferred $9,000 of indirect material into production for WIP - 1 . 8/7/23 Mount Olive Manufacturers transferred \$53,000 of direct materials into production for WIP - 2. 8/9/23 Mount Ollve Manufacturers transferred $7,500 of indirect material into production for WiP - \# 2 . 8/11/23 Mount Olive Manufacturers paid $28,000 of labor costs ($8,000 of indirect labor &$20,000 of direct labor) for WiP- $1. 8/13/23 Mount Olive Manufacturers paid $24,000 of labor costs ($6,000 of indirect labor \& $18,000 of direct labor) for WIP - \#2. 8/15/23 Mount Olive Manufacturers paid $1,200 of factory utilities. 8/17/23 Mount Olive Manufacturers paid $2,350 for rent on the factory. 8/19/23 Mount Ollve Manufacturers paid $950 in factory insurance. 8/31/23 Mount Olive Manufacturers applies factory overhead to WIP at a rate of 27% of Direct Material applied. Please use the following balances as well os the transactions above to complete the Cost of Goods Manufacturered Factory Overhead Work in Process 12 Please Journolize the following transactions for Mount Ollve Manufocturers, Inc. 8/1/23 Mount Olive Manufacturers purchased $500,000 of Raw Material with cash. 8/3/23 Mount Olive Manufacturers transferred $65,000 of direct material into production for WIP - \# 1. 8/5/23 Mount Olive Manufacturers transferred $9,000 of indirect material into production for WIP - 1 . 8/7/23 Mount Olive Manufacturers transferred \$53,000 of direct materials into production for WIP - 2. 8/9/23 Mount Ollve Manufacturers transferred $7,500 of indirect material into production for WiP - \# 2 . 8/11/23 Mount Olive Manufacturers paid $28,000 of labor costs ($8,000 of indirect labor &$20,000 of direct labor) for WiP- $1. 8/13/23 Mount Olive Manufacturers paid $24,000 of labor costs ($6,000 of indirect labor \& $18,000 of direct labor) for WIP - \#2. 8/15/23 Mount Olive Manufacturers paid $1,200 of factory utilities. 8/17/23 Mount Olive Manufacturers paid $2,350 for rent on the factory. 8/19/23 Mount Ollve Manufacturers paid $950 in factory insurance. 8/31/23 Mount Olive Manufacturers applies factory overhead to WIP at a rate of 27% of Direct Material applied. Please use the following balances as well os the transactions above to complete the Cost of Goods Manufacturered Factory Overhead Work in Process 12