Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please just answer d and e, thanks. 4. (35 points) You are given the following data for a bond. The Coupon. Payment is $50 on

please just answer d and e, thanks.

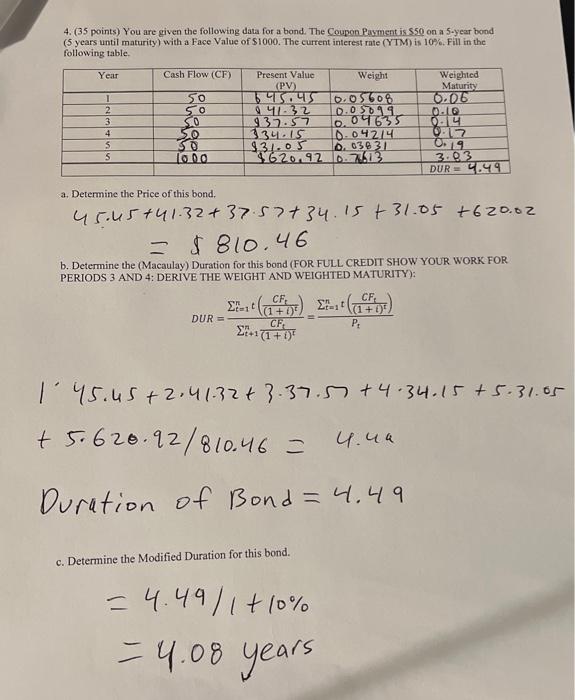

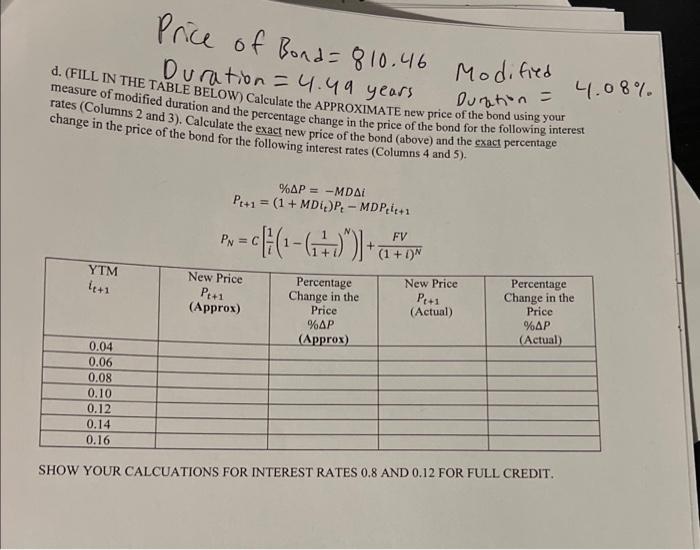

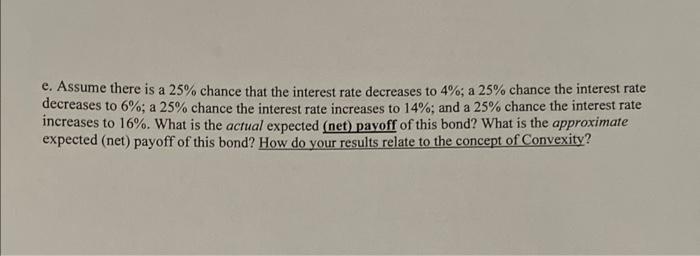

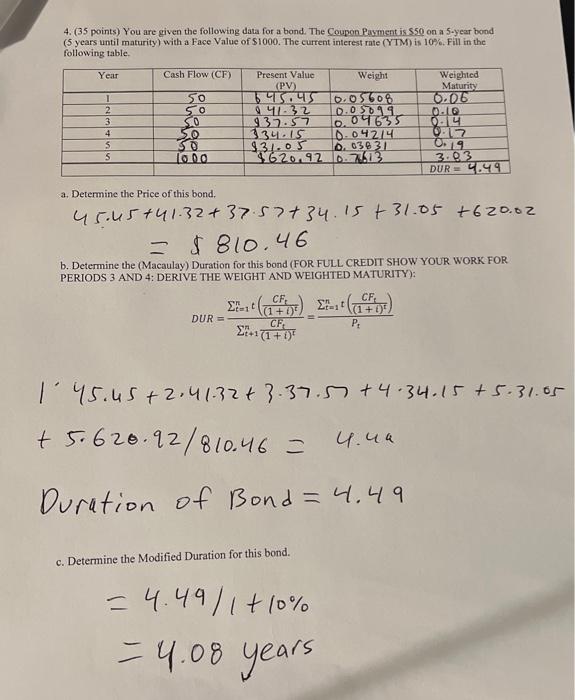

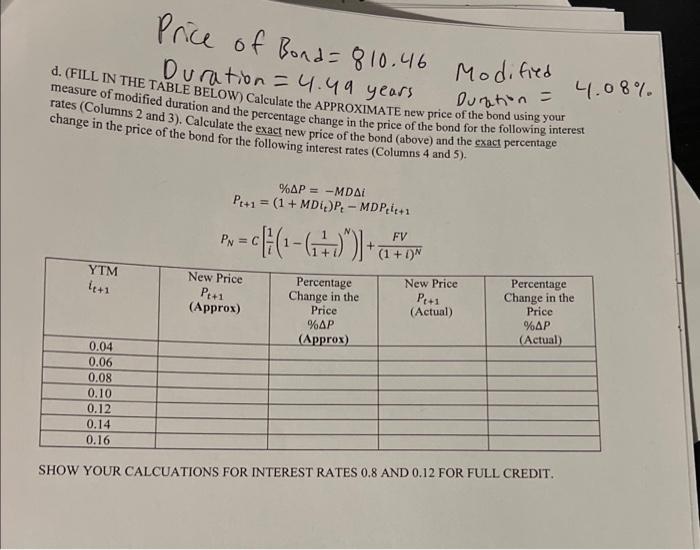

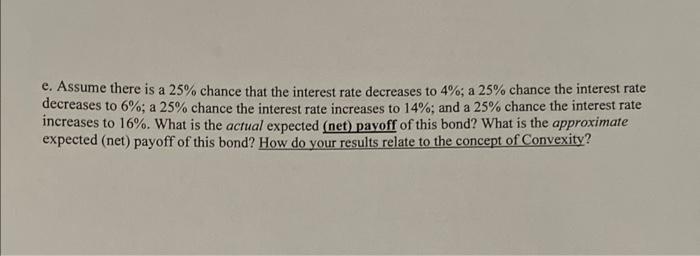

4. (35 points) You are given the following data for a bond. The Coupon. Payment is $50 on a 5 -year bond years until maturity) with a Face Value of $1000. The current interest rate (YTM) is 10%. Fill in the following table. a. Determine the Price of this bond. 45.45+41.32+37.57+34.15+31.05+620.02=$810.46 b. Determine the (Macaulay) Duration for this bond (FOR FULL CREDI SHOW YOUR. WORK FOR PERIODS 3 AND 4: DERIVE THE WEIGHT AND WEIGHTED MATURITY): DUR=t+1n(1+i)tCFtt=1nt((1+i)tCFt)=Ptt=1nt((1+i)tCFt) 1.45.45+2.41.32+3.37.57+4.34.15+5.31.05 +5.620.92/810.46=4.4a Duration of Bond =4.49 c. Determine the Modified Duration for this bond. =4.49/1+10%=4.08years measure of THE TABLE BELOW) Calculate t. 4.4 years Dupation =4. rates (Columnedified duration and the percent the APPROXIMATE new price of the bond using your change in the 2 and 3 ). Calculate the exact new change in the price of the bond for the following interest change in the price of the bond for the followew price of the bond (above) and the exact percentage %P=MDiPt+1=(1+MDit)PtMDPtit+1PN=C[i1(1(1+i1)N)]+(1+i)NFV SHOW YOUR CALCUATIONS FOR INTEREST RATES 0.8 AND 0.12 FOR FULL CREDIT. e. Assume there is a 25% chance that the interest rate decreases to 4%; a 25% chance the interest rate decreases to 6%; a 25% chance the interest rate increases to 14%; and a 25% chance the interest rate increases to 16%. What is the actual expected (net) pavoff of this bond? What is the approximate expected (net) payoff of this bond? How do your results relate to the concept of Convexity? 4. (35 points) You are given the following data for a bond. The Coupon. Payment is $50 on a 5 -year bond years until maturity) with a Face Value of $1000. The current interest rate (YTM) is 10%. Fill in the following table. a. Determine the Price of this bond. 45.45+41.32+37.57+34.15+31.05+620.02=$810.46 b. Determine the (Macaulay) Duration for this bond (FOR FULL CREDI SHOW YOUR. WORK FOR PERIODS 3 AND 4: DERIVE THE WEIGHT AND WEIGHTED MATURITY): DUR=t+1n(1+i)tCFtt=1nt((1+i)tCFt)=Ptt=1nt((1+i)tCFt) 1.45.45+2.41.32+3.37.57+4.34.15+5.31.05 +5.620.92/810.46=4.4a Duration of Bond =4.49 c. Determine the Modified Duration for this bond. =4.49/1+10%=4.08years measure of THE TABLE BELOW) Calculate t. 4.4 years Dupation =4. rates (Columnedified duration and the percent the APPROXIMATE new price of the bond using your change in the 2 and 3 ). Calculate the exact new change in the price of the bond for the following interest change in the price of the bond for the followew price of the bond (above) and the exact percentage %P=MDiPt+1=(1+MDit)PtMDPtit+1PN=C[i1(1(1+i1)N)]+(1+i)NFV SHOW YOUR CALCUATIONS FOR INTEREST RATES 0.8 AND 0.12 FOR FULL CREDIT. e. Assume there is a 25% chance that the interest rate decreases to 4%; a 25% chance the interest rate decreases to 6%; a 25% chance the interest rate increases to 14%; and a 25% chance the interest rate increases to 16%. What is the actual expected (net) pavoff of this bond? What is the approximate expected (net) payoff of this bond? How do your results relate to the concept of Convexity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started