Answered step by step

Verified Expert Solution

Question

1 Approved Answer

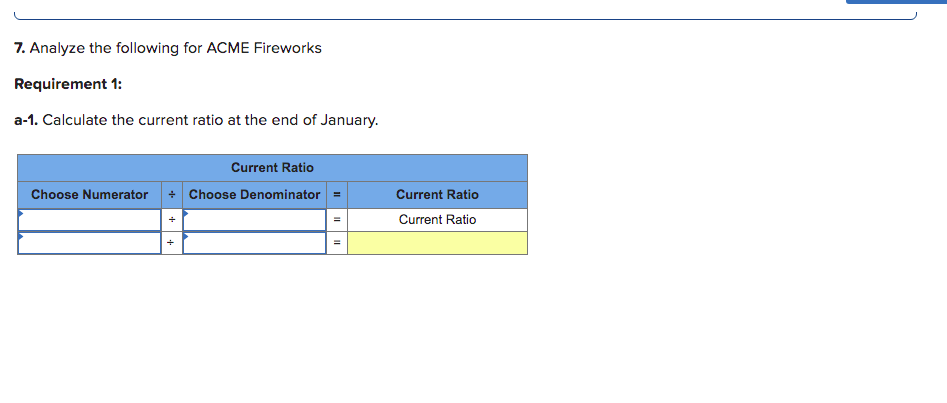

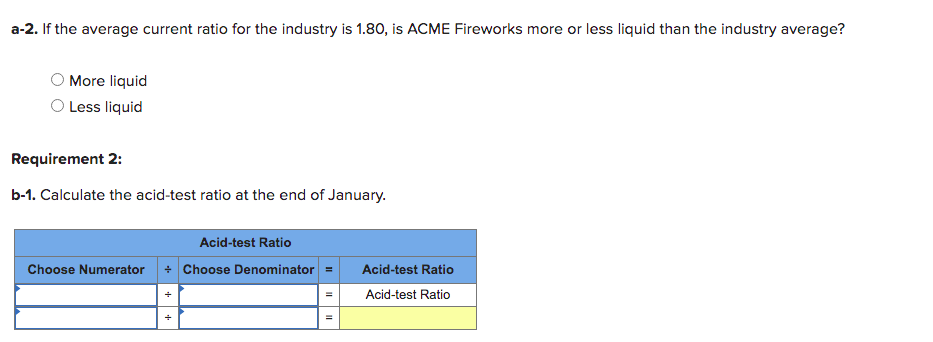

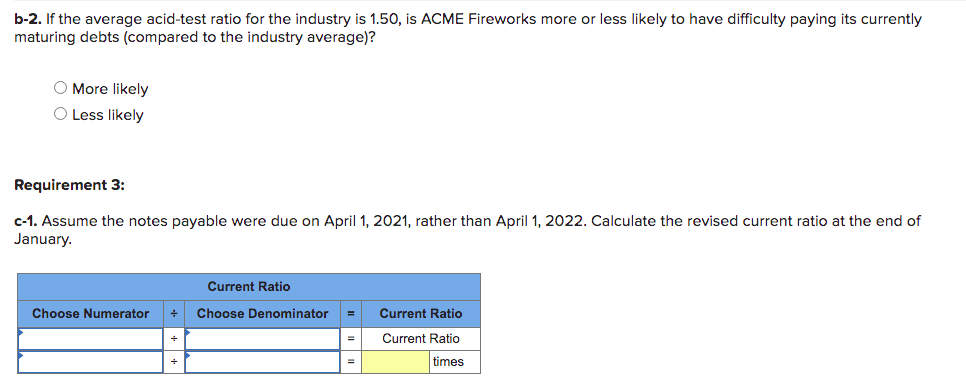

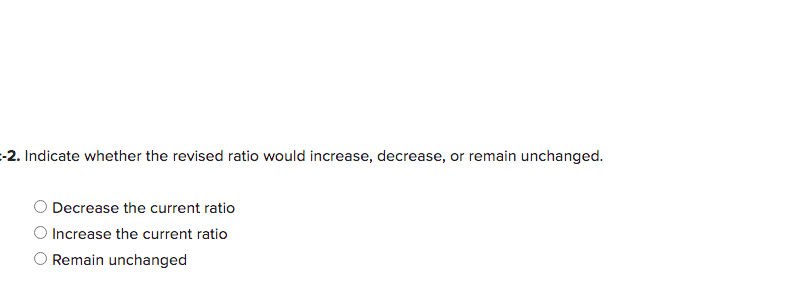

PLEASE JUST DO THE QUESTIONS AFTER THE SECOND IMAGE Required information [The following information applies to the questions displayed below.) On January 1, 2021, the

PLEASE JUST DO THE QUESTIONS AFTER THE SECOND IMAGE

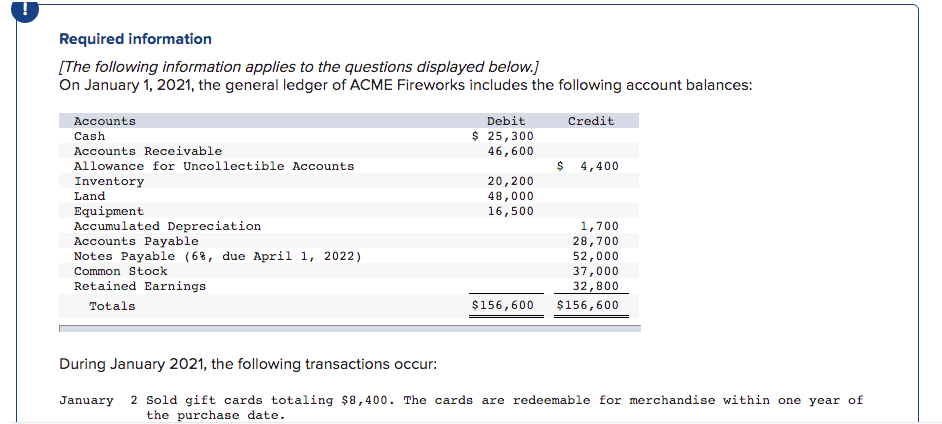

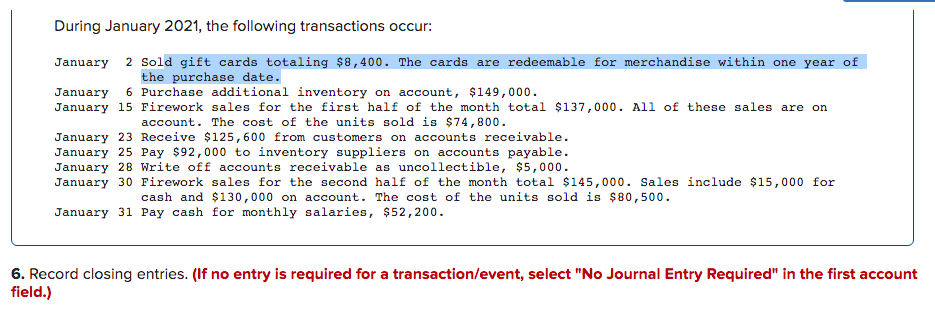

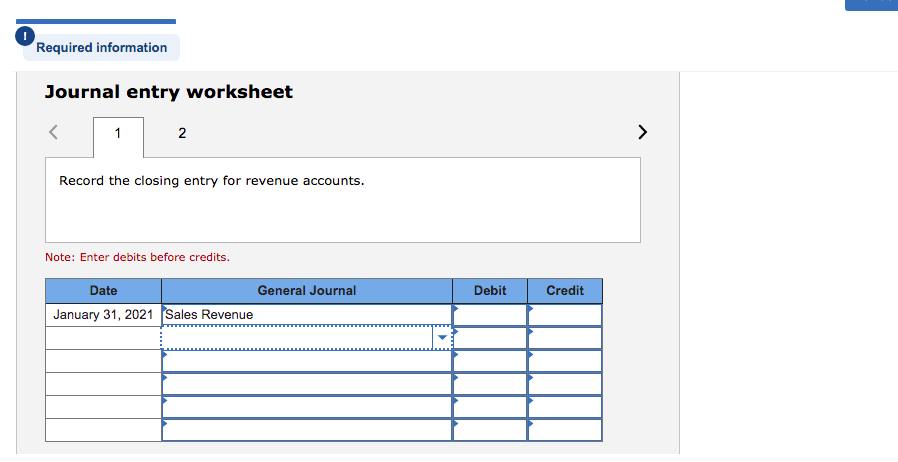

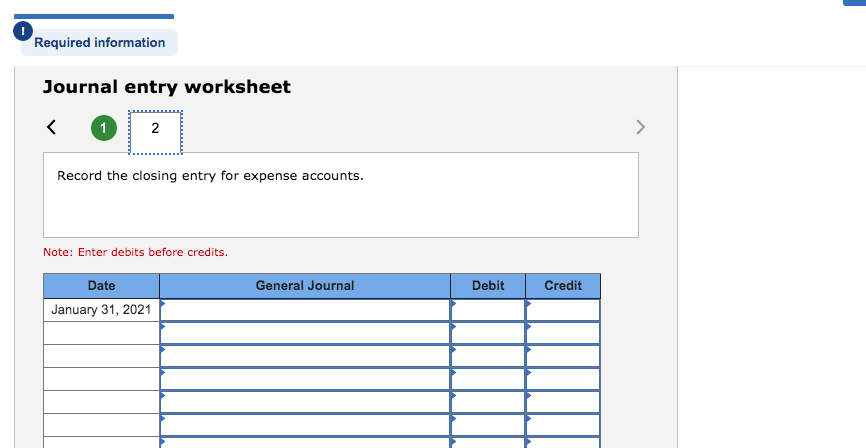

Required information [The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Credit Debit $ 25,300 46,600 $ 4,400 Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, 2022) Common Stock Retained Earnings Totals 20,200 48,000 16,500 1,700 28,700 52,000 37,000 32,800 $156,600 $156,600 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $8,400. The cards are redeemable for merchandise within one year of the purchase date. During January 2021, the following transactions occur: January 2 Sold gift cards totaling $8,400. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $149,000. January 15 Firework sales for the first half of the month total $137,000. All of these sales are on account. The cost of the units sold is $74,800. January 23 Receive $125,600 from customers on accounts receivable. January 25 Pay $92,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $5,000. January 30 Firework sales for the second half of the month total $145,000. Sales include $15,000 for cash and $130,000 on account. The cost of the units sold is $80,500. January 31 Pay cash for monthly salaries, $52,200. 6. Record closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started