PLEASE JUST GIVE ANSWERS OF ALL 3 QUESTIONS

DO NOT WASTE TIME IN SOLVING OR EXPLAINING QUESTION

THANKS!

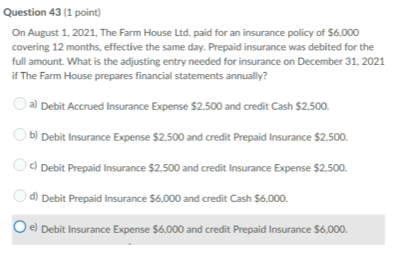

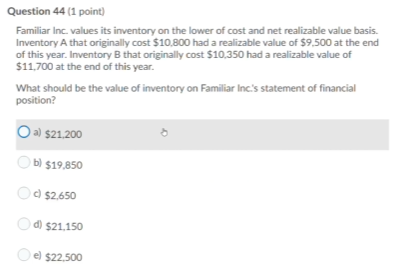

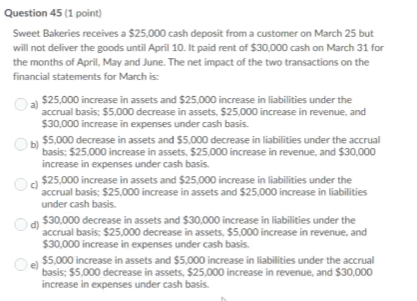

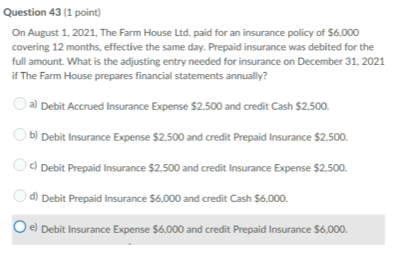

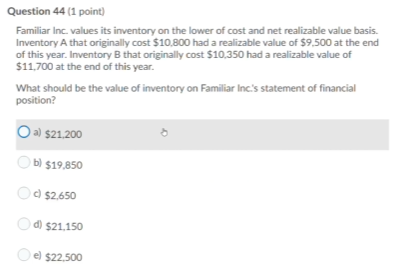

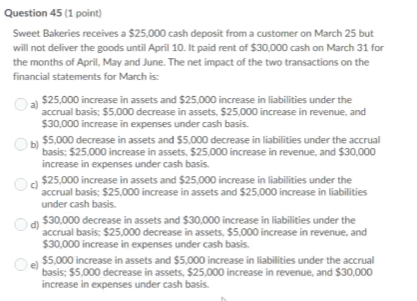

Question 43 (1 point) ) On August 1, 2021. The Farm House Ltd. paid for an insurance policy of $6,000 covering 12 months, effective the same day. Prepaid insurance was debited for the full amount. What is the adjusting entry needed for insurance on December 31, 2021 if The Farm House prepares financial statements annually? a) Debit Accrued Insurance Expense $2.500 and credit Cash $2.500. b) Debit Insurance Expense $2,500 and credit Prepaid Insurance $2,500. Debit Prepaid Insurance $2,500 and credit Insurance Expense $2,500. d) Debit Prepaid Insurance $6,000 and credit Cash $6,000 Oel Debit Insurance Expense $6,000 and credit Prepaid Insurance $6,000. Question 44(1 point) Familiar Inc. values its inventory on the lower of cost and net realizable value basis. Inventory A that originally cost $10,800 had a realizable value of $9.500 at the end of this year. Inventory B that originally cost $10,350 had a realizable value of $11,700 at the end of this year. What should be the value of inventory on Familiar Inc's statement of financial position? a) $21.200 b) $19.850 $2.650 d) $21.150 el $22.500 Question 45 (1 point) Sweet Bakeries receives a $25,000 cash deposit from a customer on March 25 but will not deliver the goods until April 10. It paid rent of $30,000 cash on March 31 for the months of April, May and June. The net impact of the two transactions on the financial statements for March is $25,000 increase in assets and $25,000 increase in liabilities under the accrual basis: $5.000 decrease in assets. $25,000 increase in revenue and $30,000 increase in expenses under cash basis. b) $5,000 decrease in assets and $5,000 decrease in liabilities under the accrual basis: $25,000 increase in assets. $25,000 increase in revenue, and $30,000 increase in expenses under cash basis. $25,000 increase in assets and $25,000 increase in liabilities under the accrual basis: $25,000 increase in assets and $25,000 increase in liabilities under cash basis. d) $30,000 decrease in assets and $30,000 increase in liabilities under the accrual basis: $25,000 decrease in assets, $5,000 increase in revenue and $30,000 increase in expenses under cash basis $5,000 increase in assets and $5,000 increase in liabilities under the accrual e basis: $5,000 decrease in assets. $25,000 increase in revenue, and $30,000 increase in expenses under cash basis