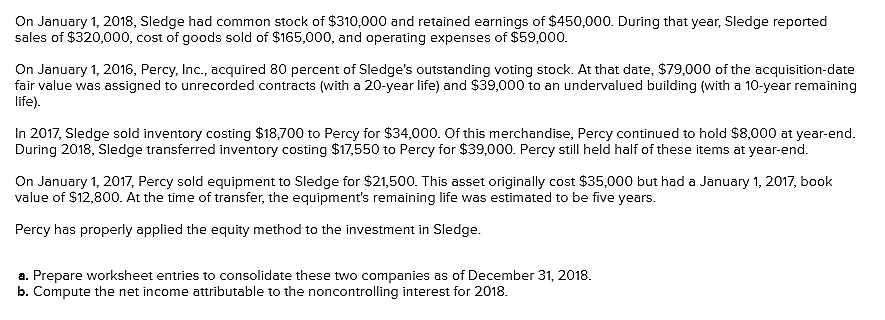

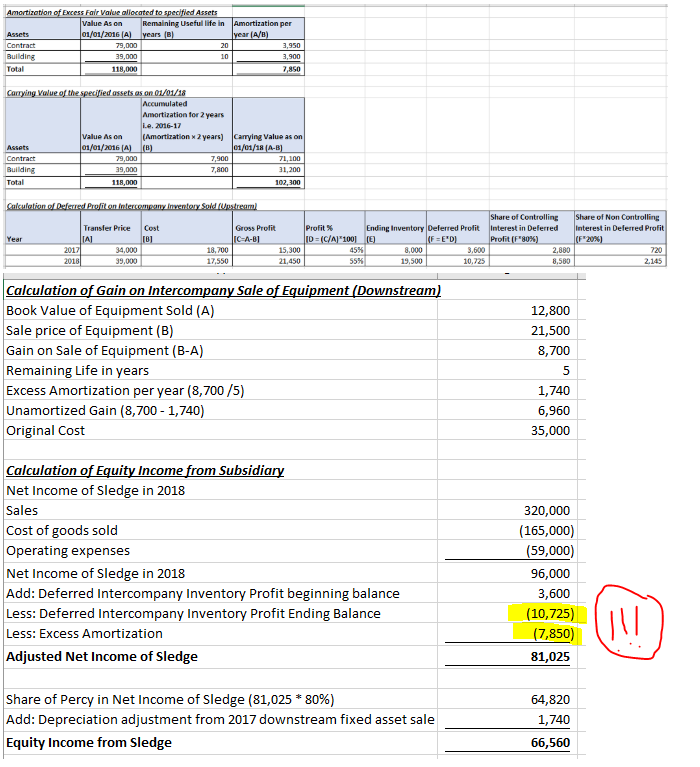

please just show me how to get the (10,725) and (7,850) I highlighted them in yellow bellow!

Thanks.

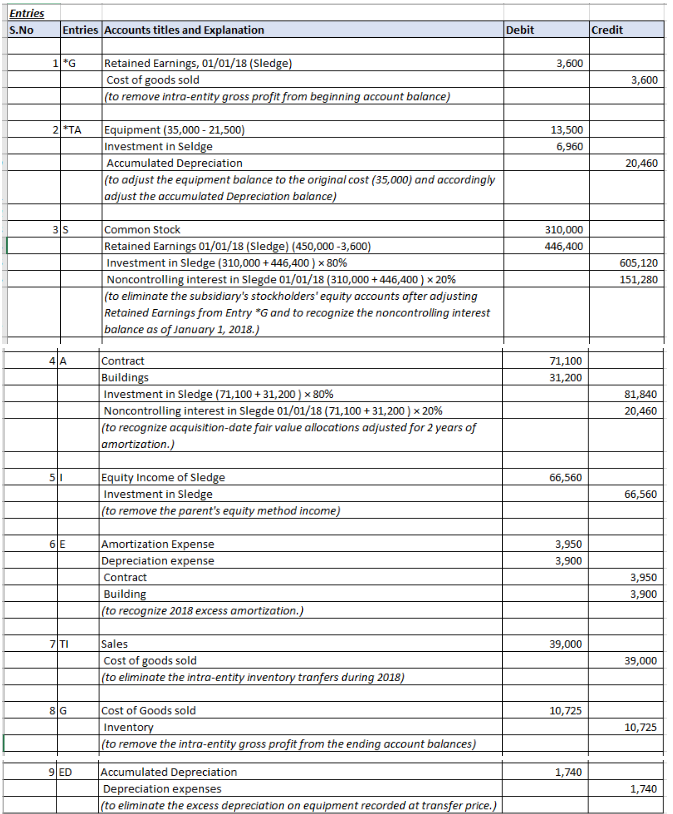

a) Prepare worksheet entries to consolidate these two companies as of December 31, 2018.

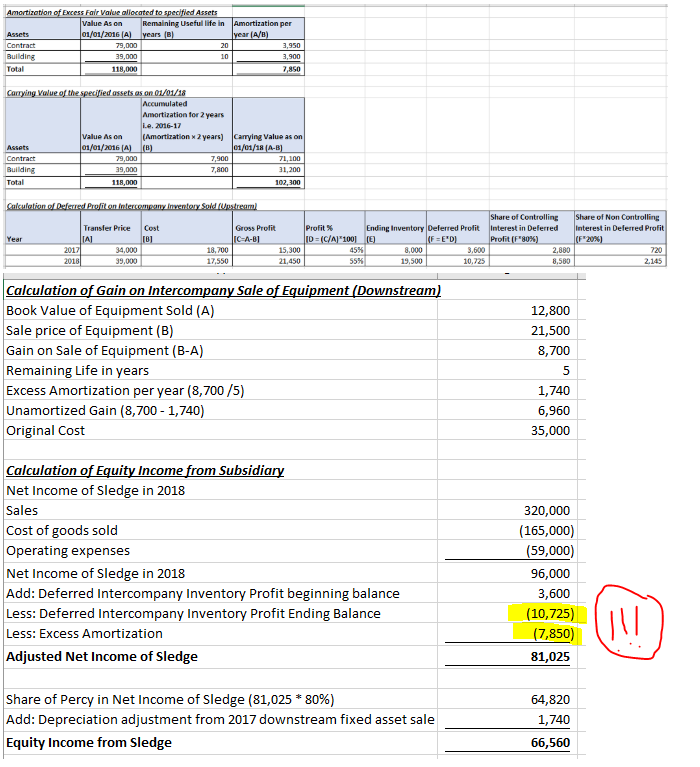

1 Prepare Entry *G to remove the intra-entity gross profit from the beginning account balances.

2 Prepare Entry *TA to adjust the equipment balance to the original cost and to adjust the accumulated depreciation to the consolidated January 1, 2018 balance.

3 Prepare Entry S to eliminate the subsidiary's stockholders' equity accounts and to recognize the noncontrolling interest balance as of January 1, 2018.

4 Prepare Entry A to recognize acquisition-date fair value allocations adjusted for 2 years of amortization.

5 Prepare Entry I to remove the parent's equity method income.

6 Prepare Entry E to recognize 2018 excess amortization.

7 Prepare Entry TI to eliminate the intra-entity inventory tranfers during 2018.

8 Prepare Entry G to remove the intra-entity gross profit from the ending account balances.

9 Prepare Entry ED to eliminate the excess depreciation on equipment recorded at transfer price.

..........................

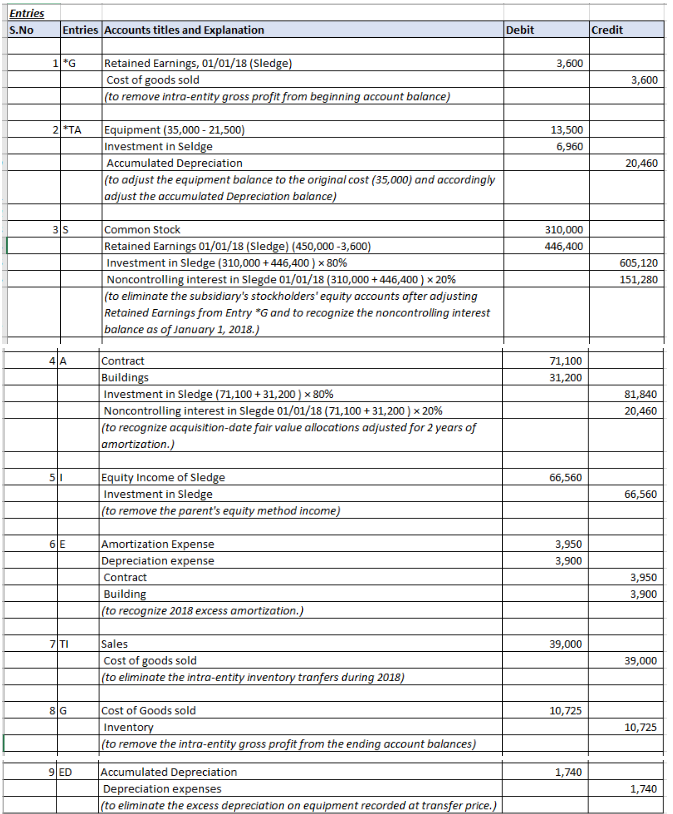

On January 1, 2018, Sledge had common stock of $310,000 and retained earnings of $450,000. During that year, Sledge reported sales of $320,000, cost of goods sold of $165,000, and operating expenses of $59,000. On January 1, 2016, Percy, Inc., acquired 80 percent of Sledge's outstanding voting stock. At that date, $79,000 of the acquisition-date fair value was assigned to unrecorded contracts (with a 20-year life) and $39,000 to an undervalued building (with a 10-year remaining life). In 2017, Sledge sold inventory costing $18,700 to Percy for $34,000. Of this merchandise, Percy continued to hold $8,000 at year-end. During 2018, Sledge transferred inventory costing $17,550 to Percy for $39,000. Percy still held half of these items at year-end. On January 1, 2017, Percy sold equipment to Sledge for $21,500. This asset originally cost $35,000 but had a January 1, 2017, book value of $12,800. At the time of transfer, the equipment's remaining life was estimated to be five years. Percy has properly applied the equity method to the investment in Sledge. a. Prepare worksheet entries to consolidate these two companies as of December 31, 2018. b. Compute the net income attributable to the noncontrolling interest for 2018. Amortization of Excess Fair Value allocated to specified Assets Value As on Remaining Useful life in Amortization per lo1/01/2016 (A) years (B) lyear (A/B) Contract 79,000 20 Building 10 Total 119,000 7,850 Carrying Value of the specified assets as on 01/01/18 Accumulated Amortization for 2 years i.e. 2016-17 Value As on Amortization 2 years) Assets 01/01/2016 (A) (B) Contract 79.000 7,900 39,000 Total 118,000 carrying Value as on 01/01/18 (A-B 71,100 31,200 102,300 7.800 Calculation of Deferred Profile on Intercongan Inventory Sold Ustream Transfer Price Cost Gross Profit IC-A-B] Share of Controlling Interest in Deferred Prolit (F*80%) 2.880 8,580 Share of Non Controlling Interest in Deferred Profit (F202) Profit % Ending Inventory Deferred Profit JID = (C/A)*100] (E) (FEED) 15,300 8,000 3,600 21,450 55% 19.500 10.725 18.700 17,550 2018 39.000 2.145 12,800 21,500 8,700 Calculation of Gain on Intercompany Sale of Equipment (Downstream) Book Value of Equipment Sold (A) Sale price of Equipment (B) Gain on Sale of Equipment (B-A) Remaining Life in years Excess Amortization per year (8,700 /5) Unamortized Gain (8,700 - 1,740) Original Cost 1,740 6,960 35,000 Calculation of Equity Income from Subsidiary Net Income of Sledge in 2018 Sales Cost of goods sold Operating expenses Net Income of Sledge in 2018 Add: Deferred Intercompany Inventory Profit beginning balance Less: Deferred Intercompany Inventory Profit Ending Balance Less: Excess Amortization Adjusted Net Income of Sledge 320,000 (165,000) (59,000) 96,000 3,600 (10,725) (7,850) 81,025 Share of Percy in Net Income of Sledge (81,025 * 80%) Add: Depreciation adjustment from 2017 downstream fixed asset sale Equity Income from Sledge 64,820 1,740 66,560 Entries S.No Entries Accounts titles and Explanation Debit Credit 1*6 3,600 Retained Earnings, 01/01/18 (Sledge) Cost of goods sold (to remove intra-entity gross profit from beginning account balance) 3,600 21 TA 13,500 6,960 Equipment (35,000 - 21,500) Investment in Seldge Accumulated Depreciation (to adjust the equipment balance to the original cost (35,000) and accordingly adjust the accumulated Depreciation balance) 20,460 310,000 446,400 Common Stock Retained Earnings 01/01/18 (Sledge) (450,000 -3,600) Investment in Sledge (310,000+ 446,400) x 80% Noncontrolling interest in Slegde 01/01/18 (310,000+ 446,400) x 20% (to eliminate the subsidiary's stockholders' equity accounts after adjusting Retained Earnings from Entry *G and to recognize the noncontrolling interest balance as of January 1, 2018.) 605,120 151,280 71,100 31.200 Contract Buildings Investment in Sledge (71,100+ 31,200) x 80% Noncontrolling interest in Slegde 01/01/18 (71,100+ 31, 200) x 20% (to recognize acquisition-date fair value allocations adjusted for 2 years of amortization.) 81,840 20,460 66,560 Equity Income of Sledge Investment in Sledge (to remove the parent's equity method income) 66,560 3,950 3,900 Amortization Expense Depreciation expense Contract Building (to recognize 2018 excess amortization.) 3,950 3,900 39,000 Sales Cost of goods sold (to eliminate the intra-entity inventory tranfers during 2018) 39,000 10,725 Cost of Goods sold Inventory (to remove the intra-entity gross profit from the ending account balances) 10,725 9 ED 1,740 Accumulated Depreciation Depreciation expenses (to eliminate the excess depreciation on equipment recorded at transfer price.) 1,740