Answered step by step

Verified Expert Solution

Question

1 Approved Answer

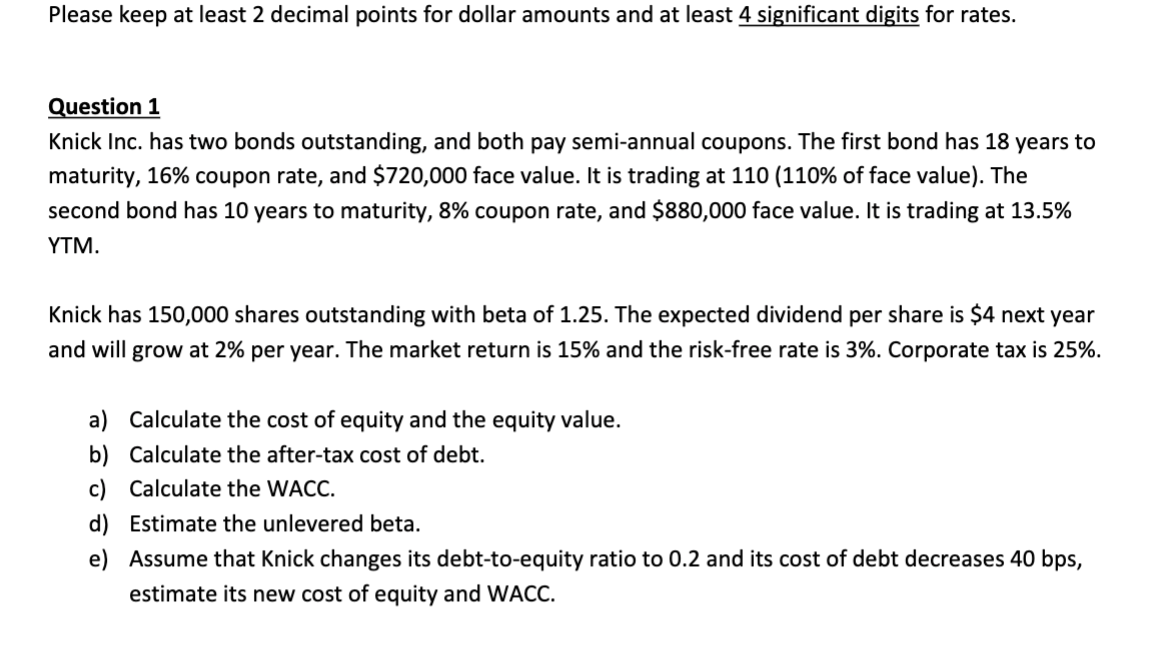

Please keep at least 2 decimal points for dollar amounts and at least 4 significant digits for rates. Question 1 Knick Inc. has two bonds

Please keep at least decimal points for dollar amounts and at least significant digits for rates.

Question

Knick Inc. has two bonds outstanding, and both pay semiannual coupons. The first bond has years to

maturity, coupon rate, and $ face value. It is trading at of face value The

second bond has years to maturity, coupon rate, and $ face value. It is trading at

YTM

Knick has shares outstanding with beta of The expected dividend per share is $ next year

and will grow at per year. The market return is and the riskfree rate is Corporate tax is

a Calculate the cost of equity and the equity value.

b Calculate the aftertax cost of debt.

c Calculate the WACC.

d Estimate the unlevered beta.

e Assume that Knick changes its debttoequity ratio to and its cost of debt decreases bps

estimate its new cost of equity and WACC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started