Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please keep in mind for this question, the answer should be $222,272,310.79. Please show how to get to this, other answers will be disregarded. Assume

Please keep in mind for this question, the answer should be $222,272,310.79. Please show how to get to this, other answers will be disregarded.

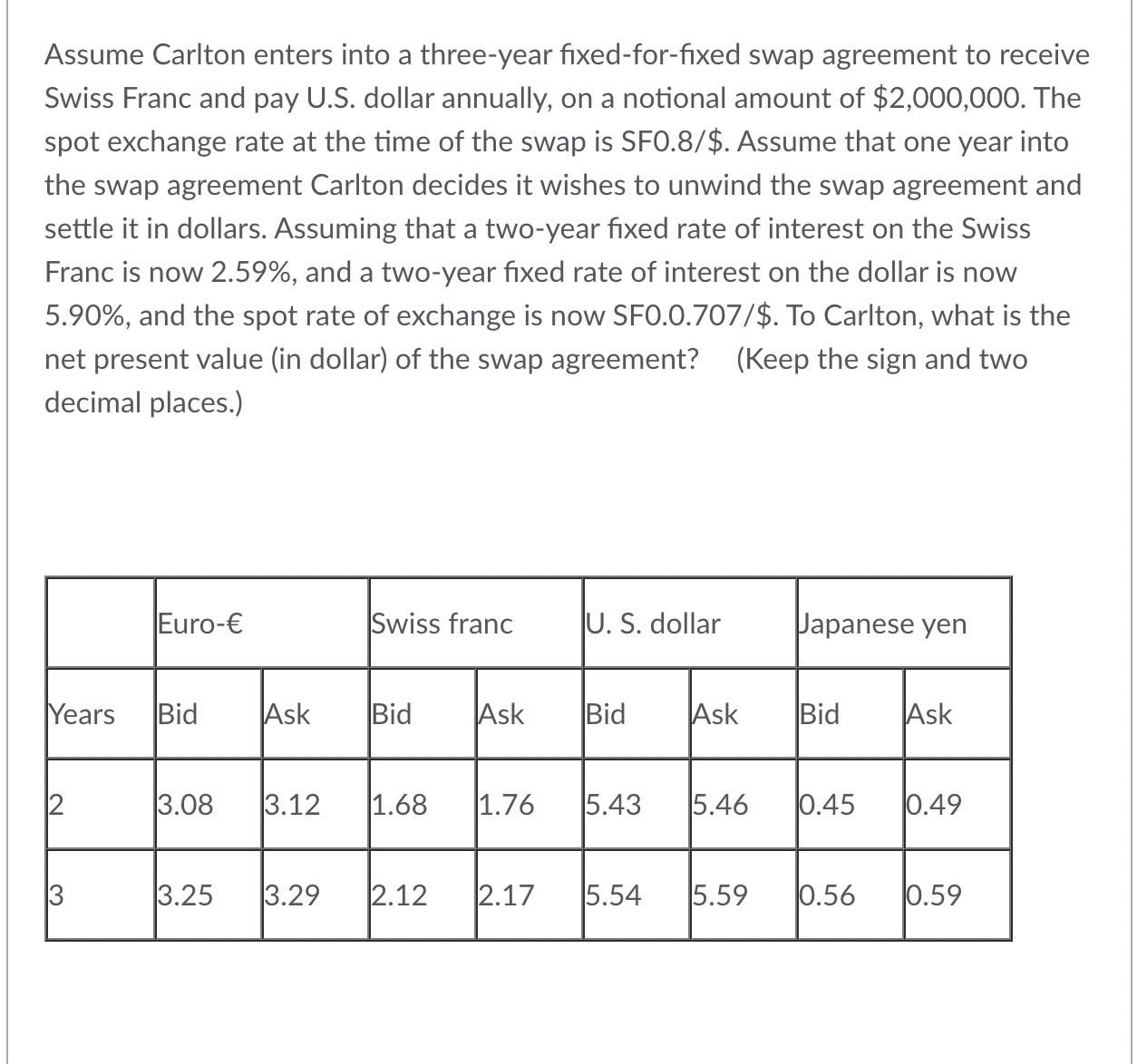

Assume Carlton enters into a three-year fixed-for-fixed swap agreement to receive Swiss Franc and pay U.S. dollar annually, on a notional amount of \\( \\$ 2,000,000 \\). The spot exchange rate at the time of the swap is SFO.8/\\$. Assume that one year into the swap agreement Carlton decides it wishes to unwind the swap agreement and settle it in dollars. Assuming that a two-year fixed rate of interest on the Swiss Franc is now \2.59, and a two-year fixed rate of interest on the dollar is now \5.90, and the spot rate of exchange is now SF0.0.707/\\$. To Carlton, what is the net present value (in dollar) of the swap agreement? (Keep the sign and two decimal places.)

Assume Carlton enters into a three-year fixed-for-fixed swap agreement to receive Swiss Franc and pay U.S. dollar annually, on a notional amount of \\( \\$ 2,000,000 \\). The spot exchange rate at the time of the swap is SFO.8/\\$. Assume that one year into the swap agreement Carlton decides it wishes to unwind the swap agreement and settle it in dollars. Assuming that a two-year fixed rate of interest on the Swiss Franc is now \2.59, and a two-year fixed rate of interest on the dollar is now \5.90, and the spot rate of exchange is now SF0.0.707/\\$. To Carlton, what is the net present value (in dollar) of the swap agreement? (Keep the sign and two decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started