Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please kindly answer all questions RRT Co. plans to raise and invest $5 million in a new project. Compared to the risks of the firm's

please kindly answer all questions

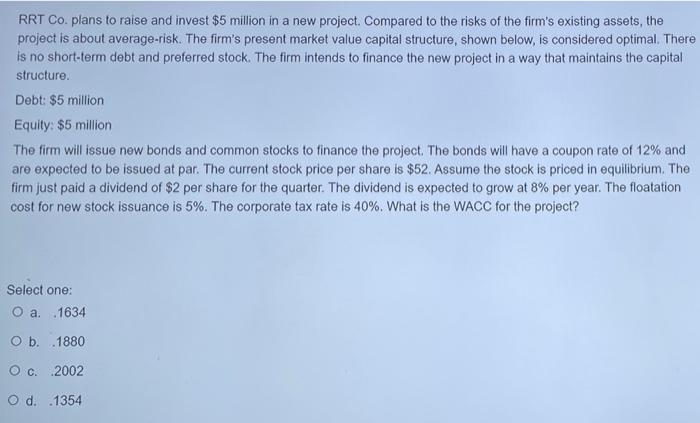

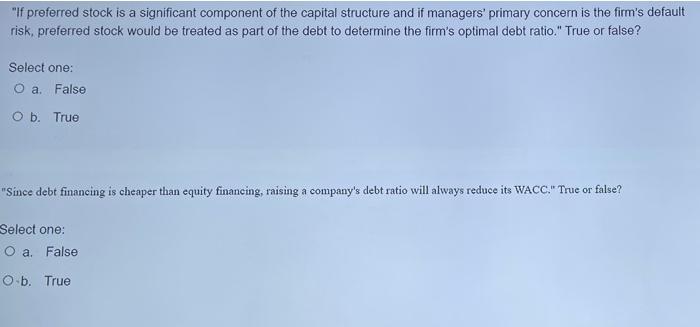

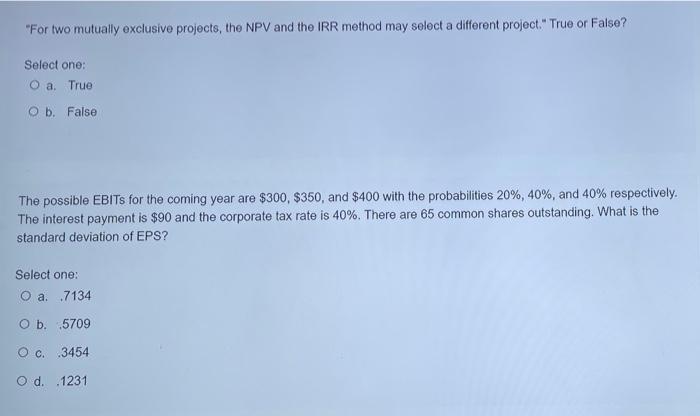

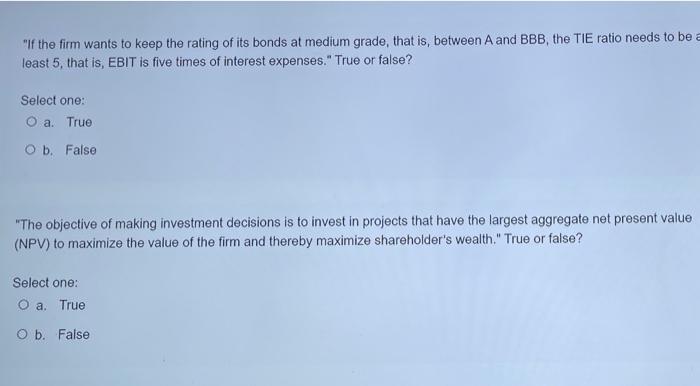

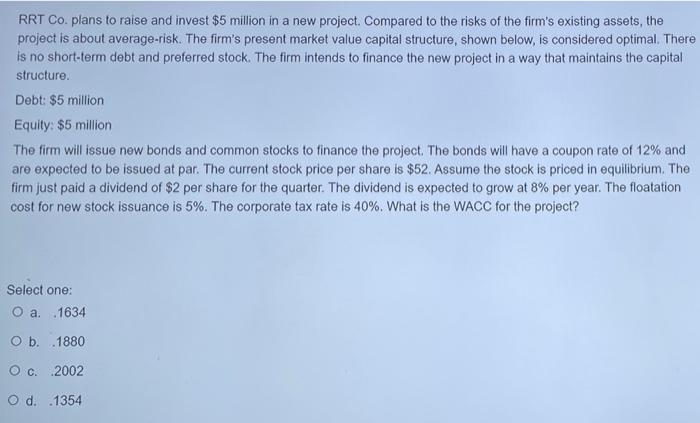

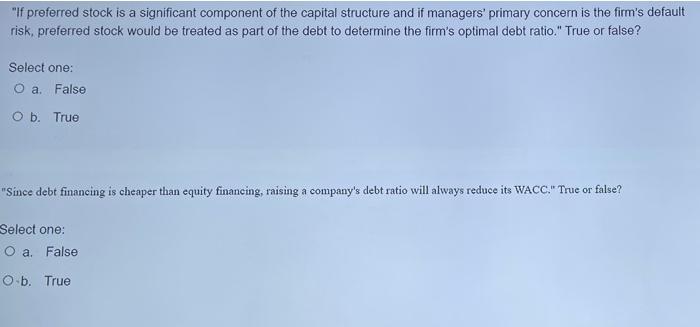

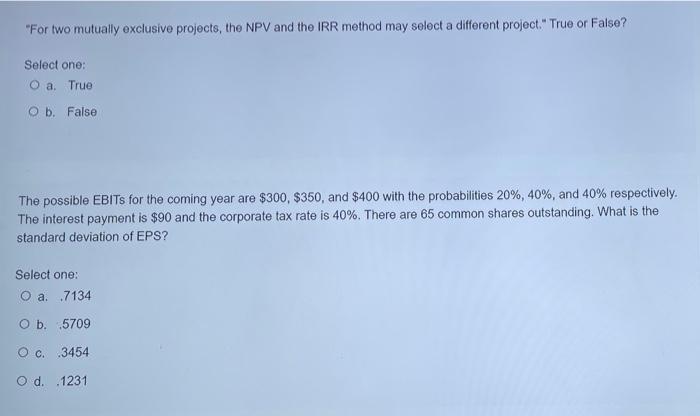

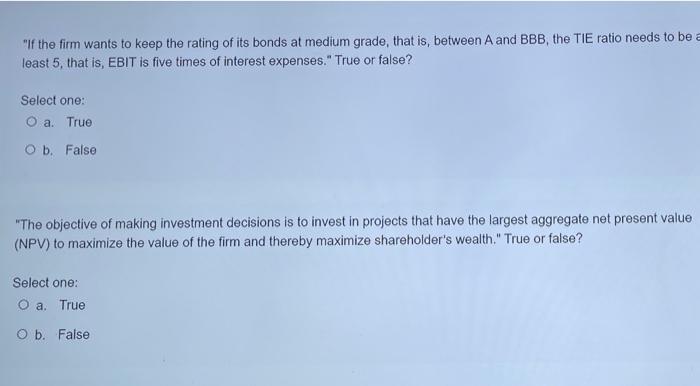

RRT Co. plans to raise and invest $5 million in a new project. Compared to the risks of the firm's existing assets, the project is about average-risk. The firm's present market value capital structure, shown below, is considered optimal. There is no short-term debt and preferred stock. The firm intends to finance the new project in a way that maintains the capital structure. Debt: $5 million Equity: $5 million The firm will issue new bonds and common stocks to finance the project. The bonds will have a coupon rate of 12% and are expected to be issued at par. The current stock price per share is $52. Assume the stock is priced in equilibrium. The firm just paid a dividend of $2 per share for the quarter. The dividend is expected to grow at 8% per year. The floatation cost for new stock issuance is 5%. The corporate tax rate is 40%. What is the WACC for the project? Select one: O a. 1634 O b. 1880 Oc. 2002 O d. 1354 "If preferred stock is a significant component of the capital structure and if managers primary concern is the firm's default risk, preferred stock would be treated as part of the debt to determine the firm's optimal debt ratio." True or false? Select one: O a False Ob. True "Since debt financing is cheaper than equity financing, raising a company's debt ratio will always reduce its WACC." True or false? Select one: O a False O b. True "For two mutually exclusive projects, the NPV and the IRR method may select a different project." True or False? Select one: O a. True Ob. False The possible EBITs for the coming year are $300, $350, and $400 with the probabilities 20%, 40%, and 40% respectively. The interest payment is $90 and the corporate tax rate is 40%. There are 65 common shares outstanding. What is the standard deviation of EPS? Select one: O a. .7134 O b. 5709 O c. 3454 O d. 1231 "If the firm wants to keep the rating of its bonds at medium grade, that is, between A and BBB, the TIE ratio needs to be a least 5, that is, EBIT is five times of interest expenses." True or false? Select one: O a. True O b. False "The objective of making investment decisions is to invest in projects that have the largest aggregate net present value (NPV) to maximize the value of the firm and thereby maximize shareholder's wealth." True or false? Select one: O a. True Ob. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started