Answered step by step

Verified Expert Solution

Question

1 Approved Answer

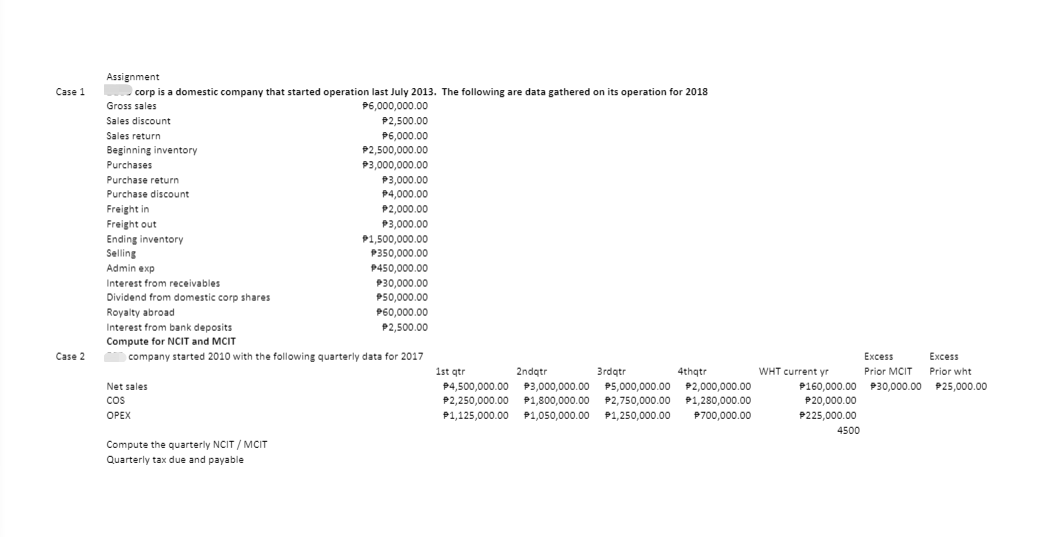

Please kindly provide an explanation. Thank you Case 1 Assignment corp is a domestic company that started operation last July 2013. The following are data

Please kindly provide an explanation. Thank you

Case 1 Assignment corp is a domestic company that started operation last July 2013. The following are data gathered on its operation for 2018 Gross sales P6,000,000.00 Sales discount P2,500.00 Sales return P6,000.00 Beginning inventory P2,500,000.00 Purchases $3,000,000.00 Purchase return P3,000.00 Purchase discount P4,000.00 Freight in P2,000.00 Freight out P3,000.00 Ending inventory 91,500,000.00 Selling +350,000.00 Admin exp P450,000.00 Interest from receivables 30,000.00 Dividend from domestic corp shares 250,000.00 Royalty abroad P60,000.00 Interest from bank deposits P2,500.00 Compute for NCIT and MCIT company started 2010 with the following quarterly data for 2017 1st qtr 2ndqtr 3rdqtr 4thgtr Net sales P4,500,000.00 P3,000,000.00 P5,000,000.00 2,000,000.00 COS P2,250,000.00 P1,800,000.00 2,750,000.00 $1,280,000.00 OPEX P1,125,000.00 1,050,000.00 $1,250,000.00 P700,000.00 Case 2 Excess Excess WHT currentyr Prior MCIT Prior wht 2160,000.00 $30,000.00 $25,000.00 P20,000.00 P225,000.00 4500 Compute the quarterly NCIT/MCIT Quarterly tax due and payable Case 1 Assignment corp is a domestic company that started operation last July 2013. The following are data gathered on its operation for 2018 Gross sales P6,000,000.00 Sales discount P2,500.00 Sales return P6,000.00 Beginning inventory P2,500,000.00 Purchases $3,000,000.00 Purchase return P3,000.00 Purchase discount P4,000.00 Freight in P2,000.00 Freight out P3,000.00 Ending inventory 91,500,000.00 Selling +350,000.00 Admin exp P450,000.00 Interest from receivables 30,000.00 Dividend from domestic corp shares 250,000.00 Royalty abroad P60,000.00 Interest from bank deposits P2,500.00 Compute for NCIT and MCIT company started 2010 with the following quarterly data for 2017 1st qtr 2ndqtr 3rdqtr 4thgtr Net sales P4,500,000.00 P3,000,000.00 P5,000,000.00 2,000,000.00 COS P2,250,000.00 P1,800,000.00 2,750,000.00 $1,280,000.00 OPEX P1,125,000.00 1,050,000.00 $1,250,000.00 P700,000.00 Case 2 Excess Excess WHT currentyr Prior MCIT Prior wht 2160,000.00 $30,000.00 $25,000.00 P20,000.00 P225,000.00 4500 Compute the quarterly NCIT/MCIT Quarterly tax due and payableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started