Answered step by step

Verified Expert Solution

Question

1 Approved Answer

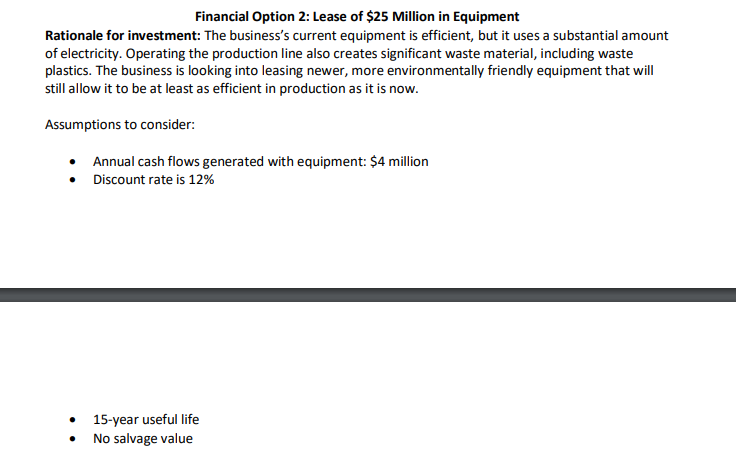

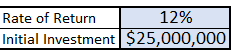

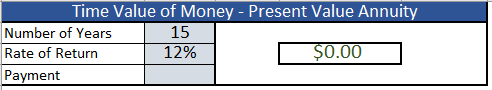

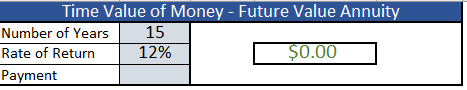

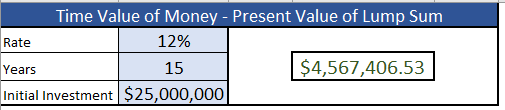

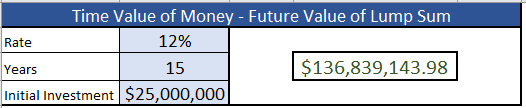

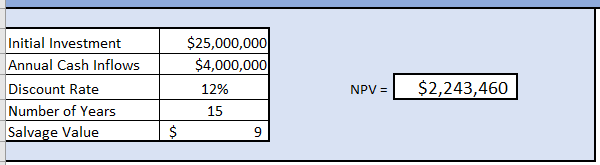

Please let me know if my below entries are correct. I am having a hard time calculating the payment for the present value annuity and

Please let me know if my below entries are correct. I am having a hard time calculating the payment for the present value annuity and future value annuity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started