Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please let me know if this okay. I have posted the problem but will continue to post more or include text Collis Jeny Seircy, Austin

please let me know if this okay. I have posted the problem but will continue to post more or include text

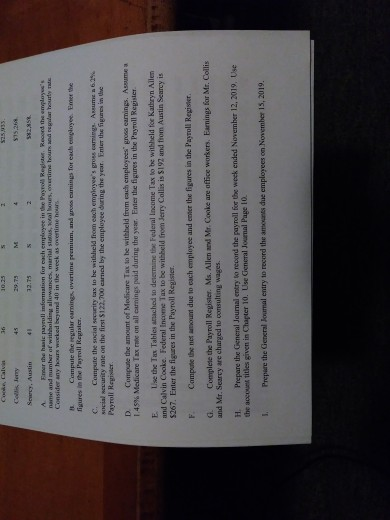

Collis Jeny Seircy, Austin 32.73 Emer the hasic payrull information for each employee in the Poyrol Regleer, Reoond the employss's lding allowances, marital stetus, rotal houws, evertima hours and eegdar hourty rate Consider any hours worked beyond 40 in the week as overtime nours s in hen Compule the regular earnings, overtime premium, and gross camings for eadh enployee. Emer the C. Compute the social security tax to be withheld from each employee's gross caming. ARRume a 62% social security rale on the first $122,700 carned by the employee during the year, Enter the figures in the Payroli Regisier DCompate the amount of Medicare Tax to be withbeld from each employees" gross earnings. Assume 1.45% Medicare Tax rtr on all earnings paid during the year. Emer the figures in the PayToll Register LUise the Tax Tables anached to determine the Federal Income Tax to be withheld for Kathryn Allen and Calvin Cooke. Federal Income Tax to be withbeld from Serry Collis is $192 and from Austin Searcy is $267. Enter the figures in the Payroll Register F. Compute the nes amount due to each employee and enver the figures in the Payroll Register G.. Complete the Payroll Register. Ms. Allen and Mir. Conke are office workers. Eamings for Mr. Collis and Mr. Searcy are charged to consulting wages H Prepare the General Journal entry to record the payroll for the week ended November 12, 2019, Use the accounk titles given in Chagter 10. Use Gieneral Journal Page 1o. Prepare the General Joumal entry to record the amounts due employees on November 15, 2019 Collis Jeny Seircy, Austin 32.73 Emer the hasic payrull information for each employee in the Poyrol Regleer, Reoond the employss's lding allowances, marital stetus, rotal houws, evertima hours and eegdar hourty rate Consider any hours worked beyond 40 in the week as overtime nours s in hen Compule the regular earnings, overtime premium, and gross camings for eadh enployee. Emer the C. Compute the social security tax to be withheld from each employee's gross caming. ARRume a 62% social security rale on the first $122,700 carned by the employee during the year, Enter the figures in the Payroli Regisier DCompate the amount of Medicare Tax to be withbeld from each employees" gross earnings. Assume 1.45% Medicare Tax rtr on all earnings paid during the year. Emer the figures in the PayToll Register LUise the Tax Tables anached to determine the Federal Income Tax to be withheld for Kathryn Allen and Calvin Cooke. Federal Income Tax to be withbeld from Serry Collis is $192 and from Austin Searcy is $267. Enter the figures in the Payroll Register F. Compute the nes amount due to each employee and enver the figures in the Payroll Register G.. Complete the Payroll Register. Ms. Allen and Mir. Conke are office workers. Eamings for Mr. Collis and Mr. Searcy are charged to consulting wages H Prepare the General Journal entry to record the payroll for the week ended November 12, 2019, Use the accounk titles given in Chagter 10. Use Gieneral Journal Page 1o. Prepare the General Joumal entry to record the amounts due employees on November 15, 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started