Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please let me know the full calculation of SCI and SFP Meek's Penguin Corp. (MPC) is a Canadian company that reports its financial results in

Please let me know the full calculation of SCI and SFP

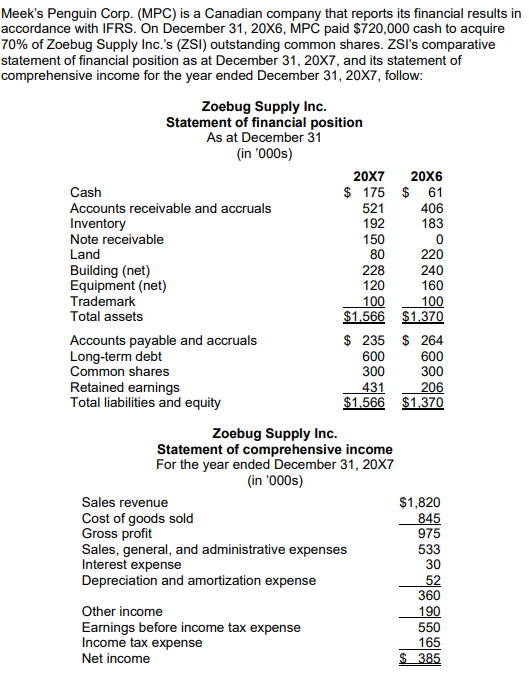

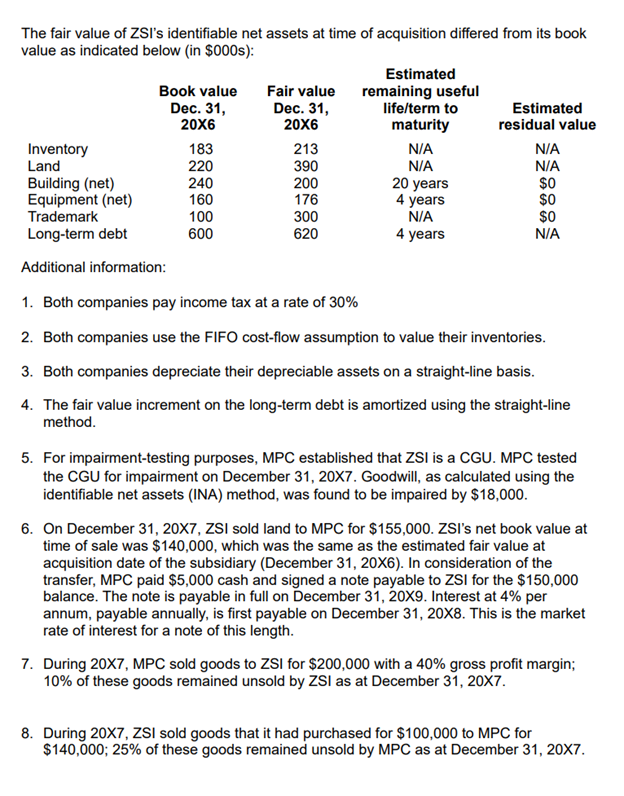

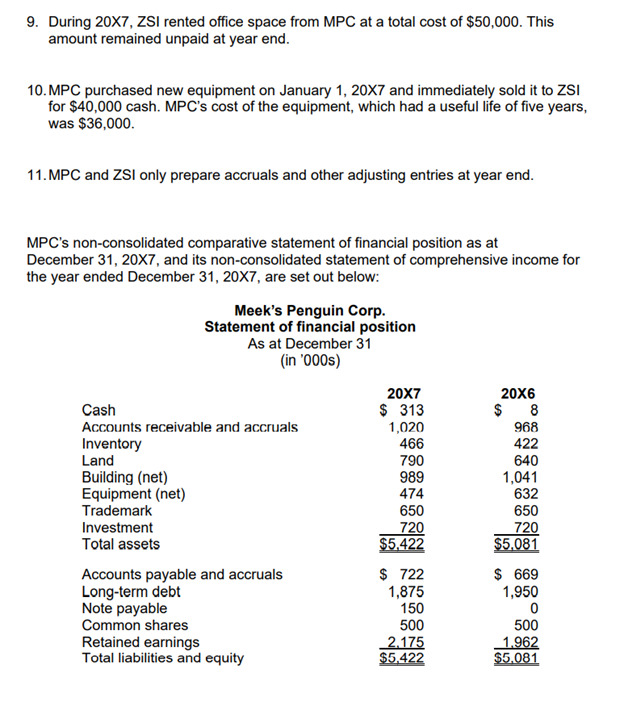

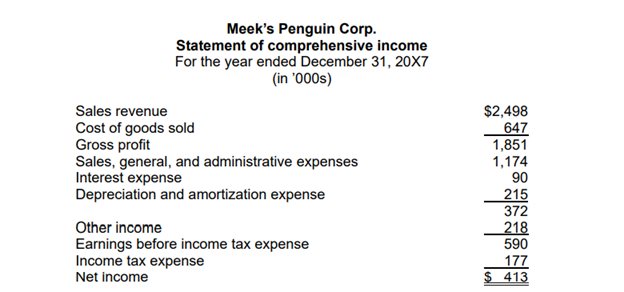

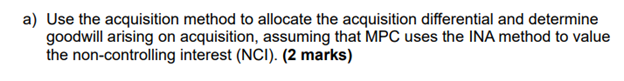

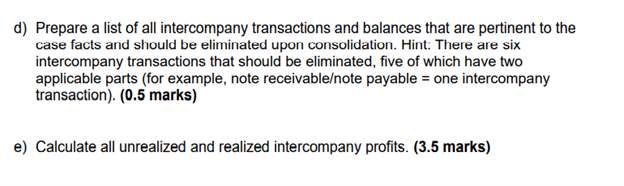

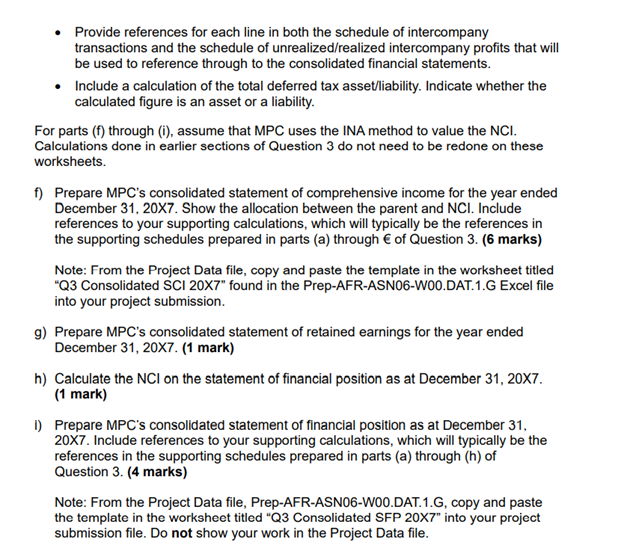

Meek's Penguin Corp. (MPC) is a Canadian company that reports its financial results in accordance with IFRS. On December 31, 20X6, MPC paid $720,000 cash to acquire 70% of Zoebug Supply Inc.'s (ZSI) outstanding common shares. ZSI's comparative statement of financial position as at December 31, 20X7, and its statement of comprehensive income for the year ended December 31, 20X7, follow: Zoebug Supply Inc. Statement of financial position As at December 31 (in '000s) 20X7 20X6 Cash $ 175 $ 61 Accounts receivable and accruals 521 406 Inventory 192 183 Note receivable 150 0 Land 80 220 Building (net) 228 240 Equipment (net) 120 160 Trademark 100 100 Total assets $1.566 $1.370 Accounts payable and accruals $ 235 $ 264 Long-term debt 600 600 Common shares 300 300 Retained earnings 206 Total liabilities and equity $1.566 $1,370 431 Zoebug Supply Inc. Statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue $1,820 Cost of goods sold 845 Gross profit 975 Sales, general, and administrative expenses 533 Interest expense 30 Depreciation and amortization expense 52 360 Other income 190 Earnings before income tax expense 550 Income tax expense 165 Net income $385 The fair value of ZSI's identifiable net assets at time of acquisition differed from its book value as indicated below (in $000s): Estimated Book value Fair value remaining useful Dec. 31, Dec. 31, life/term to Estimated 20X6 20X6 maturity residual value Inventory 183 213 N/A N/A Land 220 390 N/A N/A Building (net) 240 200 20 years $0 Equipment (net) 160 176 4 years $0 Trademark 100 300 N/A $0 Long-term debt 600 620 4 years N/A Additional information: 1. Both companies pay income tax at a rate of 30% 2. Both companies use the FIFO cost-flow assumption to value their inventories. 3. Both companies depreciate their depreciable assets on a straight-line basis. 4. The fair value increment on the long-term debt is amortized using the straight-line method. 5. For impairment-testing purposes, MPC established that ZSI is a CGU. MPC tested the CGU for impairment on December 31, 20x7. Goodwill, as calculated using the identifiable net assets (INA) method, was found to be impaired by $18,000. 6. On December 31, 20X7, ZSI sold land to MPC for $155,000. ZSI's net book value at time of sale was $140,000, which was the same as the estimated fair value at acquisition date of the subsidiary (December 31, 20X6). In consideration of the transfer, MPC paid $5,000 cash and signed a note payable to ZSI for the $150,000 balance. The note is payable in full on December 31, 20X9. Interest at 4% per annum, payable annually, is first payable on December 31, 20X8. This is the market rate of interest for a note of this length. 7. During 20X7, MPC sold goods to ZSI for $200,000 with a 40% gross profit margin; 10% of these goods remained unsold by ZSI as at December 31, 20x7. 8. During 20X7, ZSI sold goods that it had purchased for $100,000 to MPC for $140,000; 25% of these goods remained unsold by MPC as at December 31, 20x7. 9. During 20x7, ZSI rented office space from MPC at a total cost of $50,000. This amount remained unpaid at year end. 10. MPC purchased new equipment on January 1, 20X7 and immediately sold it to ZSI for $40,000 cash. MPC's cost of the equipment, which had a useful life of five years, was $36,000. 11. MPC and ZSI only prepare accruals and other adjusting entries at year end. MPC's non-consolidated comparative statement of financial position as at December 31, 20X7, and its non-consolidated statement of comprehensive income for the year ended December 31, 20X7, are set out below: Meek's Penguin Corp. Statement of financial position As at December 31 (in '000s) Cash Accounts receivable and accruals Inventory Land Building (net) Equipment (net) Trademark Investment Total assets Accounts payable and accruals Long-term debt Note payable Common shares Retained earnings Total liabilities and equity 20X7 $ 313 1,020 466 790 989 474 650 720 $5.422 20X6 $ 8 968 422 640 1,041 632 650 720 $5,081 $ 722 1,875 150 500 2.175 $5.422 $ 669 1,950 0 500 1.962 $5.081 Meek's Penguin Corp. Statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue Cost of goods sold Gross profit Sales, general, and administrative expenses Interest expense Depreciation and amortization expense Other income Earnings before income tax expense Income tax expense Net Income $2,498 647 1,851 1,174 90 215 372 218 590 177 $ 413 a) Use the acquisition method to allocate the acquisition differential and determine goodwill arising on acquisition, assuming that MPC uses the INA method to value the non-controlling interest (NCI). (2 marks) d) Prepare a list of all intercompany transactions and balances that are pertinent to the case facts and should be eliminated upon consolidation. Hint: There are six intercompany transactions that should be eliminated, five of which have two applicable parts (for example, note receivableote payable = one intercompany transaction). (0.5 marks) e) Calculate all unrealized and realized intercompany profits. (3.5 marks) Provide references for each line in both the schedule of intercompany transactions and the schedule of unrealized/realized intercompany profits that will be used to reference through to the consolidated financial statements. Include a calculation of the total deferred tax asset/liability. Indicate whether the calculated figure is an asset or a liability. For parts (6) through (i), assume that MPC uses the INA method to value the NCI. Calculations done in earlier sections of Question 3 do not need to be redone on these worksheets. f) Prepare MPC's consolidated statement of comprehensive income for the year ended December 31, 20X7. Show the allocation between the parent and NCI. Include references to your supporting calculations, which will typically be the references in the supporting schedules prepared in parts (a) through of Question 3. (6 marks) Note: From the Project Data file, copy and paste the template in the worksheet titled "Q3 Consolidated SCI 20X7" found in the Prep-AFR-ASN06-W00.DAT.1.6 Excel file into your project submission. 9) Prepare MPC's consolidated statement of retained earnings for the year ended December 31, 20X7. (1 mark) h) Calculate the NCI on the statement of financial position as at December 31, 20x7. (1 mark) 1) Prepare MPC's consolidated statement of financial position as at December 31, 20x7. Include references to your supporting calculations, which will typically be the references in the supporting schedules prepared in parts (a) through (h) of Question 3. (4 marks) Note: From the Project Data file, Prep-AFR-ASN06-WOO.DAT.1. G, copy and paste the template in the worksheet titled "Q3 Consolidated SFP 20X7" into your project submission file. Do not show your work in the Project Data file. Meek's Penguin Corp. (MPC) is a Canadian company that reports its financial results in accordance with IFRS. On December 31, 20X6, MPC paid $720,000 cash to acquire 70% of Zoebug Supply Inc.'s (ZSI) outstanding common shares. ZSI's comparative statement of financial position as at December 31, 20X7, and its statement of comprehensive income for the year ended December 31, 20X7, follow: Zoebug Supply Inc. Statement of financial position As at December 31 (in '000s) 20X7 20X6 Cash $ 175 $ 61 Accounts receivable and accruals 521 406 Inventory 192 183 Note receivable 150 0 Land 80 220 Building (net) 228 240 Equipment (net) 120 160 Trademark 100 100 Total assets $1.566 $1.370 Accounts payable and accruals $ 235 $ 264 Long-term debt 600 600 Common shares 300 300 Retained earnings 206 Total liabilities and equity $1.566 $1,370 431 Zoebug Supply Inc. Statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue $1,820 Cost of goods sold 845 Gross profit 975 Sales, general, and administrative expenses 533 Interest expense 30 Depreciation and amortization expense 52 360 Other income 190 Earnings before income tax expense 550 Income tax expense 165 Net income $385 The fair value of ZSI's identifiable net assets at time of acquisition differed from its book value as indicated below (in $000s): Estimated Book value Fair value remaining useful Dec. 31, Dec. 31, life/term to Estimated 20X6 20X6 maturity residual value Inventory 183 213 N/A N/A Land 220 390 N/A N/A Building (net) 240 200 20 years $0 Equipment (net) 160 176 4 years $0 Trademark 100 300 N/A $0 Long-term debt 600 620 4 years N/A Additional information: 1. Both companies pay income tax at a rate of 30% 2. Both companies use the FIFO cost-flow assumption to value their inventories. 3. Both companies depreciate their depreciable assets on a straight-line basis. 4. The fair value increment on the long-term debt is amortized using the straight-line method. 5. For impairment-testing purposes, MPC established that ZSI is a CGU. MPC tested the CGU for impairment on December 31, 20x7. Goodwill, as calculated using the identifiable net assets (INA) method, was found to be impaired by $18,000. 6. On December 31, 20X7, ZSI sold land to MPC for $155,000. ZSI's net book value at time of sale was $140,000, which was the same as the estimated fair value at acquisition date of the subsidiary (December 31, 20X6). In consideration of the transfer, MPC paid $5,000 cash and signed a note payable to ZSI for the $150,000 balance. The note is payable in full on December 31, 20X9. Interest at 4% per annum, payable annually, is first payable on December 31, 20X8. This is the market rate of interest for a note of this length. 7. During 20X7, MPC sold goods to ZSI for $200,000 with a 40% gross profit margin; 10% of these goods remained unsold by ZSI as at December 31, 20x7. 8. During 20X7, ZSI sold goods that it had purchased for $100,000 to MPC for $140,000; 25% of these goods remained unsold by MPC as at December 31, 20x7. 9. During 20x7, ZSI rented office space from MPC at a total cost of $50,000. This amount remained unpaid at year end. 10. MPC purchased new equipment on January 1, 20X7 and immediately sold it to ZSI for $40,000 cash. MPC's cost of the equipment, which had a useful life of five years, was $36,000. 11. MPC and ZSI only prepare accruals and other adjusting entries at year end. MPC's non-consolidated comparative statement of financial position as at December 31, 20X7, and its non-consolidated statement of comprehensive income for the year ended December 31, 20X7, are set out below: Meek's Penguin Corp. Statement of financial position As at December 31 (in '000s) Cash Accounts receivable and accruals Inventory Land Building (net) Equipment (net) Trademark Investment Total assets Accounts payable and accruals Long-term debt Note payable Common shares Retained earnings Total liabilities and equity 20X7 $ 313 1,020 466 790 989 474 650 720 $5.422 20X6 $ 8 968 422 640 1,041 632 650 720 $5,081 $ 722 1,875 150 500 2.175 $5.422 $ 669 1,950 0 500 1.962 $5.081 Meek's Penguin Corp. Statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue Cost of goods sold Gross profit Sales, general, and administrative expenses Interest expense Depreciation and amortization expense Other income Earnings before income tax expense Income tax expense Net Income $2,498 647 1,851 1,174 90 215 372 218 590 177 $ 413 a) Use the acquisition method to allocate the acquisition differential and determine goodwill arising on acquisition, assuming that MPC uses the INA method to value the non-controlling interest (NCI). (2 marks) d) Prepare a list of all intercompany transactions and balances that are pertinent to the case facts and should be eliminated upon consolidation. Hint: There are six intercompany transactions that should be eliminated, five of which have two applicable parts (for example, note receivableote payable = one intercompany transaction). (0.5 marks) e) Calculate all unrealized and realized intercompany profits. (3.5 marks) Provide references for each line in both the schedule of intercompany transactions and the schedule of unrealized/realized intercompany profits that will be used to reference through to the consolidated financial statements. Include a calculation of the total deferred tax asset/liability. Indicate whether the calculated figure is an asset or a liability. For parts (6) through (i), assume that MPC uses the INA method to value the NCI. Calculations done in earlier sections of Question 3 do not need to be redone on these worksheets. f) Prepare MPC's consolidated statement of comprehensive income for the year ended December 31, 20X7. Show the allocation between the parent and NCI. Include references to your supporting calculations, which will typically be the references in the supporting schedules prepared in parts (a) through of Question 3. (6 marks) Note: From the Project Data file, copy and paste the template in the worksheet titled "Q3 Consolidated SCI 20X7" found in the Prep-AFR-ASN06-W00.DAT.1.6 Excel file into your project submission. 9) Prepare MPC's consolidated statement of retained earnings for the year ended December 31, 20X7. (1 mark) h) Calculate the NCI on the statement of financial position as at December 31, 20x7. (1 mark) 1) Prepare MPC's consolidated statement of financial position as at December 31, 20x7. Include references to your supporting calculations, which will typically be the references in the supporting schedules prepared in parts (a) through (h) of Question 3. (4 marks) Note: From the Project Data file, Prep-AFR-ASN06-WOO.DAT.1. G, copy and paste the template in the worksheet titled "Q3 Consolidated SFP 20X7" into your project submission file. Do not show your work in the Project Data fileStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started