please look at every picture before answering. thank you

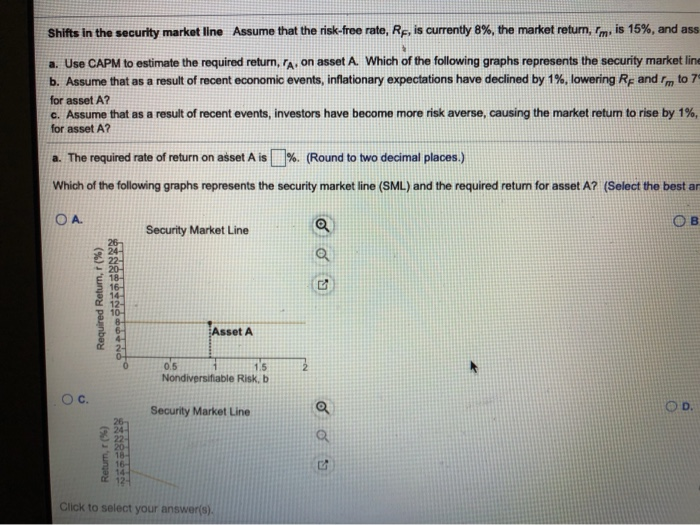

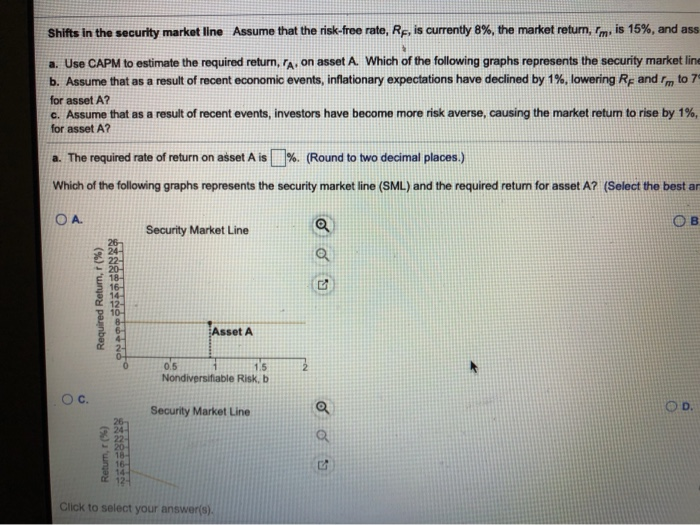

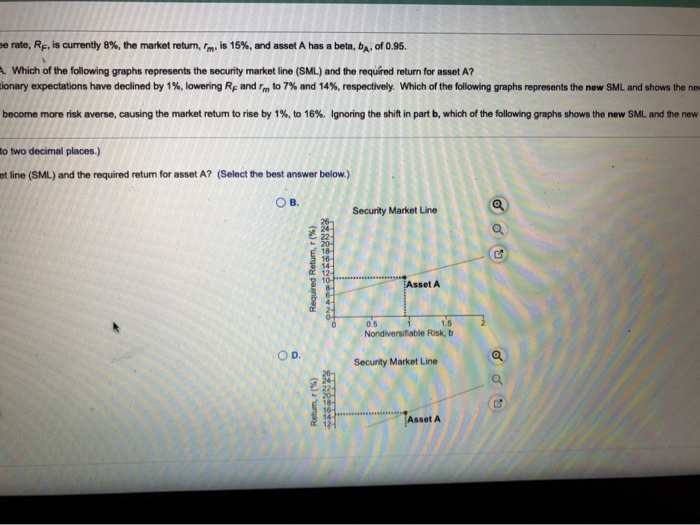

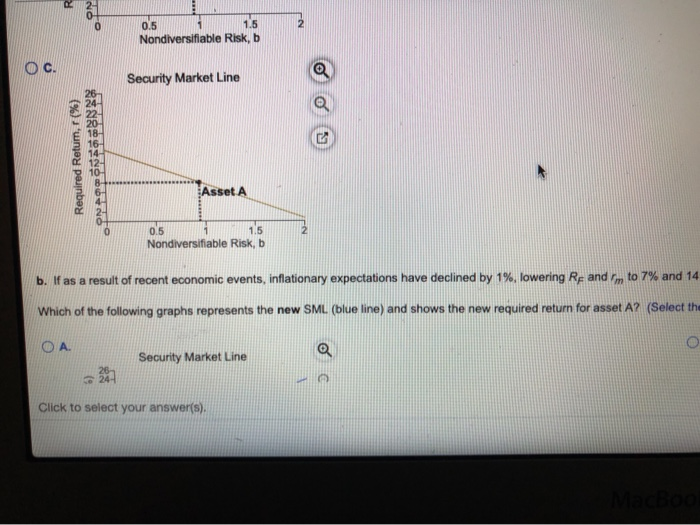

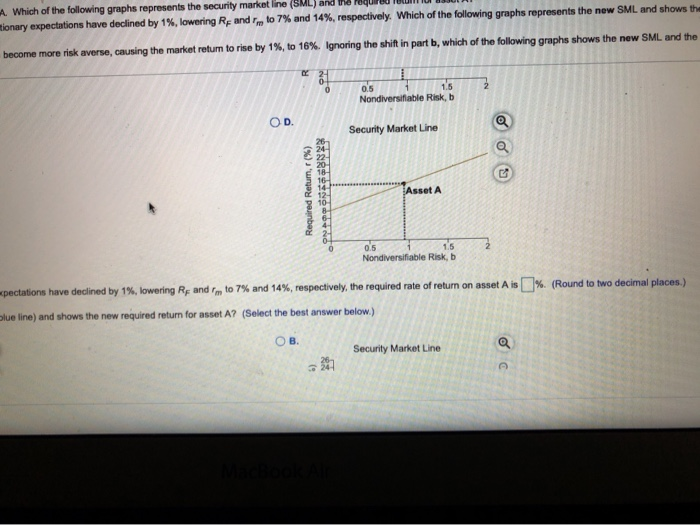

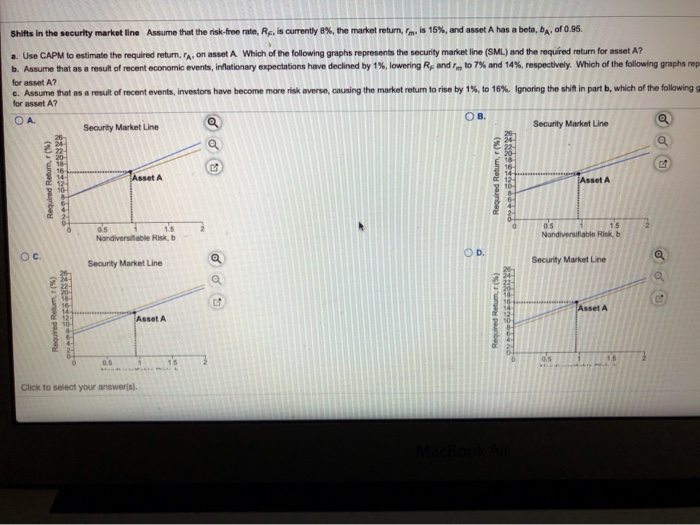

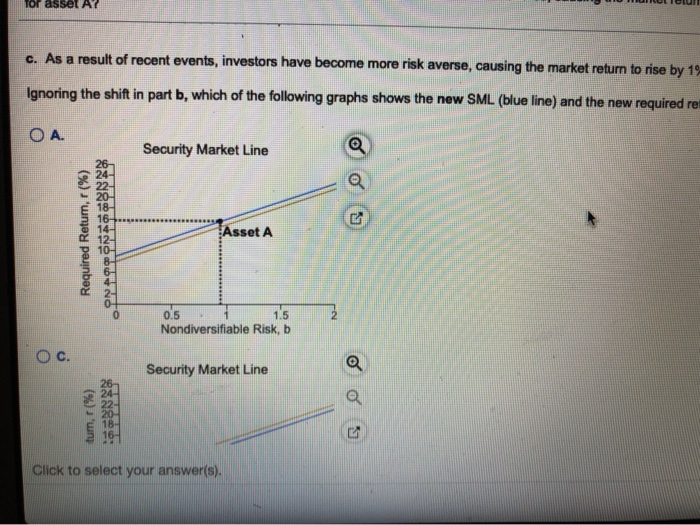

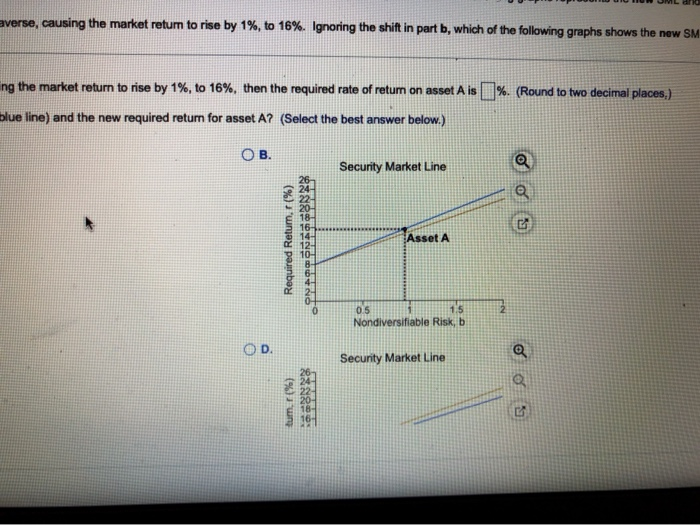

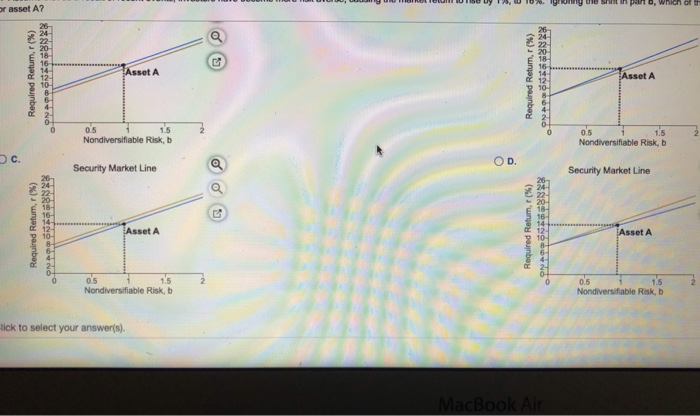

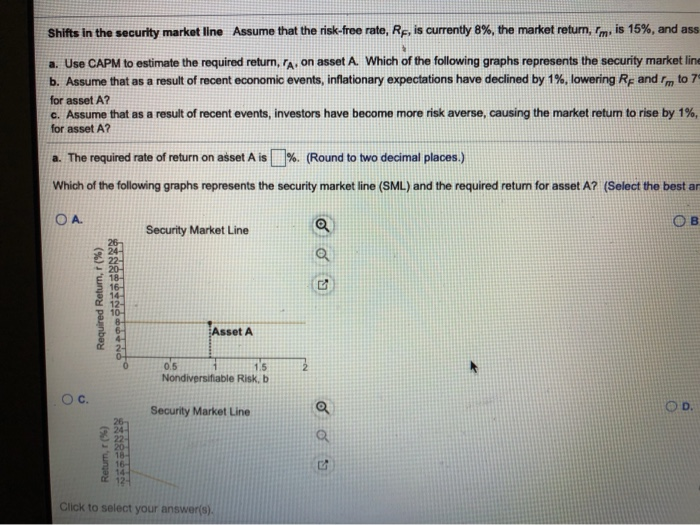

to 7 Shifts in the security market line Assume that the risk-free rate, RF, is currently 8%, the market return, rm, is 15%, and ass a. Use CAPM to estimate the required return, 7A, on asset A. Which of the following graphs represents the security market line b. Assume that as a result of recent economic events, inflationary expectations have declined by 1%, lowering Rp and im for asset A2 C. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 1%, for asset A? a. The required rate of return on asset A is % (Round to two decimal places.) Which of the following graphs represents the security market line (SML) and the required return for asset A? (Select the best ar OA. Q Security Market Line OB Required Retur, (%) 12- 10 Asset A 0.5 1.5 Nondiversifiable Risk, b o C. Security Market Line Q Q Return, r () 14 12- Click to select your answer(s). NO se rate, Re, is currently 8%, the market return, m. is 15%, and asset A has a beta, ba, of 0.95. Which of the following graphs represents the security market line (SML) and the required return for asset A? ionary expectations have declined by 1%, lowering to 7% and 14%, respectively. Which of the following graphs represents the new SML and shows the ne become more risk averse, causing the market retum to rise by 1%, to 16%. Ignoring the shift in part b, which of the following graphs shows the new SML and the new and to two decimal places.) otline (SML) and the required return for asset A? (Select the best answer below.) . Security Market Line 18 Required Retur, (%) 12- Asset A o's Nondiversifiable Risk, b OD Security Market Line Retum, (%) Asset A R NO 0.5 1.5 Nondiversifiable Risk, b Security Market Line Required Retum, r (%) ONONEN Asset A 0 0.5 1.5 Nondiversifiable Risk, b b. If as a result of recent economic events, inflationary expectations have declined by 1%, lowering Re and rm to 7% and 14 Which of the following graphs represents the new SML (blue line) and shows the new required return for asset A? (Select the OA. O Security Market Line 247 Click to select your answer(s). A. Which of the following graphs represents the security market line (SML) and the mionary expectations have declined by 1%, lowering Rp and to 7% and 14%, respectively. Which of the following graphs represents the new SML and shows the become more risk averse, causing the market return to rise by 1%, to 16%. Ignoring the shift in part b, which of the following graphs shows the new SML and the 2 0 0.5 1.5 Nondiversifiable Risk, b OD Security Market Line os Required Retur,r (%) Asset A 12 10 0.5 1.5 Nondiversifiable Risk, b wpectations have declined by 1%, lowering R and rm to 7% and 14%, respectively, the required rate of return on asset Ais % (Round to two decimal places.) blue line) and shows the new required return for asset A? (Select the best answer below.) OB Security Market Line a Shifts in the security market line Assume that the risk-free rate, Re, is currently 8%, the market return, mis 15%, and asset A has a beta, ba, of 0.95 a. Use CAPM to estimate the required return, A. on asset A. Which of the following graphs represents the security market line (SML) and the required return for asset A? b. Assume that as a result of recent economic events, Influtionary expectations have declined by 1%, lowering R and to 7% and 14%, respectively. Which of the following graphs rep for asset A? c. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 1%, to 16%. Ignoring the shift in part b, which of the following for asset A? OA OB Security Market Line Security Market Line Asset A Required Retur, () Required Retum, (%) Asset A 05 Nondiversitable Risk, b o's 1.5 Nondiversifiable Risk, b OD Oc. Security Market Line Security Market Line Required Retum (9) Required Retum, (5) Asset A SUNOD Asset A 05 0.5 Click to select your answer(s). lacBook Tor asset A c. As a result of recent events, investors have become more risk averse, causing the market return to rise by 19- Ignoring the shift in part b, which of the following graphs shows the new SML (blue line) and the new required re OA. Security Market Line (%) 22- 20 18 16- 14- 12- Asset A Required Retum, 0.5 2 1.5 Nondiversifiable Risk, b Security Market Line Q tur, (%) 18- 19- Click to select your answer(s). Everse, causing the market retum to rise by 1%, to 16%. Ignoring the shift in part b, which of the following graphs shows the new SM ing the market return to rise by 1%, to 16%, then the required rate of retum on asset Ais 1 %. (Round to two decimal places.) blue line) and the new required return for asset A? (Select the best answer below.) B. Security Market Line 22- Required Retum,r (%) 18 16 14 12 10- 8 Asset A 0.5 115 Nondiversifiable Risk, b OD. Q Security Market Line tum, (%) ON D, which or asset A? 26 Required Retum, (%) 18 16 14 12 Asset A Required Retum, (%) Asset A 14 12 10- 8 0.5 Nondiversifiable Risk, b 0.5 Nondiversifiable Risk, b c OD Security Market Line o o Security Market Line Required Retur, (%) ONANTEN Required Retum, (%) RNROUND Asset A Asset A 0.5 Nondiversifiable Risk, b 0.5 Nondiversifiable Risk, b lick to select your answer(s). MacBook Air to 7 Shifts in the security market line Assume that the risk-free rate, RF, is currently 8%, the market return, rm, is 15%, and ass a. Use CAPM to estimate the required return, 7A, on asset A. Which of the following graphs represents the security market line b. Assume that as a result of recent economic events, inflationary expectations have declined by 1%, lowering Rp and im for asset A2 C. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 1%, for asset A? a. The required rate of return on asset A is % (Round to two decimal places.) Which of the following graphs represents the security market line (SML) and the required return for asset A? (Select the best ar OA. Q Security Market Line OB Required Retur, (%) 12- 10 Asset A 0.5 1.5 Nondiversifiable Risk, b o C. Security Market Line Q Q Return, r () 14 12- Click to select your answer(s). NO se rate, Re, is currently 8%, the market return, m. is 15%, and asset A has a beta, ba, of 0.95. Which of the following graphs represents the security market line (SML) and the required return for asset A? ionary expectations have declined by 1%, lowering to 7% and 14%, respectively. Which of the following graphs represents the new SML and shows the ne become more risk averse, causing the market retum to rise by 1%, to 16%. Ignoring the shift in part b, which of the following graphs shows the new SML and the new and to two decimal places.) otline (SML) and the required return for asset A? (Select the best answer below.) . Security Market Line 18 Required Retur, (%) 12- Asset A o's Nondiversifiable Risk, b OD Security Market Line Retum, (%) Asset A R NO 0.5 1.5 Nondiversifiable Risk, b Security Market Line Required Retum, r (%) ONONEN Asset A 0 0.5 1.5 Nondiversifiable Risk, b b. If as a result of recent economic events, inflationary expectations have declined by 1%, lowering Re and rm to 7% and 14 Which of the following graphs represents the new SML (blue line) and shows the new required return for asset A? (Select the OA. O Security Market Line 247 Click to select your answer(s). A. Which of the following graphs represents the security market line (SML) and the mionary expectations have declined by 1%, lowering Rp and to 7% and 14%, respectively. Which of the following graphs represents the new SML and shows the become more risk averse, causing the market return to rise by 1%, to 16%. Ignoring the shift in part b, which of the following graphs shows the new SML and the 2 0 0.5 1.5 Nondiversifiable Risk, b OD Security Market Line os Required Retur,r (%) Asset A 12 10 0.5 1.5 Nondiversifiable Risk, b wpectations have declined by 1%, lowering R and rm to 7% and 14%, respectively, the required rate of return on asset Ais % (Round to two decimal places.) blue line) and shows the new required return for asset A? (Select the best answer below.) OB Security Market Line a Shifts in the security market line Assume that the risk-free rate, Re, is currently 8%, the market return, mis 15%, and asset A has a beta, ba, of 0.95 a. Use CAPM to estimate the required return, A. on asset A. Which of the following graphs represents the security market line (SML) and the required return for asset A? b. Assume that as a result of recent economic events, Influtionary expectations have declined by 1%, lowering R and to 7% and 14%, respectively. Which of the following graphs rep for asset A? c. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 1%, to 16%. Ignoring the shift in part b, which of the following for asset A? OA OB Security Market Line Security Market Line Asset A Required Retur, () Required Retum, (%) Asset A 05 Nondiversitable Risk, b o's 1.5 Nondiversifiable Risk, b OD Oc. Security Market Line Security Market Line Required Retum (9) Required Retum, (5) Asset A SUNOD Asset A 05 0.5 Click to select your answer(s). lacBook Tor asset A c. As a result of recent events, investors have become more risk averse, causing the market return to rise by 19- Ignoring the shift in part b, which of the following graphs shows the new SML (blue line) and the new required re OA. Security Market Line (%) 22- 20 18 16- 14- 12- Asset A Required Retum, 0.5 2 1.5 Nondiversifiable Risk, b Security Market Line Q tur, (%) 18- 19- Click to select your answer(s). Everse, causing the market retum to rise by 1%, to 16%. Ignoring the shift in part b, which of the following graphs shows the new SM ing the market return to rise by 1%, to 16%, then the required rate of retum on asset Ais 1 %. (Round to two decimal places.) blue line) and the new required return for asset A? (Select the best answer below.) B. Security Market Line 22- Required Retum,r (%) 18 16 14 12 10- 8 Asset A 0.5 115 Nondiversifiable Risk, b OD. Q Security Market Line tum, (%) ON D, which or asset A? 26 Required Retum, (%) 18 16 14 12 Asset A Required Retum, (%) Asset A 14 12 10- 8 0.5 Nondiversifiable Risk, b 0.5 Nondiversifiable Risk, b c OD Security Market Line o o Security Market Line Required Retur, (%) ONANTEN Required Retum, (%) RNROUND Asset A Asset A 0.5 Nondiversifiable Risk, b 0.5 Nondiversifiable Risk, b lick to select your answer(s). MacBook Air