Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please look at every picture before answering the questions. Integrative-Determining relevant cash flows Lombard Company is contemplatir $64,600; it was being depreciated under MACRS using

please look at every picture before answering the questions.

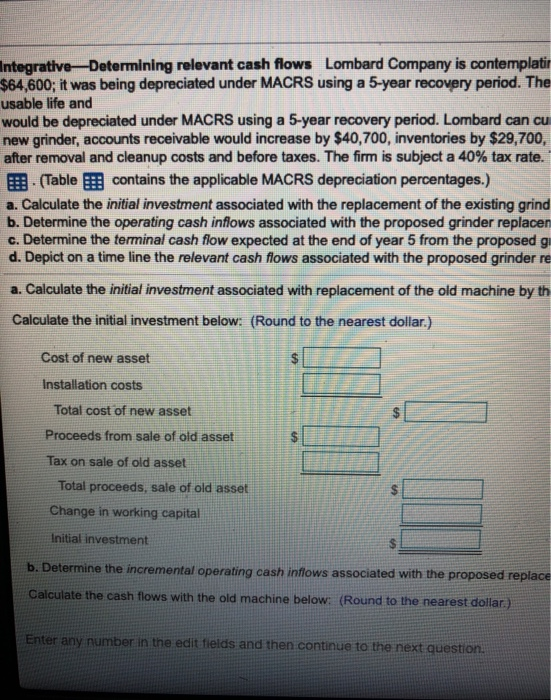

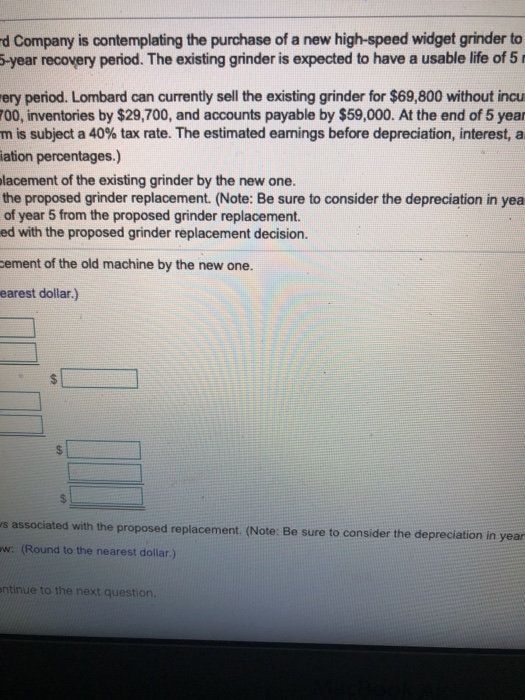

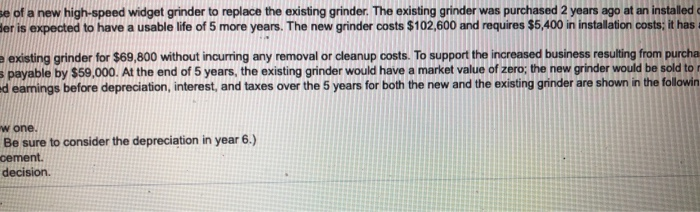

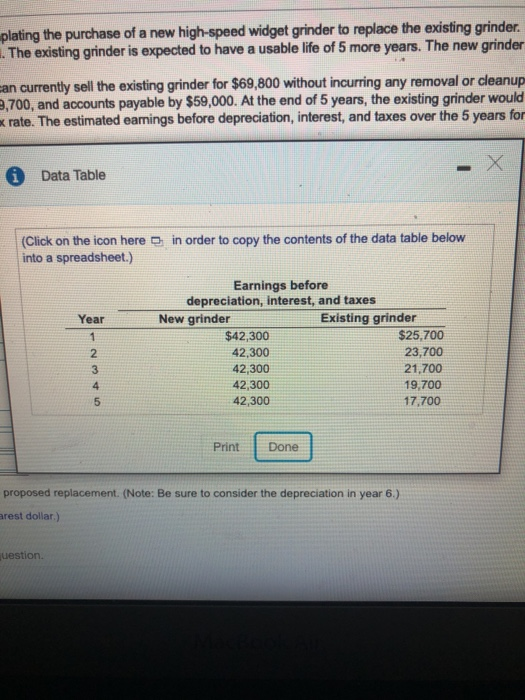

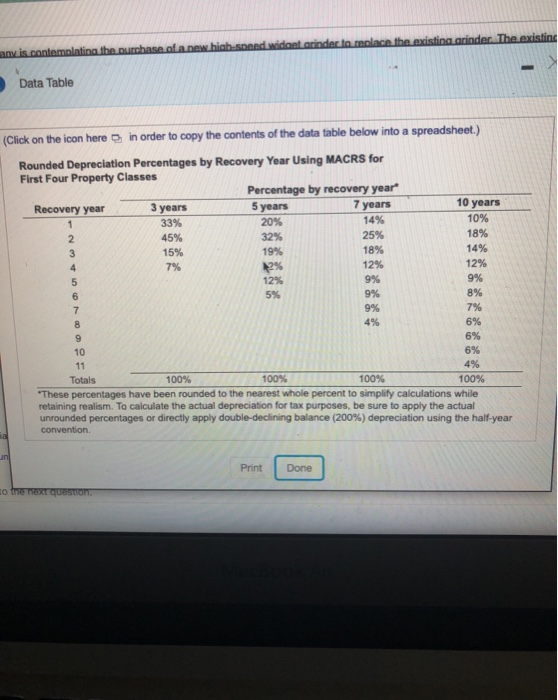

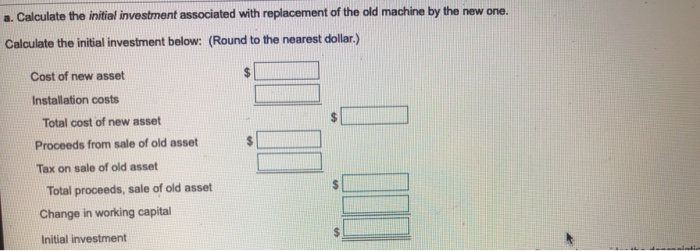

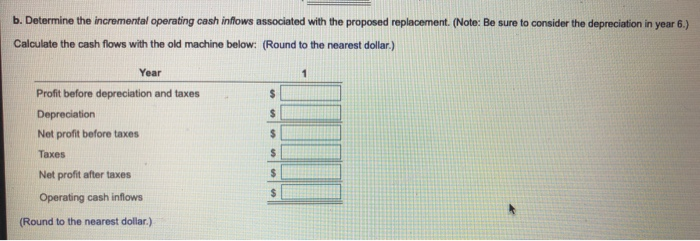

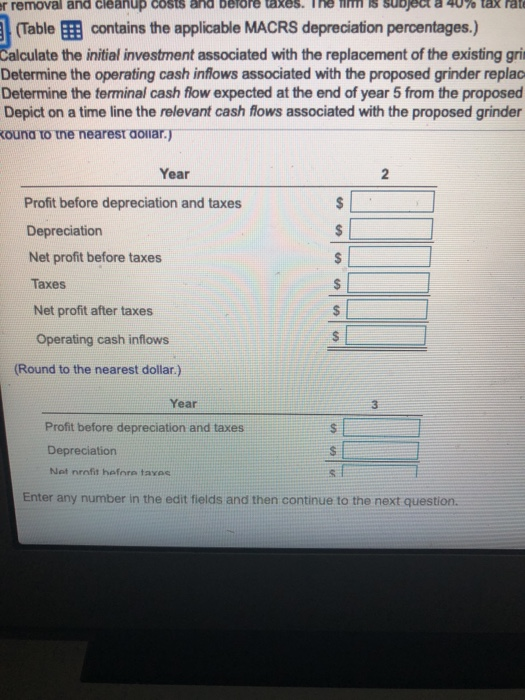

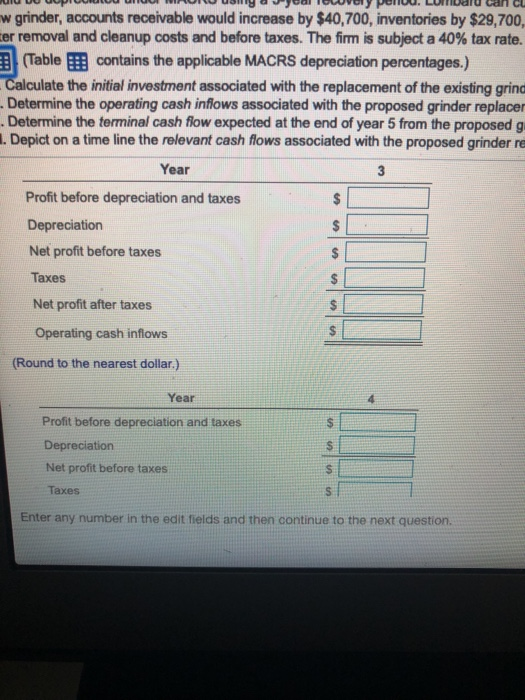

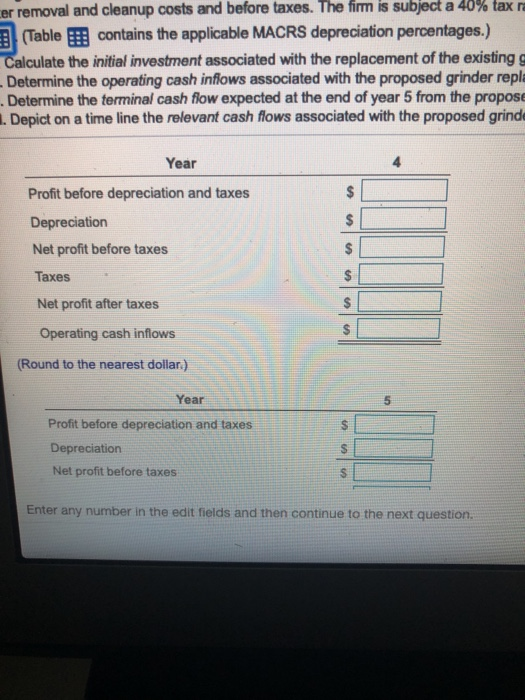

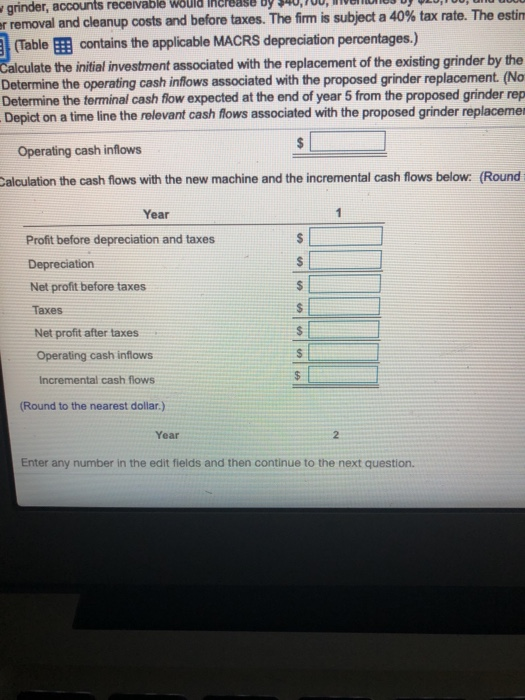

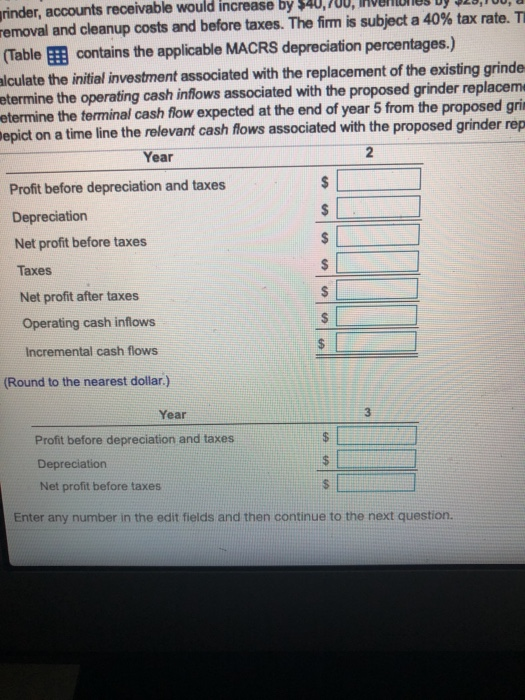

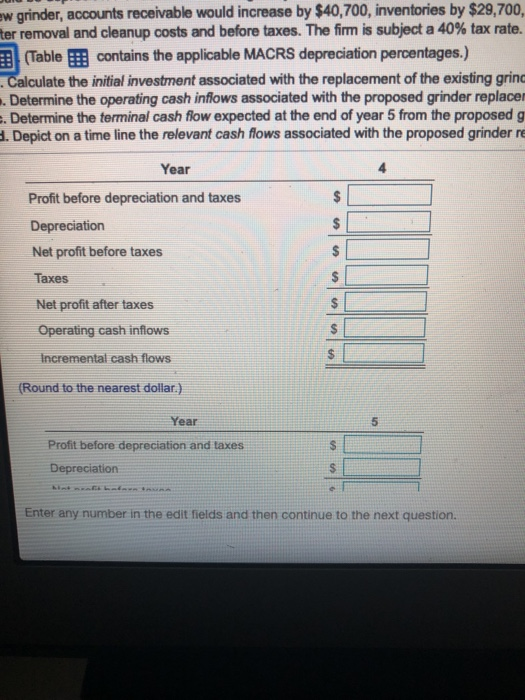

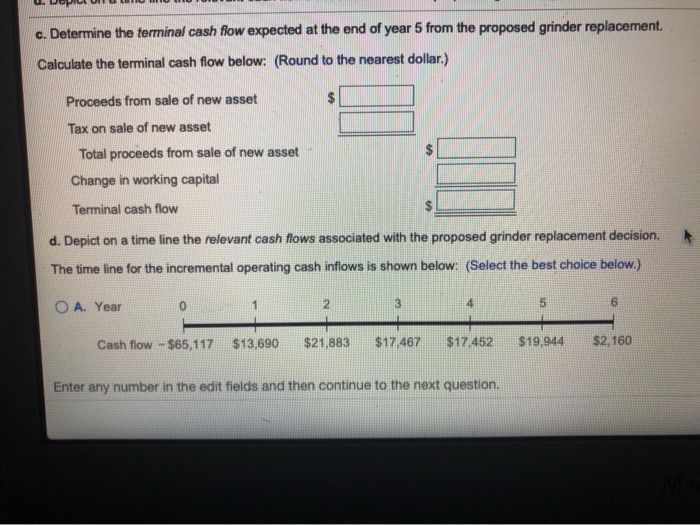

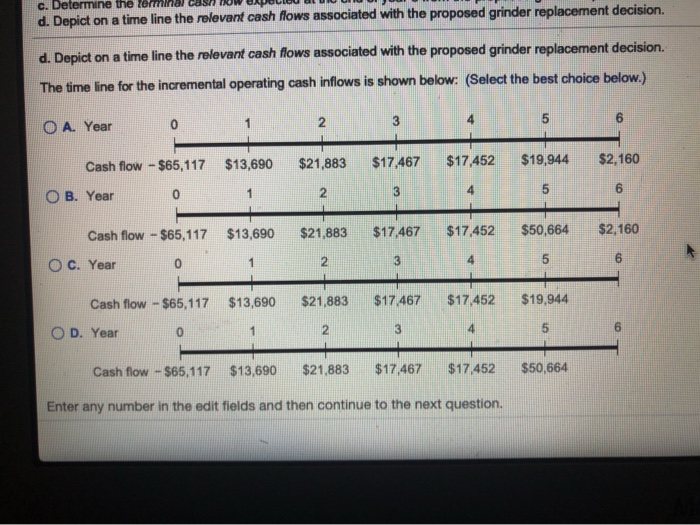

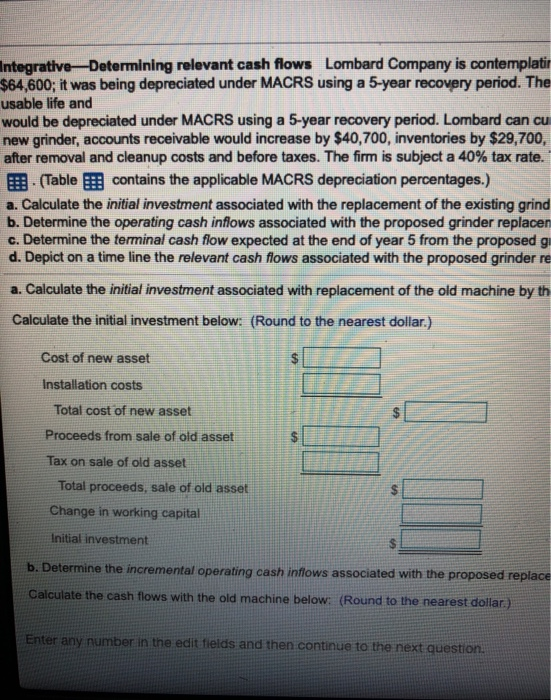

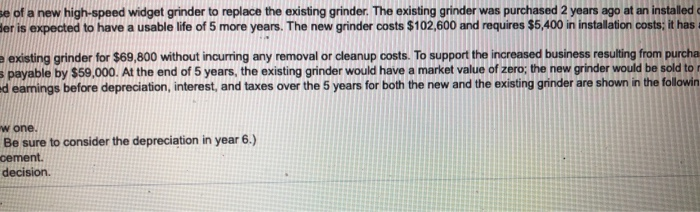

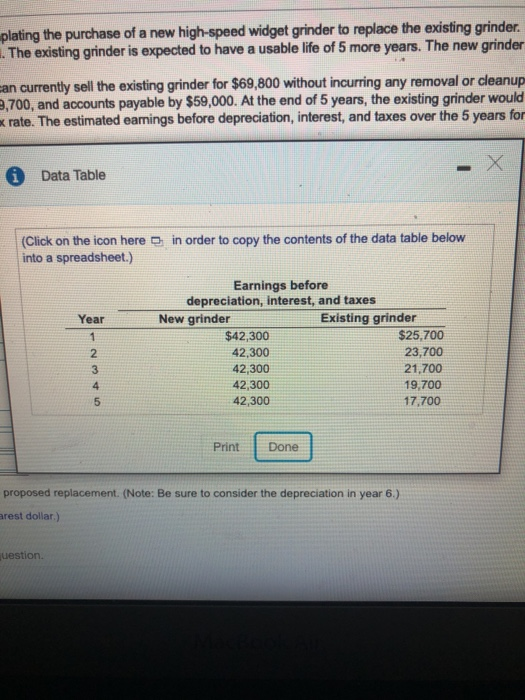

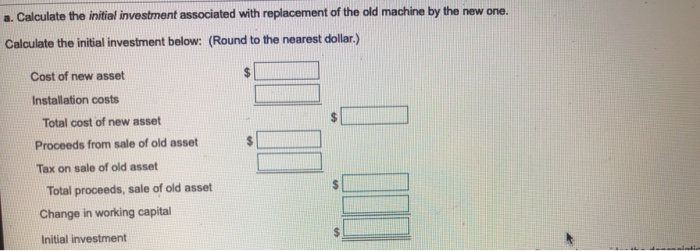

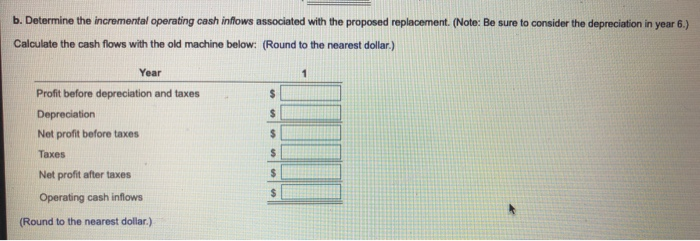

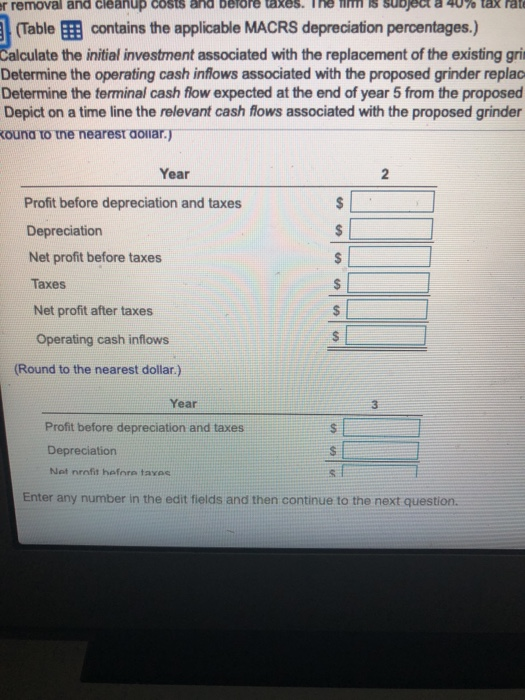

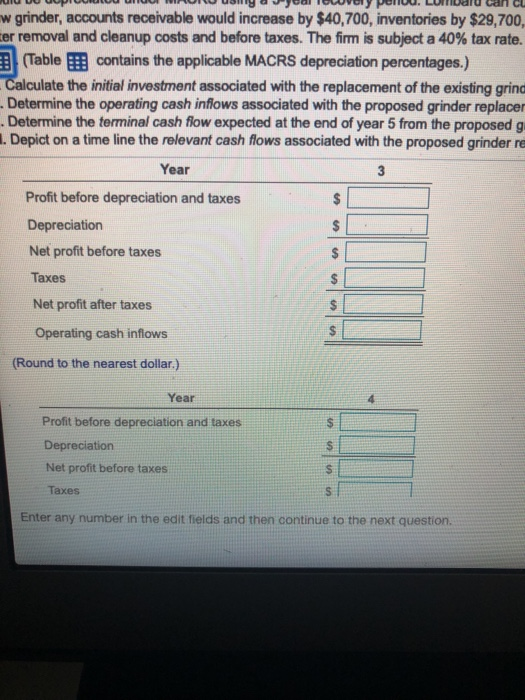

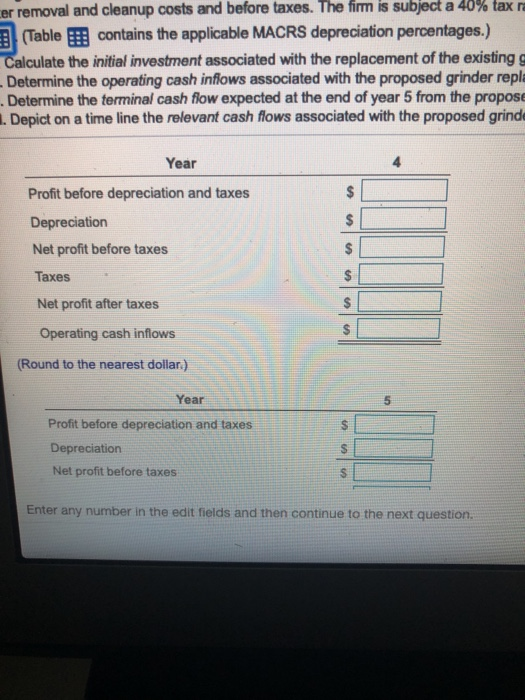

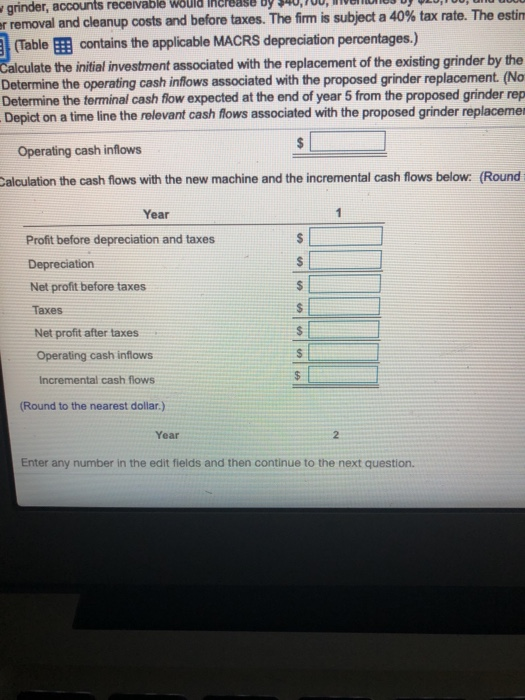

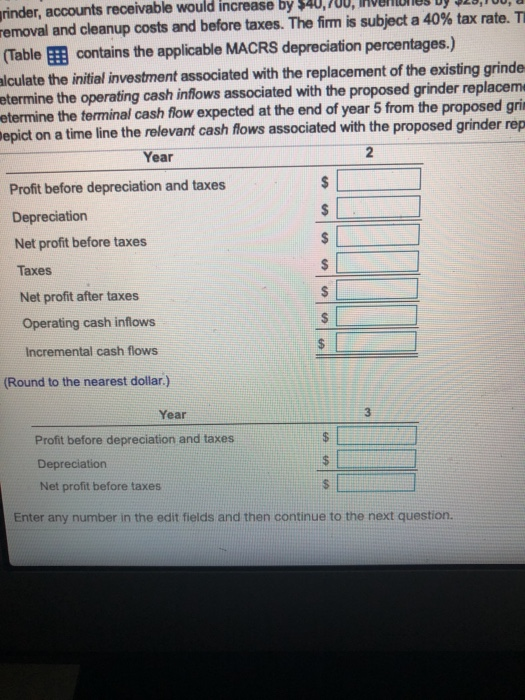

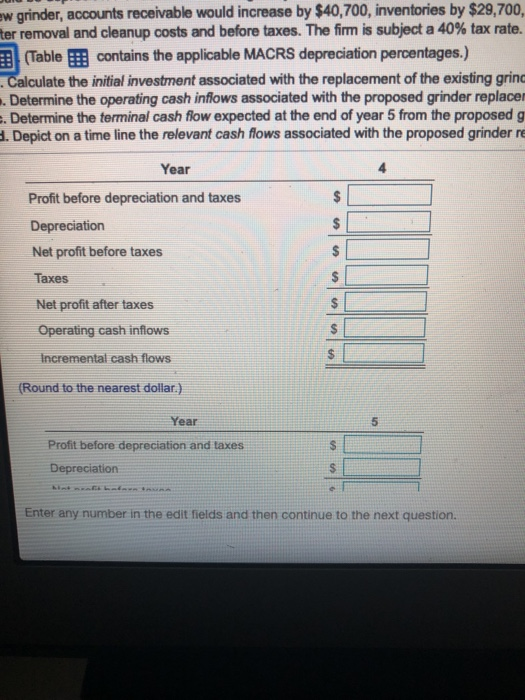

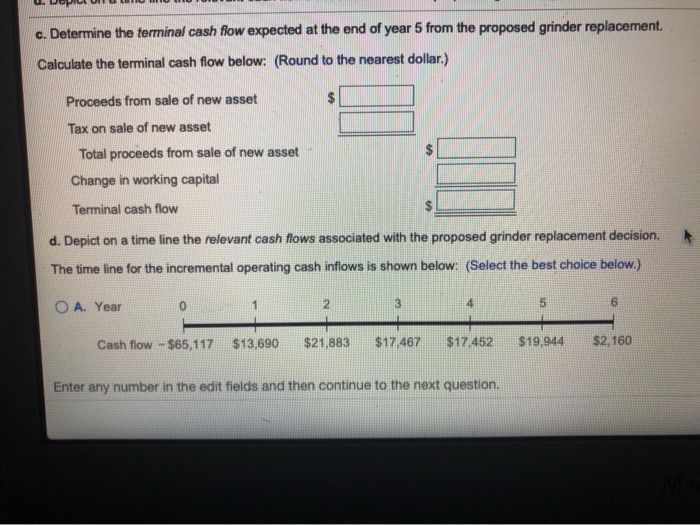

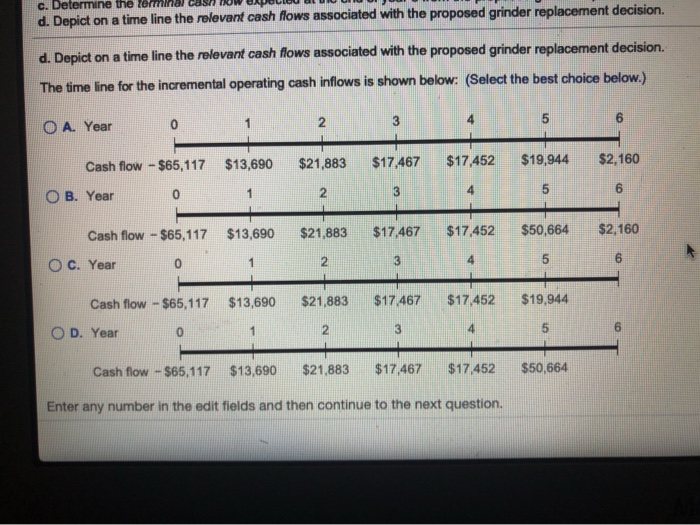

Integrative-Determining relevant cash flows Lombard Company is contemplatir $64,600; it was being depreciated under MACRS using a 5-year recovery period. The usable life and would be depreciated under MACRS using a 5-year recovery period. Lombard can cu new grinder, accounts receivable would increase by $40,700, inventories by $29,700, after removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. (Table contains the applicable MACRS depreciation percentages.) a. Calculate the initial investment associated with the replacement of the existing grind b. Determine the operating cash inflows associated with the proposed grinder replacen c. Determine the terminal cash flow expected at the end of year 5 from the proposed g d. Depict on a time line the relevant cash flows associated with the proposed grinder re a. Calculate the initial investment associated with replacement of the old machine by th Calculate the initial investment below: (Round to the nearest dollar.) Cost of new asset $ Installation costs Total cost of new asset CA Proceeds from sale of old asset $ 12 $ Tax on sale of old asset Total proceeds, sale of old asset Change in working capital Initial investment b. Determine the incremental operating cash inflows associated with the proposed replace Calculate the cash flows with the old machine below: (Round to the nearest dollar.) Enter any number in the edit fields and then continue to the next question d Company is contemplating the purchase of a new high-speed widget grinder to 5-year recovery period. The existing grinder is expected to have a usable life of 5 ery period. Lombard can currently sell the existing grinder for $69,800 without incu 700, inventories by $29,700, and accounts payable by $59,000. At the end of 5 year m is subject a 40% tax rate. The estimated earnings before depreciation, interest, a iation percentages.) lacement of the existing grinder by the new one. the proposed grinder replacement. (Note: Be sure to consider the depreciation in yea of year 5 from the proposed grinder replacement. ed with the proposed grinder replacement decision. Dement of the old machine by the new one. earest dollar.) ws associated with the proposed replacement. (Note: Be sure to consider the depreciation in year w (Round to the nearest dollar.) antinue to the next question. se of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed Her is expected to have a usable life of 5 more years. The new grinder costs $102,600 and requires $5,400 in installation costs; it has existing grinder for $69,800 without incurring any removal or cleanup costs. To support the increased business resulting from purcha s payable by $59,000. At the end of 5 years, the existing grinder would have a market value of zero; the new grinder would be sold to ed eamings before depreciation, interest, and taxes over the 5 years for both the new and the existing grinder are shown in the followin w one. Be sure to consider the depreciation in year 6.) cement. decision. plating the purchase of a new high-speed widget grinder to replace the existing grinder. 1. The existing grinder is expected to have a usable life of 5 more years. The new grinder can currently sell the existing grinder for $69,800 without incurring any removal or cleanup 2,700, and accounts payable by $59,000. At the end of 5 years, the existing grinder would x rate. The estimated earnings before depreciation, interest, and taxes over the 5 years for - 1 Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Earnings before depreciation, interest, and taxes Year New grinder Existing grinder 1 $42,300 $25,700 2 42,300 23,700 3 42,300 21,700 4 42,300 19,700 5 42,300 17,700 Print Done proposed replacement. (Note: Be sure to consider the depreciation in year 6.) arest dollar.) question any is contemplating the purchase of a new high speed widget Arinder to replace the existing grinder. The existing Data Table 5 years 4 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 7% % 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention Print Done to the next question a. Calculate the initial investment associated with replacement of the old machine by the new one. Calculate the initial investment below: (Round to the nearest dollar.) Cost of new asset Installation costs Total cost of new asset Proceeds from sale of old asset Tax on sale of old asset Total proceeds, sale of old asset Change in working capital Initial investment 1 $ b. Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6.) Calculate the cash flows with the old machine below: (Round to the nearest dollar.) Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows $ $ $ $ $ (Round to the nearest dollar.) SiS and berore taxes. er removal and cleanup subject a 40% tax rate (Table contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing gri Determine the operating cash inflows associated with the proposed grinder replac Determine the terminal cash flow expected at the end of year 5 from the proposed Depict on a time line the relevant cash flows associated with the proposed grinder kound to the nearest dollar.) Year 2. Profit before depreciation and taxes Depreciation Net profit before taxes $ $ $ Taxes $ Net profit after taxes $ Operating cash inflows (Round to the nearest dollar.) Year 3 $ Profit before depreciation and taxes Depreciation $ Net nonfit hefnra tavec S Enter any number in the edit fields and then continue to the next question. w grinder, accounts receivable would increase by $40,700, inventories by $29,700, Ker removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. 2 (Table D contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing grina Determine the operating cash inflows associated with the proposed grinder replacer . Determine the terminal cash flow expected at the end of year 5 from the proposed g 1. Depict on a time line the relevant cash flows associated with the proposed grindere Year 3 Profit before depreciation and taxes Depreciation Net profit before taxes $ $ $ Taxes Net profit after taxes Operating cash inflows $ (Round to the nearest dollar.) Year $ Profit before depreciation and taxes Depreciation Net profit before taxes S S Taxes S Enter any number in the edit fields and then continue to the next question er removal and cleanup costs and before taxes. The firm is subject a 40% tax ra (Table contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing a Determine the operating cash inflows associated with the proposed grinder repla . Determine the terminal cash flow expected at the end of year 5 from the propose 1. Depict on a time line the relevant cash flows associated with the proposed grinde Year $ Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes $ A $ $ Operating cash inflows (Round to the nearest dollar.) Year $ Profit before depreciation and taxes Depreciation Net profit before taxes $ S Enter any number in the edit fields and then continue to the next question. oy grinder, accounts receivable would er removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. The estim (Table B contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing grinder by the Determine the operating cash inflows associated with the proposed grinder replacement. (No Determine the terminal cash flow expected at the end of year 5 from the proposed grinder rep Depict on a time line the relevant cash flows associated with the proposed grinder replacemen Operating cash inflows Calculation the cash flows with the new machine and the incremental cash flows below: (Round $ $ $ Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows Incremental cash flows (Round to the nearest dollar.) $ $ $ $ Year 2 Enter any number in the edit fields and then continue to the next question. grinder, accounts receivable would increase by removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. TE (Table contains the applicable MACRS depreciation percentages.) alculate the initial investment associated with the replacement of the existing grinde etermine the operating cash inflows associated with the proposed grinder replaceme etermine the terminal cash flow expected at the end of year 5 from the proposed grim Depict on a time line the relevant cash flows associated with the proposed grinder rep Year 2 Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows $ $ $ $ $ $ Incremental cash flows (Round to the nearest dollar.) Year 3 Profit before depreciation and taxes Depreciation Net profit before taxes $ $ Enter any number in the edit fields and then continue to the next question. ew grinder, accounts receivable would increase by $40,700, inventories by $29,700, ter removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. (Table contains the applicable MACRS depreciation percentages.) . Calculate the initial investment associated with the replacement of the existing grinc . Determine the operating cash inflows associated with the proposed grinder replacem . Determine the terminal cash flow expected at the end of year 5 from the proposed g 21. Depict on a time line the relevant cash flows associated with the proposed grindere Year $ $ Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows Incremental cash flows (Round to the nearest dollar.) $ $ $ $ $ Year 5 S Profit before depreciation and taxes Depreciation Enter any number in the edit fields and then continue to the next question. c. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement. Calculate the terminal cash flow below: (Round to the nearest dollar.) Proceeds from sale of new asset $ Tax on sale of new asset $ Total proceeds from sale of new asset Change in working capital CA Terminal cash flow d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. The time line for the incremental operating cash inflows is shown below: (Select the best choice below.) 0 O A. Year 1 2 3 4 5 Cash flow - $65,117 $13,690 $21,883 $17,467 $17.452 $19,944 $2,160 Enter any number in the edit fields and then continue to the next question. c. Determine the d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. The time line for the incremental operating cash inflows is shown below: (Select the best choice below.) 02 0 1 5 O A. Year 2 3 + + Cash flow - $65,117 $13,690 $21,883 $17,467 $17,452 $19,944 $2,160 OB. Year 0 5 2 1 3 Cash flow - $65,117 $13,690 $21,883 $17,467 $17.452 $50,664 $2,160 0 OC. Year 2 3 4 5 Cash flow - $65,117 $13,690 $21,883 $17,467 $17,452 $19,944 OD. Year 0 2 3 4 5 Cash flow - $65,117 $13,690 $21,883 $17,467 $17.452 $50,664 Enter any number in the edit fields and then continue to the next question. Integrative-Determining relevant cash flows Lombard Company is contemplatir $64,600; it was being depreciated under MACRS using a 5-year recovery period. The usable life and would be depreciated under MACRS using a 5-year recovery period. Lombard can cu new grinder, accounts receivable would increase by $40,700, inventories by $29,700, after removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. (Table contains the applicable MACRS depreciation percentages.) a. Calculate the initial investment associated with the replacement of the existing grind b. Determine the operating cash inflows associated with the proposed grinder replacen c. Determine the terminal cash flow expected at the end of year 5 from the proposed g d. Depict on a time line the relevant cash flows associated with the proposed grinder re a. Calculate the initial investment associated with replacement of the old machine by th Calculate the initial investment below: (Round to the nearest dollar.) Cost of new asset $ Installation costs Total cost of new asset CA Proceeds from sale of old asset $ 12 $ Tax on sale of old asset Total proceeds, sale of old asset Change in working capital Initial investment b. Determine the incremental operating cash inflows associated with the proposed replace Calculate the cash flows with the old machine below: (Round to the nearest dollar.) Enter any number in the edit fields and then continue to the next question d Company is contemplating the purchase of a new high-speed widget grinder to 5-year recovery period. The existing grinder is expected to have a usable life of 5 ery period. Lombard can currently sell the existing grinder for $69,800 without incu 700, inventories by $29,700, and accounts payable by $59,000. At the end of 5 year m is subject a 40% tax rate. The estimated earnings before depreciation, interest, a iation percentages.) lacement of the existing grinder by the new one. the proposed grinder replacement. (Note: Be sure to consider the depreciation in yea of year 5 from the proposed grinder replacement. ed with the proposed grinder replacement decision. Dement of the old machine by the new one. earest dollar.) ws associated with the proposed replacement. (Note: Be sure to consider the depreciation in year w (Round to the nearest dollar.) antinue to the next question. se of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed Her is expected to have a usable life of 5 more years. The new grinder costs $102,600 and requires $5,400 in installation costs; it has existing grinder for $69,800 without incurring any removal or cleanup costs. To support the increased business resulting from purcha s payable by $59,000. At the end of 5 years, the existing grinder would have a market value of zero; the new grinder would be sold to ed eamings before depreciation, interest, and taxes over the 5 years for both the new and the existing grinder are shown in the followin w one. Be sure to consider the depreciation in year 6.) cement. decision. plating the purchase of a new high-speed widget grinder to replace the existing grinder. 1. The existing grinder is expected to have a usable life of 5 more years. The new grinder can currently sell the existing grinder for $69,800 without incurring any removal or cleanup 2,700, and accounts payable by $59,000. At the end of 5 years, the existing grinder would x rate. The estimated earnings before depreciation, interest, and taxes over the 5 years for - 1 Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Earnings before depreciation, interest, and taxes Year New grinder Existing grinder 1 $42,300 $25,700 2 42,300 23,700 3 42,300 21,700 4 42,300 19,700 5 42,300 17,700 Print Done proposed replacement. (Note: Be sure to consider the depreciation in year 6.) arest dollar.) question any is contemplating the purchase of a new high speed widget Arinder to replace the existing grinder. The existing Data Table 5 years 4 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 7% % 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention Print Done to the next question a. Calculate the initial investment associated with replacement of the old machine by the new one. Calculate the initial investment below: (Round to the nearest dollar.) Cost of new asset Installation costs Total cost of new asset Proceeds from sale of old asset Tax on sale of old asset Total proceeds, sale of old asset Change in working capital Initial investment 1 $ b. Determine the incremental operating cash inflows associated with the proposed replacement. (Note: Be sure to consider the depreciation in year 6.) Calculate the cash flows with the old machine below: (Round to the nearest dollar.) Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows $ $ $ $ $ (Round to the nearest dollar.) SiS and berore taxes. er removal and cleanup subject a 40% tax rate (Table contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing gri Determine the operating cash inflows associated with the proposed grinder replac Determine the terminal cash flow expected at the end of year 5 from the proposed Depict on a time line the relevant cash flows associated with the proposed grinder kound to the nearest dollar.) Year 2. Profit before depreciation and taxes Depreciation Net profit before taxes $ $ $ Taxes $ Net profit after taxes $ Operating cash inflows (Round to the nearest dollar.) Year 3 $ Profit before depreciation and taxes Depreciation $ Net nonfit hefnra tavec S Enter any number in the edit fields and then continue to the next question. w grinder, accounts receivable would increase by $40,700, inventories by $29,700, Ker removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. 2 (Table D contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing grina Determine the operating cash inflows associated with the proposed grinder replacer . Determine the terminal cash flow expected at the end of year 5 from the proposed g 1. Depict on a time line the relevant cash flows associated with the proposed grindere Year 3 Profit before depreciation and taxes Depreciation Net profit before taxes $ $ $ Taxes Net profit after taxes Operating cash inflows $ (Round to the nearest dollar.) Year $ Profit before depreciation and taxes Depreciation Net profit before taxes S S Taxes S Enter any number in the edit fields and then continue to the next question er removal and cleanup costs and before taxes. The firm is subject a 40% tax ra (Table contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing a Determine the operating cash inflows associated with the proposed grinder repla . Determine the terminal cash flow expected at the end of year 5 from the propose 1. Depict on a time line the relevant cash flows associated with the proposed grinde Year $ Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes $ A $ $ Operating cash inflows (Round to the nearest dollar.) Year $ Profit before depreciation and taxes Depreciation Net profit before taxes $ S Enter any number in the edit fields and then continue to the next question. oy grinder, accounts receivable would er removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. The estim (Table B contains the applicable MACRS depreciation percentages.) Calculate the initial investment associated with the replacement of the existing grinder by the Determine the operating cash inflows associated with the proposed grinder replacement. (No Determine the terminal cash flow expected at the end of year 5 from the proposed grinder rep Depict on a time line the relevant cash flows associated with the proposed grinder replacemen Operating cash inflows Calculation the cash flows with the new machine and the incremental cash flows below: (Round $ $ $ Year Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows Incremental cash flows (Round to the nearest dollar.) $ $ $ $ Year 2 Enter any number in the edit fields and then continue to the next question. grinder, accounts receivable would increase by removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. TE (Table contains the applicable MACRS depreciation percentages.) alculate the initial investment associated with the replacement of the existing grinde etermine the operating cash inflows associated with the proposed grinder replaceme etermine the terminal cash flow expected at the end of year 5 from the proposed grim Depict on a time line the relevant cash flows associated with the proposed grinder rep Year 2 Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows $ $ $ $ $ $ Incremental cash flows (Round to the nearest dollar.) Year 3 Profit before depreciation and taxes Depreciation Net profit before taxes $ $ Enter any number in the edit fields and then continue to the next question. ew grinder, accounts receivable would increase by $40,700, inventories by $29,700, ter removal and cleanup costs and before taxes. The firm is subject a 40% tax rate. (Table contains the applicable MACRS depreciation percentages.) . Calculate the initial investment associated with the replacement of the existing grinc . Determine the operating cash inflows associated with the proposed grinder replacem . Determine the terminal cash flow expected at the end of year 5 from the proposed g 21. Depict on a time line the relevant cash flows associated with the proposed grindere Year $ $ Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash inflows Incremental cash flows (Round to the nearest dollar.) $ $ $ $ $ Year 5 S Profit before depreciation and taxes Depreciation Enter any number in the edit fields and then continue to the next question. c. Determine the terminal cash flow expected at the end of year 5 from the proposed grinder replacement. Calculate the terminal cash flow below: (Round to the nearest dollar.) Proceeds from sale of new asset $ Tax on sale of new asset $ Total proceeds from sale of new asset Change in working capital CA Terminal cash flow d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. The time line for the incremental operating cash inflows is shown below: (Select the best choice below.) 0 O A. Year 1 2 3 4 5 Cash flow - $65,117 $13,690 $21,883 $17,467 $17.452 $19,944 $2,160 Enter any number in the edit fields and then continue to the next question. c. Determine the d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision. The time line for the incremental operating cash inflows is shown below: (Select the best choice below.) 02 0 1 5 O A. Year 2 3 + + Cash flow - $65,117 $13,690 $21,883 $17,467 $17,452 $19,944 $2,160 OB. Year 0 5 2 1 3 Cash flow - $65,117 $13,690 $21,883 $17,467 $17.452 $50,664 $2,160 0 OC. Year 2 3 4 5 Cash flow - $65,117 $13,690 $21,883 $17,467 $17,452 $19,944 OD. Year 0 2 3 4 5 Cash flow - $65,117 $13,690 $21,883 $17,467 $17.452 $50,664 Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started