Question

Please look at the table given on the next page and answer the following questions: (a) Please list the items that result in a payment

Please look at the table given on the next page and answer the following questions:

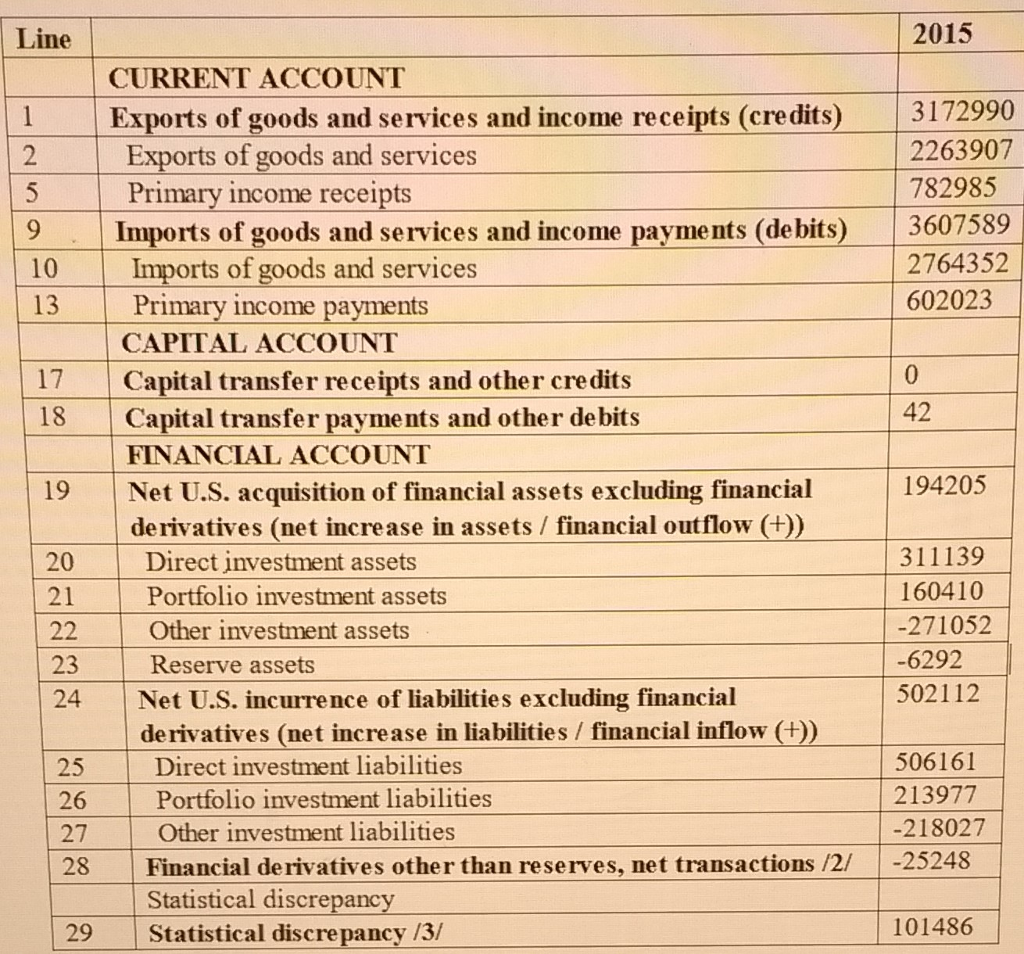

(a) Please list the items that result in a payment by US residents to foreign residents

(b) Please list the items that result in a payment by foreign residents to U.S. residents.

(c) Please calculate the Current Account Balance. Show your calculations.

(d) Please calculate the Capital + Financial Account Balance. Show your calculations.

(e) Show that the Balance of Payments is equal to zero (or at least very close to zero).

THIS INFORMATION IS ONLY FOR REFERENCE, NOT PART OF THE QUESTIONS. SO, IT IS NOT NEEDED TO ANSWER THE QUESTIONS!

Legend / Footnotes:

2. Transactions for financial derivatives are only available as a net value equal to transactions for assets less transactions for liabilities. A positive value represents net U.S. cash payments arising from derivatives contracts, and a negative value represents net U.S. cash receipts.

3. The statistical discrepancy, which can be calculated as line 38 less line 37, is the difference between total debits and total credits recorded in the current, capital, and financial accounts. In the current and capital accounts, credits and debits are labeled in the table. In the financial account, an acquisition of an asset or a repayment of a liability is a debit, and an incurrence of a liability or a disposal of an asset is a credit.

Line 2015 CURRENT ACCOUNT -172990 2263907 782985 | 3607589 2764352 602023 I 2 Exports of goods and services and income receipts(credits)- Exports of goods and services Primary income receipts 9 | Imports of goods and services and income payments (debits) 10 13 Imports of goods and services Primary income payments CAPITAL ACCOUNT 17 Capital transfer receipts and other credits 42 18 Capital transfer payments and other debits 19 Net U.S. acquisition of financial assets excluding financial 20 FINANCIAL ACCOUNT 194205 derivatives (net increase in assets financial outflow (+)) Direct investment assets Portfolio investment assets Other investment assets Reserve assets 311139 160410 -271052 6292 502112 21 23 24 Net U.S. incurrence of liabilities excluding financial derivatives (net increase in liabilities financial inflow (+)) 25 26 27 28 Financial derivatives other than reserves, net transactions /2/-25248 Direct investment liabilities Portfolio investment liabilities Other investment liabilities 506161 213977 -218027 Statistical discrepancy 29 Statistical discrepancy /3/ 101486 Line 2015 CURRENT ACCOUNT -172990 2263907 782985 | 3607589 2764352 602023 I 2 Exports of goods and services and income receipts(credits)- Exports of goods and services Primary income receipts 9 | Imports of goods and services and income payments (debits) 10 13 Imports of goods and services Primary income payments CAPITAL ACCOUNT 17 Capital transfer receipts and other credits 42 18 Capital transfer payments and other debits 19 Net U.S. acquisition of financial assets excluding financial 20 FINANCIAL ACCOUNT 194205 derivatives (net increase in assets financial outflow (+)) Direct investment assets Portfolio investment assets Other investment assets Reserve assets 311139 160410 -271052 6292 502112 21 23 24 Net U.S. incurrence of liabilities excluding financial derivatives (net increase in liabilities financial inflow (+)) 25 26 27 28 Financial derivatives other than reserves, net transactions /2/-25248 Direct investment liabilities Portfolio investment liabilities Other investment liabilities 506161 213977 -218027 Statistical discrepancy 29 Statistical discrepancy /3/ 101486Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started