please make a balance sheet with this information.

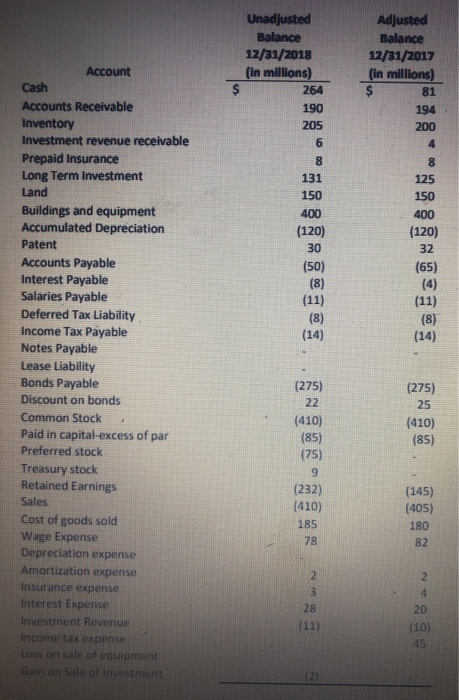

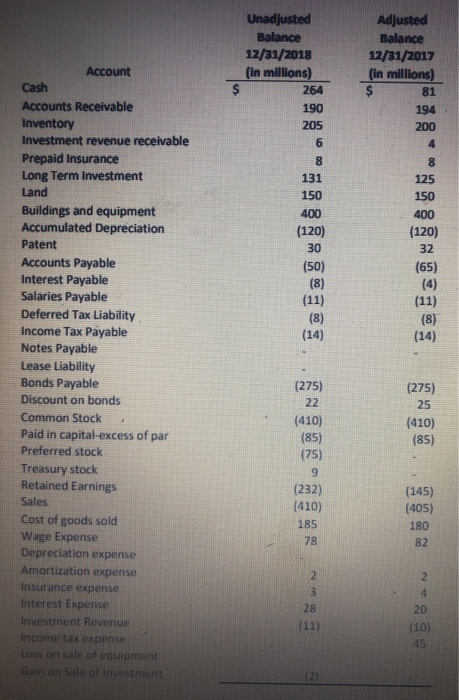

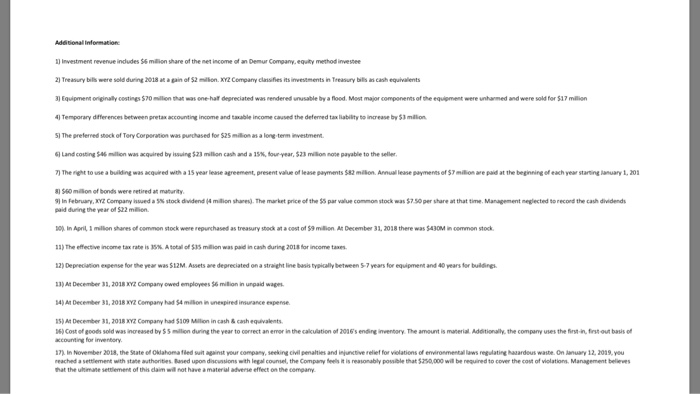

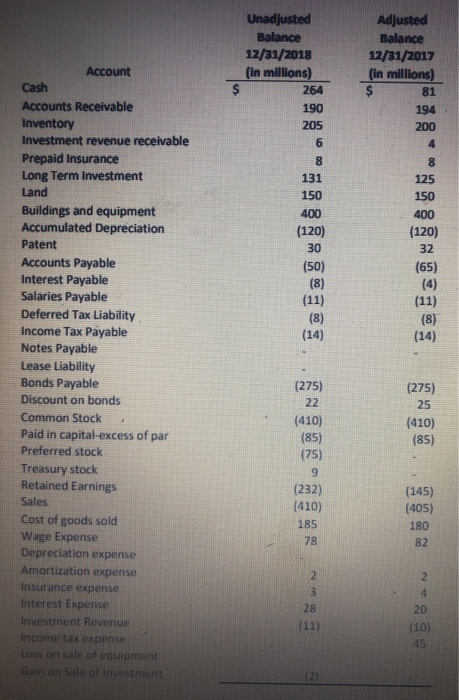

Adjusted Balance 12/31/2018 12/31/2017 (in millions)(in millions) 81 Account 264 190 205 Accounts Receivable Inventory Investment revenue receivable Prepaid Insurance Long Term Investment 131 150 400 (120) 30 (50) 125 150 400 (120) 32 (65) Buildings and equipment Accumulated Depreciation Patent Accounts Payable Interest Payable Salaries Payable Deferred Tax Liability Income Tax Payable Notes Payable Lease Liability Bonds Payable Discount on bonds Common Stock. Paid in capital-excess of par Preferred stock Treasury stock Retained Earnings Sales Cost of goods sold Wage Expense Depreciation expense Amortization expense Insurance expense Interest Expense Investment Revenue (14) (14) (275) (275) 25 (410) (85) (410) (85) (75) 9 (232) (410) 185 78 (145) (405) 180 82 28 20 (10) tax expense Loss on sale of equipment Aditional Iinformation 11 Investment revenue indudes $6 million share of the net income of an Demur Company,equity method investee 2) Treasury bils were sold durr 20.18 a.. 6an of S2 mlen. KVZ Company classfies its nvestments i, Treasury bills as cash equivalents 3) Equipment oniginaly costings $70 milion hat was one-hailf depreciated was rendered unusable by a flood. Mest major components of the equipment were unharmed and were sold for $17 million Temporary differences between pretax accounting income and taxable income caused the deferned tax liability to increase by 53 millon 5) The preferred shock of Tory Corporation was purdhased for $25milion as a long term investmen Landcasting $46 ' was acquired by issing SZ3 milion cash and15%, four ear, $23 maon none payable to the seller. 7)The" t to use abilding was qwed wth a 15 year lease agreement, present vue of lease payments S82 maon Amuallease pay nemsof$maone paid at tie begner gee each yea staring Aanuary 1, 201 8) 560 miion of bonds were retired at maturity, 9] In February, KYZ Company issued a % stock dvidend (4 maon shares) paid during the year of $22 million The market price of the $5 par value common stock was $750 per share at that time. Management neglected to record the cash dividends in April, 1 milion shares of common stock wererepurchased as treasury stock atacost of $9 maion At December 312038 there was $43ON", common stock. 11> The effective incom, tax rate is 35% Atotal of $3.5 maion was paid i, cash during 2018for income tan. 12) Deprediation epense for the year was $12M. Assets ane depreciated on a straight line basis typially between 57 years for equipment and 40 years for buildings 13) At December 33, 2018 XY2 Company owed employees 56 million in unpaid wages 4) At December 31, 2018 YZ Company had $4 million in unespired insurance espense 15) At December 31, 2018 XY2 Company had 5309 Milion in cash& cash equivalents 16)Cost of goods sold was inreased by $$ dung the year to correct anerror i, thecalculation of 2016's endirginventory The armount is muerial Adationally, the company uses the fir firstout basisof ccounting for inventory 17) In November 2018, the State of Oklahoma fled suit against your company, seeking chil penalties and injunctive relief for violations of eironmental laws regulating aardous waste. On anuary 12, 2019, you reached a settlement with state authorities Baned upon discussions with legal counsel, the Company feels it is reasonably possible that 5250,000 will be required to cover the cost of iolations Management believes adverse effect on the ulmane rot have b the cempany Adjusted Balance 12/31/2018 12/31/2017 (in millions)(in millions) 81 Account 264 190 205 Accounts Receivable Inventory Investment revenue receivable Prepaid Insurance Long Term Investment 131 150 400 (120) 30 (50) 125 150 400 (120) 32 (65) Buildings and equipment Accumulated Depreciation Patent Accounts Payable Interest Payable Salaries Payable Deferred Tax Liability Income Tax Payable Notes Payable Lease Liability Bonds Payable Discount on bonds Common Stock. Paid in capital-excess of par Preferred stock Treasury stock Retained Earnings Sales Cost of goods sold Wage Expense Depreciation expense Amortization expense Insurance expense Interest Expense Investment Revenue (14) (14) (275) (275) 25 (410) (85) (410) (85) (75) 9 (232) (410) 185 78 (145) (405) 180 82 28 20 (10) tax expense Loss on sale of equipment Aditional Iinformation 11 Investment revenue indudes $6 million share of the net income of an Demur Company,equity method investee 2) Treasury bils were sold durr 20.18 a.. 6an of S2 mlen. KVZ Company classfies its nvestments i, Treasury bills as cash equivalents 3) Equipment oniginaly costings $70 milion hat was one-hailf depreciated was rendered unusable by a flood. Mest major components of the equipment were unharmed and were sold for $17 million Temporary differences between pretax accounting income and taxable income caused the deferned tax liability to increase by 53 millon 5) The preferred shock of Tory Corporation was purdhased for $25milion as a long term investmen Landcasting $46 ' was acquired by issing SZ3 milion cash and15%, four ear, $23 maon none payable to the seller. 7)The" t to use abilding was qwed wth a 15 year lease agreement, present vue of lease payments S82 maon Amuallease pay nemsof$maone paid at tie begner gee each yea staring Aanuary 1, 201 8) 560 miion of bonds were retired at maturity, 9] In February, KYZ Company issued a % stock dvidend (4 maon shares) paid during the year of $22 million The market price of the $5 par value common stock was $750 per share at that time. Management neglected to record the cash dividends in April, 1 milion shares of common stock wererepurchased as treasury stock atacost of $9 maion At December 312038 there was $43ON", common stock. 11> The effective incom, tax rate is 35% Atotal of $3.5 maion was paid i, cash during 2018for income tan. 12) Deprediation epense for the year was $12M. Assets ane depreciated on a straight line basis typially between 57 years for equipment and 40 years for buildings 13) At December 33, 2018 XY2 Company owed employees 56 million in unpaid wages 4) At December 31, 2018 YZ Company had $4 million in unespired insurance espense 15) At December 31, 2018 XY2 Company had 5309 Milion in cash& cash equivalents 16)Cost of goods sold was inreased by $$ dung the year to correct anerror i, thecalculation of 2016's endirginventory The armount is muerial Adationally, the company uses the fir firstout basisof ccounting for inventory 17) In November 2018, the State of Oklahoma fled suit against your company, seeking chil penalties and injunctive relief for violations of eironmental laws regulating aardous waste. On anuary 12, 2019, you reached a settlement with state authorities Baned upon discussions with legal counsel, the Company feels it is reasonably possible that 5250,000 will be required to cover the cost of iolations Management believes adverse effect on the ulmane rot have b the cempany