please make a Cash flow based off the intial information and a cash flow the new additional information

heres the orginal

heres the additional information for the new cash flow

this is all the addtional information i can give you this is from the intial information given.

i just need the net cash flow from the intial information and new cash flow based off of the additional information given in the second picture Just for design A please

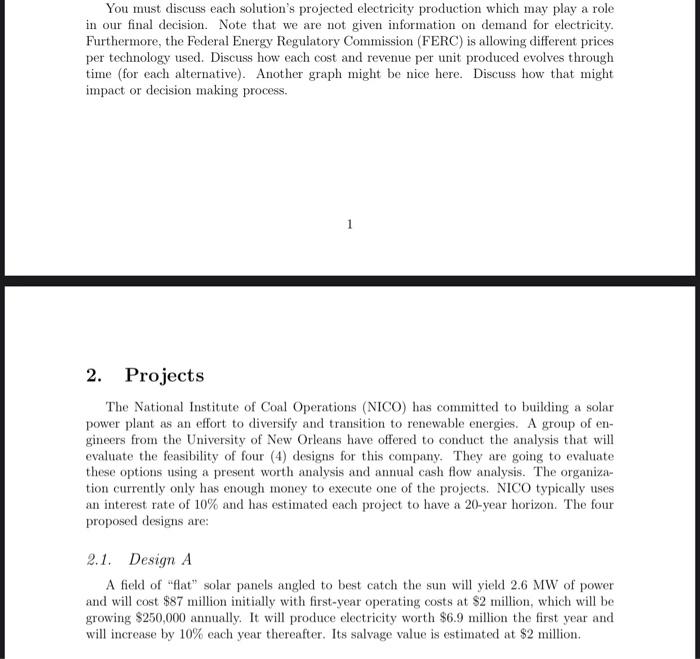

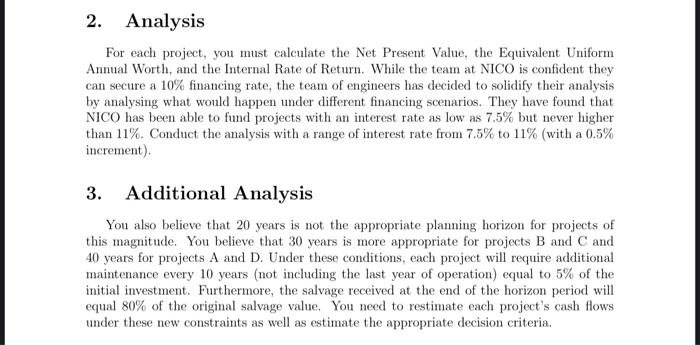

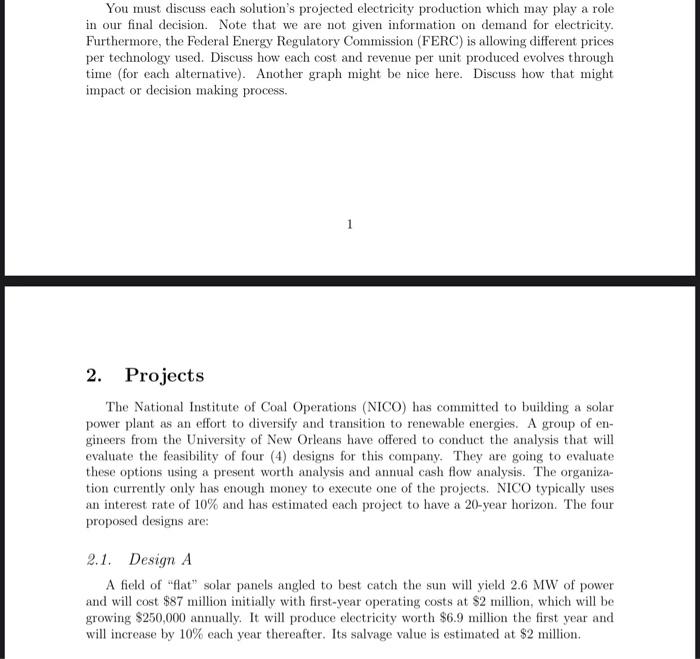

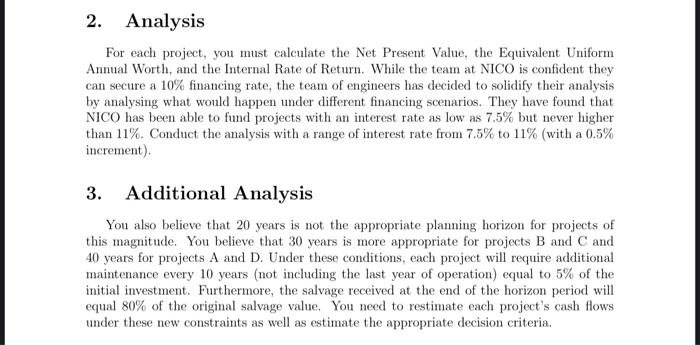

You must discuss each solution's projected electricity production which may play a role in our final decision. Note that we are not given information on demand for electricity. Furthermore, the Federal Energy Regulatory Commission (FERC) is allowing different prices per technology used. Discuss how each cost and revenue per unit produced evolves through time (for each alternative). Another graph might be nice here. Discuss how that might impact or decision making process. 1 2. Projects The National Institute of Coal Operations (NICO) has committed to building a solar power plant as an effort to diversify and transition to renewable energies. A group of en- gineers from the University of New Orleans have offered to conduct the analysis that will evaluate the feasibility of four (4) designs for this company. They are going to evaluate these options using a present worth analysis and annual cash flow analysis. The organiza- tion currently only has enough money to execute one of the projects. NICO typically uses an interest rate of 10% and has estimated each project to have a 20-year horizon. The four proposed designs are: 2.1. Design A A field of "flat" solar panels angled to best catch the sun will yield 2.6 MW of power and will cost $87 million initially with first-year operating costs at $2 million, which will be growing $250,000 annually. It will produce electricity worth $6.9 million the first year and will increase by 10% each year thereafter. Its salvage value is estimated at $2 million. 2. Analysis For each project, you must calculate the Net Present Value, the Equivalent Uniform Annual Worth, and the Internal Rate of Return. While the team at NICO is confident they can secure a 10% financing rate, the team of engineers has decided to solidify their analysis by analysing what would happen under different financing scenarios. They have found that NICO has been able to fund projects with an interest rate as low as 7.5% but never higher than 11%. Conduct the analysis with a range of interest rate from 7.5% to 11% (with a 0.5% increment). 3. Additional Analysis You also believe that 20 years is not the appropriate planning horizon for projects of this magnitude. You believe that 30 years is more appropriate for projects B and C and 40 years for projects A and D. Under these conditions, each project will require additional maintenance every 10 years (not including the last year of operation) equal to 5% of the initial investment. Furthermore, the salvage received at the end of the horizon period will equal 80% of the original salvage value. You need to restimate each project's cash flows under these new constraints as well as estimate the appropriate decision criteria. The first part of this case study will serve as the introduction of your final report which will compile ad subpast). In this introduction, you will present stumty of each sative projecte revente costs and cash flow. You will produce 3 sepatste stap (1 for constant to comparing the alternative rol You must each solution's projected electricity production which may play a role its charital decision. Note that we are not the information dead for dectricity Furthermore, the Federal Energy Regulatory Commision (FERC) is allowing differenties per technology use Discesso al cent and rese per i produced evolves time (for euch alternative). Another graph might be sie bere Deshow that might impact or decision making proces 2. Projects The National Institute of Coal Operations (NICO) smitted to viding a power plant an efort to diversity and transition to mewable energie. A group of ineers from the University of New Orleans we offered to condut the analynks that will evaluate the feasibility of four (4) des for this company. They gig to eat these options sing a present worth lysts and custom The tion currently only has got to the of the projects NICO typically intrate of 10% and has estimated end project to use your home. The for 2.1. Design A field of Intolat panel angled to best catch them will yield 26 MW of power and will cost $87 million initially with first-perating costs at $2 million shich will be greeing $250,000 nmully. It will produse dectricity worth $6.9 million the first year and will increase by 10% each year thereafter. Its salvage value is estimated at 2 million 2.2. Design B A field of chuized alates rotates from side to side that they are prontioned parallel to the sun's , maximizing the production of electricity. The design will yil 31 MW of power and will cost $0 million initially with first-perating contat $3.5 million, which will grow $20.00mly. It will produce electricity worth 5.5 million the first year and will now 13% each year theater. Its along the sentimated $ 2.3. Design C This designs a bed of us to focus the sun's us to a bolewmedia tower. The boiler the produces stand generate electricity the same way a coa plan operate This systemy 3.3 MW of power and will cost $0 million initially with first-operating costs at 83 million, which will grow $350,000 any It will produce dectricity worth $8.5 million the first year and will it Scarlettsalge valo is estimated at 1 milli 24. Design D The best the states design (with mos being proded with different technology). However, this system vid 3 MW od poner and will cost 572 milli initially with first-operating costs at $2.5 million, which will grow $150.000 am It will peoduce electricity worth $5.5 million the first year and will increme 120 nach yet Its salvage value is estimated at $1.5 milli The first part of this case study will serve as the introduction of your final report which will compile ad subpast). In this introduction, you will present stumty of each sative projecte revente costs and cash flow. You will produce 3 sepatste stap (1 for constant to comparing the alternative rol You must each solution's projected electricity production which may play a role its charital decision. Note that we are not the information dead for dectricity Furthermore, the Federal Energy Regulatory Commision (FERC) is allowing differenties per technology use Discesso al cent and rese per i produced evolves time (for euch alternative). Another graph might be sie bere Deshow that might impact or decision making proces 2. Projects The National Institute of Coal Operations (NICO) smitted to viding a power plant an efort to diversity and transition to mewable energie. A group of ineers from the University of New Orleans we offered to condut the analynks that will evaluate the feasibility of four (4) des for this company. They gig to eat these options sing a present worth lysts and custom The tion currently only has got to the of the projects NICO typically intrate of 10% and has estimated end project to use your home. The for 2.1. Design A field of Intolat panel angled to best catch them will yield 26 MW of power and will cost $87 million initially with first-perating costs at $2 million shich will be greeing $250,000 nmully. It will produse dectricity worth $6.9 million the first year and will increase by 10% each year thereafter. Its salvage value is estimated at 2 million 2.2. Design B A field of chuized alates rotates from side to side that they are prontioned parallel to the sun's , maximizing the production of electricity. The design will yil 31 MW of power and will cost $0 million initially with first-perating contat $3.5 million, which will grow $20.00mly. It will produce electricity worth 5.5 million the first year and will now 13% each year theater. Its along the sentimated $ 2.3. Design C This designs a bed of us to focus the sun's us to a bolewmedia tower. The boiler the produces stand generate electricity the same way a coa plan operate This systemy 3.3 MW of power and will cost $0 million initially with first-operating costs at 83 million, which will grow $350,000 any It will produce dectricity worth $8.5 million the first year and will it Scarlettsalge valo is estimated at 1 milli 24. Design D The best the states design (with mos being proded with different technology). However, this system vid 3 MW od poner and will cost 572 milli initially with first-operating costs at $2.5 million, which will grow $150.000 am It will peoduce electricity worth $5.5 million the first year and will increme 120 nach yet Its salvage value is estimated at $1.5 milli You must discuss each solution's projected electricity production which may play a role in our final decision. Note that we are not given information on demand for electricity. Furthermore, the Federal Energy Regulatory Commission (FERC) is allowing different prices per technology used. Discuss how each cost and revenue per unit produced evolves through time (for each alternative). Another graph might be nice here. Discuss how that might impact or decision making process. 1 2. Projects The National Institute of Coal Operations (NICO) has committed to building a solar power plant as an effort to diversify and transition to renewable energies. A group of en- gineers from the University of New Orleans have offered to conduct the analysis that will evaluate the feasibility of four (4) designs for this company. They are going to evaluate these options using a present worth analysis and annual cash flow analysis. The organiza- tion currently only has enough money to execute one of the projects. NICO typically uses an interest rate of 10% and has estimated each project to have a 20-year horizon. The four proposed designs are: 2.1. Design A A field of "flat" solar panels angled to best catch the sun will yield 2.6 MW of power and will cost $87 million initially with first-year operating costs at $2 million, which will be growing $250,000 annually. It will produce electricity worth $6.9 million the first year and will increase by 10% each year thereafter. Its salvage value is estimated at $2 million. 2. Analysis For each project, you must calculate the Net Present Value, the Equivalent Uniform Annual Worth, and the Internal Rate of Return. While the team at NICO is confident they can secure a 10% financing rate, the team of engineers has decided to solidify their analysis by analysing what would happen under different financing scenarios. They have found that NICO has been able to fund projects with an interest rate as low as 7.5% but never higher than 11%. Conduct the analysis with a range of interest rate from 7.5% to 11% (with a 0.5% increment). 3. Additional Analysis You also believe that 20 years is not the appropriate planning horizon for projects of this magnitude. You believe that 30 years is more appropriate for projects B and C and 40 years for projects A and D. Under these conditions, each project will require additional maintenance every 10 years (not including the last year of operation) equal to 5% of the initial investment. Furthermore, the salvage received at the end of the horizon period will equal 80% of the original salvage value. You need to restimate each project's cash flows under these new constraints as well as estimate the appropriate decision criteria. The first part of this case study will serve as the introduction of your final report which will compile ad subpast). In this introduction, you will present stumty of each sative projecte revente costs and cash flow. You will produce 3 sepatste stap (1 for constant to comparing the alternative rol You must each solution's projected electricity production which may play a role its charital decision. Note that we are not the information dead for dectricity Furthermore, the Federal Energy Regulatory Commision (FERC) is allowing differenties per technology use Discesso al cent and rese per i produced evolves time (for euch alternative). Another graph might be sie bere Deshow that might impact or decision making proces 2. Projects The National Institute of Coal Operations (NICO) smitted to viding a power plant an efort to diversity and transition to mewable energie. A group of ineers from the University of New Orleans we offered to condut the analynks that will evaluate the feasibility of four (4) des for this company. They gig to eat these options sing a present worth lysts and custom The tion currently only has got to the of the projects NICO typically intrate of 10% and has estimated end project to use your home. The for 2.1. Design A field of Intolat panel angled to best catch them will yield 26 MW of power and will cost $87 million initially with first-perating costs at $2 million shich will be greeing $250,000 nmully. It will produse dectricity worth $6.9 million the first year and will increase by 10% each year thereafter. Its salvage value is estimated at 2 million 2.2. Design B A field of chuized alates rotates from side to side that they are prontioned parallel to the sun's , maximizing the production of electricity. The design will yil 31 MW of power and will cost $0 million initially with first-perating contat $3.5 million, which will grow $20.00mly. It will produce electricity worth 5.5 million the first year and will now 13% each year theater. Its along the sentimated $ 2.3. Design C This designs a bed of us to focus the sun's us to a bolewmedia tower. The boiler the produces stand generate electricity the same way a coa plan operate This systemy 3.3 MW of power and will cost $0 million initially with first-operating costs at 83 million, which will grow $350,000 any It will produce dectricity worth $8.5 million the first year and will it Scarlettsalge valo is estimated at 1 milli 24. Design D The best the states design (with mos being proded with different technology). However, this system vid 3 MW od poner and will cost 572 milli initially with first-operating costs at $2.5 million, which will grow $150.000 am It will peoduce electricity worth $5.5 million the first year and will increme 120 nach yet Its salvage value is estimated at $1.5 milli The first part of this case study will serve as the introduction of your final report which will compile ad subpast). In this introduction, you will present stumty of each sative projecte revente costs and cash flow. You will produce 3 sepatste stap (1 for constant to comparing the alternative rol You must each solution's projected electricity production which may play a role its charital decision. Note that we are not the information dead for dectricity Furthermore, the Federal Energy Regulatory Commision (FERC) is allowing differenties per technology use Discesso al cent and rese per i produced evolves time (for euch alternative). Another graph might be sie bere Deshow that might impact or decision making proces 2. Projects The National Institute of Coal Operations (NICO) smitted to viding a power plant an efort to diversity and transition to mewable energie. A group of ineers from the University of New Orleans we offered to condut the analynks that will evaluate the feasibility of four (4) des for this company. They gig to eat these options sing a present worth lysts and custom The tion currently only has got to the of the projects NICO typically intrate of 10% and has estimated end project to use your home. The for 2.1. Design A field of Intolat panel angled to best catch them will yield 26 MW of power and will cost $87 million initially with first-perating costs at $2 million shich will be greeing $250,000 nmully. It will produse dectricity worth $6.9 million the first year and will increase by 10% each year thereafter. Its salvage value is estimated at 2 million 2.2. Design B A field of chuized alates rotates from side to side that they are prontioned parallel to the sun's , maximizing the production of electricity. The design will yil 31 MW of power and will cost $0 million initially with first-perating contat $3.5 million, which will grow $20.00mly. It will produce electricity worth 5.5 million the first year and will now 13% each year theater. Its along the sentimated $ 2.3. Design C This designs a bed of us to focus the sun's us to a bolewmedia tower. The boiler the produces stand generate electricity the same way a coa plan operate This systemy 3.3 MW of power and will cost $0 million initially with first-operating costs at 83 million, which will grow $350,000 any It will produce dectricity worth $8.5 million the first year and will it Scarlettsalge valo is estimated at 1 milli 24. Design D The best the states design (with mos being proded with different technology). However, this system vid 3 MW od poner and will cost 572 milli initially with first-operating costs at $2.5 million, which will grow $150.000 am It will peoduce electricity worth $5.5 million the first year and will increme 120 nach yet Its salvage value is estimated at $1.5 milli