Question

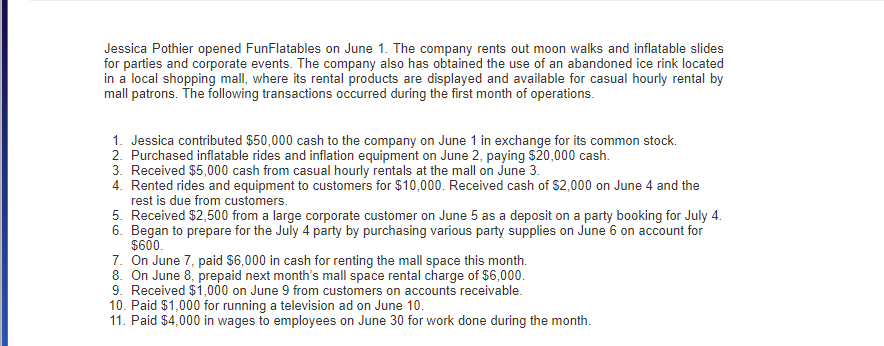

Please make a journal entry for 1 - 11 1 Jessica contributed $50,000 cash to the company on June 1 in exchange for its common

Please make a journal entry for 1 - 11

Please make a journal entry for 1 - 11

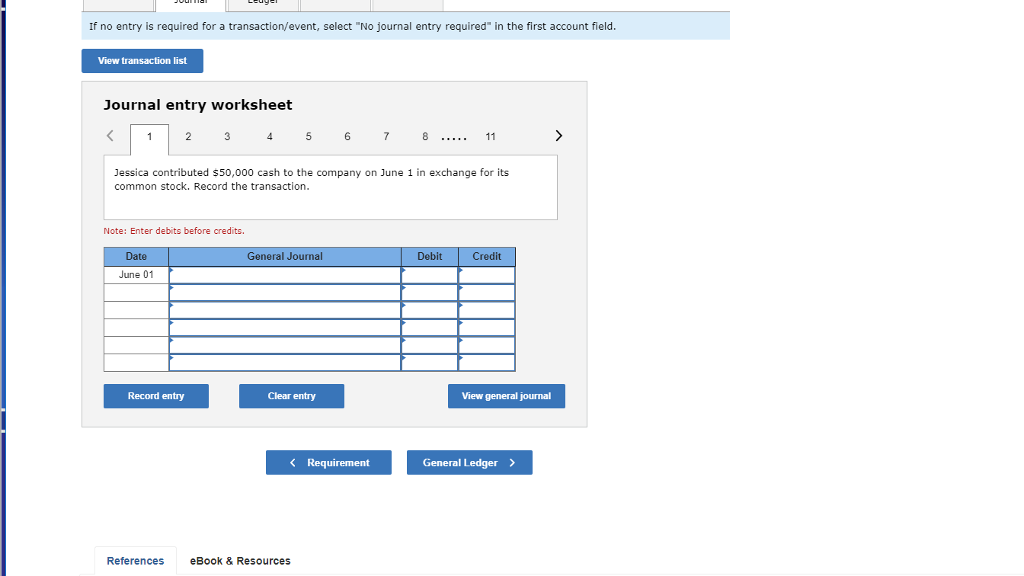

1

Jessica contributed $50,000 cash to the company on June 1 in exchange for its common stock. Record the transaction.

2

Purchased inflatable rides and inflation equipment on June 2, paying $20,000 cash. Record the transaction.

3

Received $5,000 cash from casual hourly rentals at the mall on June 3. Record the transaction.

4

Rented rides and equipment to customers for $10,000. Received cash of $2,000 on June 4 and the rest is due from customers. Record the transaction.

5

Received $2,500 from a large corporate customer on June 5 as a deposit on a party booking for July 4. Record the transaction.

6

Began to prepare for the July 4 party by purchasing various party supplies on June 6 on account for $600. Record the transaction.

7

On June 7, paid $6,000 in cash for renting the mall space this month. Record the transaction.

8

On June 8, prepaid next months mall space rental charge of $6,000. Record the transaction.

9

Received $1,000 on June 9 from customers on accounts receivable. Record the transaction.

10

Paid $1,000 for running a television ad on June 10. Record the transaction.

11

Paid $4,000 in wages to employees on June 30 for work done during the month. Record the transaction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started