Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make a table in excel GREY Co Company, a permanent establishment in Indonesia, runs business in selling computers. They started their business in 2019

Please make a table in excel

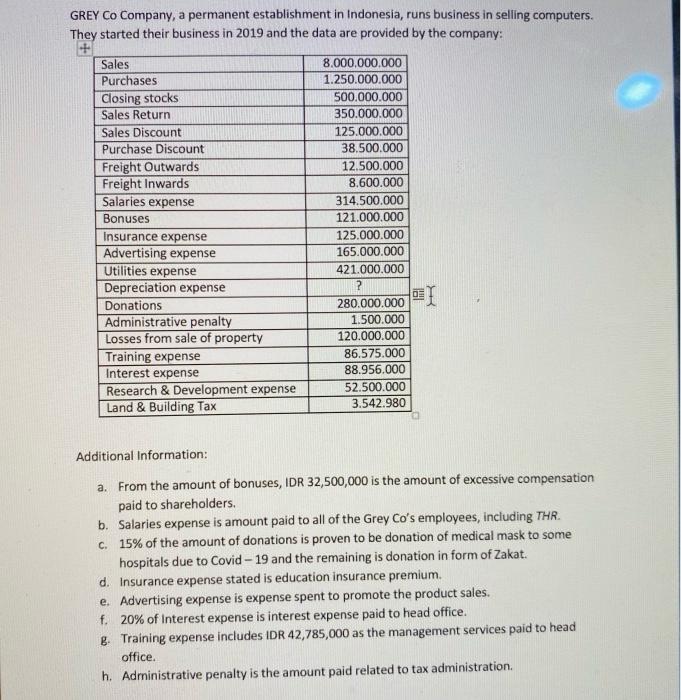

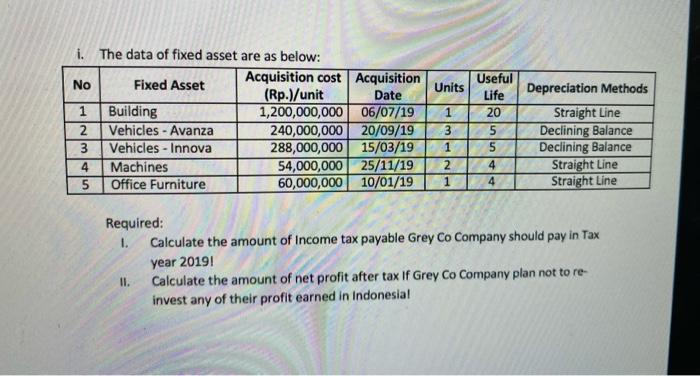

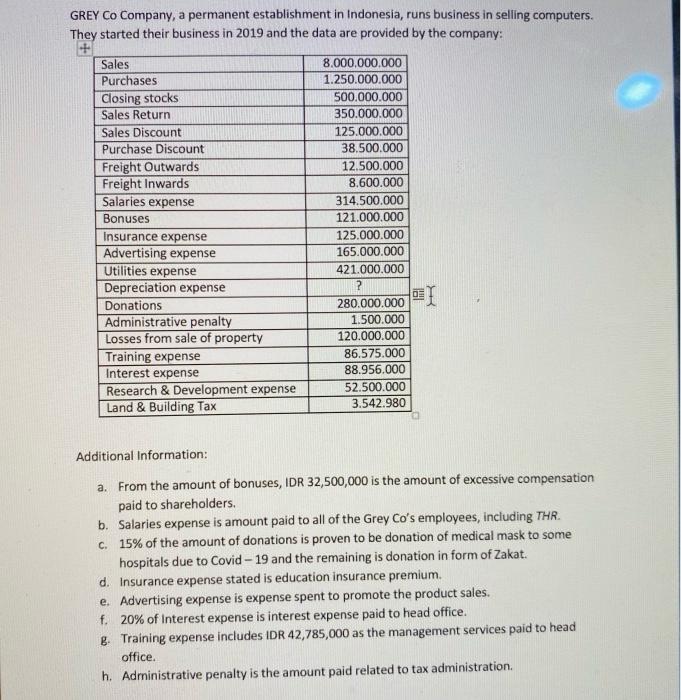

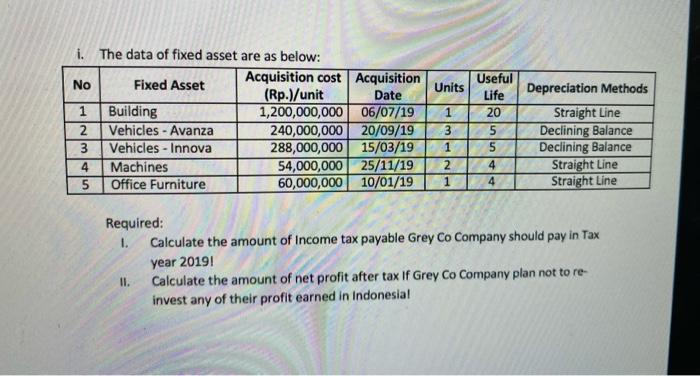

GREY Co Company, a permanent establishment in Indonesia, runs business in selling computers. They started their business in 2019 and the data are provided by the company: + Sales 8.000.000.000 Purchases 1.250.000.000 Closing stocks 500.000.000 Sales Return 350.000.000 Sales Discount 125.000.000 Purchase Discount 38.500.000 Freight Outwards 12.500.000 Freight Inwards 8.600.000 Salaries expense 314.500.000 Bonuses 121.000.000 Insurance expense 125.000.000 Advertising expense 165.000.000 Utilities expense 421.000.000 Depreciation expense ? Donations 280.000.000 Administrative penalty 1.500.000 Losses from sale of property 120.000.000 Training expense 86.575.000 Interest expense 88.956.000 Research & Development expense 52.500.000 Land & Building Tax 3.542.980 I Additional Information: a. From the amount of bonuses, IDR 32,500,000 is the amount of excessive compensation paid to shareholders. b. Salaries expense is amount paid to all of the Grey Co's employees, including THR. c. 15% of the amount of donations is proven to be donation of medical mask to some hospitals due to Covid - 19 and the remaining is donation in form of Zakat. d. Insurance expense stated is education insurance premium. e. Advertising expense is expense spent to promote the product sales. f. 20% of Interest expense is interest expense paid to head office. g. Training expense includes IDR 42,785,000 as the management services paid to head office. h. Administrative penalty is the amount paid related to tax administration Units Useful Life 20 i. The data of fixed asset are as below: Fixed Asset Acquisition cost Acquisition No (Rp.)/unit Date 1 Building 1,200,000,000 06/07/19 2 Vehicles - Avanza 240,000,000 20/09/19 3 Vehicles - Innova 288,000,000 15/03/19 4 Machines 54,000,000 25/11/19 5 Office Furniture 60,000,000 10/01/19 1 3 1 5 5 4 4 Depreciation Methods Straight Line Declining Balance Declining Balance Straight Line Straight Line 2 1 Required: 1. Calculate the amount of Income tax payable Grey Co Company should pay in Tax year 20191 II. Calculate the amount of net profit after tax if Grey Co Company plan not to re- invest any of their profit earned in Indonesia! GREY Co Company, a permanent establishment in Indonesia, runs business in selling computers. They started their business in 2019 and the data are provided by the company: + Sales 8.000.000.000 Purchases 1.250.000.000 Closing stocks 500.000.000 Sales Return 350.000.000 Sales Discount 125.000.000 Purchase Discount 38.500.000 Freight Outwards 12.500.000 Freight Inwards 8.600.000 Salaries expense 314.500.000 Bonuses 121.000.000 Insurance expense 125.000.000 Advertising expense 165.000.000 Utilities expense 421.000.000 Depreciation expense ? Donations 280.000.000 Administrative penalty 1.500.000 Losses from sale of property 120.000.000 Training expense 86.575.000 Interest expense 88.956.000 Research & Development expense 52.500.000 Land & Building Tax 3.542.980 I Additional Information: a. From the amount of bonuses, IDR 32,500,000 is the amount of excessive compensation paid to shareholders. b. Salaries expense is amount paid to all of the Grey Co's employees, including THR. c. 15% of the amount of donations is proven to be donation of medical mask to some hospitals due to Covid - 19 and the remaining is donation in form of Zakat. d. Insurance expense stated is education insurance premium. e. Advertising expense is expense spent to promote the product sales. f. 20% of Interest expense is interest expense paid to head office. g. Training expense includes IDR 42,785,000 as the management services paid to head office. h. Administrative penalty is the amount paid related to tax administration Units Useful Life 20 i. The data of fixed asset are as below: Fixed Asset Acquisition cost Acquisition No (Rp.)/unit Date 1 Building 1,200,000,000 06/07/19 2 Vehicles - Avanza 240,000,000 20/09/19 3 Vehicles - Innova 288,000,000 15/03/19 4 Machines 54,000,000 25/11/19 5 Office Furniture 60,000,000 10/01/19 1 3 1 5 5 4 4 Depreciation Methods Straight Line Declining Balance Declining Balance Straight Line Straight Line 2 1 Required: 1. Calculate the amount of Income tax payable Grey Co Company should pay in Tax year 20191 II. Calculate the amount of net profit after tax if Grey Co Company plan not to re- invest any of their profit earned in Indonesia

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started