Answered step by step

Verified Expert Solution

Question

1 Approved Answer

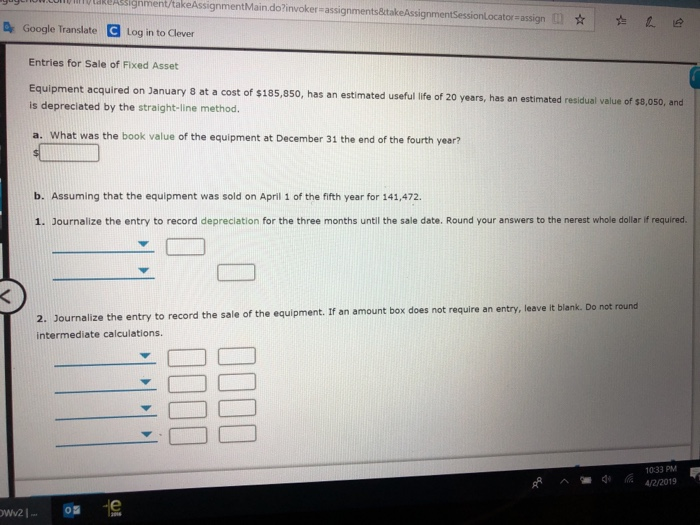

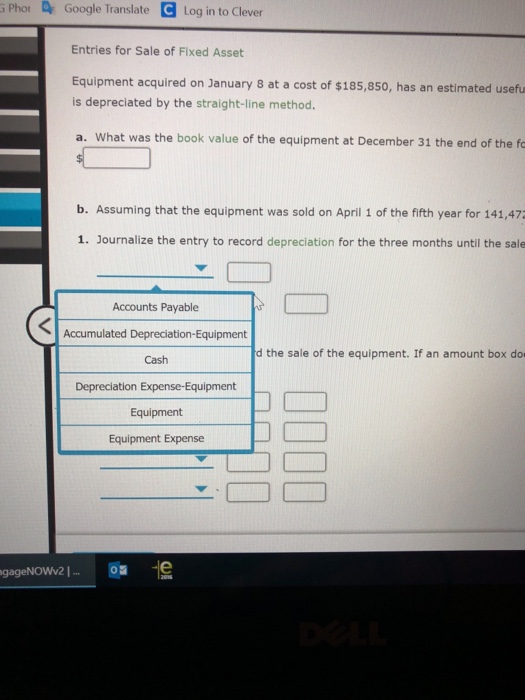

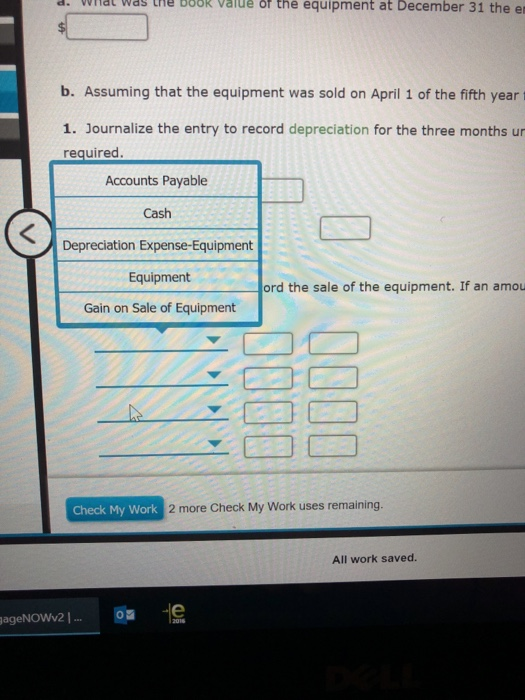

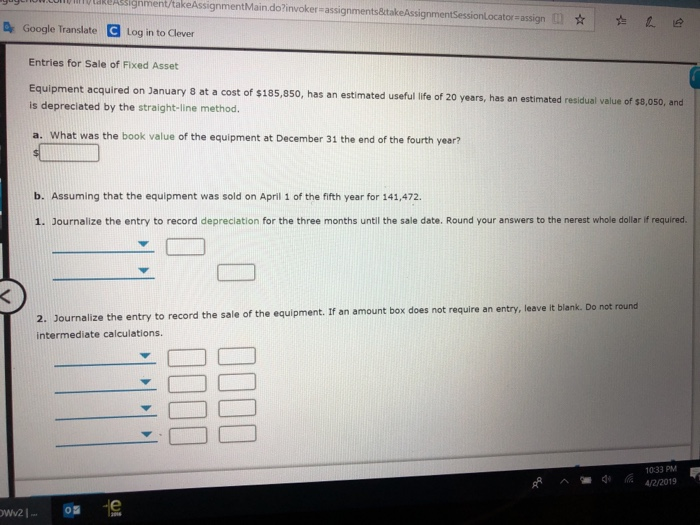

please make answers really clear Assignment r eintak e / takeAssignmentMain doinvoke-assignments&takeAssignment essionlocator-assign D Google Translate C Log in to Clever Entries for Sale of

please make answers really clear

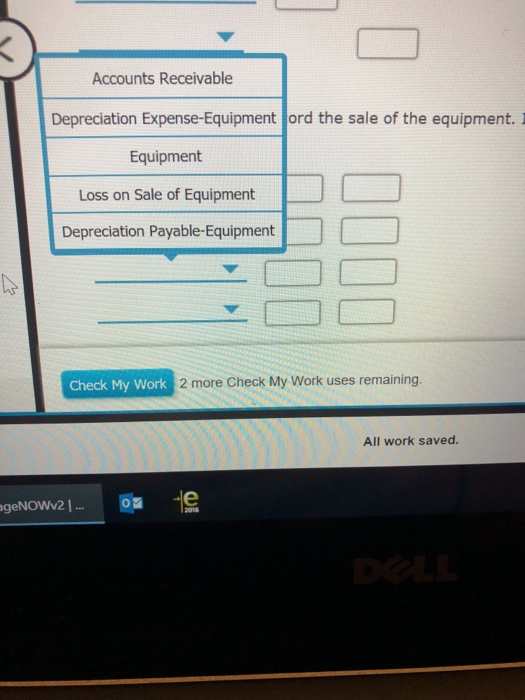

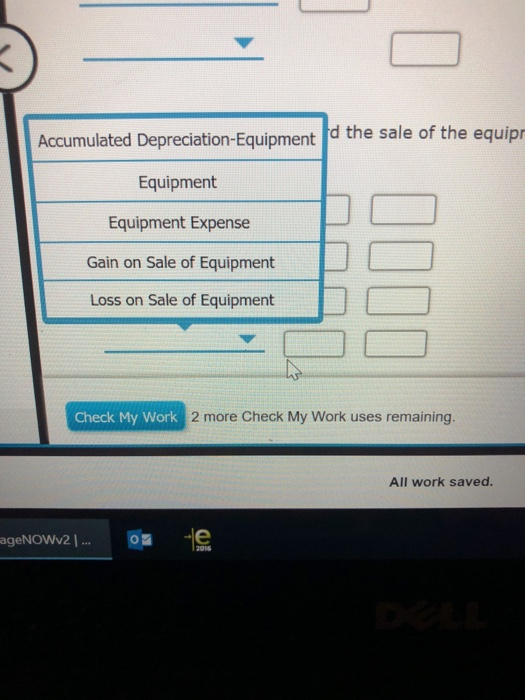

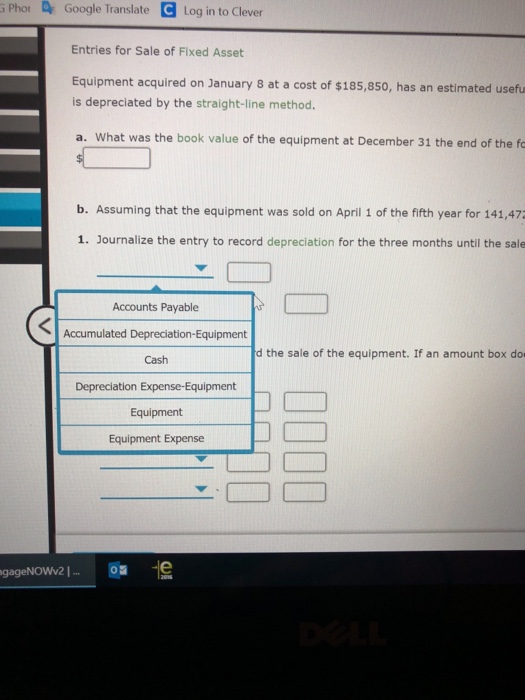

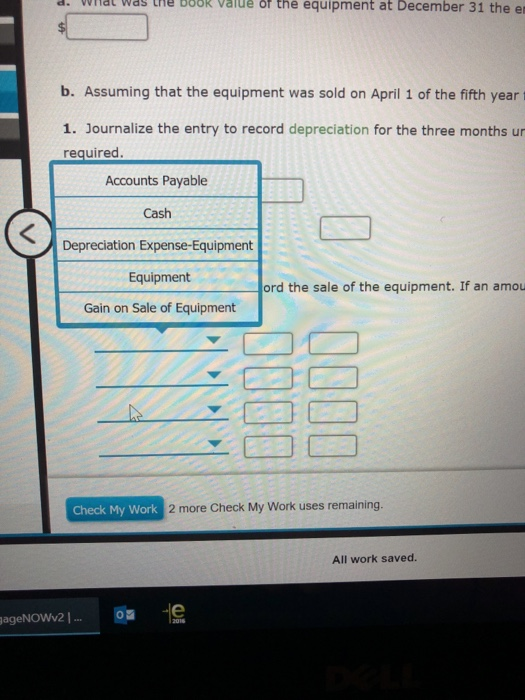

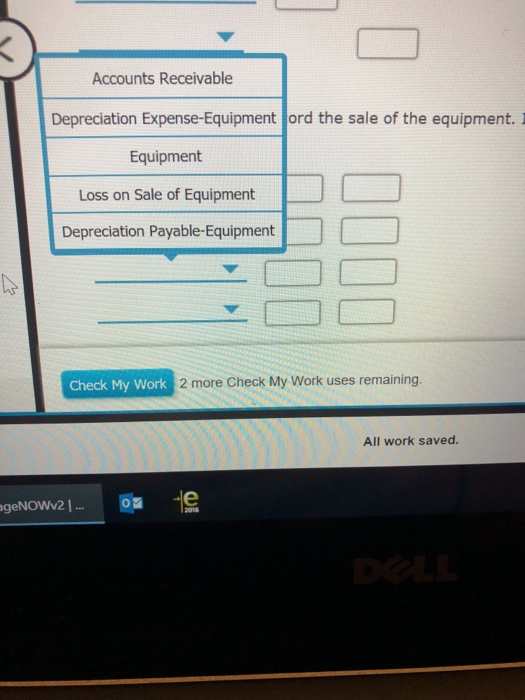

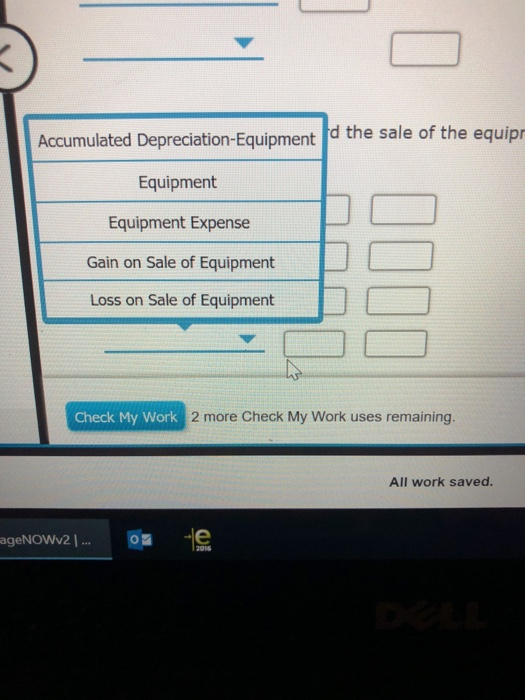

Assignment r eintak e / takeAssignmentMain doinvoke-assignments&takeAssignment essionlocator-assign D Google Translate C Log in to Clever Entries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $185,850, has an estimated useful life of 20 years, has an estimated is depreciated by the straight-line method. residual value of $8,050, and a. What was the book value of the equipment at December 31 the end of the fourth year? b. Assuming that the equipment was sold on April 1 of the fifth year for 141,472. 1. Journalize the entry to record depreclation for the three months until the sale date. Round your answers to the nerest whole dollar if required. le of the equipment. If an amount box does not require an entry, leave it blank. Do not round 2. Journalize the entry to record the sal intermediate calculations. A 1033 PM 422019 os e i Phor Google Translate C Log in to Clever Entries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $185,850, has an estimated usefu is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fo b. Assuming that the equipment was sold on April 1 of the fifth year for 141,472 1. Journalize the entry to record depreciation for the three months until the sale Accounts Payable Accumulated Depreciation-Equipment Cash Depreciation Expense-Equipment Equipment Equipment Expense d the sale of the equipment. If an amount box do a. VWlat was tHe BO8k Value of the equipment at December 31 the e b. Assuming that the equipment was sold on April 1 of the fifth year t 1. Journalize the entry to record depreciation for the three months ur required Accounts Payable Cash Depreciation Expense-Equipment Equipment Gain on Sale of Equipment ord the sale of the equipment. If an amou Check My Work 2 more Check My Work uses remaining. All work saved ageNOWv2 .. Accounts Receivable Depreciation Expense-Equipment ord the sale of the equipment. 1 Equipment Loss on Sale of Equipment Depreciation Payable-Equipment Check My Work ork 2 more Check My Work uses remaining. All work saved. geNOWv21 Accumulated Depreciation-Equipment 'd the sale of the equipr Equipment Equipment Expense Gain on Sale of Equipment Loss on Sale of Equipment Check My Work 2 more Check My Work uses remaining All work saved. ageNOWv2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started