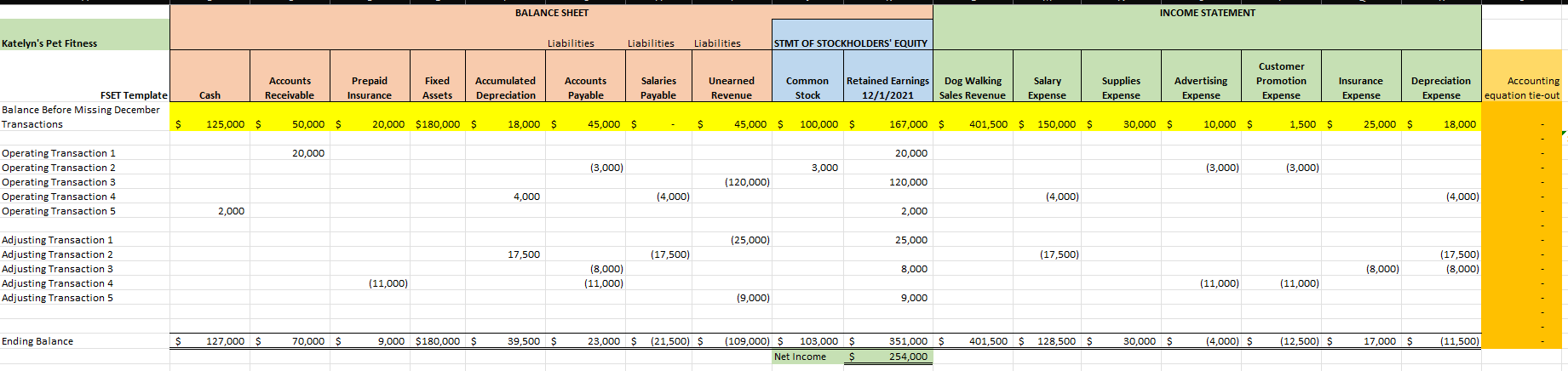

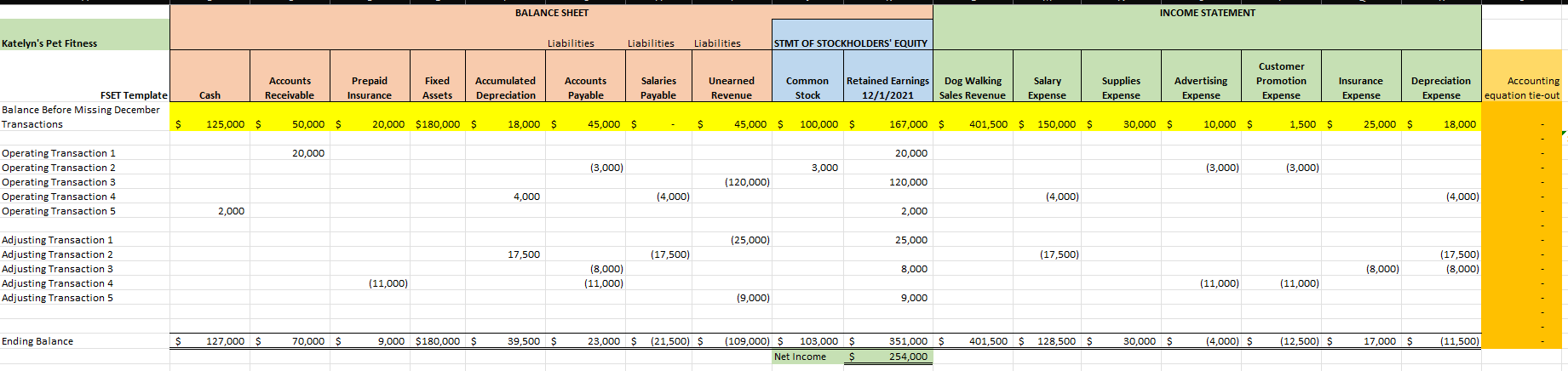

Please make sure that both sides of the accounting equation(A=L +SE) are equal and that when you finish the TAT sheet, please check over. Also, make sure there are 2 transactions per the 10 transaction problems above. Also, if there is anything wrong with the financial statements, please correct them or if any problems on the TAT sheet as well. On the right hand side on the TAT sheet(highlighted in orange) is a SUM equation that's suppose to see whether the transaction is balanced on both sides for the particular problem I wanted to mention.

*My bad, here are the instructions.

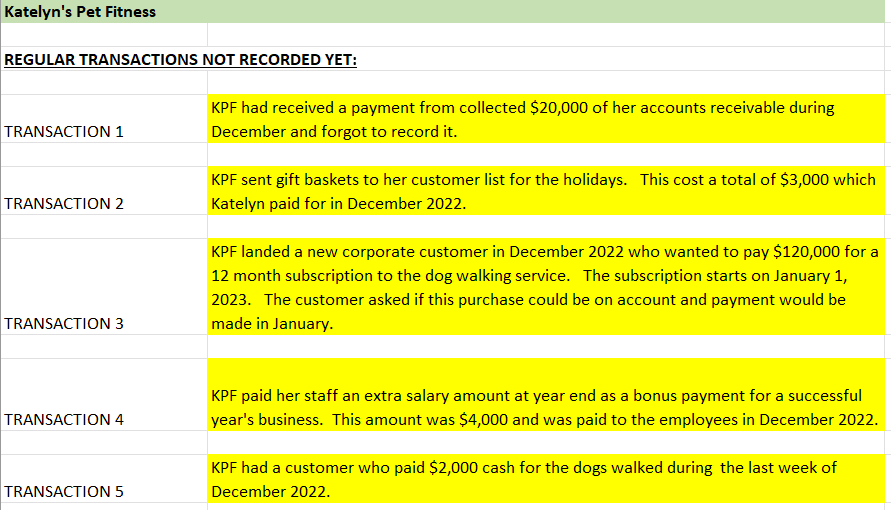

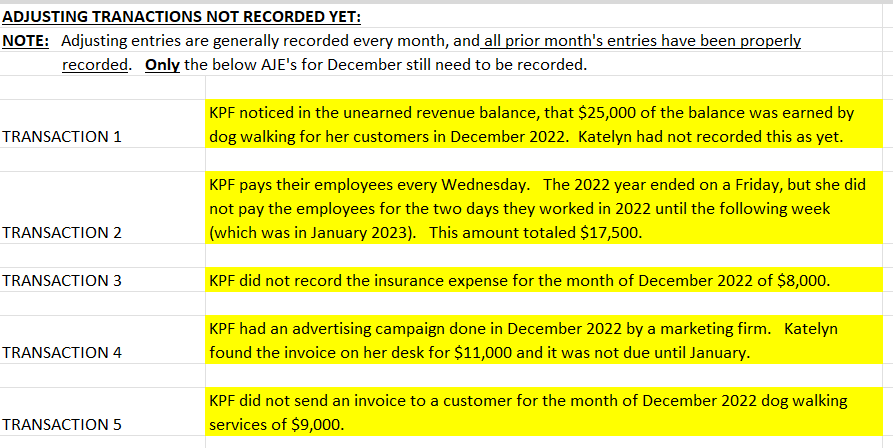

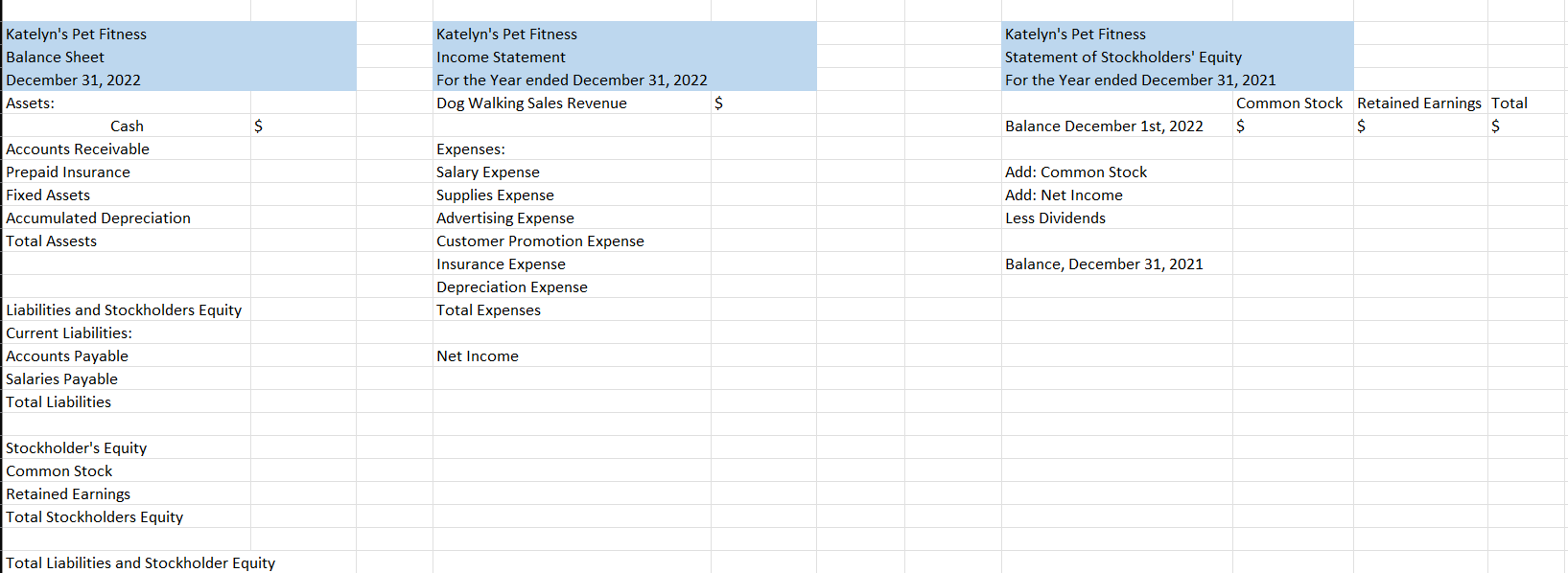

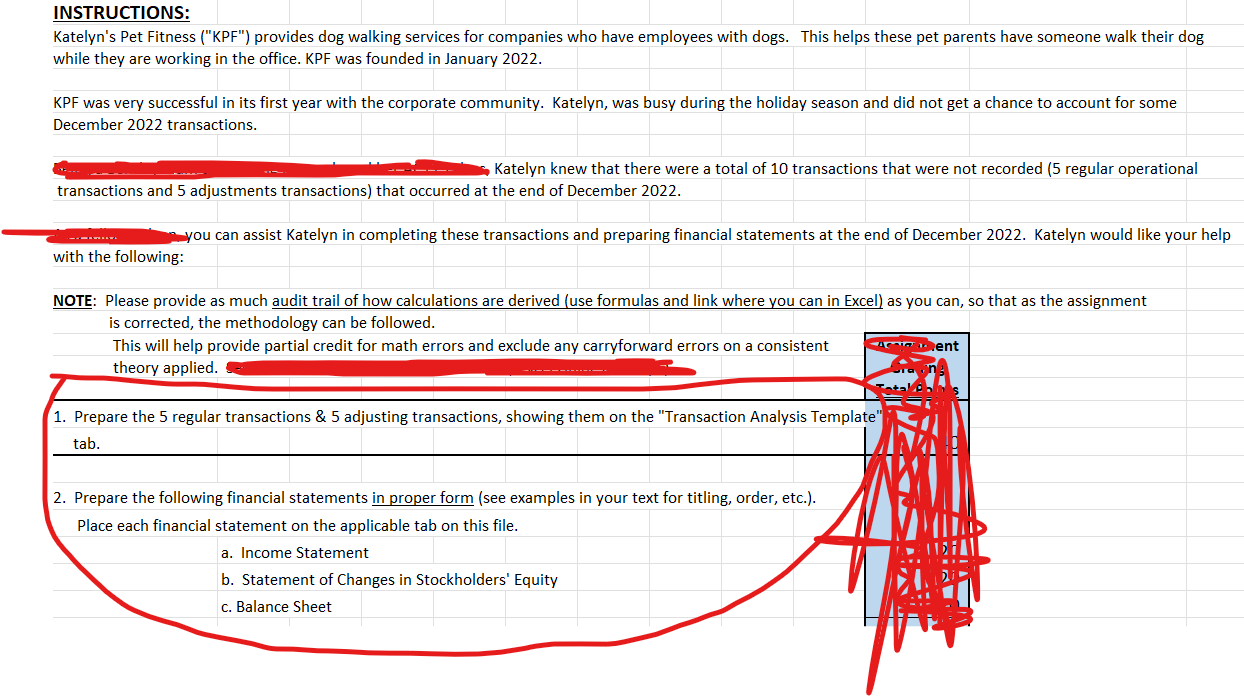

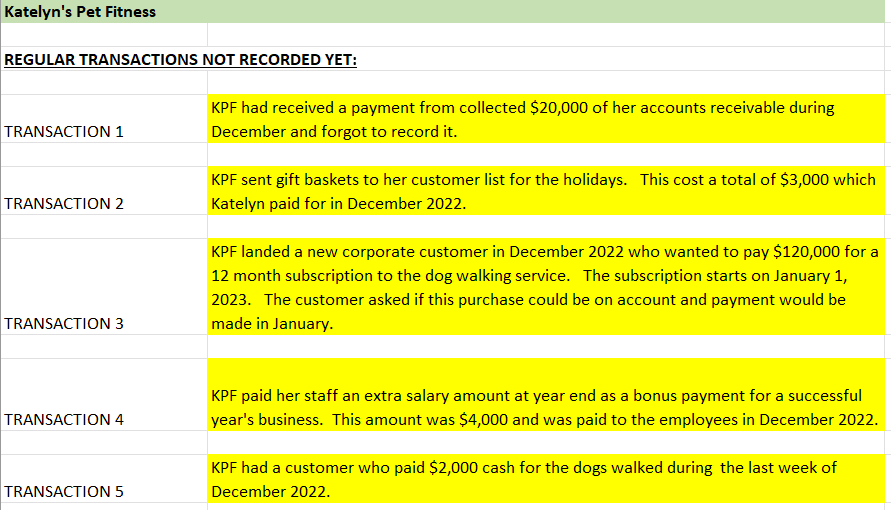

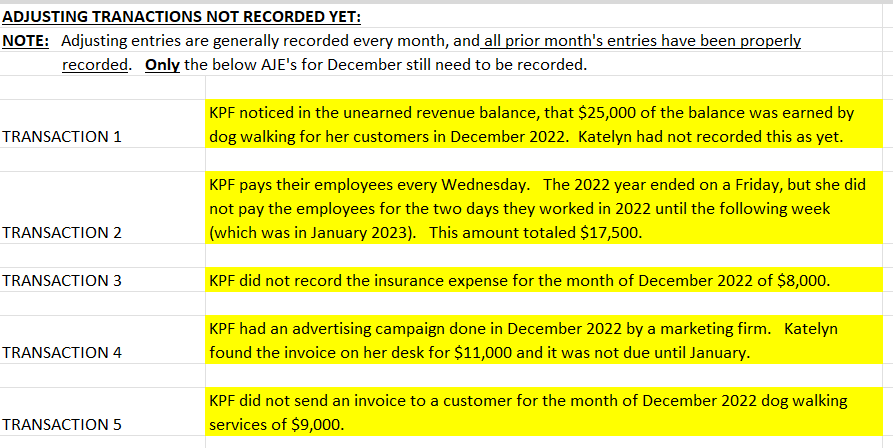

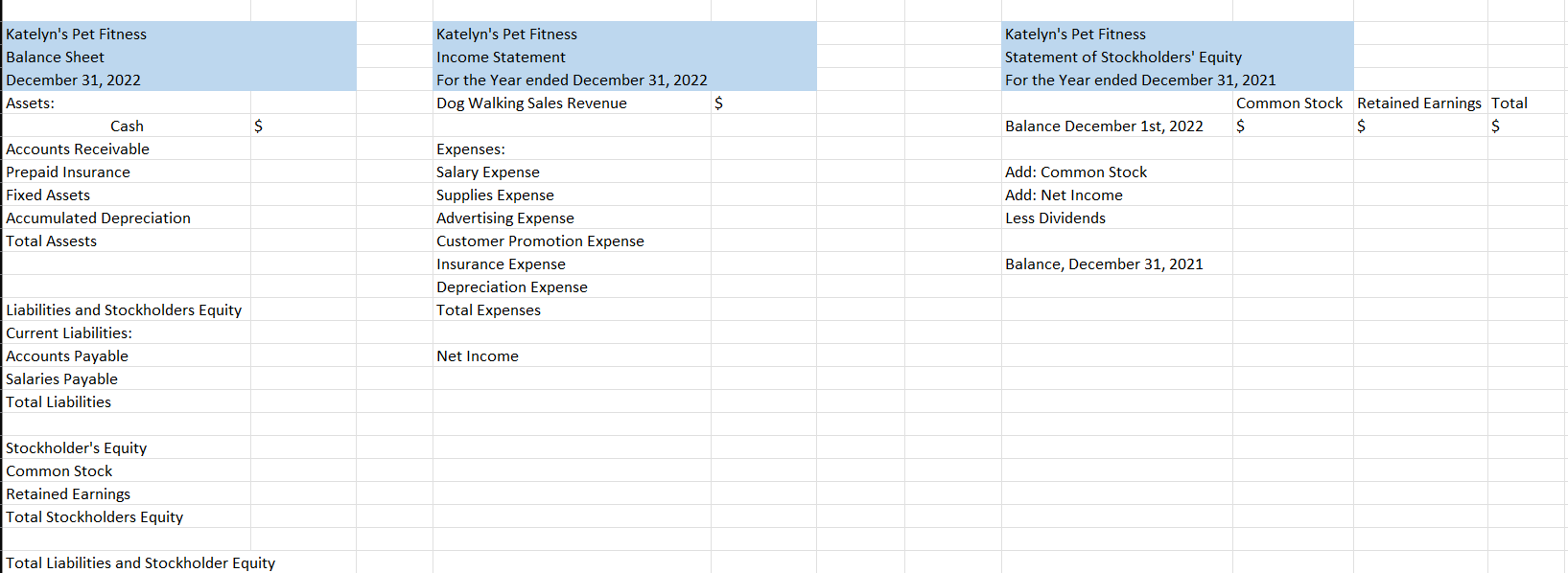

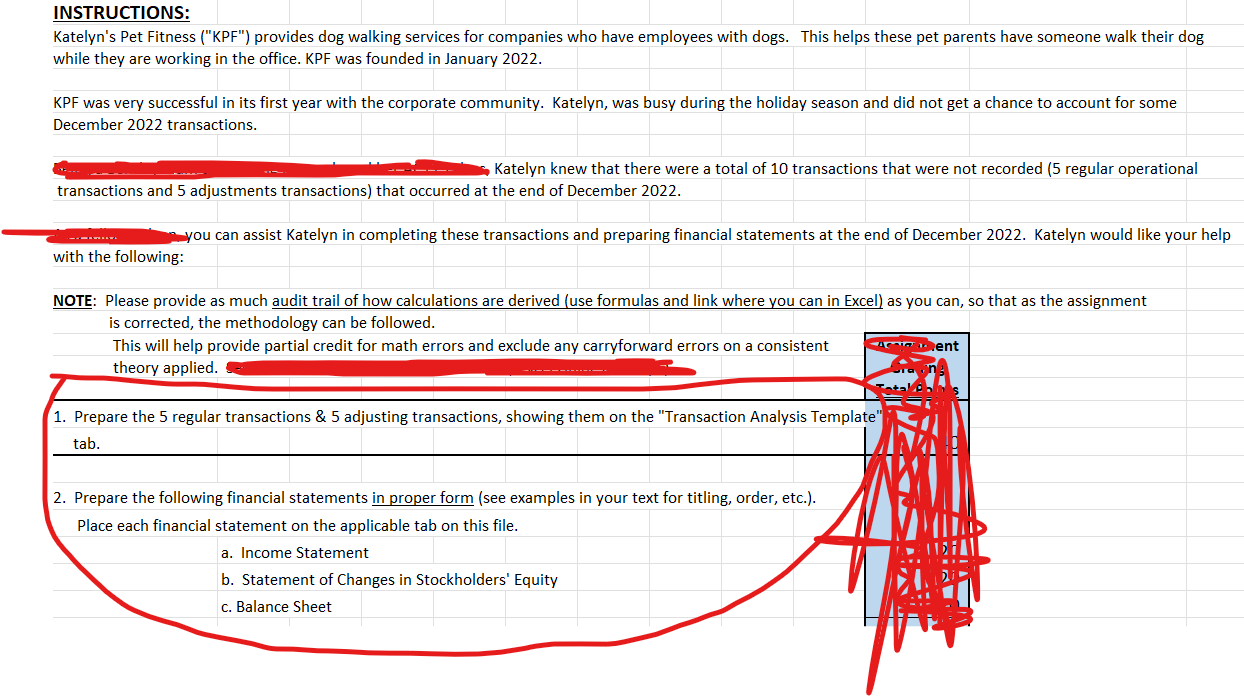

Katelyn's Pet Fitness REGULAR TRANSACTIONS NOT RECORDED YET: KPF had received a payment from collected $20,000 of her accounts receivable during TRANSACTION 1 December and forgot to record it. KPF sent gift baskets to her customer list for the holidays. This cost a total of $3,000 which TRANSACTION 2 Katelyn paid for in December 2022. KPF landed a new corporate customer in December 2022 who wanted to pay $120,000 for a 12 month subscription to the dog walking service. The subscription starts on January 1 , 2023. The customer asked if this purchase could be on account and payment would be TRANSACTION 3 made in January. KPF paid her staff an extra salary amount at year end as a bonus payment for a successful TRANSACTION 4 year's business. This amount was $4,000 and was paid to the employees in December 2022. KPF had a customer who paid $2,000 cash for the dogs walked during the last week of TRANSACTION 5 December 2022. ADJUSTING TRANACTIONS NOT RECORDED YET: NOTE: Adjusting entries are generally recorded every month, and all prior month's entries have been properly recorded. Only the below AJE's for December still need to be recorded. KPF noticed in the unearned revenue balance, that $25,000 of the balance was earned by TRANSACTION 1 dog walking for her customers in December 2022. Katelyn had not recorded this as yet. KPF pays their employees every Wednesday. The 2022 year ended on a Friday, but she did not pay the employees for the two days they worked in 2022 until the following week TRANSACTION 2 (which was in January 2023). This amount totaled $17,500. TRANSACTION 3 KPF did not record the insurance expense for the month of December 2022 of $8,000. KPF had an advertising campaign done in December 2022 by a marketing firm. Katelyn TRANSACTION 4 found the invoice on her desk for $11,000 and it was not due until January. KPF did not send an invoice to a customer for the month of December 2022 dog walking TRANSACTION 5 services of $9,000. Total Liabilities and Stockholder Equity INSTRUCTIONS: Katelyn's Pet Fitness ("KPF") provides dog walking services for companies who have employees with dogs. This helps these pet parents have someone walk their dog while they are working in the office. KPF was founded in January 2022. KPF was very successful in its first year with the corporate community. Katelyn, was busy during the holiday season and did not get a chance to account for some December 2022 transactions. Katelyn knew that there were a total of 10 transactions that were not recorded ( 5 regular operational transactions and 5 adjustments transactions) that occurred at the end of December 2022. you can assist Katelyn in completing these transactions and preparing financial statements at the end of December 2022 . Katelyn would like your help with the following: NOTE: Please provide as much audit trail of how calculations are derived (use formulas and link where you can in Excel) as you can, so that as the assignment is corrected, the methodology can be followed. This will help provide partial credit for math errors and exclude any carryforward errors on a consistent theory applied. 1. Prepare the 5 regular transactions \& 5 adjusting transactions, showing them on the "Transaction Analysis Template" tab. 2. Prepare the following financial statements in proper form (see examples in your text for titling, order, etc.). Place each financial statement on the applicable tab on this file. a. Income Statement b. Statement of Changes in Stockholders' Equity c. Balance Sheet