Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make sure the answer is correct 100% Presented below is the adjusted trial balance of Power SA at December 31, 2019. Power SA Adjusted

Please make sure the answer is correct 100%

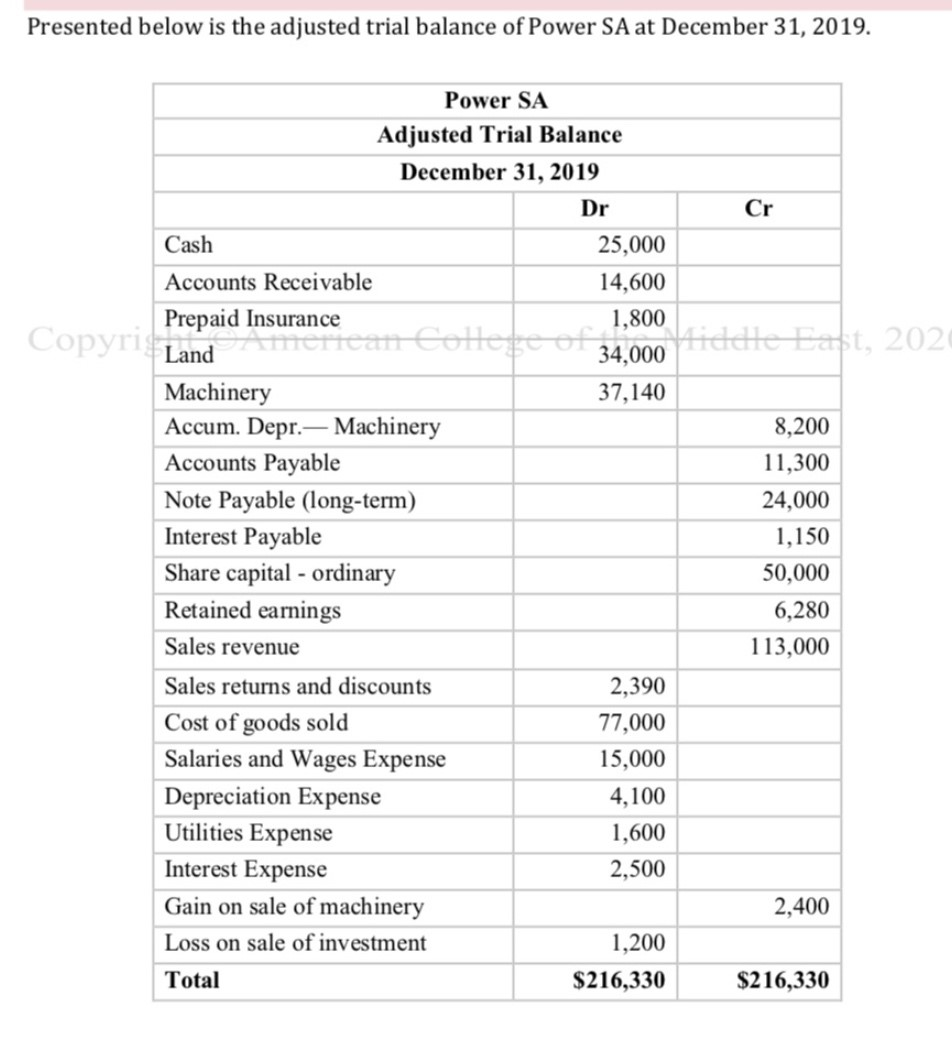

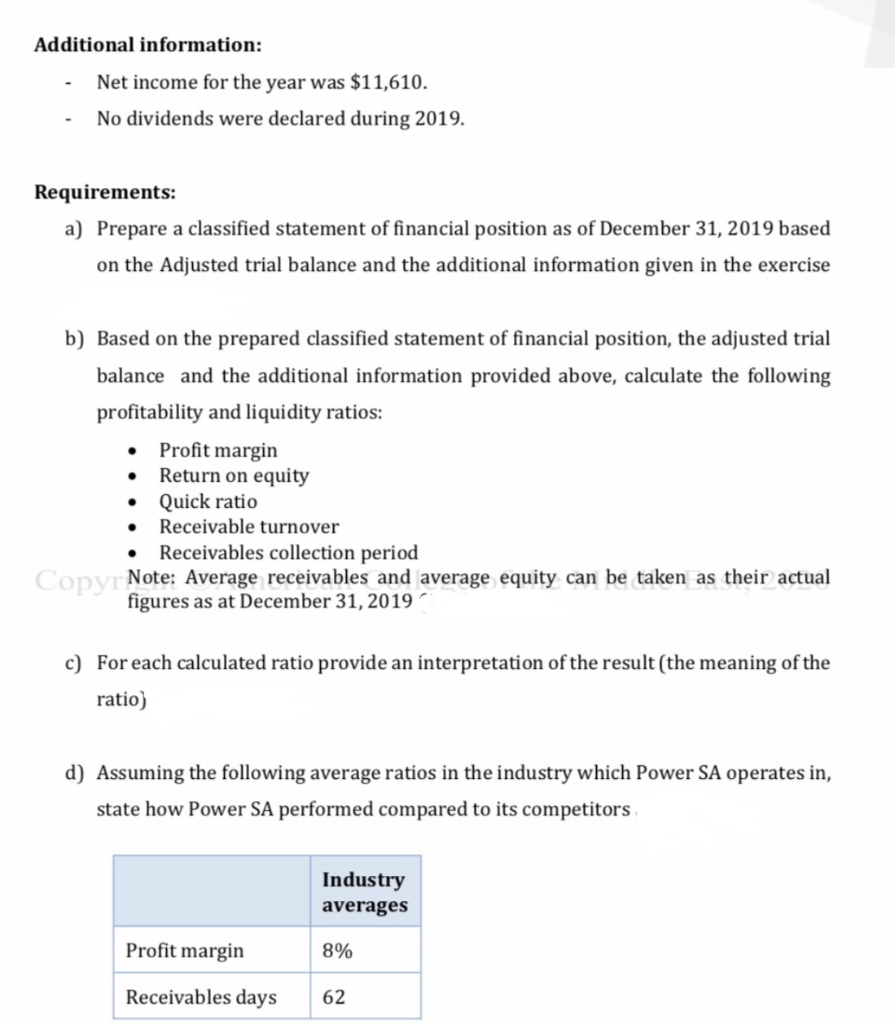

Presented below is the adjusted trial balance of Power SA at December 31, 2019. Power SA Adjusted Trial Balance December 31, 2019 Dr Cash 25,000 Accounts Receivable 14,600 1,800 Copyri Familia Insurance can Gottefco 34,000iddle East, 202 37,140 8,200 11,300 24,000 1,150 50,000 6,280 113,000 Machinery Accum. Depr.- Machinery Accounts Payable Note Payable (long-term) Interest Payable Share capital - ordinary Retained earnings Sales revenue Sales returns and discounts Cost of goods sold Salaries and Wages Expense Depreciation Expense Utilities Expense Interest Expense Gain on sale of machinery Loss on sale of investment Total 2,390 77,000 15,000 4,100 1,600 2,500 2,400 1,200 $216,330 $216,330 Additional information: Net income for the year was $11,610. No dividends were declared during 2019. Requirements: a) Prepare a classified statement of financial position as of December 31, 2019 based on the Adjusted trial balance and the additional information given in the exercise b) Based on the prepared classified statement of financial position, the adjusted trial balance and the additional information provided above, calculate the following profitability and liquidity ratios: Profit margin Return on equity Quick ratio Receivable turnover Receivables collection period Copy. Note: Average receivables and average equity can be taken as their actual figures as at December 31, 2019 . c) For each calculated ratio provide an interpretation of the result (the meaning of the ratio) d) Assuming the following average ratios in the industry which Power SA operates in, state how Power SA performed compared to its competitors Industry averages Profit margin 8% Receivables days 62Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started