Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make sure to include detailed step-by-step calculations. If possible, describe your thought process in each step so I can learn the methodology for future

Please make sure to include detailed step-by-step calculations. If possible, describe your thought process in each step so I can learn the methodology for future problems. Will leave a thumbs up if answer is detailed! Thank you :)

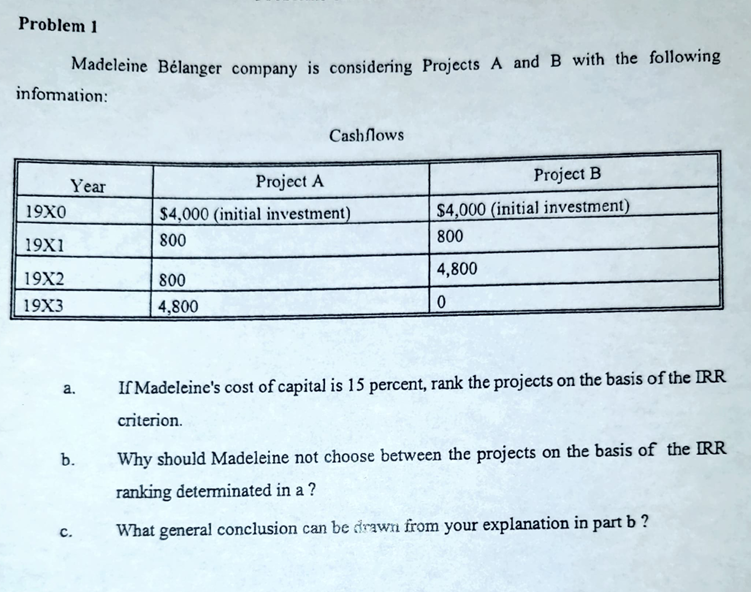

Madeleine Blanger company is considering Projects A and B with the following information: Cashflows a. If Madeleine's cost of capital is 15 percent, rank the projects on the basis of the IRR criterion. b. Why should Madeleine not choose between the projects on the basis of the IRR ranking determinated in a ? c. What general conclusion can be drawn from your explanation in part bStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started