Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE MAKE SURE TO INPUT THE DATA INTO THE LEASE CALCULATION TAB. I would really appreciate it if you guys could answer this for me

PLEASE MAKE SURE TO INPUT THE DATA INTO THE LEASE CALCULATION TAB. I would really appreciate it if you guys could answer this for me or even help me out as much as you could. if you could provide me with examples or any tips to get this question answered. I would really apprecaite it and will like the question if you could help me out in anyway. I would also be interested to do a 1 on 1 session if I need to get this question answered. I dont have time and I really need this done in 8 hours.

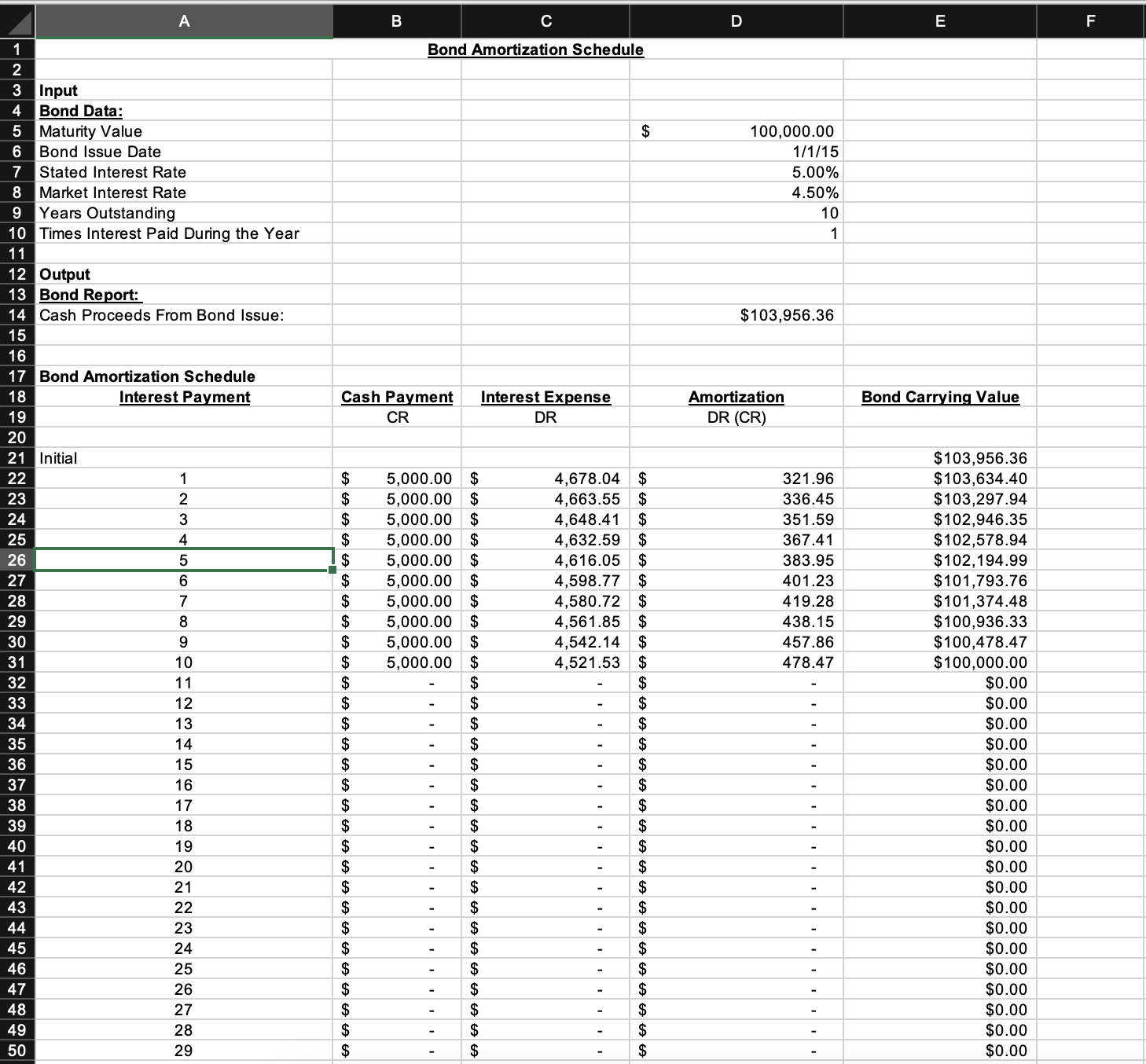

A "what-if" model has inputs and outputs. The outputs (calculated amounts) include formulas that reference the input cells. Properly creating "models" allow you to use many of the "what-if" analysis capabilities of EXCEL and allow you to make quick changes to data and have the results immediately without editing any formulas. Not editing formulas allows you to minimize the risk of errors. Open the Project \#1 excel spreadsheet and note how the Bond Amortization sheet is set-up. Your task is to develop a "what-if" model to calculate some key lease amounts. See below for more specific details. Output area formulas should not include constants but should refer to the previously calculated cell in the output area amounts in the input area. You may want to use the many financial functions available in EXCEL to develop your models or use the time value formulas noted in Chapter 5. You should develop models that are as flexible as possible. After developing your model, you should format your cells and turn in a project that you would submit to your manager at work. Details: On the "Lease Calculation Tab" set up an input area or data area. This area should include all the data points needed to calculate the output. At a minimum, these data points should include: Current (Fair Value) of the Asset to be Leased - Residual Value (lessor's perspective) - Residual Value guaranteed by Lessee - Expected Residual Value (lessee's perspective) - Lease Term - Implicit Rate of Return - Incremental Borrowing Rate - Executory Costs Paid to 3rd parties - Executory Costs Paid to Lessor - Initial direct costs \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & & B & & C & D & E \\ \hline 1 & \multicolumn{7}{|c|}{ Bond Amortization Schedule } \\ \hline 2 & & & & & & & \\ \hline 3 & Input & & & & & & \\ \hline 4 & Bond Data: & & & & & & \\ \hline 5 & Maturity Value & & & & & 100,000.00 & \\ \hline 6 & Bond Issue Date & & & & & 1/1/15 & \\ \hline 7 & Stated Interest Rate & & & & & 5.00% & \\ \hline 8 & Market Interest Rate & & & & & 4.50% & \\ \hline 9 & Years Outstanding & & & & & 10 & \\ \hline 10 & Times Interest Paid During the Year & & & & & 1 & \\ \hline 11 & & & & & & & \\ \hline 12 & Output & & & & & & \\ \hline 13 & Bond Report: & & & & & & \\ \hline 14 & Cash Proceeds From Bond Issue: & & & & & $103,956.36 & \\ \hline 15 & & & & & & & \\ \hline 16 & & & & & & & \\ \hline 17 & Bond Amortization Schedule & & & & & & \\ \hline 18 & Interest Payment & & ash Payment & & nterest Expense & Amortization & Bond Carrying Value \\ \hline 19 & & & CR & & DR & DR(CR) & \\ \hline 20 & & & & & & & \\ \hline 21 & Initial & & & & & & $103,956.36 \\ \hline 22 & 1 & $ & 5,000.00 & $ & 4,678.04 & 321.96 & $103,634.40 \\ \hline 23 & 2 & $ & 5,000.00 & $ & 4,663.55 & 336.45 & $103,297.94 \\ \hline 24 & 3 & $ & 5,000.00 & $ & 4,648.41 & 351.59 & $102,946.35 \\ \hline 25 & 4 & $ & 5,000.00 & $ & 4,632.59 & 367.41 & $102,578.94 \\ \hline 26 & 5 & 1$ & 5,000.00 & $ & 4,616.05 & 383.95 & $102,194.99 \\ \hline 27 & 6 & $ & 5,000.00 & $ & 4,598.77 & 401.23 & $101,793.76 \\ \hline 28 & 7 & $ & 5,000.00 & $ & 4,580.72 & 419.28 & $101,374.48 \\ \hline 29 & 8 & $ & 5,000.00 & $ & 4,561.85 & 438.15 & $100,936.33 \\ \hline 30 & 9 & $ & 5,000.00 & $ & 4,542.14 & 457.86 & $100,478.47 \\ \hline 31 & 10 & $ & 5,000.00 & $ & 4,521.53 & 478.47 & $100,000.00 \\ \hline 32 & 11 & $ & - & $ & - & $ & $0.00 \\ \hline 33 & 12 & $ & - & $ & - & $ & $0.00 \\ \hline 34 & 13 & $ & - & $ & - & $ & $0.00 \\ \hline 35 & 14 & $ & - & $ & \begin{tabular}{ll} - \\ - \end{tabular} & $ & $0.00 \\ \hline 36 & 15 & $ & - & $ & - & $ & $0.00 \\ \hline 37 & 16 & $ & - & $ & - & $ & $0.00 \\ \hline 38 & 17 & $ & - & $ & - & $ & $0.00 \\ \hline 39 & 18 & $ & - & $ & - & $ & $0.00 \\ \hline 40 & 19 & $ & - & $ & - & $ & $0.00 \\ \hline 41 & 20 & $ & - & $ & - & $ & $0.00 \\ \hline 42 & 21 & $ & - & $ & \begin{tabular}{ll} - \\ - \end{tabular} & $ & $0.00 \\ \hline 43 & 22 & $ & - & $ & - & $ & $0.00 \\ \hline 44 & 23 & $ & - & $ & - & $ & $0.00 \\ \hline 45 & 24 & $ & - & $ & - & $ & $0.00 \\ \hline 46 & 25 & $ & - & $ & - & $ & $0.00 \\ \hline 47 & 26 & $ & - & $ & \begin{tabular}{ll} - \\ - \end{tabular} & $ & $0.00 \\ \hline 48 & 27 & $ & - & $ & - & $ & $0.00 \\ \hline 49 & 28 & $ & - & $ & - & $ & $0.00 \\ \hline 50 & 29 & $ & - & $ & - & $ & $0.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & \multicolumn{2}{|c|}{ B } & \multicolumn{2}{|c|}{ C } & \multicolumn{2}{|c|}{ D } & \multirow[b]{2}{*}{ DU.UU } \\ \hline0 & 29 & & & & & & & \\ \hline 51 & 30 & $ & - & $ & - & $ & - & $0.00 \\ \hline 52 & 31 & $ & - & $ & - & $ & - & $0.00 \\ \hline 53 & 32 & $ & - & $ & - & $ & - & $0.00 \\ \hline 54 & 33 & $ & - & $ & - & $ & - & $0.00 \\ \hline 55 & 34 & $ & - & $ & - & $ & - & $0.00 \\ \hline 56 & 35 & $ & - & $ & - & $ & - & $0.00 \\ \hline 57 & 36 & $ & - & $ & - & $ & - & $0.00 \\ \hline 58 & 37 & $ & - & $ & - & $ & - & $0.00 \\ \hline 59 & 38 & $ & - & $ & - & $ & - & $0.00 \\ \hline 60 & 39 & $ & - & $ & - & $ & - & $0.00 \\ \hline 61 & 40 & $ & - & $ & - & $ & - & $0.00 \\ \hline 62 & 41 & $ & - & $ & - & $ & - & $0.00 \\ \hline 63 & 42 & $ & - & $ & - & $ & - & $0.00 \\ \hline 64 & 43 & $ & - & $ & - & $ & - & $0.00 \\ \hline 65 & 44 & $ & - & $ & - & $ & - & $0.00 \\ \hline 66 & 45 & $ & - & $ & - & $ & - & $0.00 \\ \hline 67 & 46 & $ & - & $ & - & $ & - & $0.00 \\ \hline 68 & 47 & $ & - & $ & - & $ & - & $0.00 \\ \hline 69 & 48 & $ & - & $ & - & $ & - & $0.00 \\ \hline 70 & 49 & $ & - & $ & - & $ & - & $0.00 \\ \hline 71 & 50 & $ & - & $ & - & $ & - & $0.00 \\ \hline 72 & 51 & $ & - & $ & - & $ & - & $0.00 \\ \hline 73 & 52 & $ & - & $ & - & $ & - & $0.00 \\ \hline 74 & 53 & $ & - & $ & - & $ & - & $0.00 \\ \hline 75 & 54 & $ & - & $ & - & $ & - & $0.00 \\ \hline 76 & 55 & $ & - & $ & - & $ & - & $0.00 \\ \hline 77 & 56 & $ & - & $ & - & $ & - & $0.00 \\ \hline 78 & 57 & $ & - & $ & - & $ & - & $0.00 \\ \hline 79 & 58 & $ & - & $ & - & $ & - & $0.00 \\ \hline 80 & 59 & $ & - & $ & - & $ & - & $0.00 \\ \hline 81 & 60 & $ & - & $ & - & $ & - & $0.00 \\ \hline 82 & 61 & $ & - & $ & - & $ & - & $0.00 \\ \hline 83 & 62 & $ & - & $ & - & $ & - & $0.00 \\ \hline 84 & 63 & $ & - & $ & - & $ & - & $0.00 \\ \hline 85 & 64 & $ & - & $ & - & $ & - & $0.00 \\ \hline 86 & 65 & $ & - & $ & - & $ & - & $0.00 \\ \hline 87 & 66 & $ & - & $ & - & $ & - & $0.00 \\ \hline 88 & 67 & $ & - & $ & - & $ & - & $0.00 \\ \hline 89 & 68 & $ & - & $ & - & $ & - & $0.00 \\ \hline 90 & 69 & $ & - & $ & - & $ & - & $0.00 \\ \hline 91 & 70 & $ & - & $ & - & $ & - & $0.00 \\ \hline 92 & 71 & $ & - & $ & - & $ & - & $0.00 \\ \hline 93 & 72 & $ & - & $ & - & $ & - & $0.00 \\ \hline 94 & 73 & $ & - & $ & - & $ & - & $0.00 \\ \hline 95 & 74 & $ & - & $ & - & $ & - & $0.00 \\ \hline 96 & 75 & $ & - & $ & - & $ & - & $0.00 \\ \hline 97 & 76 & $ & - & $ & - & $ & - & $0.00 \\ \hline 98 & 77 & $ & - & $ & - & $ & - & $0.00 \\ \hline 99 & 78 & $ & - & $ & - & $ & - & $0.00 \\ \hline 100 & 79 & $ & - & $ & - & $ & - & $0.00 \\ \hline \end{tabular} 1. The bond amortization schedule and numbers are not used in your project, this is just an example of a "what if" model. In a model, there is an input area and that input area is used to calculate output. In the bond example, the output was (1) Cash Proceeds and (2) a Bond amortization schedule. When creating this model, I determined the input I would need to calculate the desired output. For example, to determine cash proceeds, I need the maturity value, stated rate, market rate, etc. If designed properly, you could input any numbers in the input area, and the output will be calculated for you. This is a very useful model when having many different bond issues. 2. For your project, the output should include three calculations: (1) Lease Payment, (2) Lessor's Lease Receivable, and (3) Lessee's Lease Liability. Your input should include the data that you need to calculate the outputs. In my instructions, I include the minimum inputs you would need: - Fair value of equipment - Residual Value - Guaranteed Residual Value - Expected Residual Value from Lessee's Perspective - Lease Term - Number of payments - Implicit Rate of Return - Incremental Borrowing rate - and others .the more inputs may result in the most flexibility and options. After you have your inputs, think about how the lease Payment is calculated and create a formula referring to your input cells to calculate the payment. It is a great review...use your notes and the book. You can use any numbers in your input cells to calculate the output. If other items are needed in your output calculation, add these items to the input area. Being able to automatically calculate the output when your data changes in the input is the benefit of the model. (See my instructions( Once you calculate the lease payment move on to the next output...Lease Receivable.... Once again, use your book and notes to determine what is included in the Lease Receivable amount...You know it begins with the PV of lease payments, plus PV of residual value, etc. Now move onto the Lease Liability. You may need to be creative in your inputs. You can test your model with a wide range of numbersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started