Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make sure you answer everything step by step. most importantly I need the correct answer. make sure it is all correct and clear before

please make sure you answer everything step by step. most importantly I need the correct answer. make sure it is all correct and clear before you post the answer.

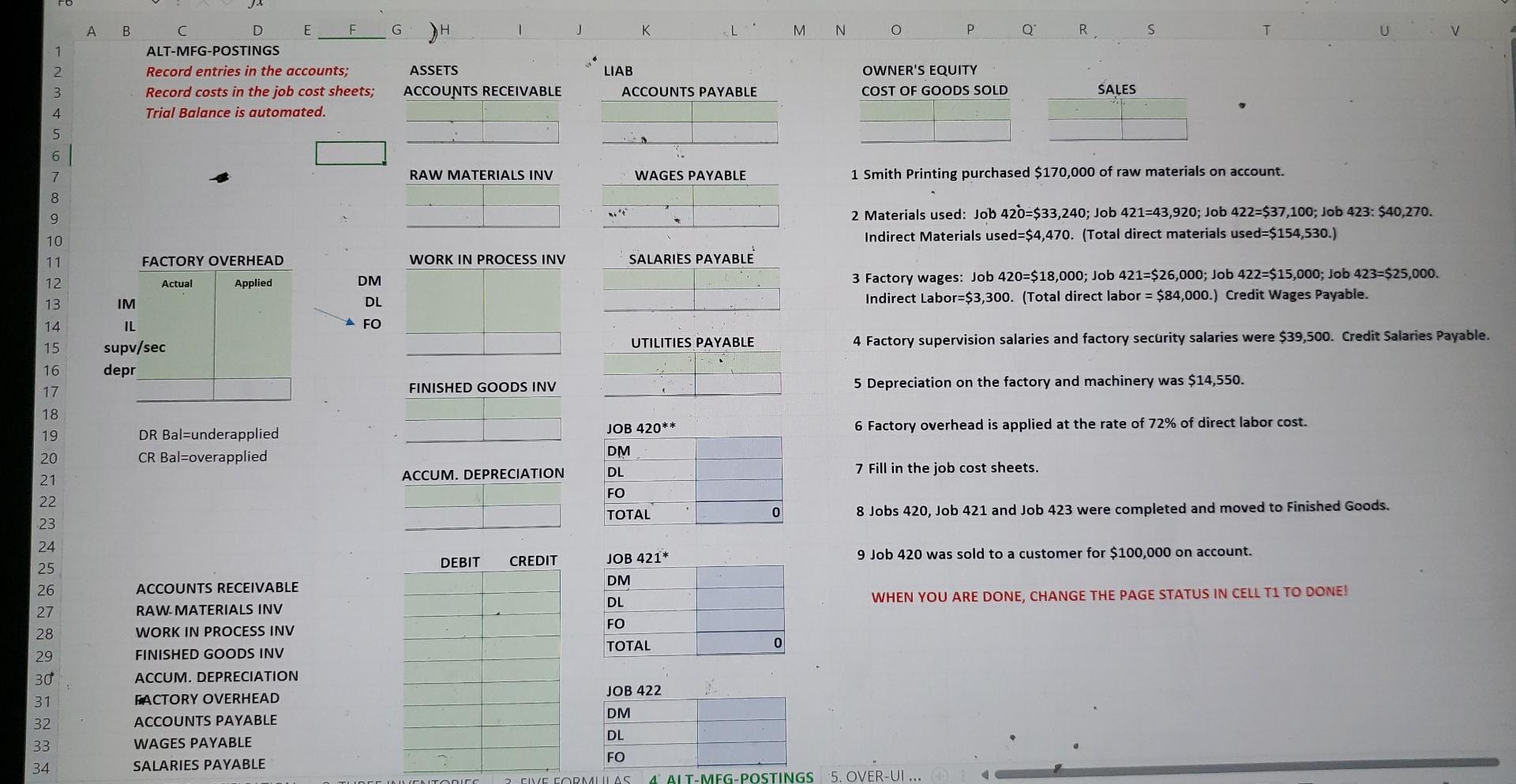

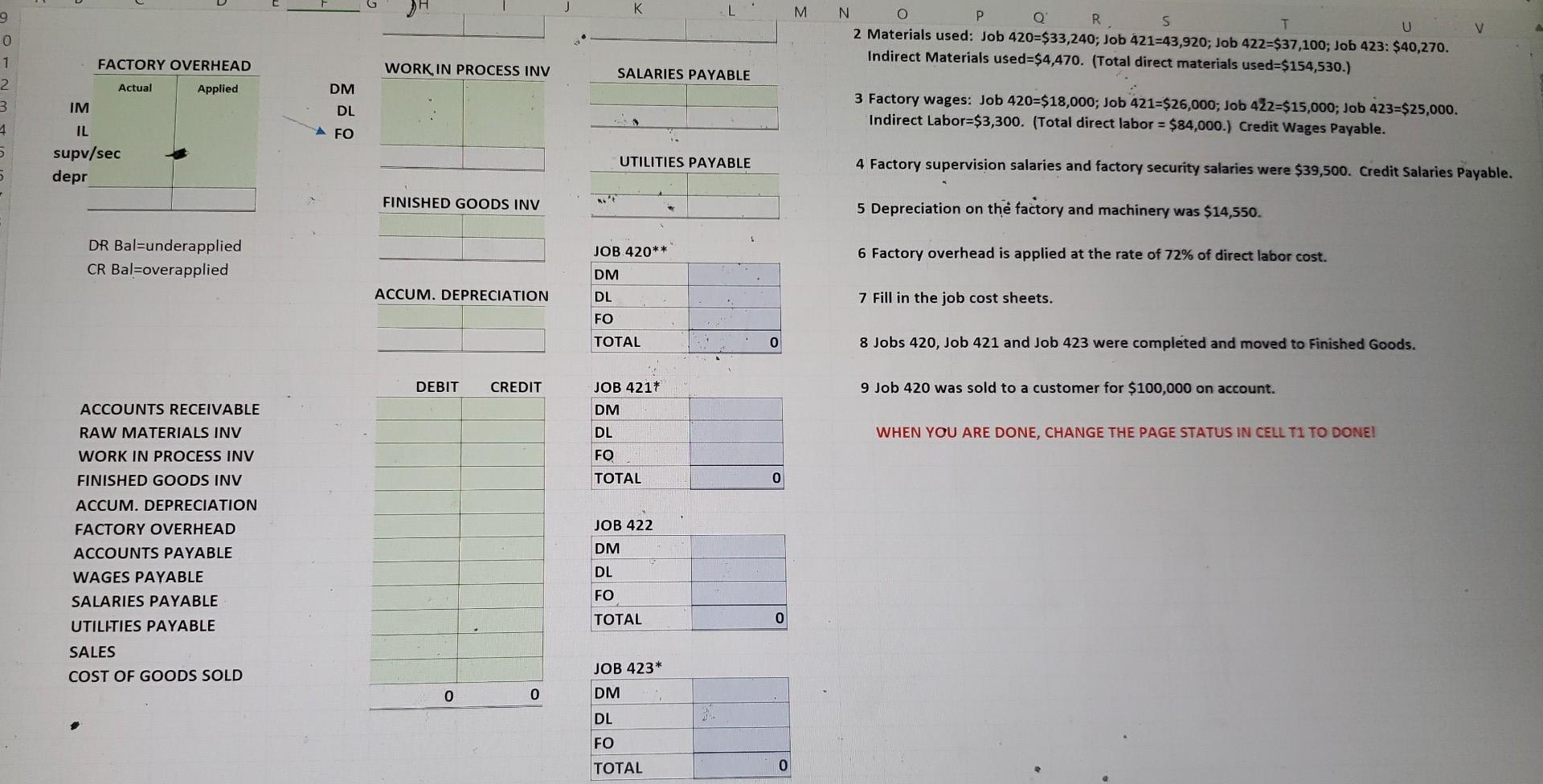

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 A B C F D E ALT-MFG-POSTINGS Record entries in the accounts; Record costs in the job cost sheets; Trial Balance is automated. FACTORY OVERHEAD Actual Applied DR Bal=underapplied CR Bal=overapplied ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION FACTORY OVERHEAD ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE IM IL supv/sec depr DM DL FO G H ASSETS ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV JOB 420** DM ACCUM. DEPRECIATION DL FO TOTAL DEBIT CREDIT JOB 421* DM DL FO TOTAL JOB 42 DM DL FO NTORIES 2 FIVE FORMULAS 4 ALT-MFG-POSTINGS 5. OVER-UI... LIAB K ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE UTILITIES PAYABLE ni't MN 22 Q R S O P T U V OWNER'S EQUITY COST OF GOODS SOLD SALES 1 Smith Printing purchased $170,000 of raw materials on account. 2 Materials used: Job 420-$33,240; Job 421-43,920; Job 422-$37,100; Job 423: $40,270. Indirect Materials used=$4,470. (Total direct materials used=$154,530.) 3 Factory wages: Job 420-$18,000; Job 421=-$26,000; Job 422=$15,000; Job 423-$25,000. Indirect Labor=$3,300. (Total direct labor = $84,000.) Credit Wages Payable. 4 Factory supervision salaries and factory security salaries were $39,500. Credit Salaries Payable. 5 Depreciation on the factory and machinery was $14,550. 6 Factory overhead is applied at the rate of 72% of direct labor cost. 7 Fill in the job cost sheets. 8 Jobs 420, Job 421 and Job 423 were completed and moved to Finished Goods. 9 Job 420 was sold to a customer for $100,000 on account. WHEN YOU ARE DONE, CHANGE THE PAGE STATUS IN CELL T1 TO DONE! 0 1 2 3 4 5 FACTORY OVERHEAD Actual Applied DR Bal=underapplied CR Bal-overapplied ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION FACTORY OVERHEAD ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE UTILITIES PAYABLE SALES COST OF GOODS SOLD IM IL supv/sec depr DM DL FO WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION DEBIT CREDIT 0 0 K SALARIES PAYABLE UTILITIES PAYABLE JOB 420** DM DL FO TOTAL JOB 421* DM DL FO TOTAL JOB 422 DM DL FO TOTAL JOB 423* DM DL FO TOTAL 0 0 0 0 M N O P R S T U V 2 Materials used: Job 420-$33,240; Job 421-43,920; Job 422-$37,100; Job 423: $40,270. Indirect Materials used=$4,470. (Total direct materials used=$154,530.) 3 Factory wages: Job 420-$18,000; Job 421-$26,000; Job 422-$15,000; Job 423-$25,000. Indirect Labor-$3,300. (Total direct labor = $84,000.) Credit Wages Payable. 4 Factory supervision salaries and factory security salaries were $39,500. Credit Salaries Payable. 5 Depreciation on the factory and machinery was $14,550. 6 Factory overhead is applied at the rate of 72% of direct labor cost. 7 Fill in the job cost sheets. 8 Jobs 420, Job 421 and Job 423 were completed and moved to Finished Goods. 9 Job 420 was sold to a customer for $100,000 on account. WHEN YOU ARE DONE, CHANGE THE PAGE STATUS IN CELL T1 TO DONE! 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 A B C F D E ALT-MFG-POSTINGS Record entries in the accounts; Record costs in the job cost sheets; Trial Balance is automated. FACTORY OVERHEAD Actual Applied DR Bal=underapplied CR Bal=overapplied ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION FACTORY OVERHEAD ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE IM IL supv/sec depr DM DL FO G H ASSETS ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV JOB 420** DM ACCUM. DEPRECIATION DL FO TOTAL DEBIT CREDIT JOB 421* DM DL FO TOTAL JOB 42 DM DL FO NTORIES 2 FIVE FORMULAS 4 ALT-MFG-POSTINGS 5. OVER-UI... LIAB K ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE UTILITIES PAYABLE ni't MN 22 Q R S O P T U V OWNER'S EQUITY COST OF GOODS SOLD SALES 1 Smith Printing purchased $170,000 of raw materials on account. 2 Materials used: Job 420-$33,240; Job 421-43,920; Job 422-$37,100; Job 423: $40,270. Indirect Materials used=$4,470. (Total direct materials used=$154,530.) 3 Factory wages: Job 420-$18,000; Job 421=-$26,000; Job 422=$15,000; Job 423-$25,000. Indirect Labor=$3,300. (Total direct labor = $84,000.) Credit Wages Payable. 4 Factory supervision salaries and factory security salaries were $39,500. Credit Salaries Payable. 5 Depreciation on the factory and machinery was $14,550. 6 Factory overhead is applied at the rate of 72% of direct labor cost. 7 Fill in the job cost sheets. 8 Jobs 420, Job 421 and Job 423 were completed and moved to Finished Goods. 9 Job 420 was sold to a customer for $100,000 on account. WHEN YOU ARE DONE, CHANGE THE PAGE STATUS IN CELL T1 TO DONE! 0 1 2 3 4 5 FACTORY OVERHEAD Actual Applied DR Bal=underapplied CR Bal-overapplied ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION FACTORY OVERHEAD ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE UTILITIES PAYABLE SALES COST OF GOODS SOLD IM IL supv/sec depr DM DL FO WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION DEBIT CREDIT 0 0 K SALARIES PAYABLE UTILITIES PAYABLE JOB 420** DM DL FO TOTAL JOB 421* DM DL FO TOTAL JOB 422 DM DL FO TOTAL JOB 423* DM DL FO TOTAL 0 0 0 0 M N O P R S T U V 2 Materials used: Job 420-$33,240; Job 421-43,920; Job 422-$37,100; Job 423: $40,270. Indirect Materials used=$4,470. (Total direct materials used=$154,530.) 3 Factory wages: Job 420-$18,000; Job 421-$26,000; Job 422-$15,000; Job 423-$25,000. Indirect Labor-$3,300. (Total direct labor = $84,000.) Credit Wages Payable. 4 Factory supervision salaries and factory security salaries were $39,500. Credit Salaries Payable. 5 Depreciation on the factory and machinery was $14,550. 6 Factory overhead is applied at the rate of 72% of direct labor cost. 7 Fill in the job cost sheets. 8 Jobs 420, Job 421 and Job 423 were completed and moved to Finished Goods. 9 Job 420 was sold to a customer for $100,000 on account. WHEN YOU ARE DONE, CHANGE THE PAGE STATUS IN CELL T1 TO DONEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started