Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make sure you work is readable and i can see the work to check my work! thank you in advance! tid More info 00

please make sure you work is readable and i can see the work to check my work! thank you in advance!

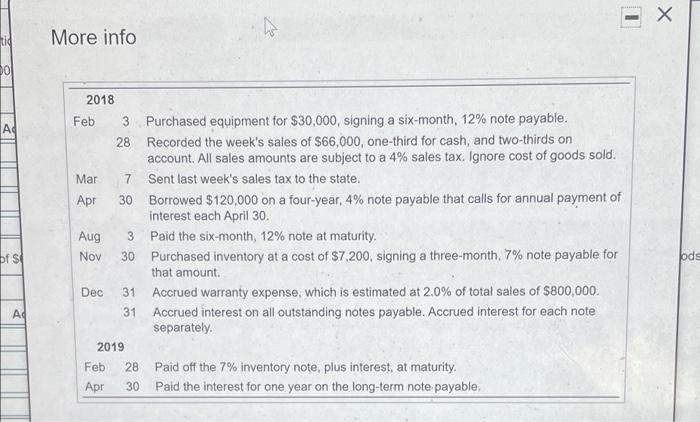

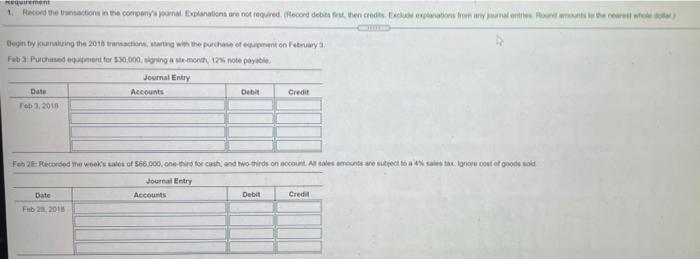

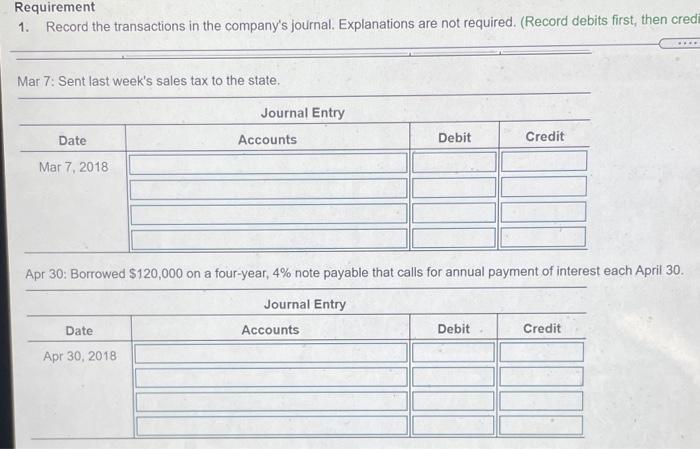

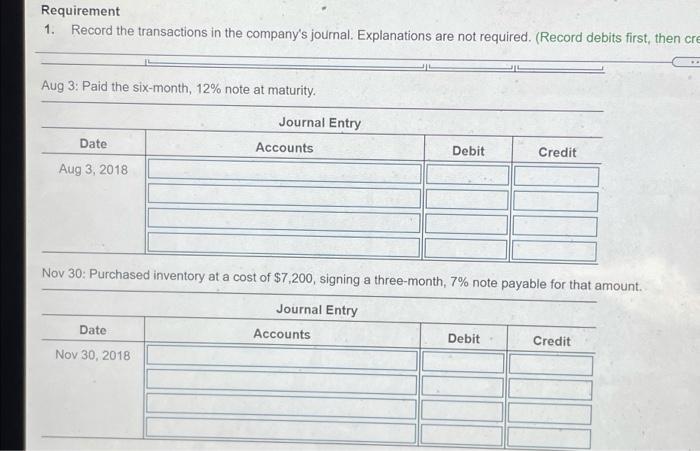

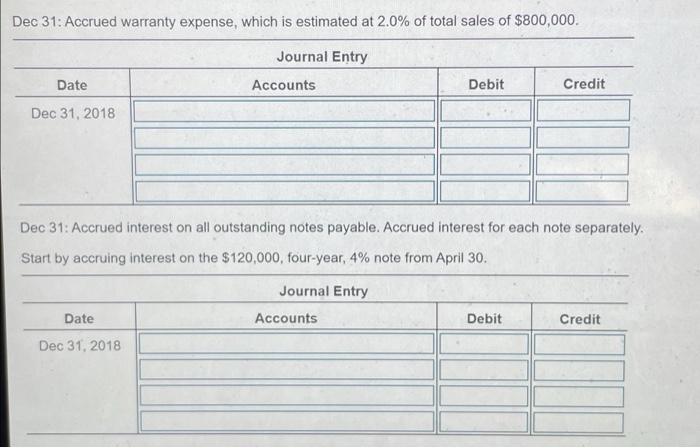

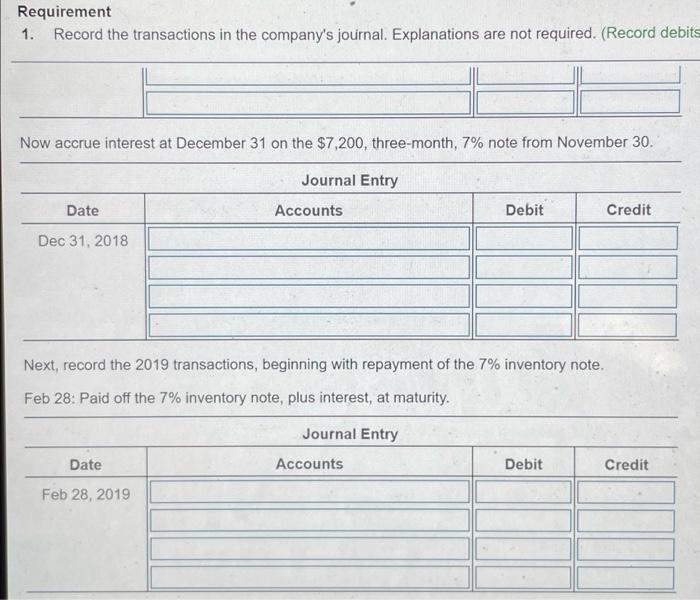

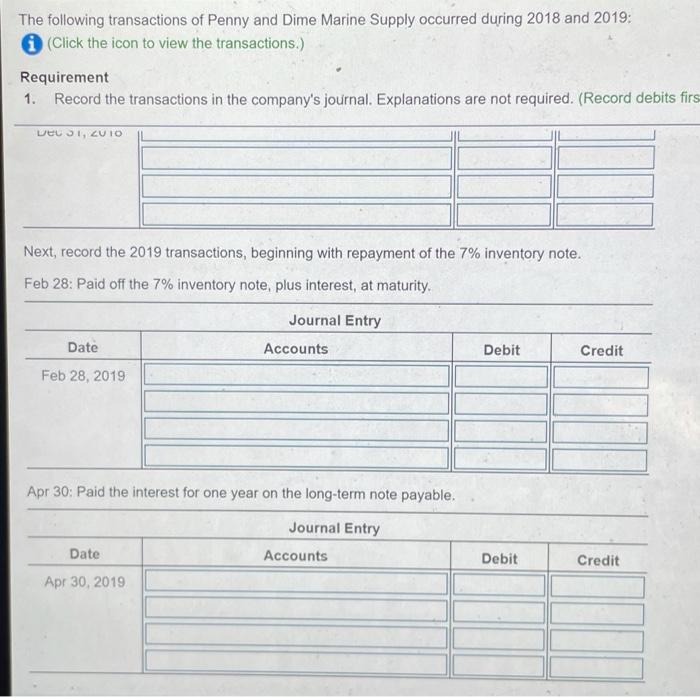

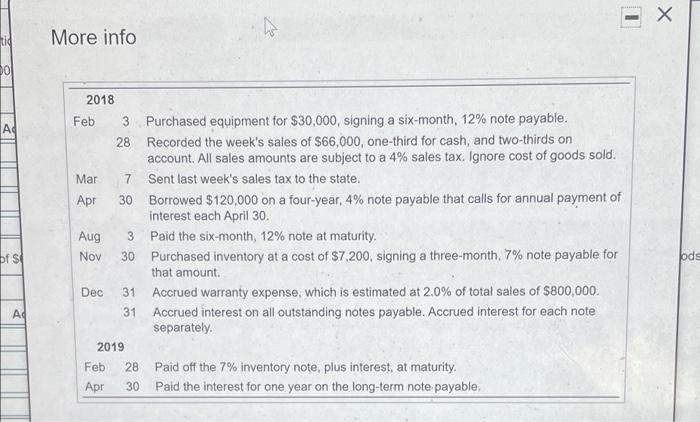

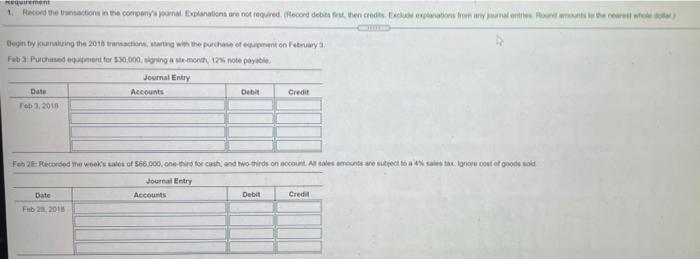

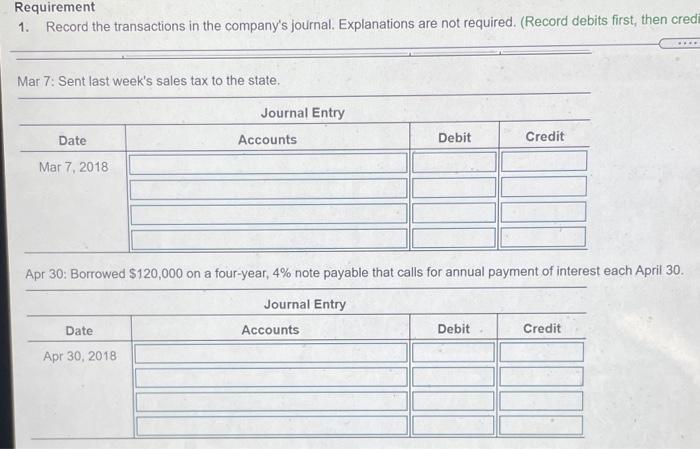

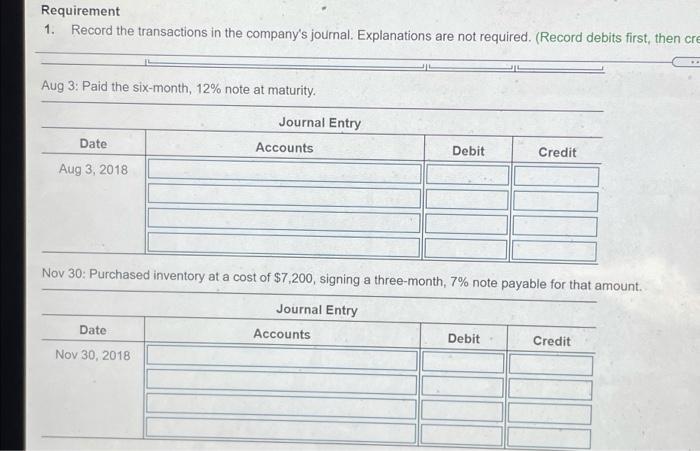

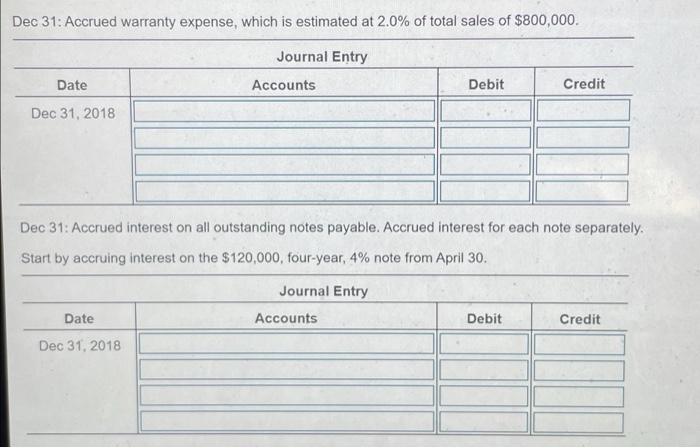

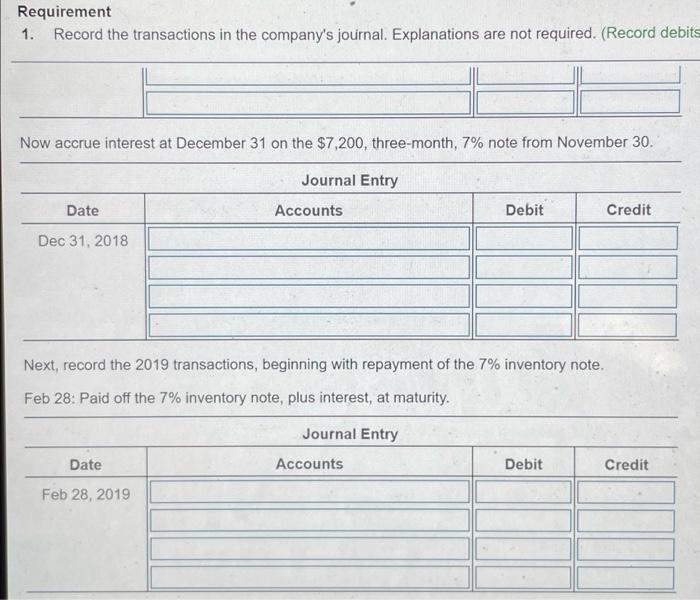

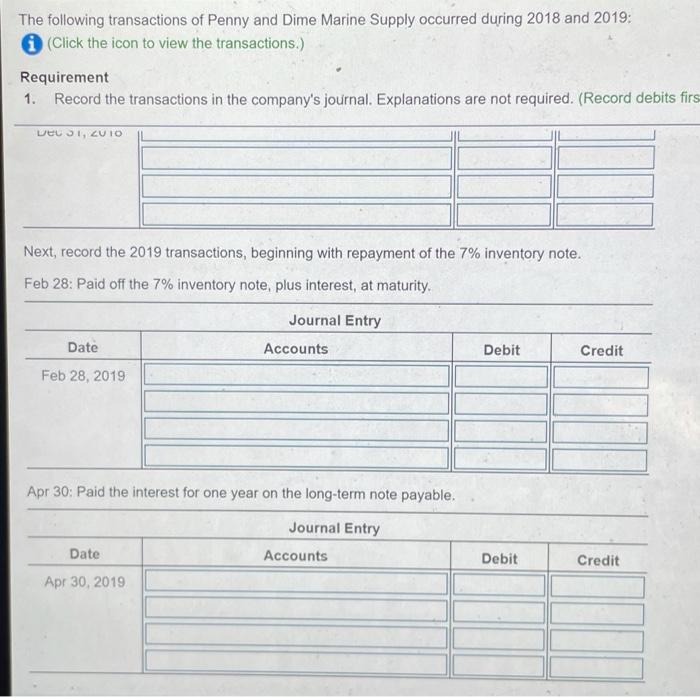

tid More info 00 AC 2018 Feb 3 Purchased equipment for $30,000, signing a six-month, 12% note payable. 28 Recorded the week's sales of $66,000, one-third for cash, and two-thirds on account. All sales amounts are subject to a 4% sales tax. Ignore cost of goods sold. Mar 7 Sent last week's sales tax to the state. Apr 30 Borrowed $120,000 on a four-year, 4% note payable that calls for annual payment of interest each April 30. Aug 3 Paid the six-month, 12% note at maturity. Nov 30 Purchased inventory at a cost of $7.200, signing a three-month, 7% note payable for that amount Dec 31 Accrued warranty expense, which is estimated at 2.0% of total sales of $800,000 31 Accrued interest on all outstanding notes payable. Accrued interest for each note separately. 2019 Feb 28 Paid off the 7% inventory note, plus interest, at maturity. Apr 30 Paid the interest for one year on the long-term note payable. bfs bds Ad rement 1. Record te wacions in the company mat. Explanations are not required. Record debite the creditores do where Begin by ournaling the 2016 marting with the purchase of enton Petuary Fabi Purchase ment for 5.30.000 nga month126 note pay Journal Entry Date Accounts Debit Credit Feb 3, 2010 Feb 2e Recorded the wokes of 56.000.third forces and to thirds on court. Alles more to stalno out of good Journal Entry Date Accounts Debit Credit Fub 20, 2011 Requirement 1. Record the transactions in the company's journal. Explanations are not required. (Record debits first, then credi Mar 7: Sent last week's sales tax to the state. Journal Entry Date Accounts Debit Credit Mar 7, 2018 Apr 30: Borrowed $120,000 on a four-year, 4% note payable that calls for annual payment of interest each April 30. Journal Entry Date Accounts Debit Credit Apr 30, 2018 Requirement 1. Record the transactions in the company's journal. Explanations are not required. (Record debits first, then cre Aug 3: Paid the six-month, 12% note at maturity. Journal Entry Date Accounts Debit Credit Aug 3, 2018 Nov 30: Purchased inventory at a cost of $7.200, signing a three-month, 7% note payable for that amount. Journal Entry Date Accounts Debit Credit Nov 30, 2018 Dec 31: Accrued warranty expense, which is estimated at 2.0% of total sales of $800,000. Journal Entry Accounts Debit Credit Date Dec 31, 2018 Dec 31: Accrued interest on all outstanding notes payable. Accrued interest for each note separately. Start by accruing interest on the $120,000, four-year, 4% note from April 30. Journal Entry Date Accounts Debit Credit Dec 31, 2018 Requirement 1. Record the transactions in the company's journal. Explanations are not required. (Record debits Now accrue interest at December 31 on the $7,200, three-month, 7% note from November 30. Journal Entry Date Accounts Debit Credit Dec 31, 2018 Next, record the 2019 transactions, beginning with repayment of the 7% inventory note. Feb 28: Paid off the 7% inventory note, plus interest, at maturity. Journal Entry Date Accounts Debit Credit Feb 28, 2019 The following transactions of Penny and Dime Marine Supply occurred during 2018 and 2019: (Click the icon to view the transactions.) Requirement 1. Record the transactions in the company's journal. Explanations are not required. (Record debits firs VEUSI, 2010 Next, record the 2019 transactions, beginning with repayment of the 7% inventory note. Feb 28: Paid off the 7% inventory note, plus interest, at maturity. Journal Entry Date Accounts Debit Credit Feb 28, 2019 Apr 30: Paid the interest for one year on the long-term note payable. Journal Entry Accounts Date Debit Credit Apr 30, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started