Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make t chart accounts only complete question 1 and 2 Perth Corporation began its second year of operations in 2009. The following balance sheet

please make t chart accounts

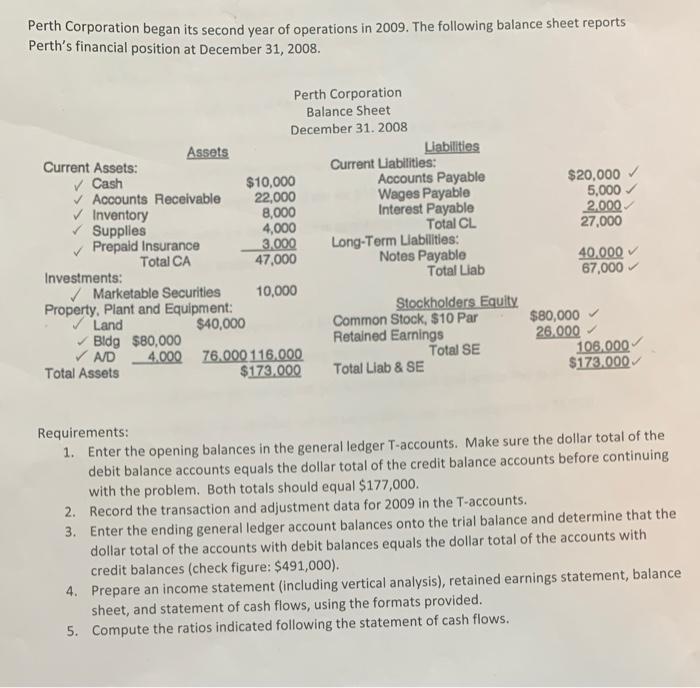

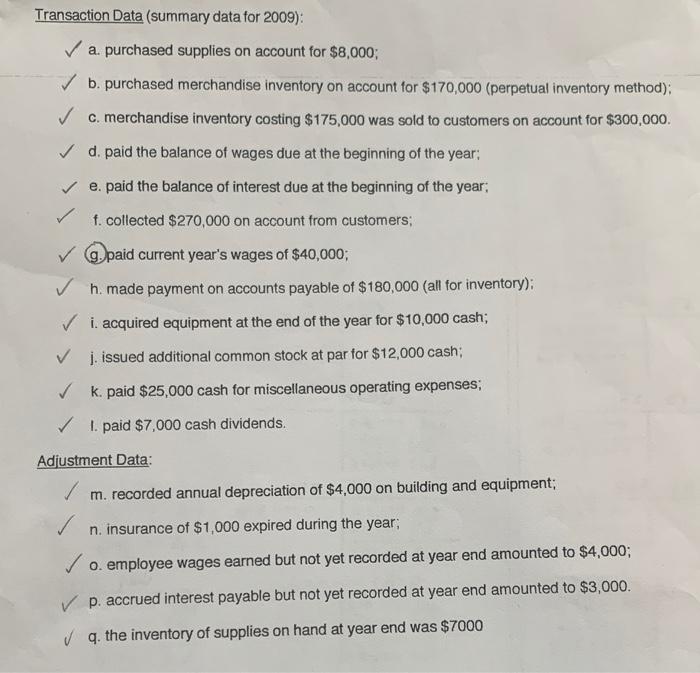

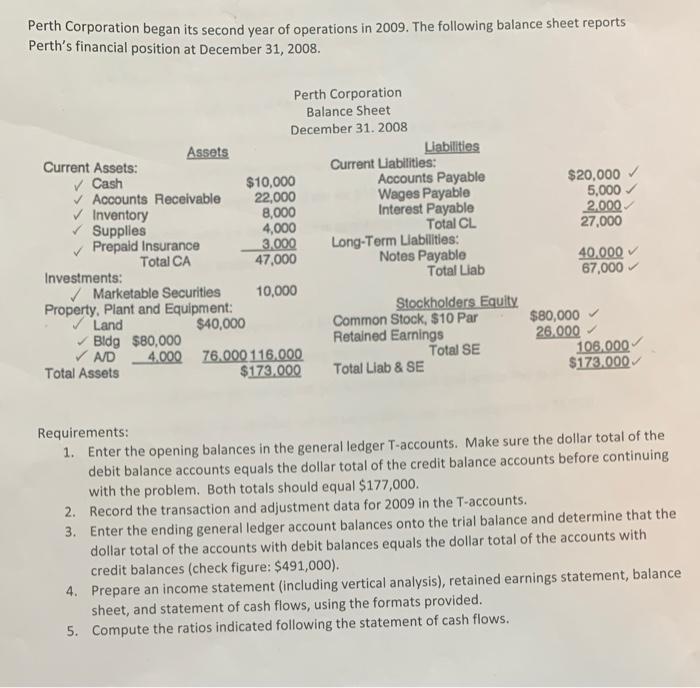

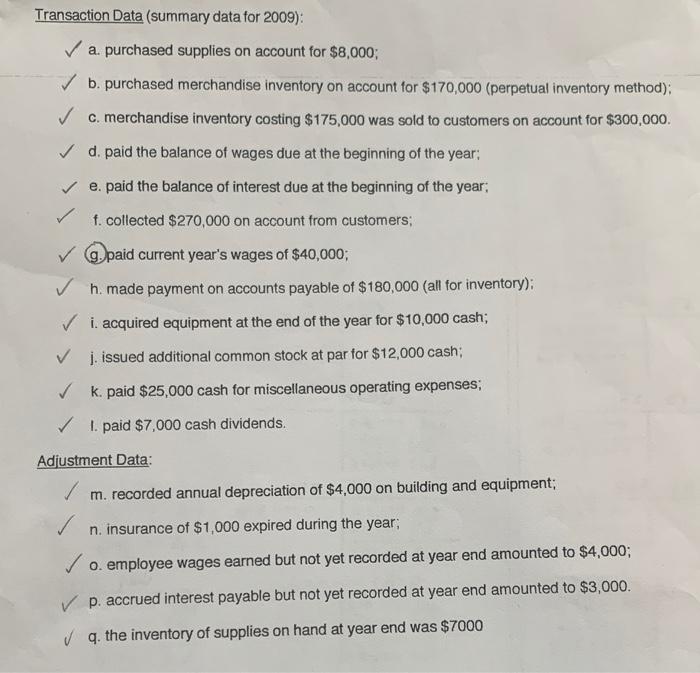

Perth Corporation began its second year of operations in 2009. The following balance sheet reports Perth's financial position at December 31, 2008. $20,000 5,000 2.000 27,000 Perth Corporation Balance Sheet December 31, 2008 Assets Liabilities Current Assets: Current Liabilities: Cash $10,000 Accounts Payable Accounts Receivable 22,000 Wages Payable Inventory 8,000 Interest Payable Supplies 4,000 Total CL Prepaid Insurance 3.000 Long-Term Liabilities: Total CA 47,000 Notes Payable Investments: Total Liab Marketable Securities 10,000 Property, Plant and Equipment: Stockholders Equity Land $40,000 Common Stock, $10 Par Bldg $80,000 Retained Earnings A/D 4.000 76.000 116.000 Total SE Total Assets $173.000 Total Liab & SE 40.000 67,000 $80,000 26.000 106.000 $173.000 Requirements: 1. Enter the opening balances in the general ledger T-accounts. Make sure the dollar total of the debit balance accounts equals the dollar total of the credit balance accounts before continuing with the problem. Both totals should equal $177,000. 2. Record the transaction and adjustment data for 2009 in the T-accounts. 3. Enter the ending general ledger account balances onto the trial balance and determine that the dollar total of the accounts with debit balances equals the dollar total of the accounts with credit balances (check figure: $491,000). 4. Prepare an income statement (including vertical analysis), retained earnings statement, balance sheet, and statement of cash flows, using the formats provided. 5. Compute the ratios indicated following the statement of cash flows. Transaction Data (summary data for 2009): a purchased supplies on account for $8,000; b. purchased merchandise inventory on account for $170,000 (perpetual inventory method); c. merchandise inventory costing $175,000 was sold to customers on account for $300,000 d. paid the balance of wages due at the beginning of the year: e. paid the balance of interest due at the beginning of the year; f. collected $270,000 on account from customers; paid current year's wages of $40,000; h. made payment on accounts payable of $180,000 (all for inventory); i acquired equipment at the end of the year for $10,000 cash; j. issued additional common stock at par for $12,000 cash; k. paid $25,000 cash for miscellaneous operating expenses; 1. paid $7,000 cash dividends. Adjustment Data: m. recorded annual depreciation of $4,000 on building and equipment: n. insurance of $1,000 expired during the year; o. employee wages earned but not yet recorded at year end amounted to $4,000; p. accrued interest payable but not yet recorded at year end amounted to $3,000. q. the inventory of supplies on hand at year end was $7000 only complete question 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started