Please make the answers are right and include the formula you used.

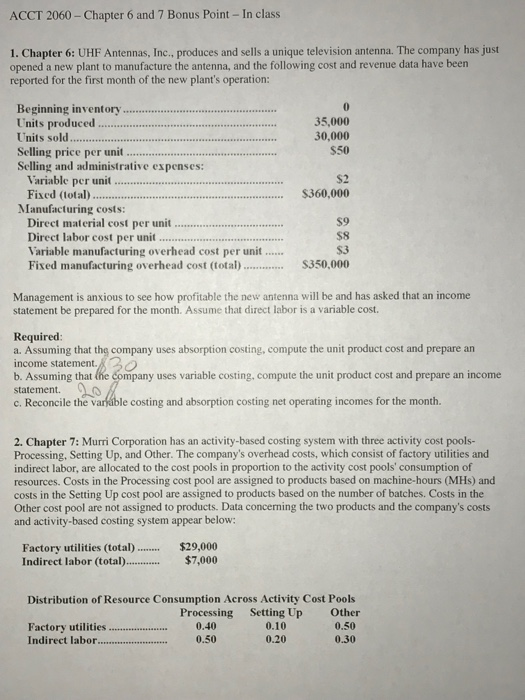

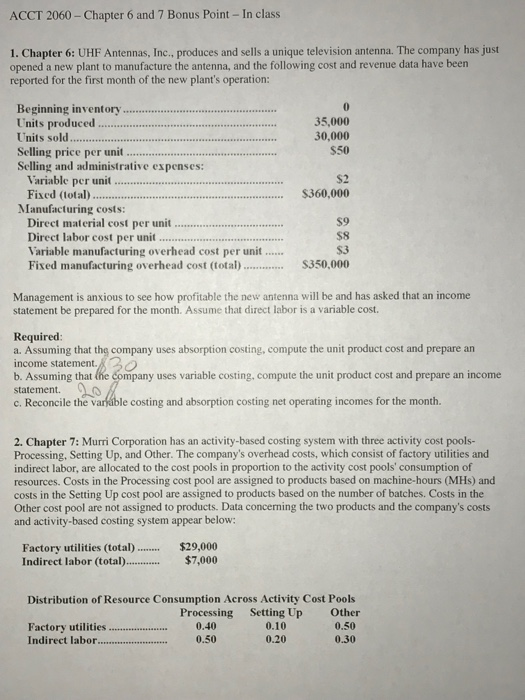

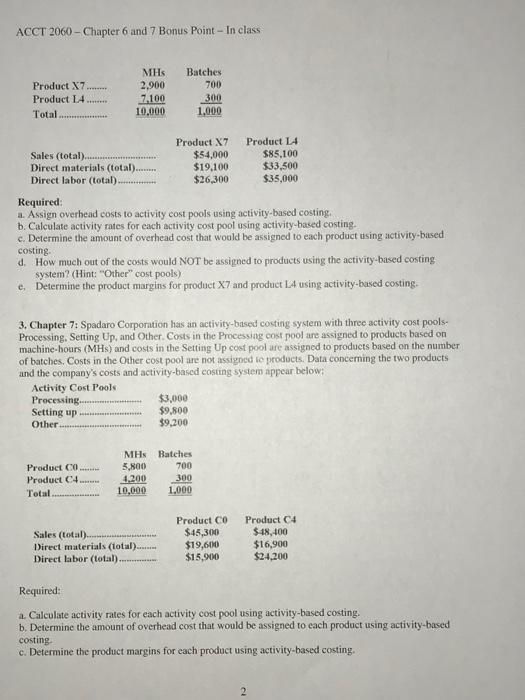

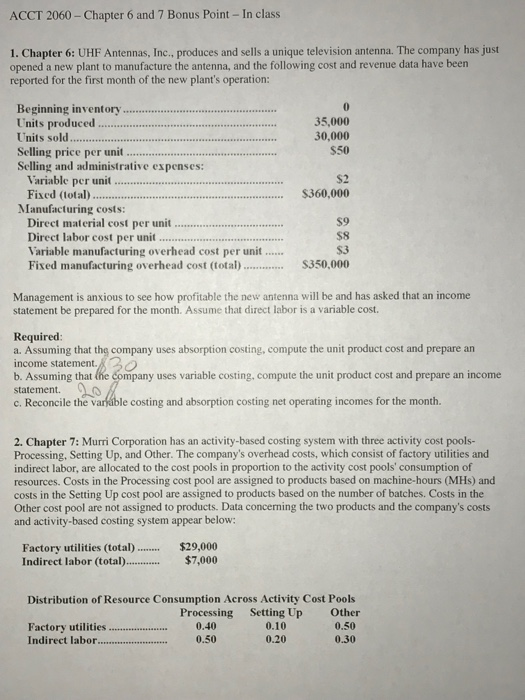

ACCT 2060- Chapter 6 and 7 Bonus Point- In class 1. Chapter 6: UHF Antennas, Inc., produces and sells a unique television antenna. The company has just opened a new plant to manufacture the antenna, and the following cost and revenue data have been reported for the first month of the new plant's operation: Beginning inventory. Units produced. 35,000 30,000 $50 Selling price per unit. Selling and administrative expenses: Variable per unit. $2 Fixed (total)....$360,000 Manufacturing costs: Direct material cost per unit. $9 Direct labor cost per unit S8 Variable manufacturing overhead cost per unit..... S3 Fixed manufacturing overhead cost (total)S350,000 Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month. Assume that direct labor is a variable cost. Required a. Assuming that the company uses absorption costing, compute the unit product cost and prepare an income statement.50 b. Assuming that statement. c. Reconcile the varkible costing and absorption costing net operating incomes for the month. pany uses variable costing. compute the unit product cost and prepare an income 2. Chapter 7: Murri Corporation has an activity-based costing system with three activity cost pools- Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below: Factory utilities (total.... $29,000 Indirect labor (total$7,000 Distribution of Resource Consumption Across Activity Cost Pools Factory utilities0.40 Processing Setting Up Other 0.50 0.30 0.10 0.20 ACCT 2060- Chapter 6 and 7 Bonus Point - In class MHs Batches 700 Product LA..7,100300 Total .. 10,000 1,000 Product X7.2,900 Product X7 $54,000 $19,100 $26,300 Product LA $85,100 $33,500 $35,000 Sales (total) Direct materials (total). Direct labor (total).. Required a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing d. How much out of the costs would NOT be assigned to products using the activity-based costing system? (Hint:"Other" cost pools) Determine the product margins for product X7 and product LA using activity-based costing. e. 3. Chapter 7: Spadaro Corporation has an activity-based costing system with three activity cost pools- Processing, Setting Up, and Other. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below: Activity Cost Pools Processing... $3,000 Setting up .$9,800 Other$9,200 MHs Batches Product CO.5800 700 Product C44200 300 10,000 1,000 Total Preduct CO $45,300 Sales (total) Direct materials (lotal)$19,600 Direct labor (total). Product C4 $48,400 $16,900 $24,200 $15,900 Required: a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing