Please make the cash budget and income statement budget with the following information

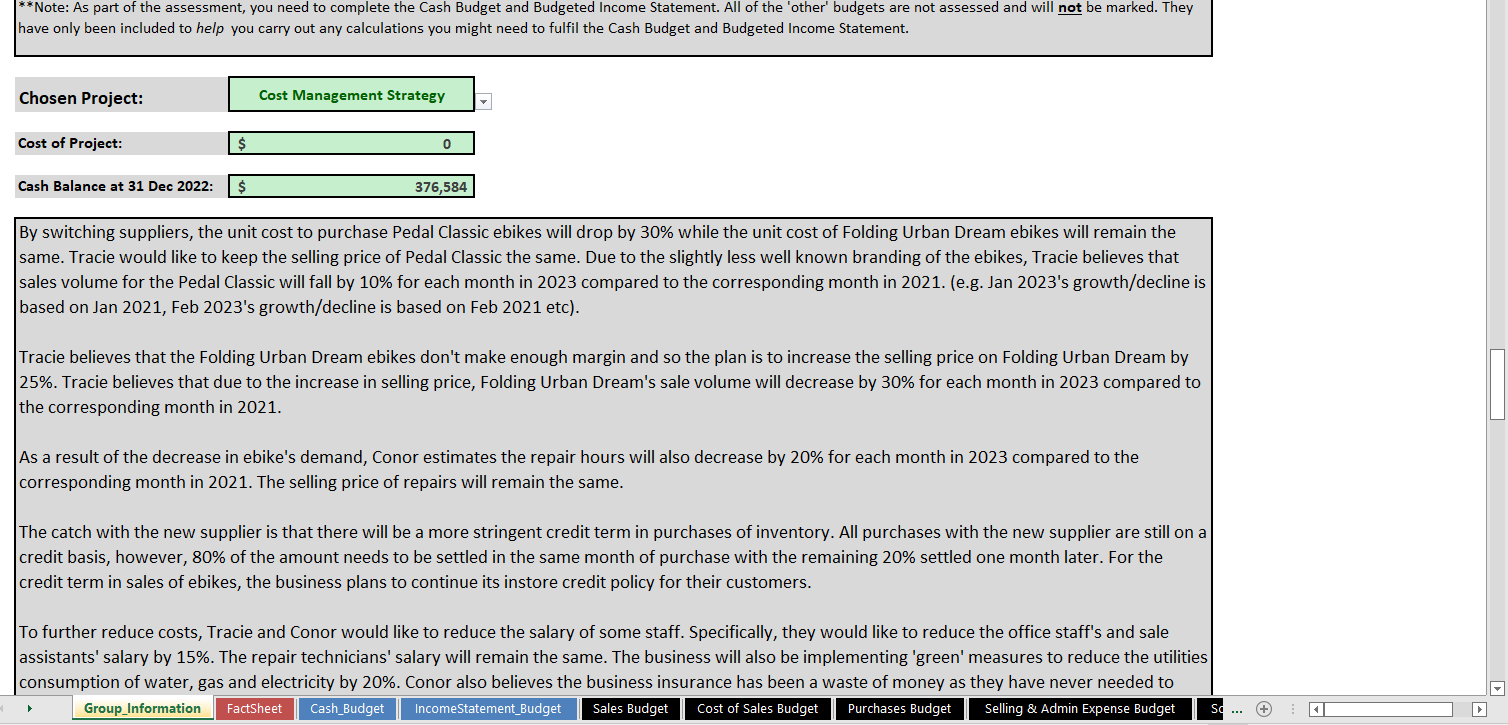

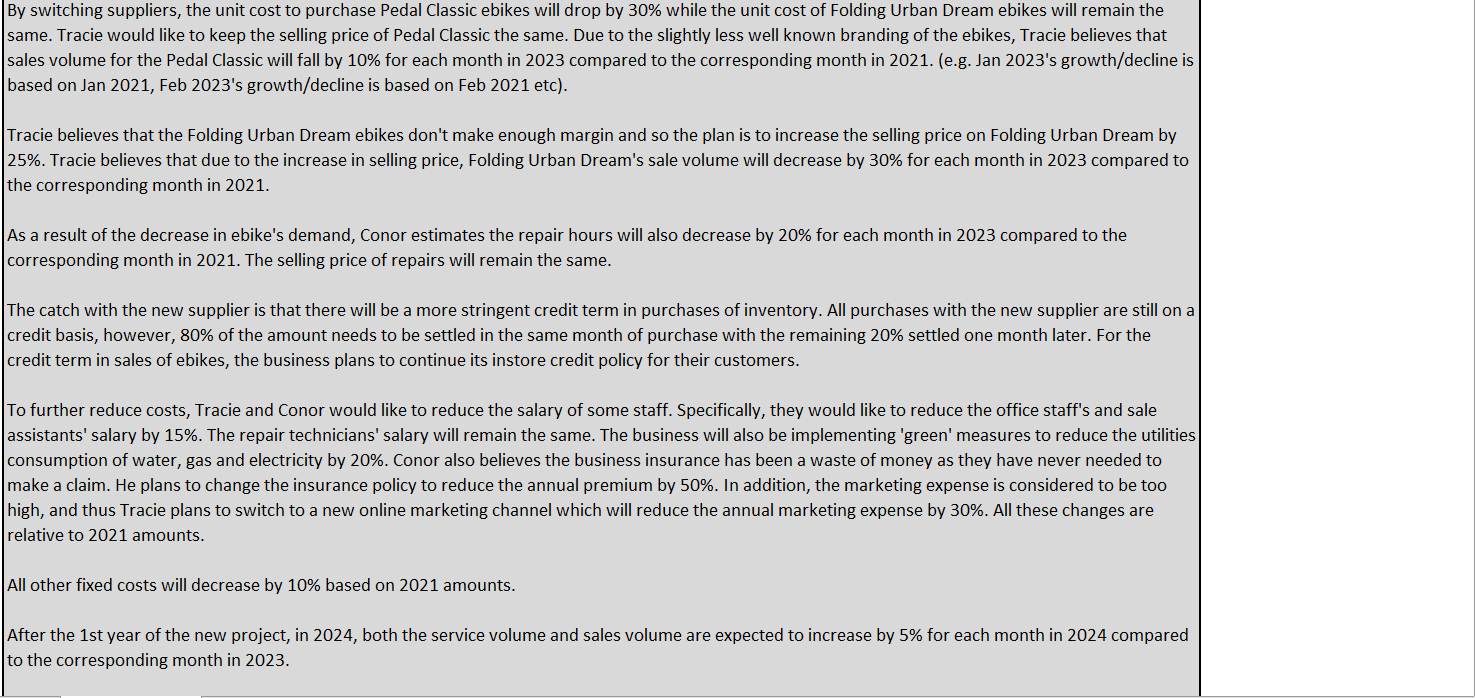

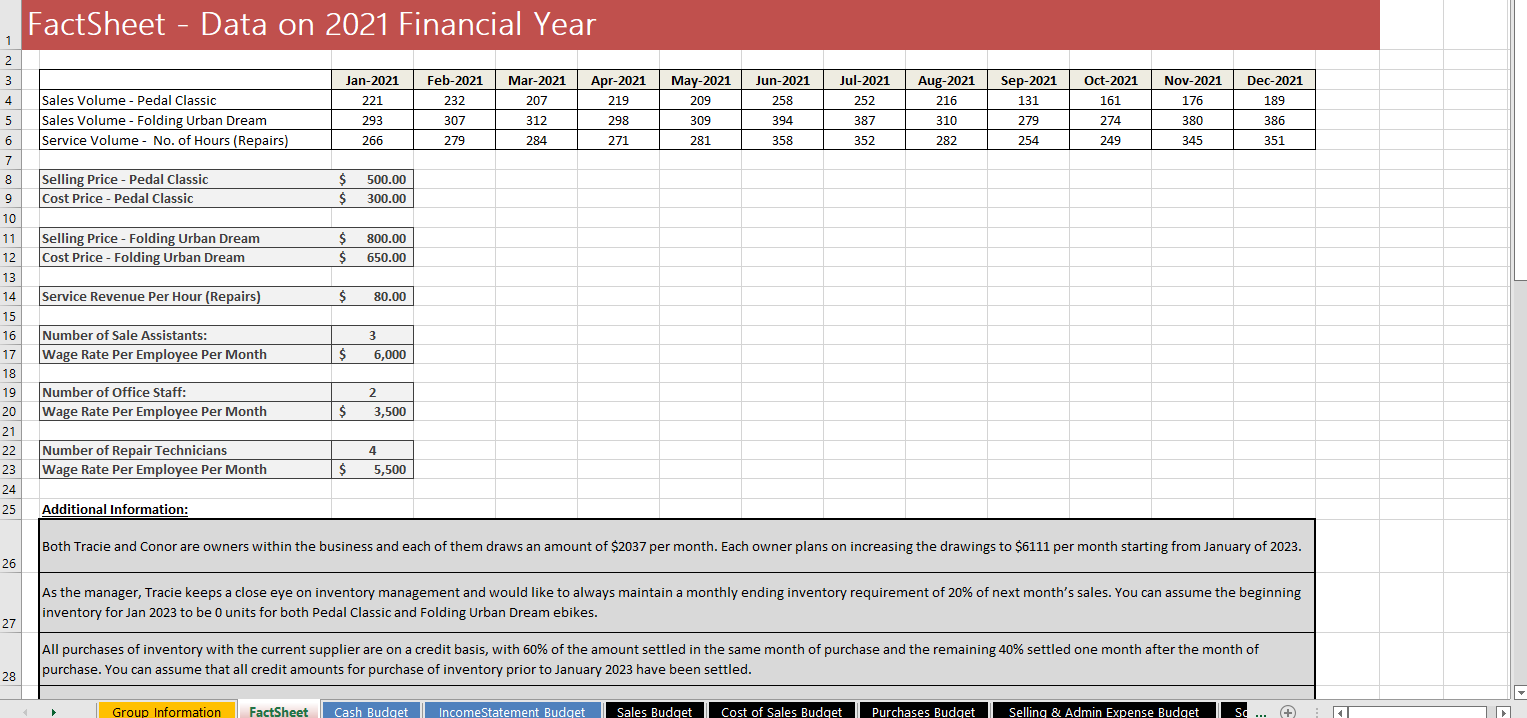

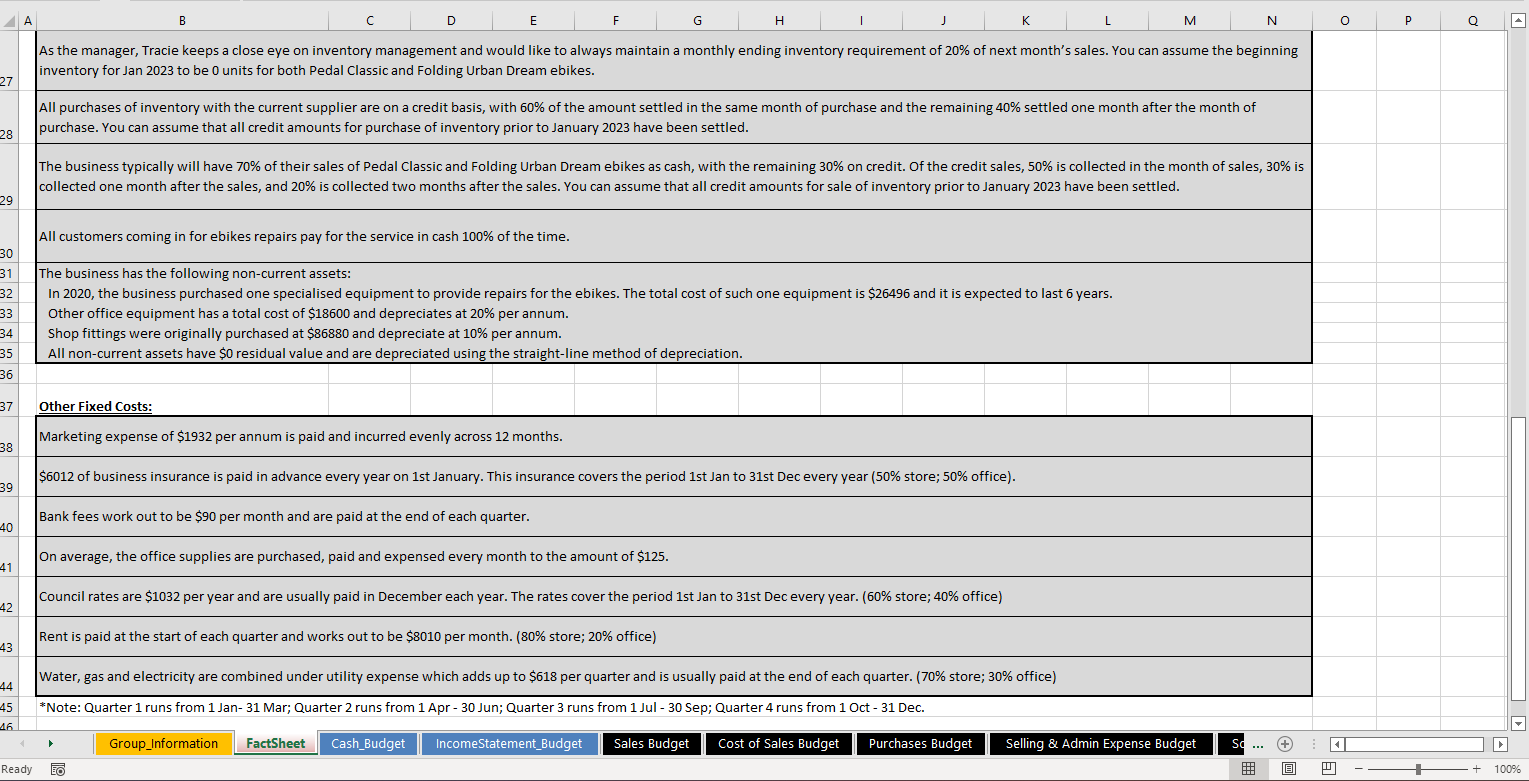

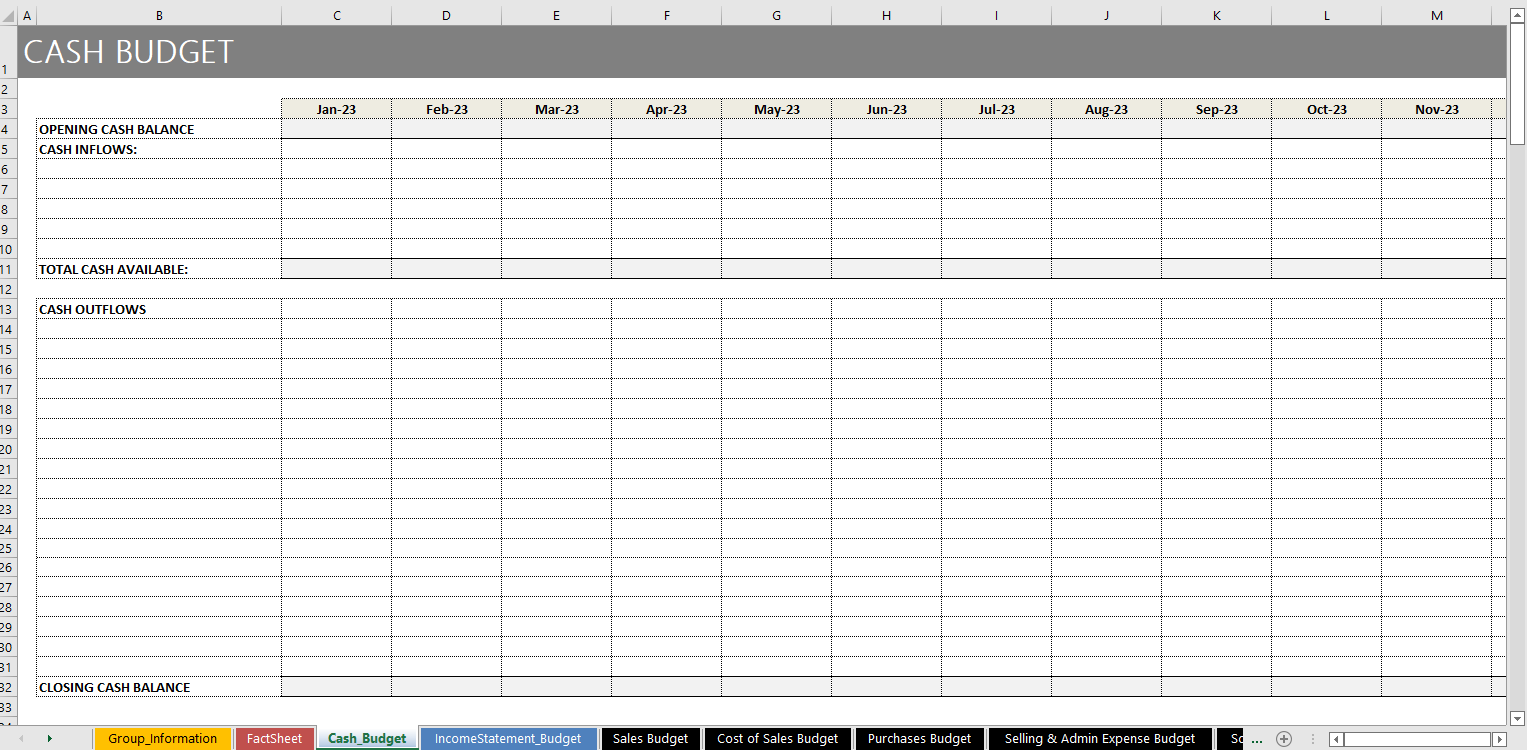

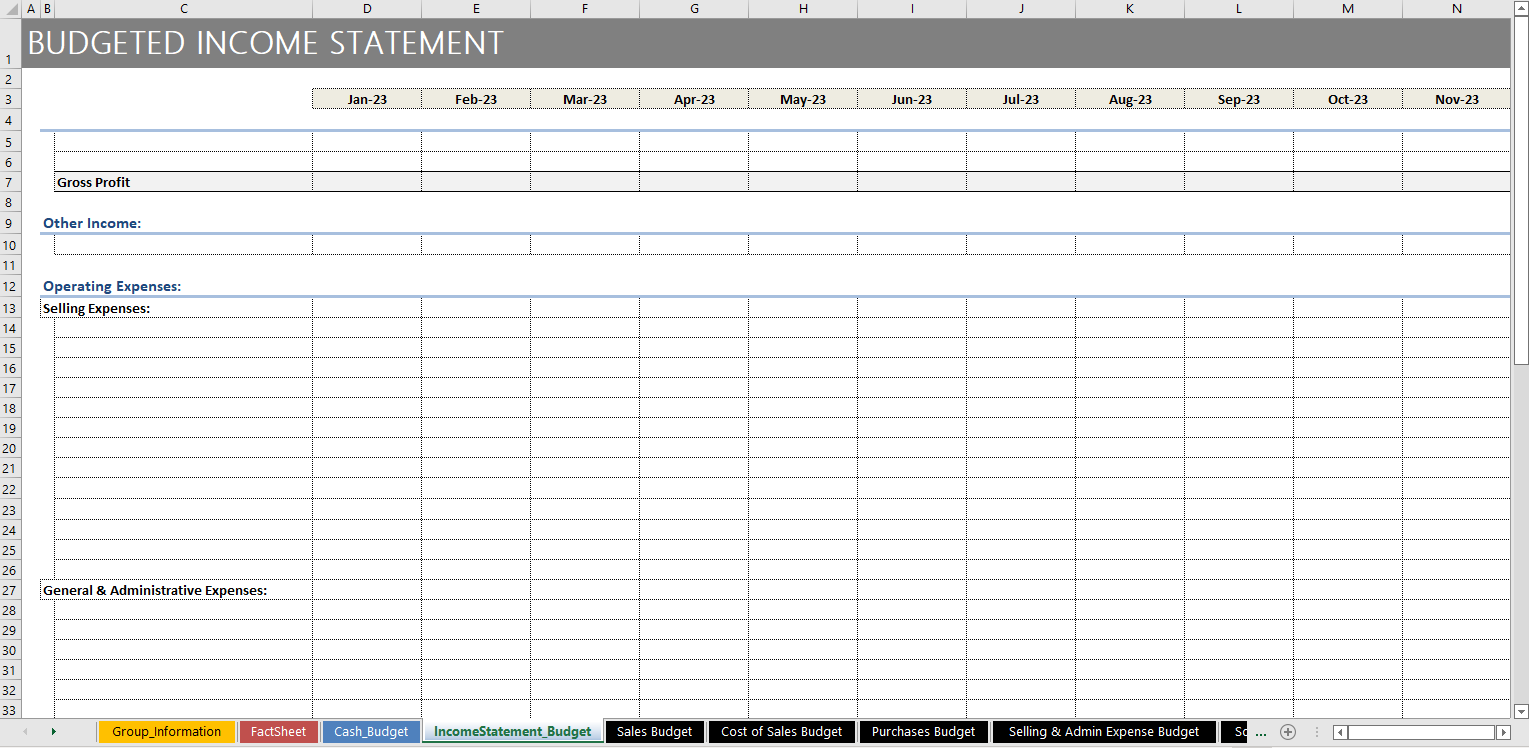

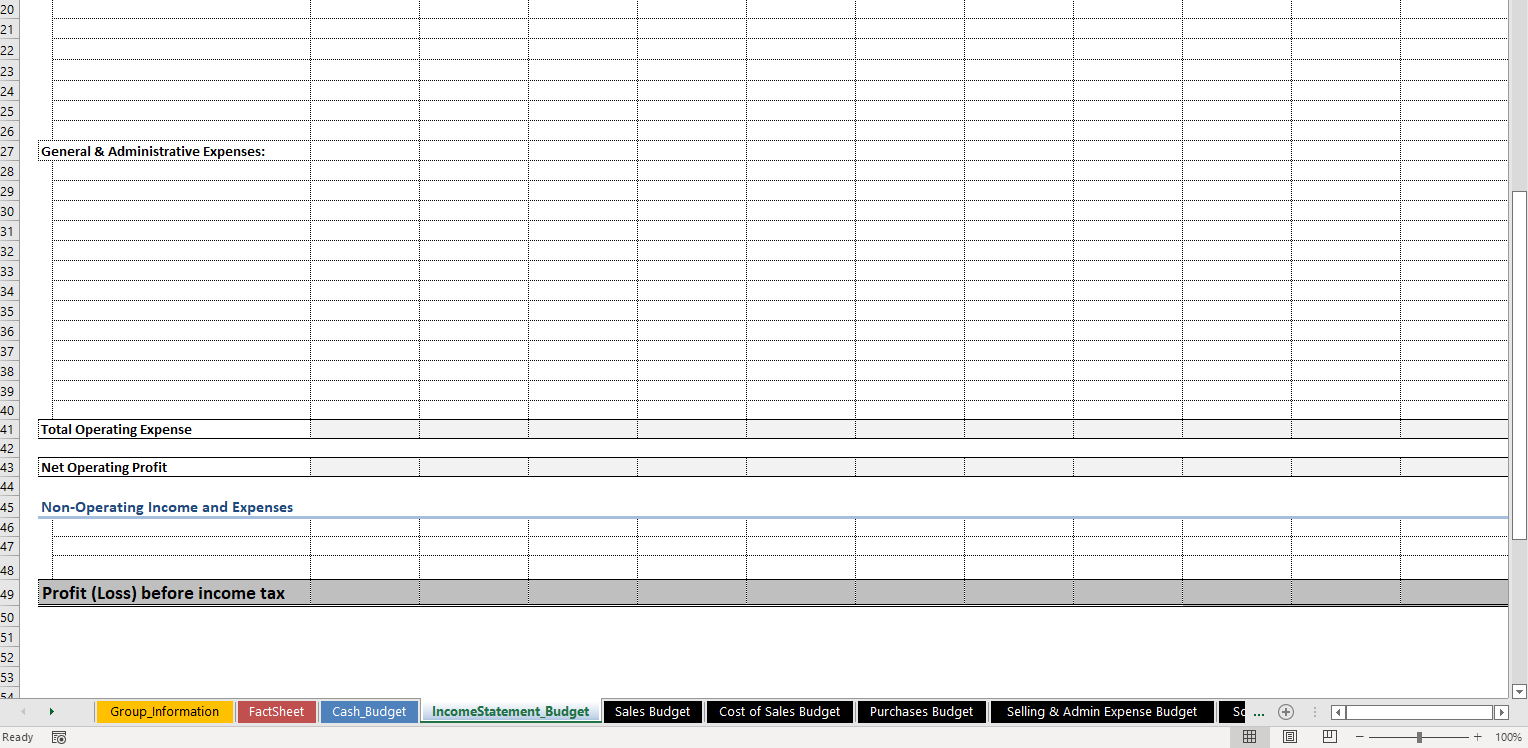

NOTE- CHOSEN STRATEGY- cost management strategy

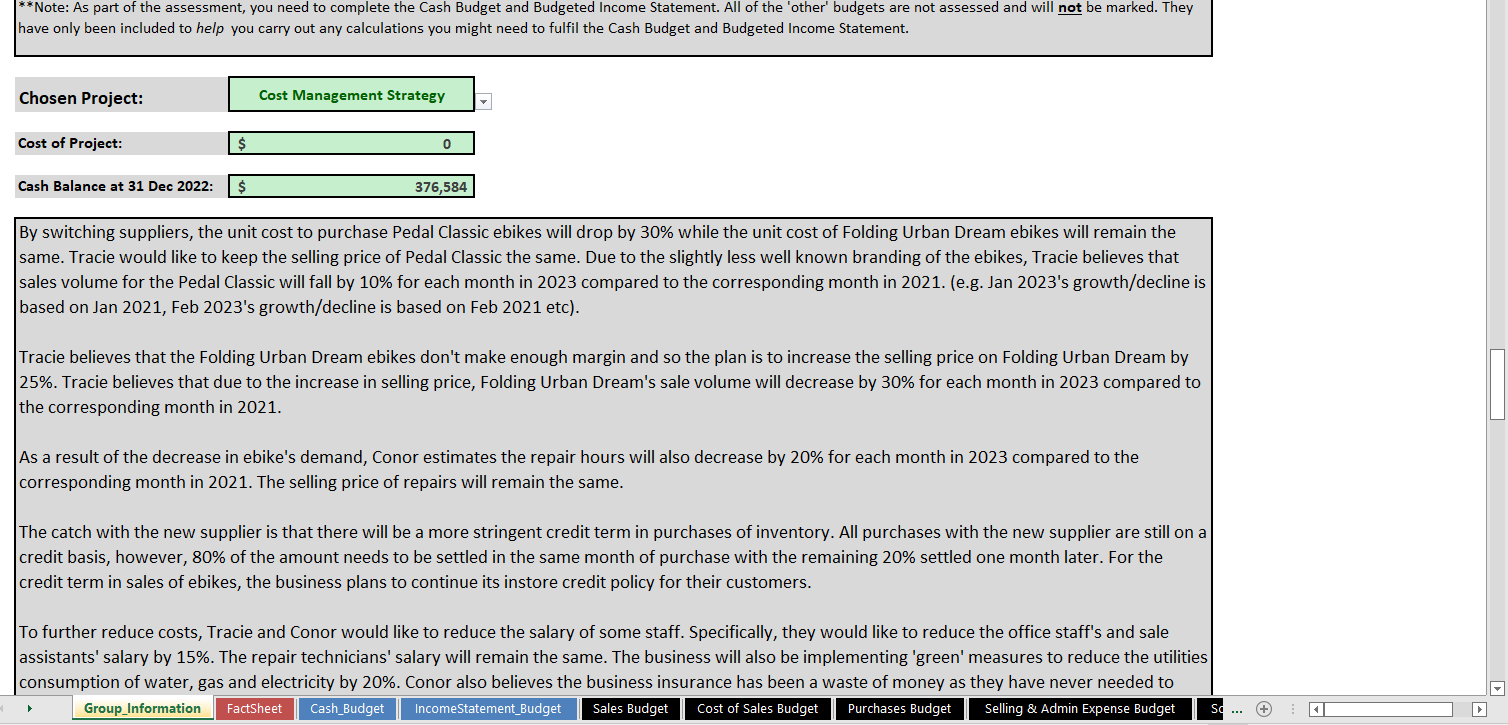

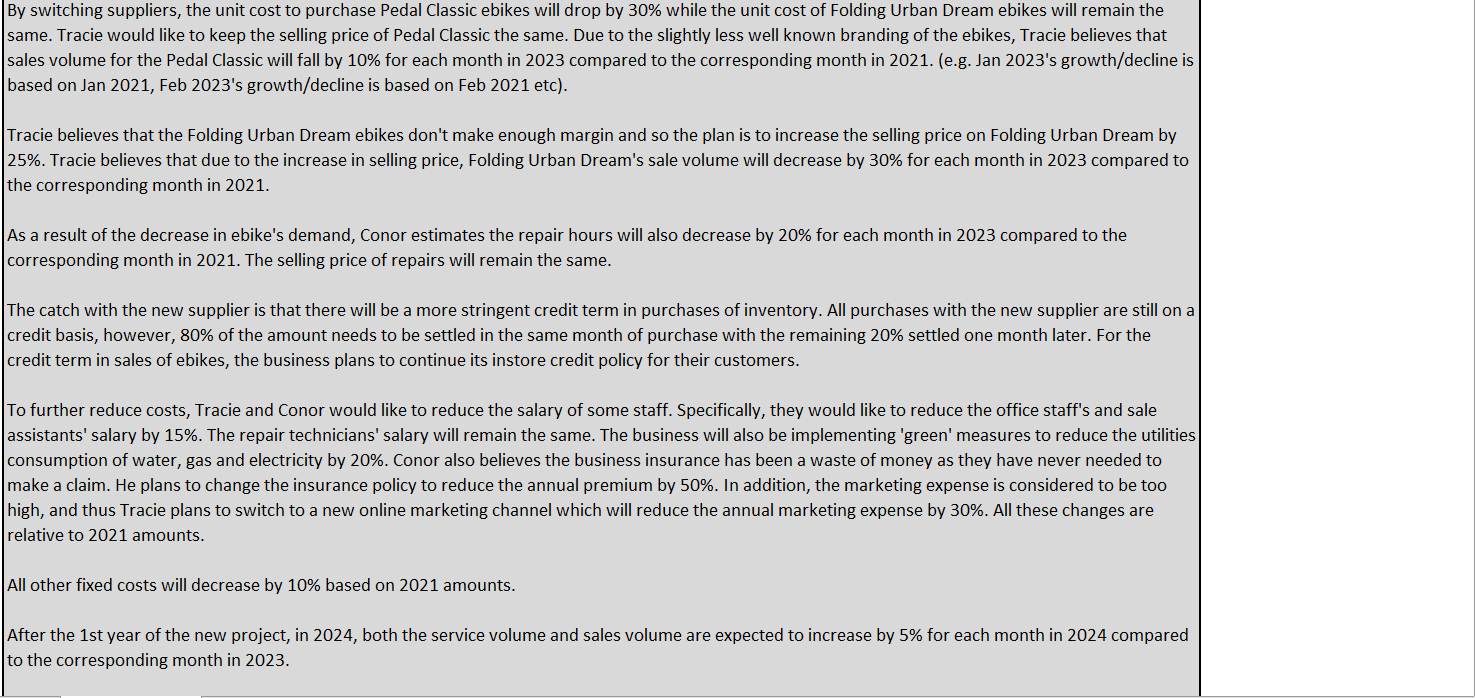

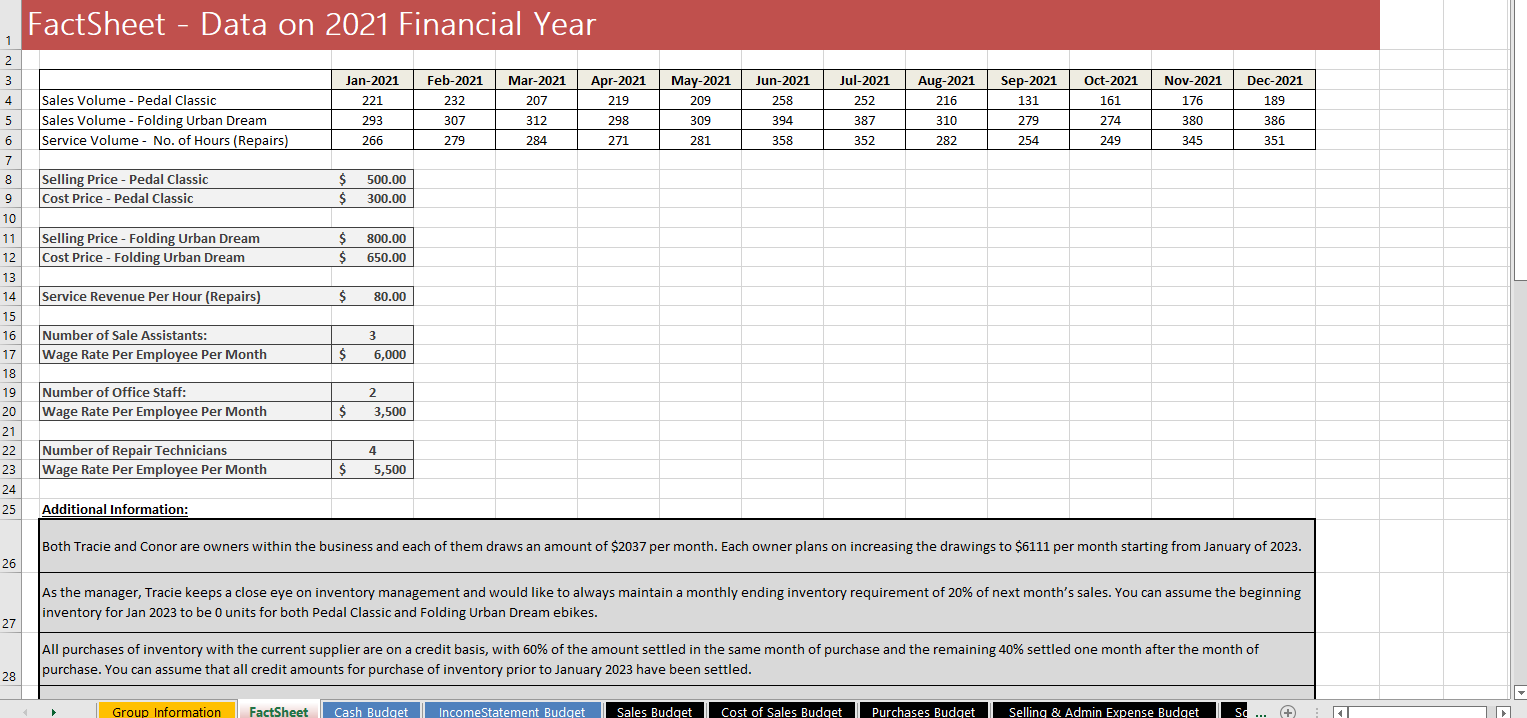

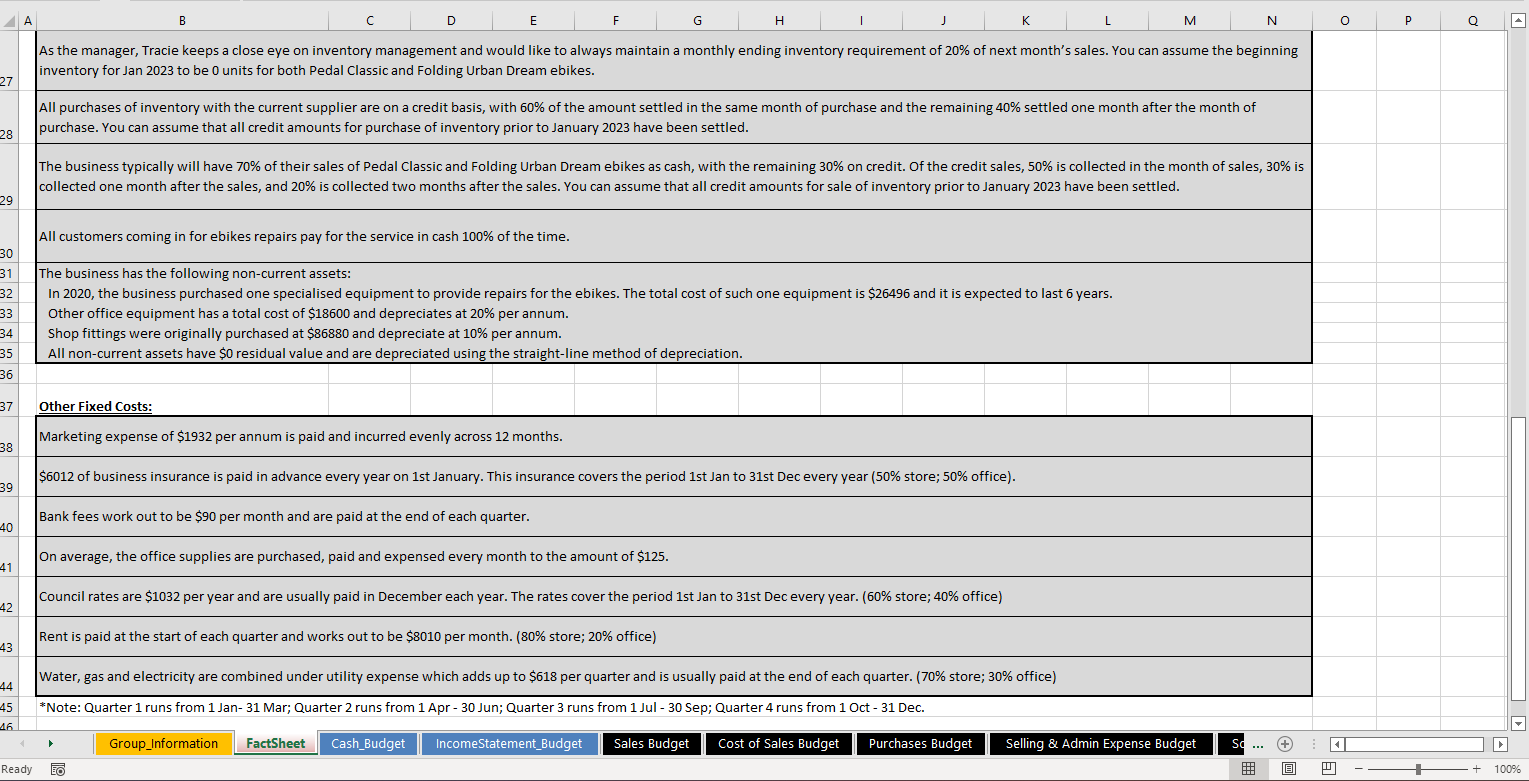

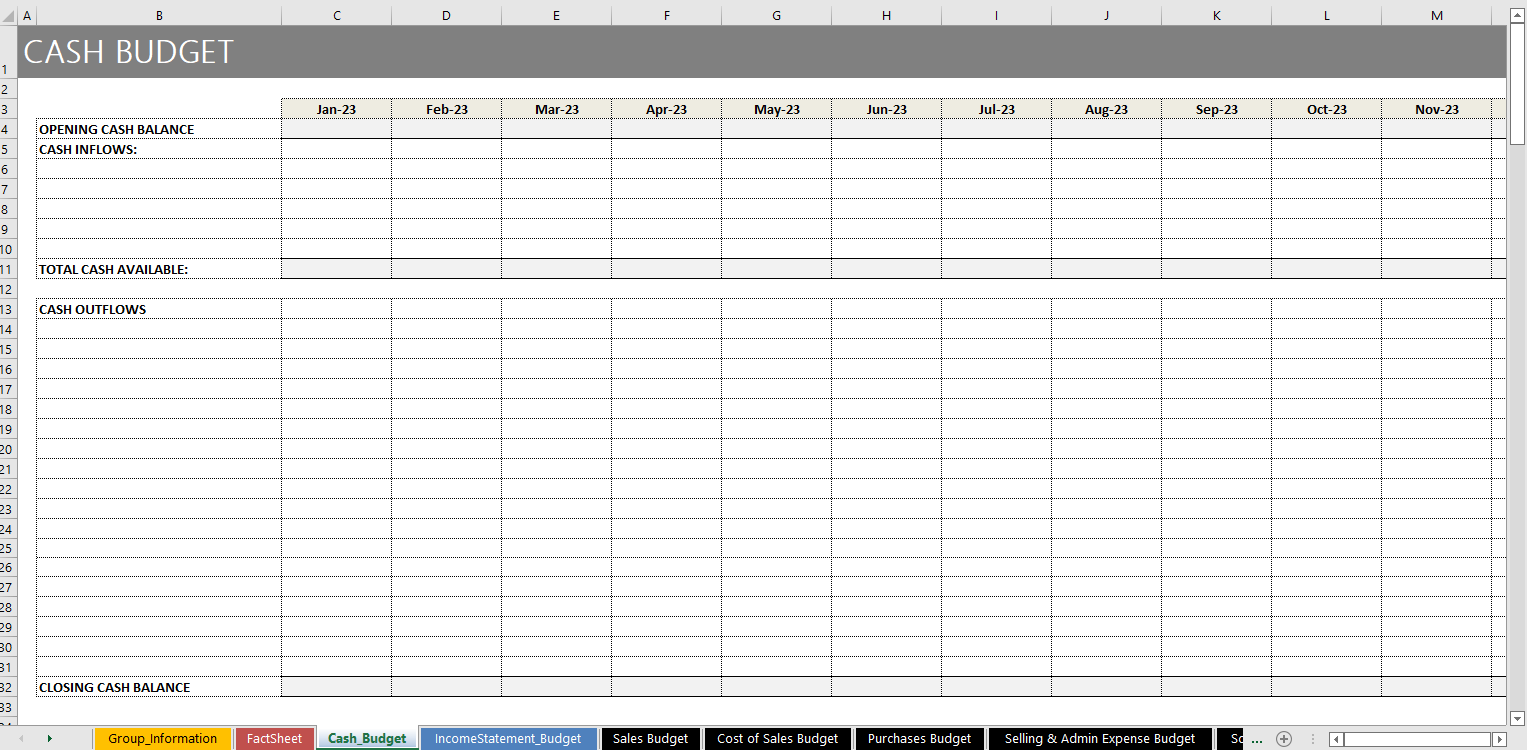

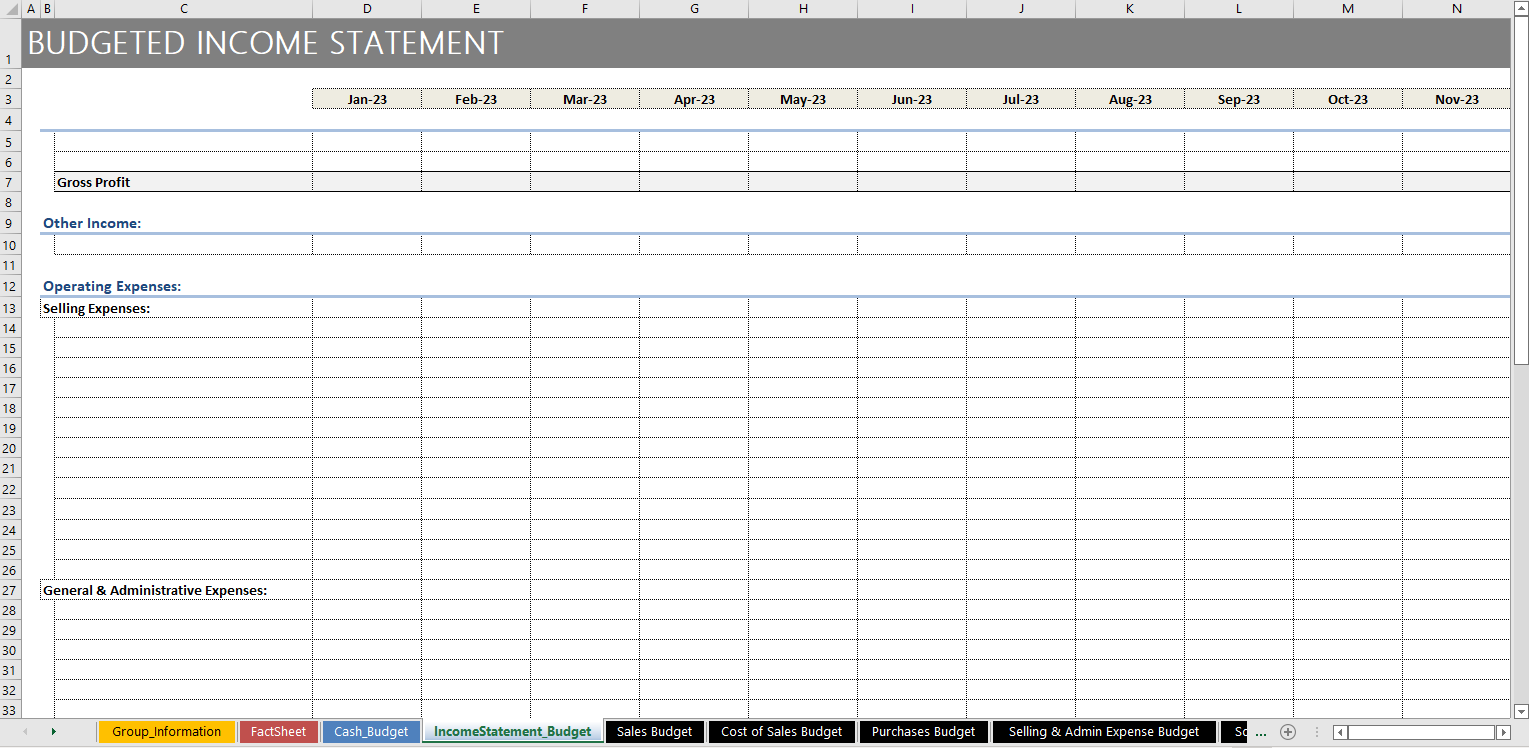

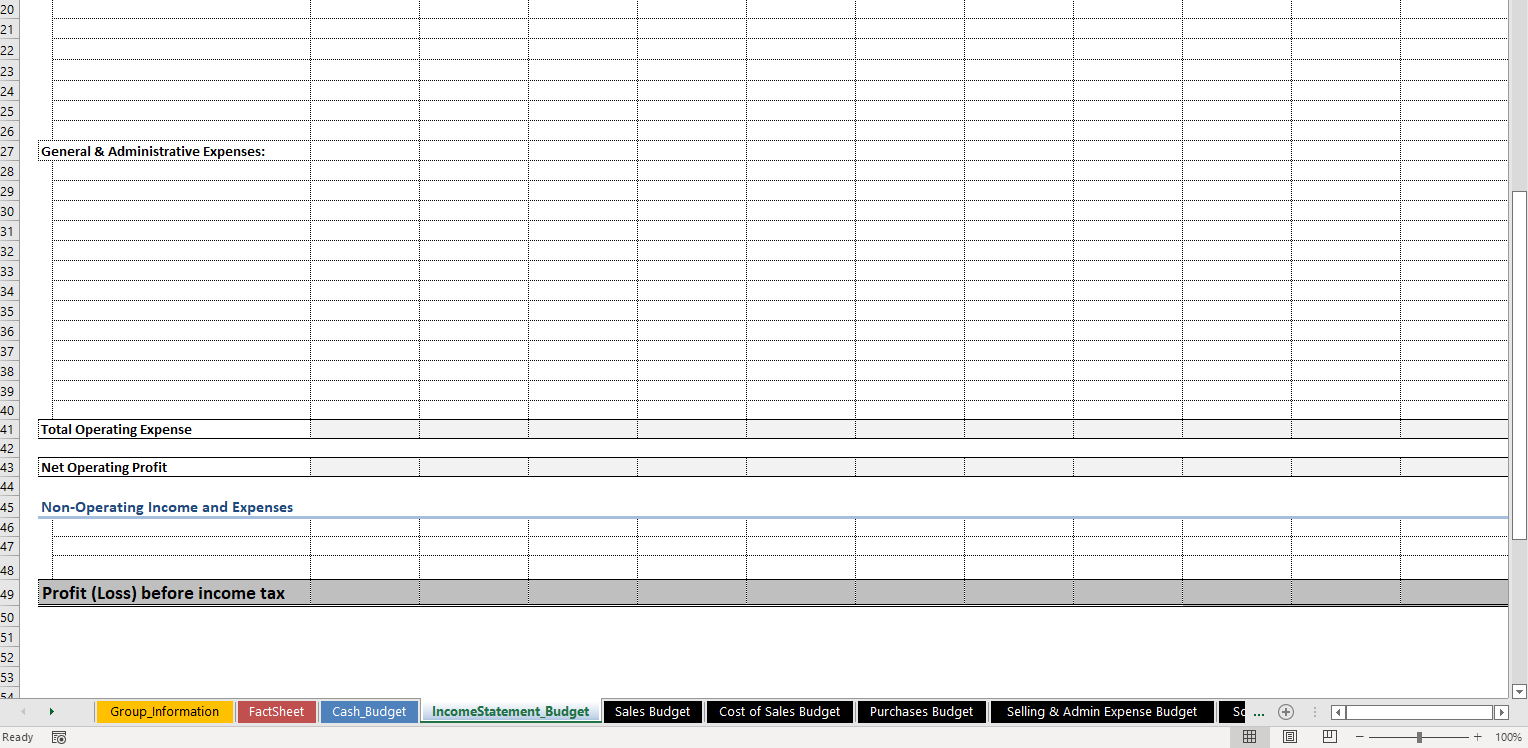

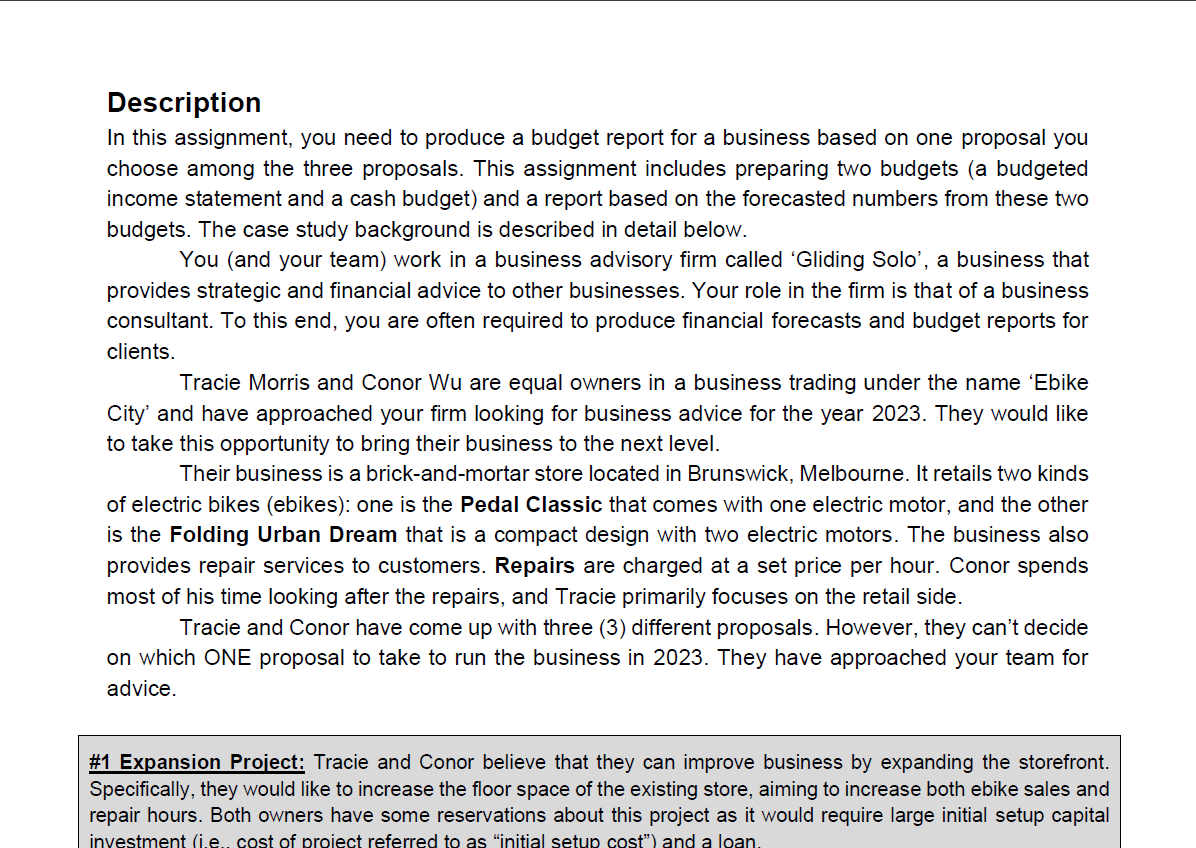

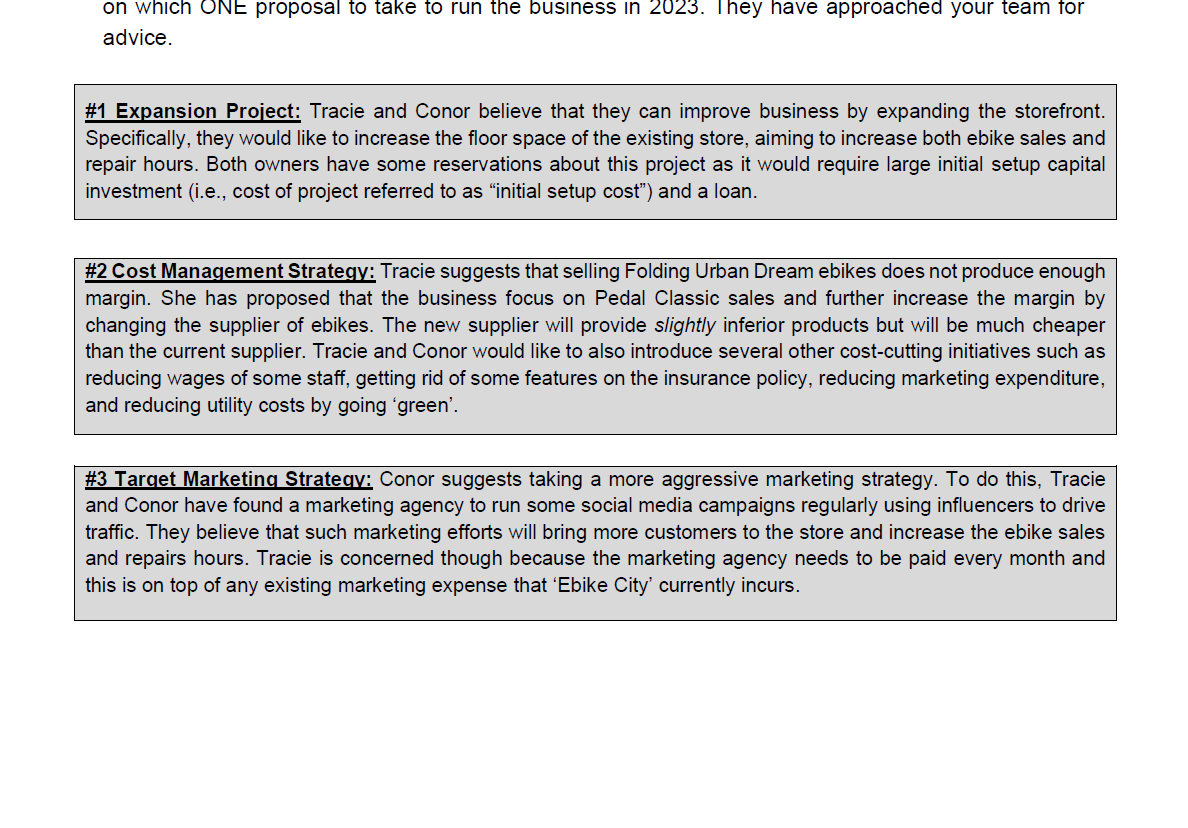

Description In this assignment, you need to produce a budget report for a business based on one proposal you choose among the three proposals. This assignment includes preparing two budgets (a budgeted income statement and a cash budget) and a report based on the forecasted numbers from these two budgets. The case study background is described in detail below. You (and your team) work in a business advisory firm called 'Gliding Solo', a business that provides strategic and financial advice to other businesses. Your role in the firm is that of a business consultant. To this end, you are often required to produce financial forecasts and budget reports for clients. Tracie Morris and Conor Wu are equal owners in a business trading under the name 'Ebike City' and have approached your firm looking for business advice for the year 2023. They would like to take this opportunity to bring their business to the next level. Their business is a brick-and-mortar store located in Brunswick, Melbourne. It retails two kinds of electric bikes (ebikes): one is the Pedal Classic that comes with one electric motor, and the other is the Folding Urban Dream that is a compact design with two electric motors. The business also provides repair services to customers. Repairs are charged at a set price per hour. Conor spends most of his time looking after the repairs, and Tracie primarily focuses on the retail side. Tracie and Conor have come up with three (3) different proposals. However, they can't decide on which ONE proposal to take to run the business in 2023. They have approached your team for advice. \#1 Expansion Project: Tracie and Conor believe that they can improve business by expanding the storefront. Specifically, they would like to increase the floor space of the existing store, aiming to increase both ebike sales and repair hours. Both owners have some reservations about this project as it would require large initial setup capital on which ONE proposal to take to run the business in 2023 . They have approached your team for advice. \#1 Expansion Project: Tracie and Conor believe that they can improve business by expanding the storefront. Specifically, they would like to increase the floor space of the existing store, aiming to increase both ebike sales and repair hours. Both owners have some reservations about this project as it would require large initial setup capital investment (i.e., cost of project referred to as "initial setup cost") and a loan. \#2 Cost Management Strategy: Tracie suggests that selling Folding Urban Dream ebikes does not produce enough margin. She has proposed that the business focus on Pedal Classic sales and further increase the margin by changing the supplier of ebikes. The new supplier will provide slightly inferior products but will be much cheaper than the current supplier. Tracie and Conor would like to also introduce several other cost-cutting initiatives such as reducing wages of some staff, getting rid of some features on the insurance policy, reducing marketing expenditure, and reducing utility costs by going 'green'. \#3 Target Marketing Strateqv: Conor suggests taking a more aggressive marketing strategy. To do this, Tracie and Conor have found a marketing agency to run some social media campaigns regularly using influencers to drive traffic. They believe that such marketing efforts will bring more customers to the store and increase the ebike sales and repairs hours. Tracie is concerned though because the marketing agency needs to be paid every month and this is on top of any existing marketing expense that 'Ebike City' currently incurs. **Note: As part of the assessment, you need to complete the Cash Budget and Budgeted Income Statement. All of the 'other' budgets are not assessed and will not be marked. They have only been included to help you carry out any calculations you might need to fulfil the Cash Budget and Budgeted Income Statement. By switching suppliers, the unit cost to purchase Pedal Classic ebikes will drop by 30% while the unit cost of Folding Urban Dream ebikes will remain the same. Tracie would like to keep the selling price of Pedal Classic the same. Due to the slightly less well known branding of the ebikes, Tracie believes that sales volume for the Pedal Classic will fall by 10% for each month in 2023 compared to the corresponding month in 2021 . (e.g. Jan 2023 's growth/decline is based on Jan 2021, Feb 2023's growth/decline is based on Feb 2021 etc). Tracie believes that the Folding Urban Dream ebikes don't make enough margin and so the plan is to increase the selling price on Folding Urban Dream by 25%. Tracie believes that due to the increase in selling price, Folding Urban Dream's sale volume will decrease by 30% for each month in 2023 compared to the corresponding month in 2021. As a result of the decrease in ebike's demand, Conor estimates the repair hours will also decrease by 20% for each month in 2023 compared to the corresponding month in 2021 . The selling price of repairs will remain the same. The catch with the new supplier is that there will be a more stringent credit term in purchases of inventory. All purchases with the new supplier are still on a credit basis, however, 80% of the amount needs to be settled in the same month of purchase with the remaining 20% settled one month later. For the credit term in sales of ebikes, the business plans to continue its instore credit policy for their customers. To further reduce costs, Tracie and Conor would like to reduce the salary of some staff. Specifically, they would like to reduce the office staff's and sale assistants' salary by 15%. The repair technicians' salary will remain the same. The business will also be implementing 'green' measures to reduce the utilities consumption of water, gas and electricity by 20%. Conor also believes the business insurance has been a waste of money as they have never needed to By switching suppliers, the unit cost to purchase Pedal Classic ebikes will drop by 30% while the unit cost of Folding Urban Dream ebikes will remain the same. Tracie would like to keep the selling price of Pedal Classic the same. Due to the slightly less well known branding of the ebikes, Tracie believes that sales volume for the Pedal Classic will fall by 10% for each month in 2023 compared to the corresponding month in 2021. (e.g. Jan 2023's growth/decline is based on Jan 2021, Feb 2023's growth/decline is based on Feb 2021 etc). Tracie believes that the Folding Urban Dream ebikes don't make enough margin and so the plan is to increase the selling price on Folding Urban Dream by 25\%. Tracie believes that due to the increase in selling price, Folding Urban Dream's sale volume will decrease by 30% for each month in 2023 compared to the corresponding month in 2021. As a result of the decrease in ebike's demand, Conor estimates the repair hours will also decrease by 20% for each month in 2023 compared to the corresponding month in 2021. The selling price of repairs will remain the same. The catch with the new supplier is that there will be a more stringent credit term in purchases of inventory. All purchases with the new supplier are still on a credit basis, however, 80% of the amount needs to be settled in the same month of purchase with the remaining 20% settled one month later. For the credit term in sales of ebikes, the business plans to continue its instore credit policy for their customers. To further reduce costs, Tracie and Conor would like to reduce the salary of some staff. Specifically, they would like to reduce the office staff's and sale assistants' salary by 15%. The repair technicians' salary will remain the same. The business will also be implementing 'green' measures to reduce the utilities consumption of water, gas and electricity by 20%. Conor also believes the business insurance has been a waste of money as they have never needed to make a claim. He plans to change the insurance policy to reduce the annual premium by 50%. In addition, the marketing expense is considered to be too high, and thus Tracie plans to switch to a new online marketing channel which will reduce the annual marketing expense by 30%. All these changes are relative to 2021 amounts. All other fixed costs will decrease by 10% based on 2021 amounts. After the 1st year of the new project, in 2024, both the service volume and sales volume are expected to increase by 5% for each month in 2024 compared to the corresponding month in 2023. inventory for Jan 2023 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. purchase. You can assume that all credit amounts for purchase of inventory prior to January 2023 have been settled. A inventory for Jan 2023 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. purchase. You can assume that all credit amounts for purchase of inventory prior to January 2023 have been settled. All customers coming in for ebikes repairs pay for the service in cash 100% of the time. The business has the following non-current assets: Other office equipment has a total cost of $18600 and depreciates at 20% per annum. Shop fittings were originally purchased at $86880 and depreciate at 10% per annum. All non-current assets have $0 residual value and are depreciated using the straight-line method of depreciation. Other Fixed Costs: Marketing expense of $1932 per annum is paid and incurred evenly across 12 months. $6012 of business insurance is paid in advance every year on 1st January. This insurance covers the period 1 st Jan to 31 st Dec every year ( 50% store; 50% office). Bank fees work out to be $90 per month and are paid at the end of each quarter. On average, the office supplies are purchased, paid and expensed every month to the amount of \$125. Council rates are $1032 per year and are usually paid in December each year. The rates cover the period 1 st Jan to 31 st Dec every year. (60\% store; 40% office) Rent is paid at the start of each quarter and works out to be $8010 per month. ( 80% store; 20% office) *Note: Quarter 1 runs from 1 Jan- 31 Mar; Quarter 2 runs from 1 Apr - 30 Jun; Quarter 3 runs from 1 Jul - 30 Sep; Quarter 4 runs from 1 Oct - 31 Dec. CASH BUDGET OPENING CASH BALANCE CASH INFLOWS: TOTAL CASH AVAILABLE: CASH OUTFLOWS CLOSING CASH BALANCE BUDGETED INCOME STATEMENT Other Income: Operating Expenses: Selling Expenses: Description In this assignment, you need to produce a budget report for a business based on one proposal you choose among the three proposals. This assignment includes preparing two budgets (a budgeted income statement and a cash budget) and a report based on the forecasted numbers from these two budgets. The case study background is described in detail below. You (and your team) work in a business advisory firm called 'Gliding Solo', a business that provides strategic and financial advice to other businesses. Your role in the firm is that of a business consultant. To this end, you are often required to produce financial forecasts and budget reports for clients. Tracie Morris and Conor Wu are equal owners in a business trading under the name 'Ebike City' and have approached your firm looking for business advice for the year 2023. They would like to take this opportunity to bring their business to the next level. Their business is a brick-and-mortar store located in Brunswick, Melbourne. It retails two kinds of electric bikes (ebikes): one is the Pedal Classic that comes with one electric motor, and the other is the Folding Urban Dream that is a compact design with two electric motors. The business also provides repair services to customers. Repairs are charged at a set price per hour. Conor spends most of his time looking after the repairs, and Tracie primarily focuses on the retail side. Tracie and Conor have come up with three (3) different proposals. However, they can't decide on which ONE proposal to take to run the business in 2023. They have approached your team for advice. \#1 Expansion Project: Tracie and Conor believe that they can improve business by expanding the storefront. Specifically, they would like to increase the floor space of the existing store, aiming to increase both ebike sales and repair hours. Both owners have some reservations about this project as it would require large initial setup capital on which ONE proposal to take to run the business in 2023 . They have approached your team for advice. \#1 Expansion Project: Tracie and Conor believe that they can improve business by expanding the storefront. Specifically, they would like to increase the floor space of the existing store, aiming to increase both ebike sales and repair hours. Both owners have some reservations about this project as it would require large initial setup capital investment (i.e., cost of project referred to as "initial setup cost") and a loan. \#2 Cost Management Strategy: Tracie suggests that selling Folding Urban Dream ebikes does not produce enough margin. She has proposed that the business focus on Pedal Classic sales and further increase the margin by changing the supplier of ebikes. The new supplier will provide slightly inferior products but will be much cheaper than the current supplier. Tracie and Conor would like to also introduce several other cost-cutting initiatives such as reducing wages of some staff, getting rid of some features on the insurance policy, reducing marketing expenditure, and reducing utility costs by going 'green'. \#3 Target Marketing Strateqv: Conor suggests taking a more aggressive marketing strategy. To do this, Tracie and Conor have found a marketing agency to run some social media campaigns regularly using influencers to drive traffic. They believe that such marketing efforts will bring more customers to the store and increase the ebike sales and repairs hours. Tracie is concerned though because the marketing agency needs to be paid every month and this is on top of any existing marketing expense that 'Ebike City' currently incurs. **Note: As part of the assessment, you need to complete the Cash Budget and Budgeted Income Statement. All of the 'other' budgets are not assessed and will not be marked. They have only been included to help you carry out any calculations you might need to fulfil the Cash Budget and Budgeted Income Statement. By switching suppliers, the unit cost to purchase Pedal Classic ebikes will drop by 30% while the unit cost of Folding Urban Dream ebikes will remain the same. Tracie would like to keep the selling price of Pedal Classic the same. Due to the slightly less well known branding of the ebikes, Tracie believes that sales volume for the Pedal Classic will fall by 10% for each month in 2023 compared to the corresponding month in 2021 . (e.g. Jan 2023 's growth/decline is based on Jan 2021, Feb 2023's growth/decline is based on Feb 2021 etc). Tracie believes that the Folding Urban Dream ebikes don't make enough margin and so the plan is to increase the selling price on Folding Urban Dream by 25%. Tracie believes that due to the increase in selling price, Folding Urban Dream's sale volume will decrease by 30% for each month in 2023 compared to the corresponding month in 2021. As a result of the decrease in ebike's demand, Conor estimates the repair hours will also decrease by 20% for each month in 2023 compared to the corresponding month in 2021 . The selling price of repairs will remain the same. The catch with the new supplier is that there will be a more stringent credit term in purchases of inventory. All purchases with the new supplier are still on a credit basis, however, 80% of the amount needs to be settled in the same month of purchase with the remaining 20% settled one month later. For the credit term in sales of ebikes, the business plans to continue its instore credit policy for their customers. To further reduce costs, Tracie and Conor would like to reduce the salary of some staff. Specifically, they would like to reduce the office staff's and sale assistants' salary by 15%. The repair technicians' salary will remain the same. The business will also be implementing 'green' measures to reduce the utilities consumption of water, gas and electricity by 20%. Conor also believes the business insurance has been a waste of money as they have never needed to By switching suppliers, the unit cost to purchase Pedal Classic ebikes will drop by 30% while the unit cost of Folding Urban Dream ebikes will remain the same. Tracie would like to keep the selling price of Pedal Classic the same. Due to the slightly less well known branding of the ebikes, Tracie believes that sales volume for the Pedal Classic will fall by 10% for each month in 2023 compared to the corresponding month in 2021. (e.g. Jan 2023's growth/decline is based on Jan 2021, Feb 2023's growth/decline is based on Feb 2021 etc). Tracie believes that the Folding Urban Dream ebikes don't make enough margin and so the plan is to increase the selling price on Folding Urban Dream by 25\%. Tracie believes that due to the increase in selling price, Folding Urban Dream's sale volume will decrease by 30% for each month in 2023 compared to the corresponding month in 2021. As a result of the decrease in ebike's demand, Conor estimates the repair hours will also decrease by 20% for each month in 2023 compared to the corresponding month in 2021. The selling price of repairs will remain the same. The catch with the new supplier is that there will be a more stringent credit term in purchases of inventory. All purchases with the new supplier are still on a credit basis, however, 80% of the amount needs to be settled in the same month of purchase with the remaining 20% settled one month later. For the credit term in sales of ebikes, the business plans to continue its instore credit policy for their customers. To further reduce costs, Tracie and Conor would like to reduce the salary of some staff. Specifically, they would like to reduce the office staff's and sale assistants' salary by 15%. The repair technicians' salary will remain the same. The business will also be implementing 'green' measures to reduce the utilities consumption of water, gas and electricity by 20%. Conor also believes the business insurance has been a waste of money as they have never needed to make a claim. He plans to change the insurance policy to reduce the annual premium by 50%. In addition, the marketing expense is considered to be too high, and thus Tracie plans to switch to a new online marketing channel which will reduce the annual marketing expense by 30%. All these changes are relative to 2021 amounts. All other fixed costs will decrease by 10% based on 2021 amounts. After the 1st year of the new project, in 2024, both the service volume and sales volume are expected to increase by 5% for each month in 2024 compared to the corresponding month in 2023. inventory for Jan 2023 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. purchase. You can assume that all credit amounts for purchase of inventory prior to January 2023 have been settled. A inventory for Jan 2023 to be 0 units for both Pedal Classic and Folding Urban Dream ebikes. purchase. You can assume that all credit amounts for purchase of inventory prior to January 2023 have been settled. All customers coming in for ebikes repairs pay for the service in cash 100% of the time. The business has the following non-current assets: Other office equipment has a total cost of $18600 and depreciates at 20% per annum. Shop fittings were originally purchased at $86880 and depreciate at 10% per annum. All non-current assets have $0 residual value and are depreciated using the straight-line method of depreciation. Other Fixed Costs: Marketing expense of $1932 per annum is paid and incurred evenly across 12 months. $6012 of business insurance is paid in advance every year on 1st January. This insurance covers the period 1 st Jan to 31 st Dec every year ( 50% store; 50% office). Bank fees work out to be $90 per month and are paid at the end of each quarter. On average, the office supplies are purchased, paid and expensed every month to the amount of \$125. Council rates are $1032 per year and are usually paid in December each year. The rates cover the period 1 st Jan to 31 st Dec every year. (60\% store; 40% office) Rent is paid at the start of each quarter and works out to be $8010 per month. ( 80% store; 20% office) *Note: Quarter 1 runs from 1 Jan- 31 Mar; Quarter 2 runs from 1 Apr - 30 Jun; Quarter 3 runs from 1 Jul - 30 Sep; Quarter 4 runs from 1 Oct - 31 Dec. CASH BUDGET OPENING CASH BALANCE CASH INFLOWS: TOTAL CASH AVAILABLE: CASH OUTFLOWS CLOSING CASH BALANCE BUDGETED INCOME STATEMENT Other Income: Operating Expenses: Selling Expenses