please missing the highlights

please missing the highlights

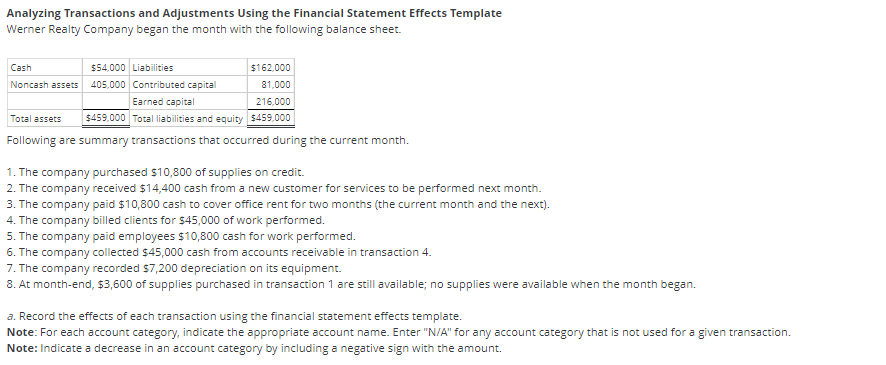

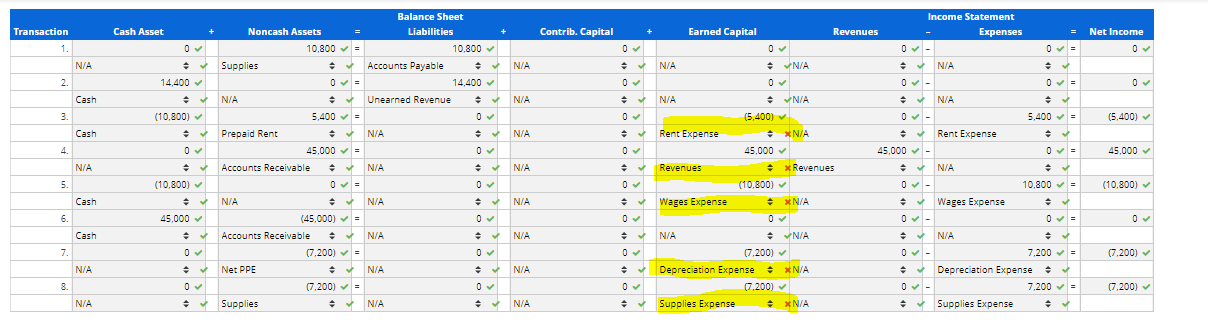

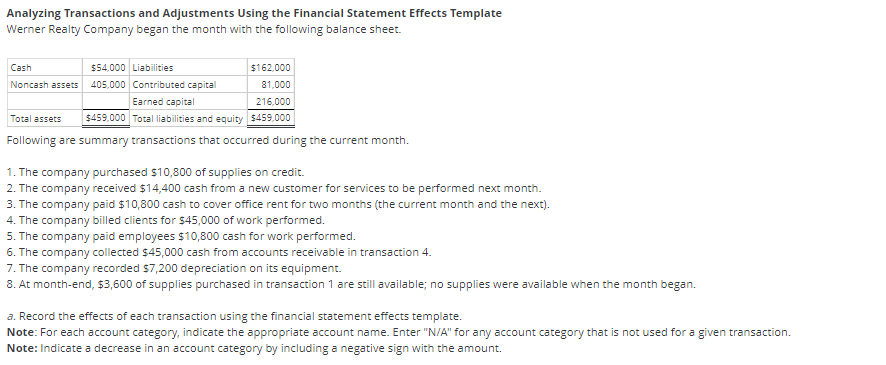

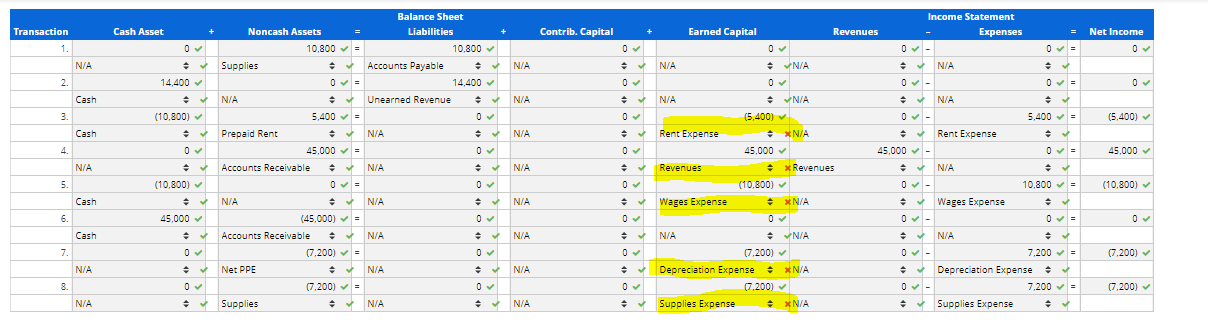

Analyzing Transactions and Adjustments Using the Financial Statement Effects Template Werner Realty Company began the month with the following balance sheet. Cash $54,000 Liabilities $162.000 Noncash assets 405.000 Contributed capital 81,000 Earned capital 216,000 Total assets $459,000 Total liabilities and equity $459.000 Following are summary transactions that occurred during the current month. 1. The company purchased $10,800 of supplies on credit. 2. The company received $14,400 cash from a new customer for services to be performed next month. 3. The company paid $10,800 cash to cover office rent for two months (the current month and the next). 4. The company billed clients for 545,000 of work performed. 5. The company paid employees $10,800 cash for work performed. 6. The company collected $45,000 cash from accounts receivable in transaction 4. 7. The company recorded 57,200 depreciation on its equipment. 8. At month-end, $3,600 of supplies purchased in transaction 1 are still available; no supplies were available when the month began. a. Record the effects of each transaction using the financial statement effects template. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Cash Asset + Contrib. Capital + Earned Capital Revenues = Net Income Transaction 1. Noncash Assets 10.800 Supplies . Balance Sheet Liabilities 10.800 Accounts Payable 14,400 Income Statement Expenses 0 - N/A 0 - N/A N/A N/A N/A N/A 2. 14,400 Cash Unearned Revenue NIA . N/A . N/A 3 (10,800) (5,400) 5,400 = (5.400) Cash N/A 5.400 Prepaid Rent 45.000 = Accounts Receivable N/A . N/A Rent Expense N/A Rent Expense 45.000 - 4 0 45,000 45.000 N/A N/A N/A Revenues * Revenues N/A . 5. (10.800) + (10.800) 10.800 (10.800) Cash . N/A N/A Wages Expense XN/A Wages Expense . 6. 45.000 Cash >>> N/A N/A . N/A (45.000) Accounts Receivable (7.200) = Net PPE . (7.200) Supplies 7. (7.200) N/A N/A N/A N/A N/A (7.200) Depreciation Expense N/A (7.200) () Supplies Expense * N/A 2 N/A 7.200= Depreciation Expense 7.200 - Supplies Expense 8. (7.200) N/A N/A N/A

please missing the highlights

please missing the highlights