Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please model cash flows for American Greetings for fiscal years 2012 through 2015 based on the two sets of ratios in case Exhibit 8. Based

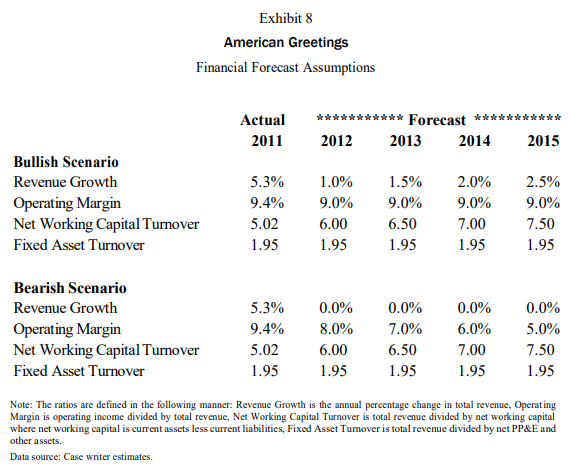

Please model cash flows for American Greetings for fiscal years 2012 through 2015 based on the two sets of ratios in case Exhibit 8. Based on the discounted cash flows associated with the forecast, what is the implied enterprise value of American Greetings and the corresponding share price?

Exhibit 8 American Greetings Financial Forecast Assumptions Note: The ratios are defined in the following manner: Revenue Growth is the annual percentage change in total revenue, Operating Margin is operating income divided by total revenue, Net Working Capital Turnover is total revenue divided by net working capital where net working capital is current assets less current liabilities, Fixed Asset Tumover is total revenue divided by net PP\&E and other assets. Data source: Case writer estimates. Exhibit 8 American Greetings Financial Forecast Assumptions Note: The ratios are defined in the following manner: Revenue Growth is the annual percentage change in total revenue, Operating Margin is operating income divided by total revenue, Net Working Capital Turnover is total revenue divided by net working capital where net working capital is current assets less current liabilities, Fixed Asset Tumover is total revenue divided by net PP\&E and other assets. Data source: Case writer estimatesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started