Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please name the answer ( the company) and explain why 7. There are additional tax advantages, beyond mismatch of income and deduction, for the establishment

please name the answer ( the company)

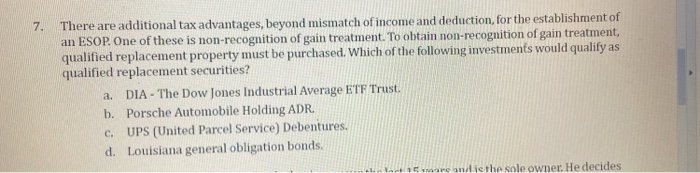

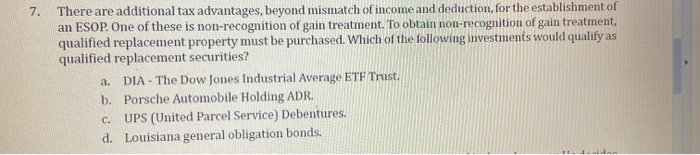

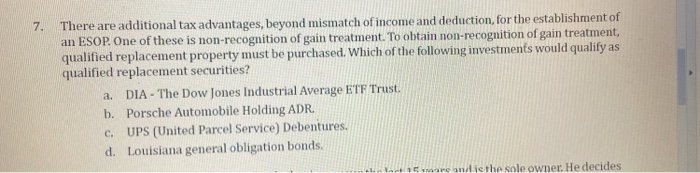

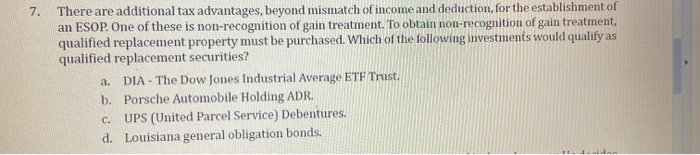

7. There are additional tax advantages, beyond mismatch of income and deduction, for the establishment of an ESOP. One of these is non-recognition of gain treatment. To obtain non-recognition of gain treatment, qualified replacement property must be purchased. Which of the following investments would qualify as qualified replacement securities? a. DIA - The Dow Jones Industrial Average ETF Trust. b. Porsche Automobile Holding ADR. UPS (United Parcel Service) Debentures. d. Louisiana general obligation bonds. C. are and is the sole owner. He decides 7. There are additional tax advantages, beyond mismatch of income and deduction, for the establishment of an ESOP. One of these is non-recognition of gain treatment. To obtain non-recognition of gain treatment, qualified replacement property must be purchased. Which of the following investments would qualify as qualified replacement securities? DIA - The Dow Jones Industrial Average ETF Trust. b. Porsche Automobile Holding ADR. UPS (United Parcel Service) Debentures. d. Louisiana general obligation bonds. a. c and explain why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started