Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please need asap .. urgenr Suppose that the pound is pegged to gold at 25 per ounce and the dollar is pegged to gold at

please need asap .. urgenr

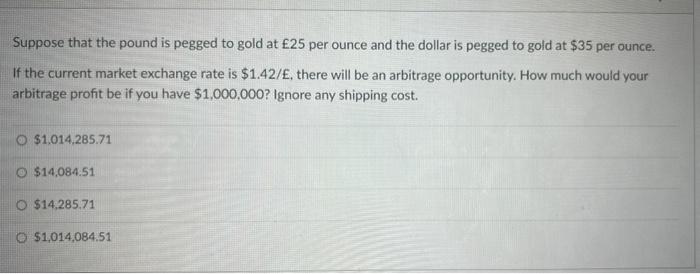

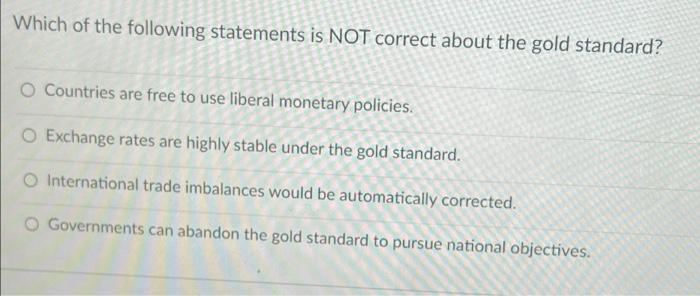

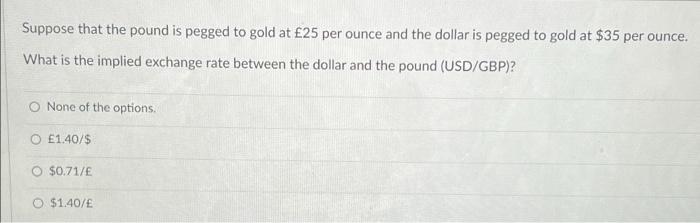

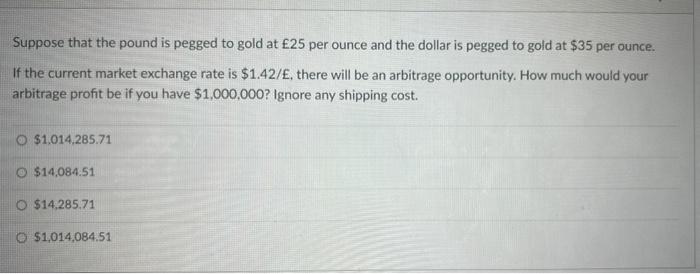

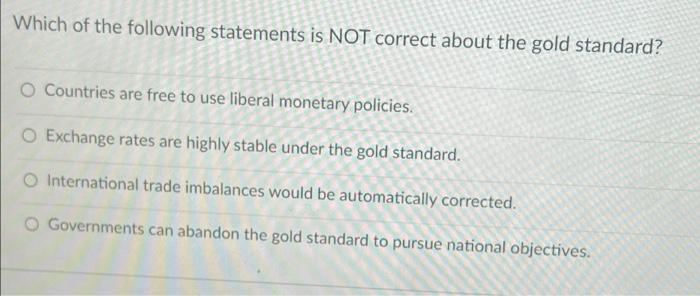

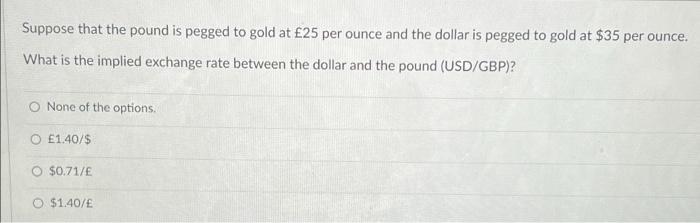

Suppose that the pound is pegged to gold at 25 per ounce and the dollar is pegged to gold at $35 per ounce. If the current market exchange rate is $1.42/, there will be an arbitrage opportunity. How much would your arbitrage profit be if you have $1,000,000? Ignore any shipping cost. O $1,014,285.71 O $14,084.51 O $14,285.71 $1,014,084.51 Which of the following statements is NOT correct about the gold standard? O Countries are free to use liberal monetary policies. O Exchange rates are highly stable under the gold standard. International trade imbalances would be automatically corrected. O Governments can abandon the gold standard to pursue national objectives. Suppose that the pound is pegged to gold at 25 per ounce and the dollar is pegged to gold at $35 per ounce. What is the implied exchange rate between the dollar and the pound (USD/GBP)? None of the options O 1.40/$ O $0.71/E O $1.40/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started