Answered step by step

Verified Expert Solution

Question

1 Approved Answer

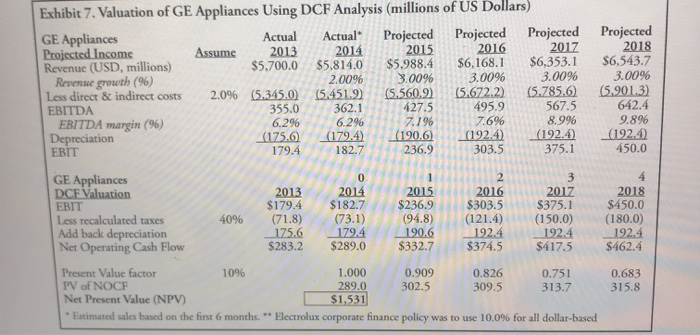

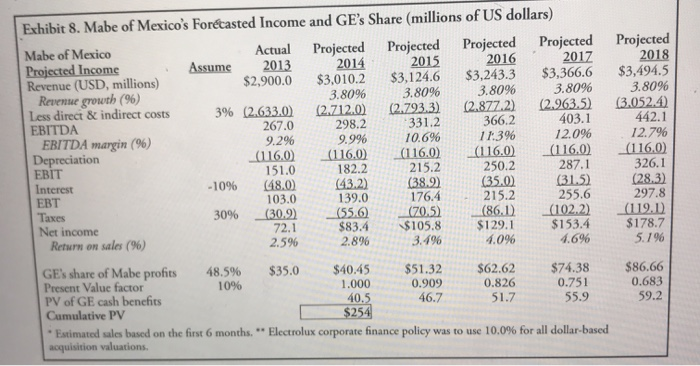

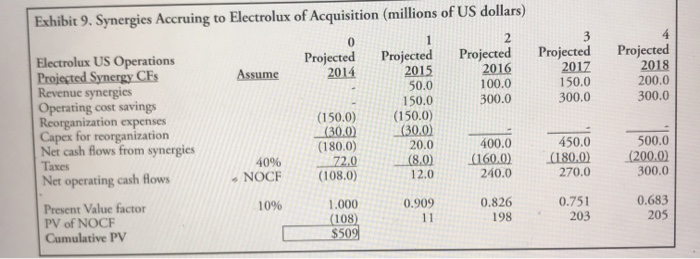

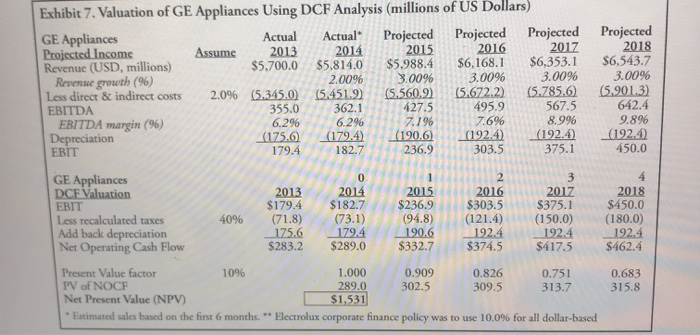

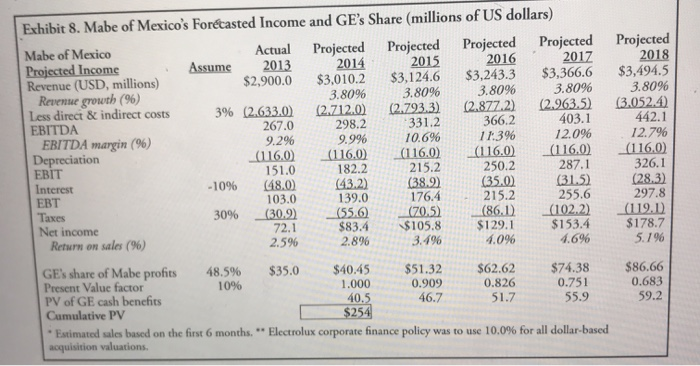

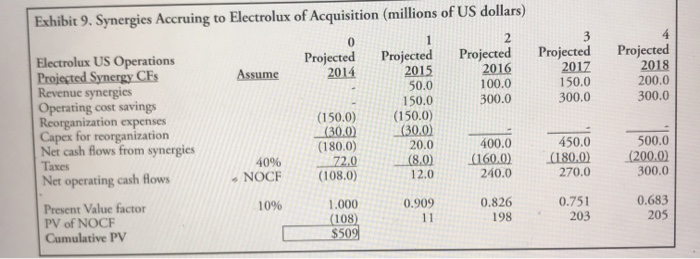

please need help calculating total value for two companies. can you please explain how got the answer. Total value = Ge Applications + Mabe Interest

please need help calculating total value for two companies. can you please explain how got the answer. Total value = Ge Applications + Mabe Interest + Synergies. please show how you got the work. Thanks

Exhibit 7. Valuation of GE Appliances Using DCF Analysis (millions of US Dollars) Projected Projected 2017 $6,353.1 3.00% (5.785.6) 567.5 Projected Projected 2015 $5.988.4 3.00% (5.560.9) 427.5 7.1 % (190.6) 236.9 Actual 2014 $5,814.0 2.00% (5,451.9) 362.1 6.2% (179.4) 182.7 Actual 2013 $5.700,0 GE Appliances Projected Income Revenue (USD, millions) Revenue growth (9%) Less direct & indirect costs 2018 $6,543.7 3,00% 2016 $6,168.1 Assume 3.00% (5.672.2) 495.9 7.6% (192.4) 303.5 (5.901.3) 642.4 2.0% ( 5.345.0) 355.0 6.2% EBITDA 9.8% (192.4) 450.0 8.9% EBITDA margin (9%) Depreciation EBIT (192.4) 375.1 (175.6 179.4 4 0 2 3 GE Appliances DCF Valuation EBIT 2014 $182.7 (73.1) 179.4 $289.0 2013 $179.4 (71.8) 175.6 $283.2 2015 2016 $303.5 (121.4) 192.4 $374.5 2017 $375.1 (150.0) 192.4 $417.5 2018 $236.9 (94.8) 190.6 $332.7 $450.0 (180.0) 192.4 $462.4 Less recalculated taxes Add back depreciation Net Operating Cash Flow 40% Present Value factor PV of NOCF Net Present Value (NPV) 1.000 0.909 0.826 10% 0.751 0.683 289.0 302.5 309.5 315.8 313.7 $1,531 Estimated sales based on the first 6 months. **Electrolux corporate finance policy was to use 10.0% for all dollar-based Exhibit 8. Mabe of Mexico's Fortasted Income and GE's Share (millions of US dollars) Projected 2018 $3,494.5 3.80% Projected Projected Actual Projected Projected 2015 $3,124.6 3.80% (2.793.3) 331.2 10.6% Mabe of Mexico 2016 2017 2014 $3,010.2 2013 $2,900.0 Projected Income Revenue (USD, millions) Revenue growth (9%) Less direct & indirect costs EBITDA EBITDA margin (%) Depreciation EBIT Interest EBT Assume $3,366.6 $3,243.3 3.80% (2.963.5) 403.1 12.0% 3.80% (2.877.2) 366.2 11.3% (116.0 250.2 (35.0) 215.2 (86.1) $129.1 4.0 % 3.80% (3.052.4) 442.1 12.79% (116.0) 326.1 (28.3) 297.8 (2.712.0) 298.2 9.9% (116.0) 182.2 (43.2) 139.0 (55.6) $83.4 2.89% 3% (2.633.0) 267.0 9.2% (16.0) 151.0 (48.0) 103.0 (30.9) 72.1 2.5% (116.0) 287.1 (31.5) 255.6 (102.2) $153.4 4.6% (116.0) 215.2 (38.9) 176.4 -10% (119.1) $178.7 5.19% (70.5) $105.8 3.4% 30% Taxes Net income Return on sales (%) $86.66 0.683 59.2 $62.62 $74.38 0.751 55.9 $51.32 $40.45 1.000 40.5 $254 $35.0 GE's share of Mabe profits Present Value factor PV of GE cash benefits Cumulative PV 48.5% 10% 0,826 0.909 46.7 51.7 Estimated sales based on the first 6 months. Electrolux corporate finance policy acquisition valuations was to use 10,0% for all dollar-based Exhibit 9. Synergies Accruing to Electrolux of Acquisition (millions of US dollars) 2 0 Projected 2018 200,0 Projected 2017 150.0 300.0 Projected 2016 100.0 Projected 2015 50.0 Projected 2014 Electrolux US Operations Projected Synergy CEs Revenue synergies Operating cost savings Reorganization expenses Capex for reorganization Net cash flows from synergies Taxes Assume 300.0 300.0 150.0 (150.0) (30.0) 20.0 (150.0) (30.0) (180.0) 72.0 (108.0) 500.0 (200.0) 300.0 450.0 (180.0) 270.0 400,0 (160.0) 240.0 (8.0) 40% 12.0 NOCF Net operating cash flows 0,683 205 0.751 203 0.826 0.909 1,000 10% Present Value factor PV of NOCF Cumulative PV 198 11 (108) $509 Exhibit 7. Valuation of GE Appliances Using DCF Analysis (millions of US Dollars) Projected Projected 2017 $6,353.1 3.00% (5.785.6) 567.5 Projected Projected 2015 $5.988.4 3.00% (5.560.9) 427.5 7.1 % (190.6) 236.9 Actual 2014 $5,814.0 2.00% (5,451.9) 362.1 6.2% (179.4) 182.7 Actual 2013 $5.700,0 GE Appliances Projected Income Revenue (USD, millions) Revenue growth (9%) Less direct & indirect costs 2018 $6,543.7 3,00% 2016 $6,168.1 Assume 3.00% (5.672.2) 495.9 7.6% (192.4) 303.5 (5.901.3) 642.4 2.0% ( 5.345.0) 355.0 6.2% EBITDA 9.8% (192.4) 450.0 8.9% EBITDA margin (9%) Depreciation EBIT (192.4) 375.1 (175.6 179.4 4 0 2 3 GE Appliances DCF Valuation EBIT 2014 $182.7 (73.1) 179.4 $289.0 2013 $179.4 (71.8) 175.6 $283.2 2015 2016 $303.5 (121.4) 192.4 $374.5 2017 $375.1 (150.0) 192.4 $417.5 2018 $236.9 (94.8) 190.6 $332.7 $450.0 (180.0) 192.4 $462.4 Less recalculated taxes Add back depreciation Net Operating Cash Flow 40% Present Value factor PV of NOCF Net Present Value (NPV) 1.000 0.909 0.826 10% 0.751 0.683 289.0 302.5 309.5 315.8 313.7 $1,531 Estimated sales based on the first 6 months. **Electrolux corporate finance policy was to use 10.0% for all dollar-based Exhibit 8. Mabe of Mexico's Fortasted Income and GE's Share (millions of US dollars) Projected 2018 $3,494.5 3.80% Projected Projected Actual Projected Projected 2015 $3,124.6 3.80% (2.793.3) 331.2 10.6% Mabe of Mexico 2016 2017 2014 $3,010.2 2013 $2,900.0 Projected Income Revenue (USD, millions) Revenue growth (9%) Less direct & indirect costs EBITDA EBITDA margin (%) Depreciation EBIT Interest EBT Assume $3,366.6 $3,243.3 3.80% (2.963.5) 403.1 12.0% 3.80% (2.877.2) 366.2 11.3% (116.0 250.2 (35.0) 215.2 (86.1) $129.1 4.0 % 3.80% (3.052.4) 442.1 12.79% (116.0) 326.1 (28.3) 297.8 (2.712.0) 298.2 9.9% (116.0) 182.2 (43.2) 139.0 (55.6) $83.4 2.89% 3% (2.633.0) 267.0 9.2% (16.0) 151.0 (48.0) 103.0 (30.9) 72.1 2.5% (116.0) 287.1 (31.5) 255.6 (102.2) $153.4 4.6% (116.0) 215.2 (38.9) 176.4 -10% (119.1) $178.7 5.19% (70.5) $105.8 3.4% 30% Taxes Net income Return on sales (%) $86.66 0.683 59.2 $62.62 $74.38 0.751 55.9 $51.32 $40.45 1.000 40.5 $254 $35.0 GE's share of Mabe profits Present Value factor PV of GE cash benefits Cumulative PV 48.5% 10% 0,826 0.909 46.7 51.7 Estimated sales based on the first 6 months. Electrolux corporate finance policy acquisition valuations was to use 10,0% for all dollar-based Exhibit 9. Synergies Accruing to Electrolux of Acquisition (millions of US dollars) 2 0 Projected 2018 200,0 Projected 2017 150.0 300.0 Projected 2016 100.0 Projected 2015 50.0 Projected 2014 Electrolux US Operations Projected Synergy CEs Revenue synergies Operating cost savings Reorganization expenses Capex for reorganization Net cash flows from synergies Taxes Assume 300.0 300.0 150.0 (150.0) (30.0) 20.0 (150.0) (30.0) (180.0) 72.0 (108.0) 500.0 (200.0) 300.0 450.0 (180.0) 270.0 400,0 (160.0) 240.0 (8.0) 40% 12.0 NOCF Net operating cash flows 0,683 205 0.751 203 0.826 0.909 1,000 10% Present Value factor PV of NOCF Cumulative PV 198 11 (108) $509

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started