Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please need help doing this project, can someone do this. It will probably have 200 lines of code I added some detail to make it

Please need help doing this project, can someone do this. It will probably have 200 lines of code I added some detail to make it easier. Thanks

In c++

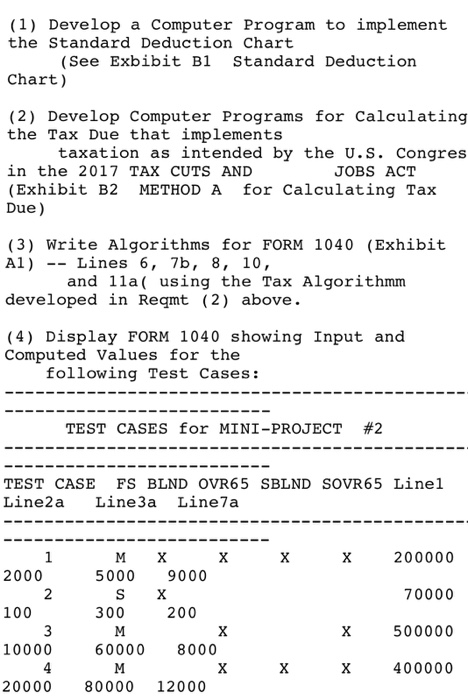

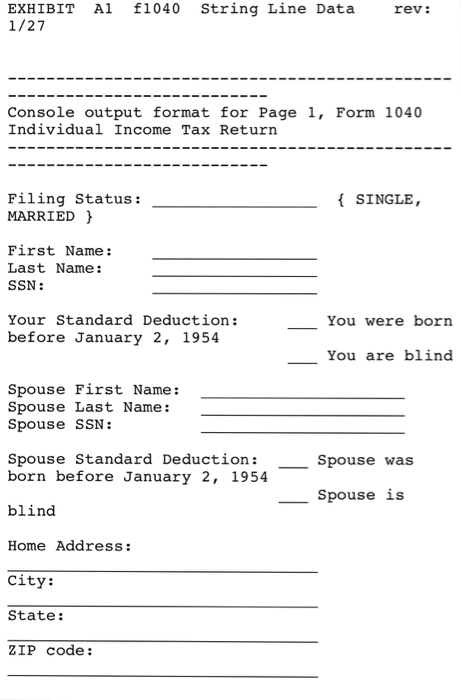

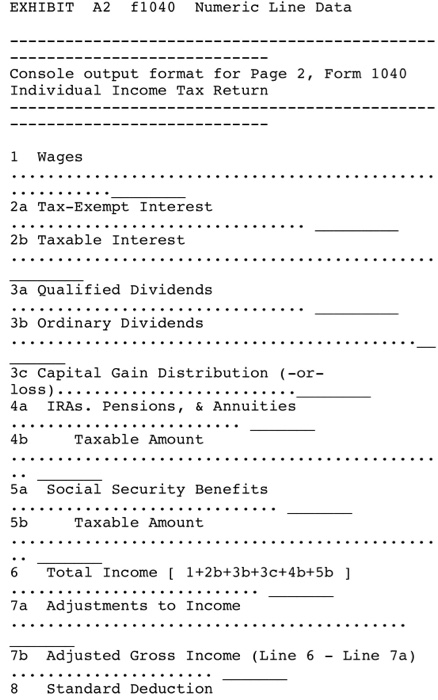

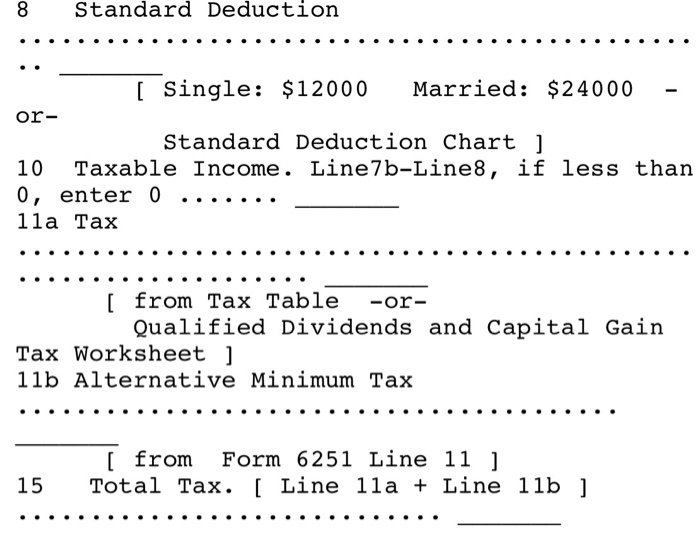

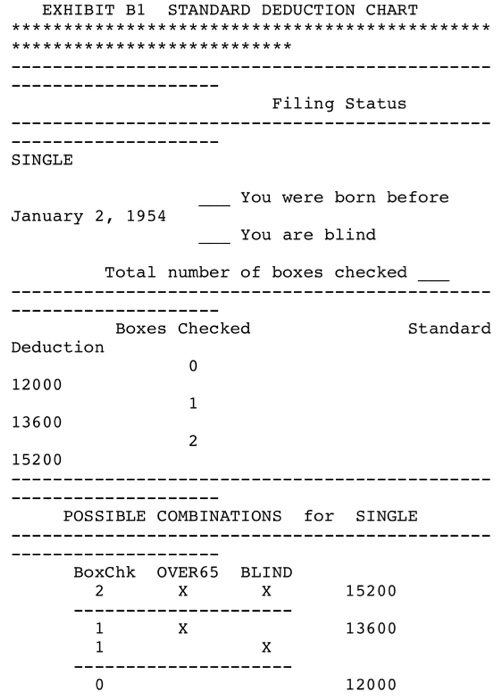

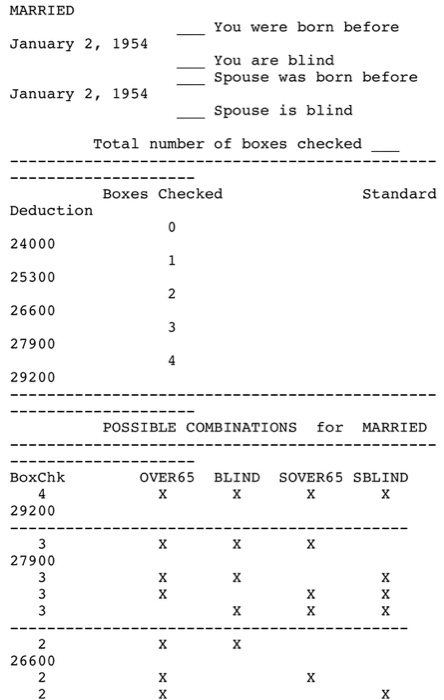

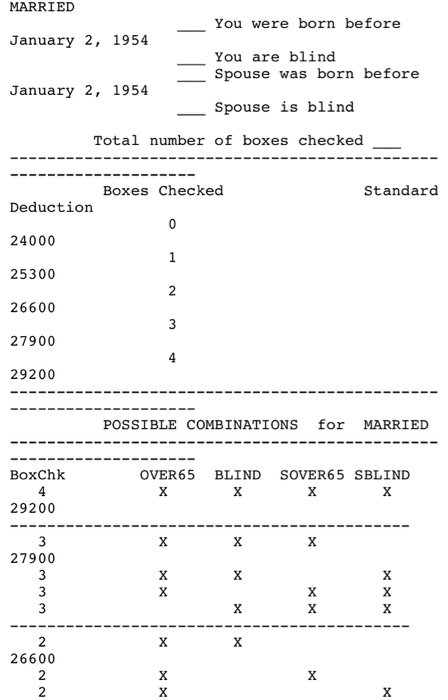

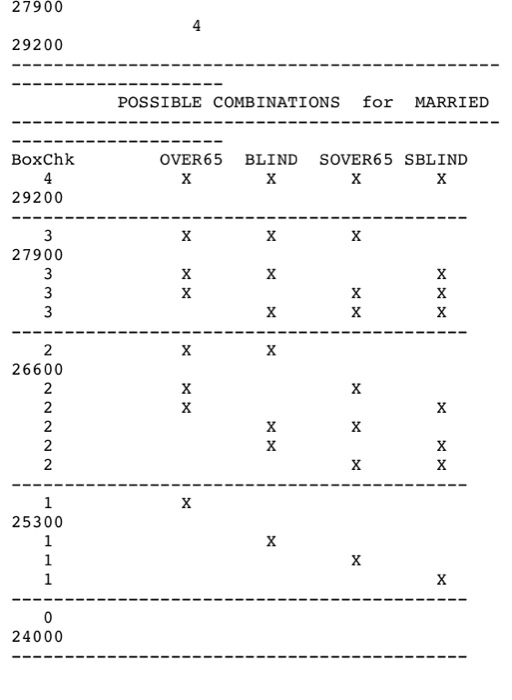

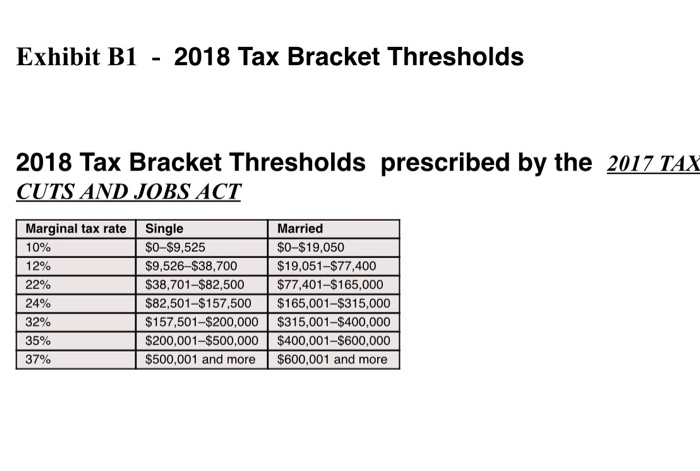

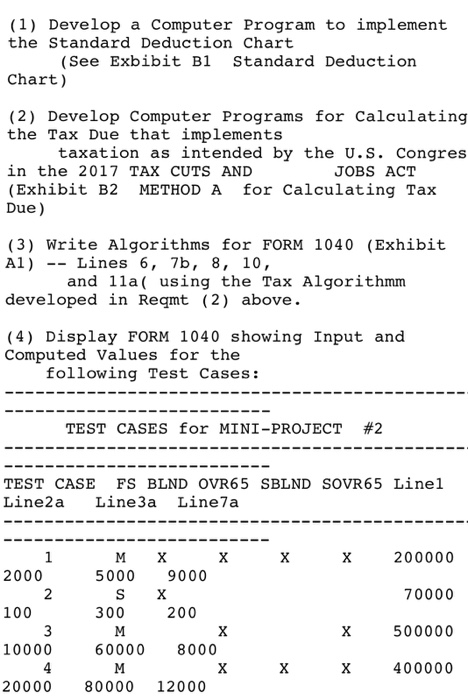

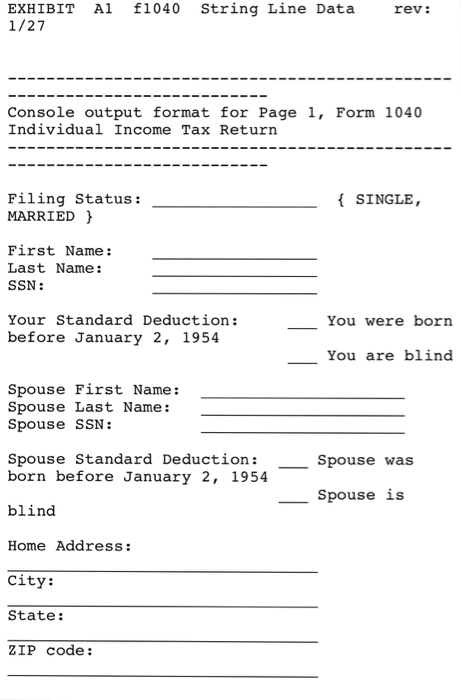

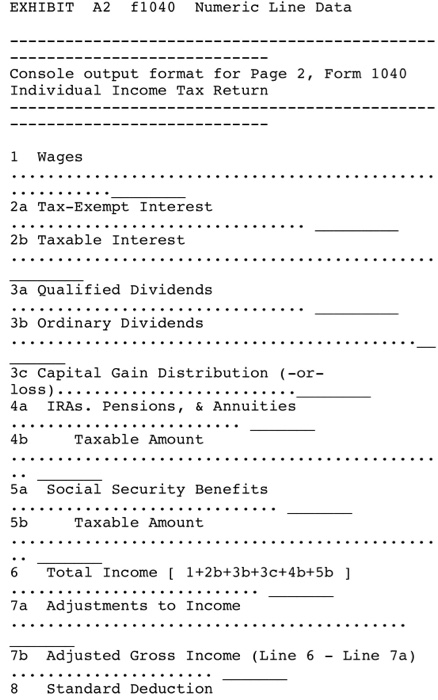

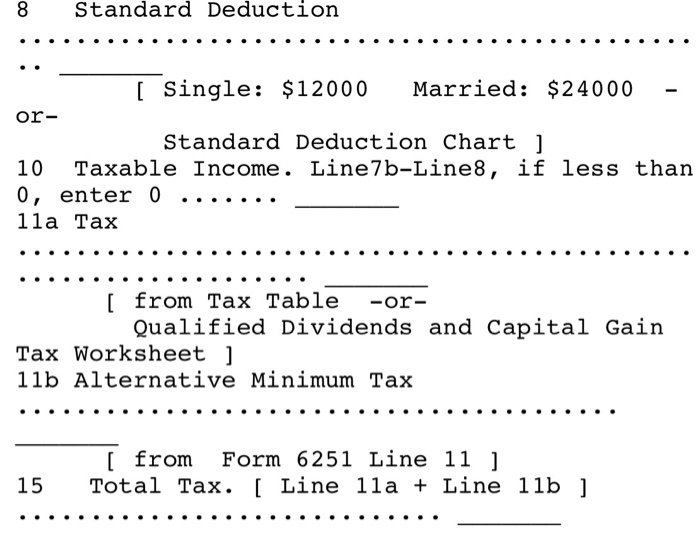

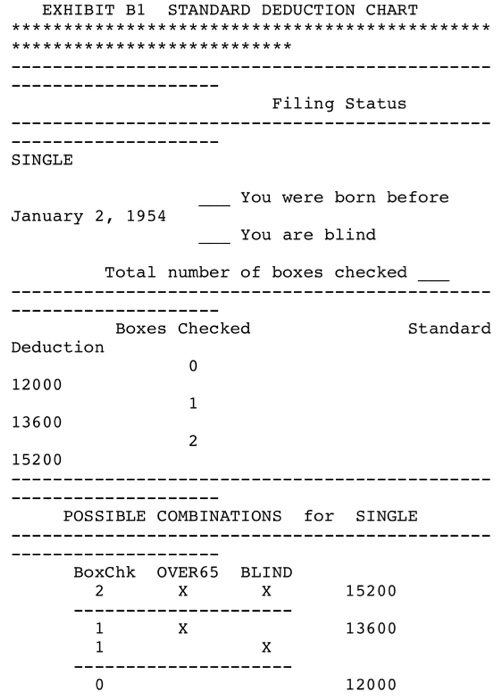

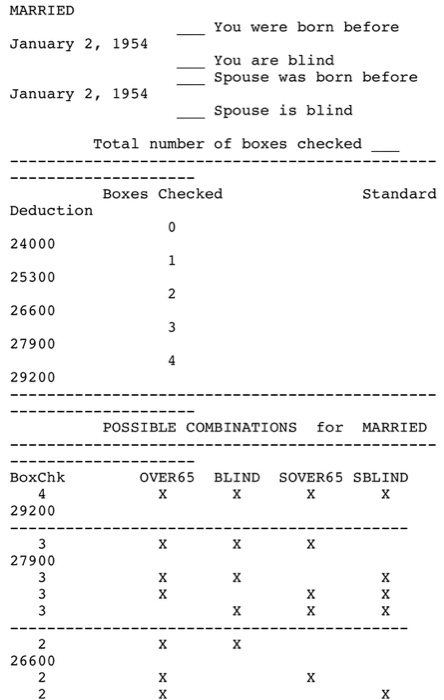

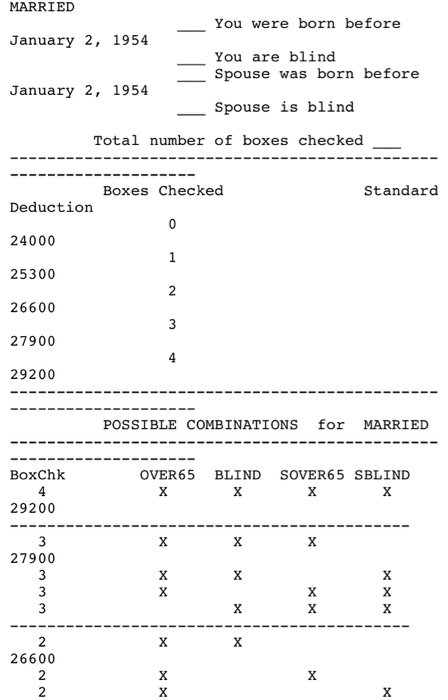

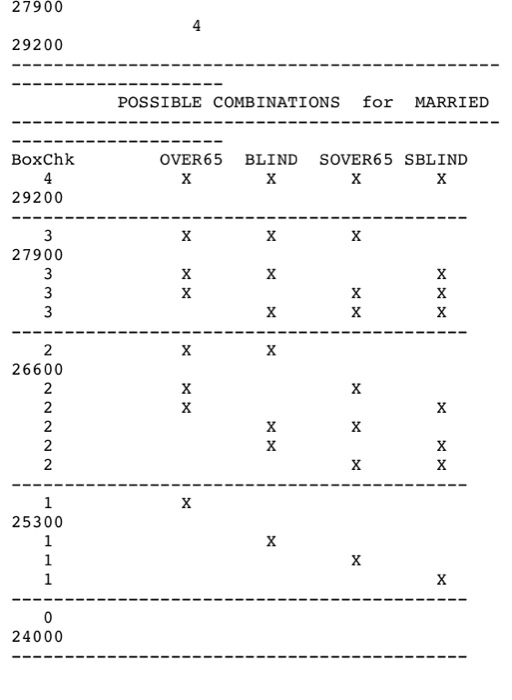

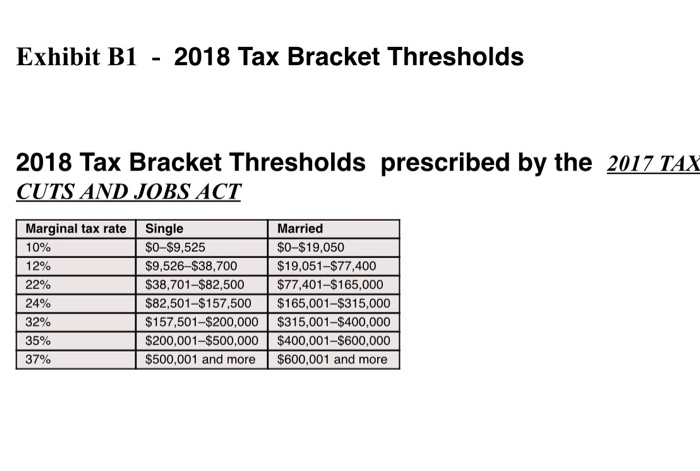

(1) Develop a Computer Program to implement the Standard Deduction Chart (See Exbbit B1 Standard Deduction Chart) (2) Develop Computer Programs for Calculating the Tax Due that implements taxation as intended by the U.S. Congres in the 2017 TAX CUTS AND (Exhibit B2 METHOD A for Calculating Tax Due JOBS ACT (3) Write Algorithms for FORM 1040 (Exhibit A1) -- Lines 6, 7b, 8, 10, and 1la ( using the Tax Algorithmm developed in Reqmt (2) above. (4) Display FORM 1040 showing Input and Computed Values for the following Test Cases: TEST CASES for MINI-PROJECT #2 TEST CASE FS BLND OVR65 SBLND SOVR65 Linel Line2a Line3a Line7a M X 2000 100 10000 20000 80000 12000 5000 9000 300 60000 8000 200000 70000 500000 400000 200 EXHIBIT Al f1040 String Line Data 1/27 rev: Console output format for Page 1, Form 1040 Individual Income Tax Return Filing Status: MARRIEDh SINGLE, First Name: Last Name: SSN: Your Standard Deduction: before January 2, 1954 You were born You are blind Spouse First Name: Spouse Last Name: Spouse SSN: Spouse Standard Deduction: born before January 2, 1954 Spouse was Spouse is blind Home Address City: State: ZIP Code: EXHIBIT A2 f1040 Numeric Line Data Console output format for Page 2, Form 1040 Individual Income Tax Return 1 Wages 2a Tax-Exempt Interest 2b Taxable Interest 3a Qualified Dividends 3b Ordinary Dividends 3c Capital Gain Distribution (-or- 4a IRAs. Pensions, & Annuities 4b Taxable Amount 5a Social Security Benefits 5b Taxable Amount 6 Total Income 1+2b+3b+3c+4b+5b 1 7a Adjustments to Income 7b Adjusted Gross Income (Line 6 - Line 7a) 8 Standard Deduction 8 Standard Deduction [ Single: $12000 Married: $24000 or- Standard Deduction Chart] 10 Taxable Income. Line7b-Line8, if less than 0, enter 0 .. . . 1la Tax [ from Tax Table -or- Qualified Dividends and Capital Gain Tax Worksheet ] 11b Alternative Minimum Tax [ from Form 6251 Line 11 ] 15 Total Tax. [ Line 1la + Line 1lb ] EXHIBIT Bl STANDARD DEDUCTION CHART Filing Status SINGLE You were born before January 2, 1954 You are blind Total number of boxes checked Boxes Checked Standard Deduction 12000 13600 15200 POSSIBLE COMBINATIONS for SINGLE BoxChk OVER65 BLIND 15200 13600 12000 MARRIED You were born before January 2, 1954 You are blind Spouse was born before January 2, 1954 spouse is blind Total number of boxes checked Boxes Checked Standard Deduction 24000 25300 26600 27900 29200 3 POSSIBLE COMBINATIONS for MARRIED BoxChk OVER65 BLIND SOVER65 SBLIND 29200 27900 26600 2 MARRIED You were born before January 2, 1954 You are blind Spouse was born before January 2, 1954 Spouse is blind Total number of boxes checked Boxes Checked Standard Deduction 24000 25300 26600 27900 29200 POSSIBLE COMBINATIONS for MARRIED BoxChk OVER65 BLIND SOVER65 SBLIND 29200 27900 3 26600 27900 29200 POSSIBLE COMBINATIONS for MARRIED BoxChk OVER65 BLIND SOVER65 SBLIND 29200 27900 26600 25300 24000 Exhibit B1 - 2018 Tax Bracket Thresholds 2018 Tax Bracket Thresholds prescribed by the 2017 TAX CUTS AND JOBS ACT Married $0-$19,050 $19,051-$77,400 Marginal tax rate 10% 12% 22% 2490 32% 35% 37% Single $0-$9,525 $9,526-$38,700 $38,701-$82,500 $77,401-$165,000 $82,501-$157,500 $165,001-$315,000 $157,501-$200,000 $315,001-$400,000 $200,001-$500,000 $400,001-$600,000 $500,001 and more $600,001 and more Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started