Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please need help. the first pictures questions are 1 and the last 1 is another question please. The financial statements of Snapit Company are given

please need help. the first pictures questions are 1 and the last 1 is another question please.

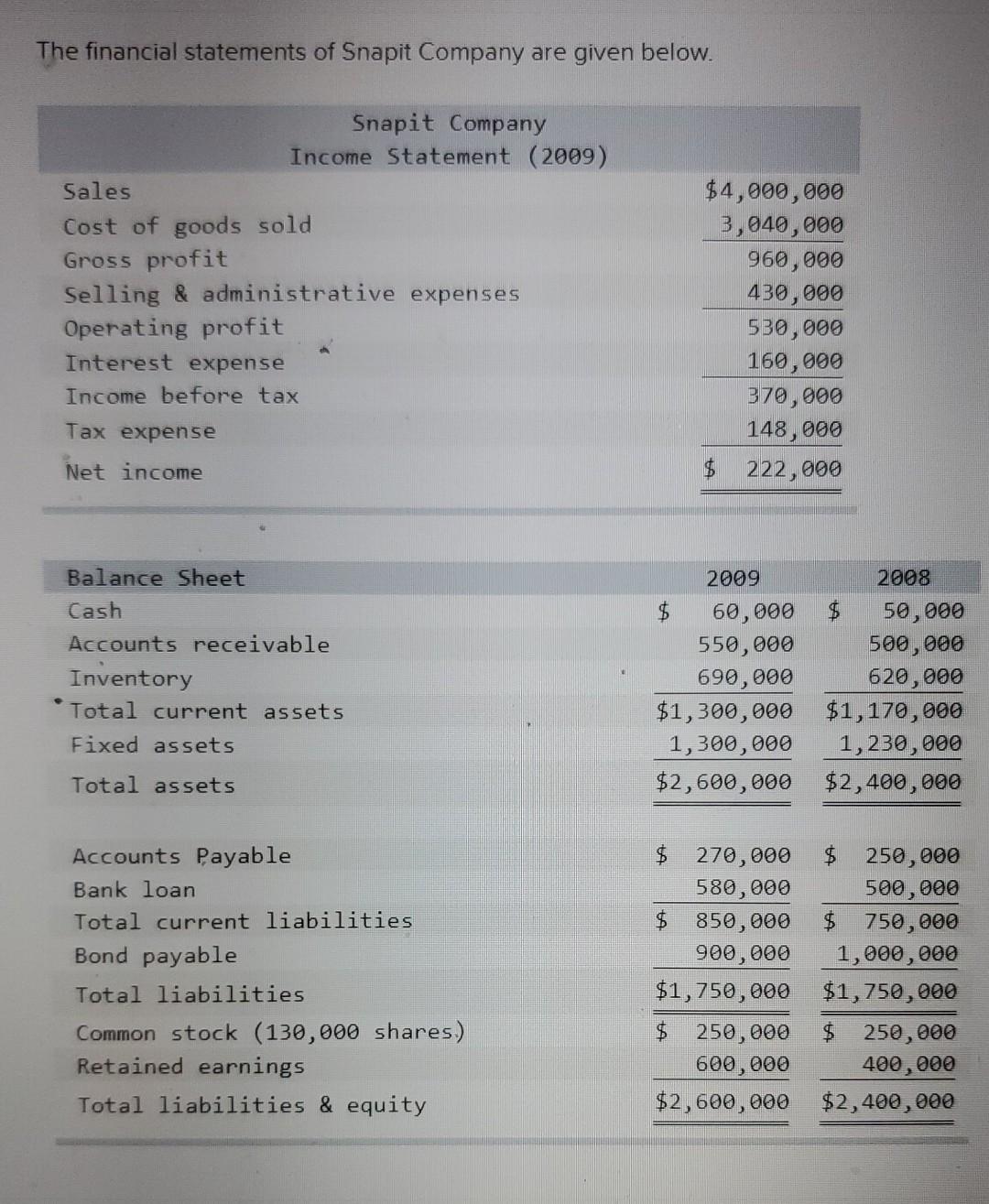

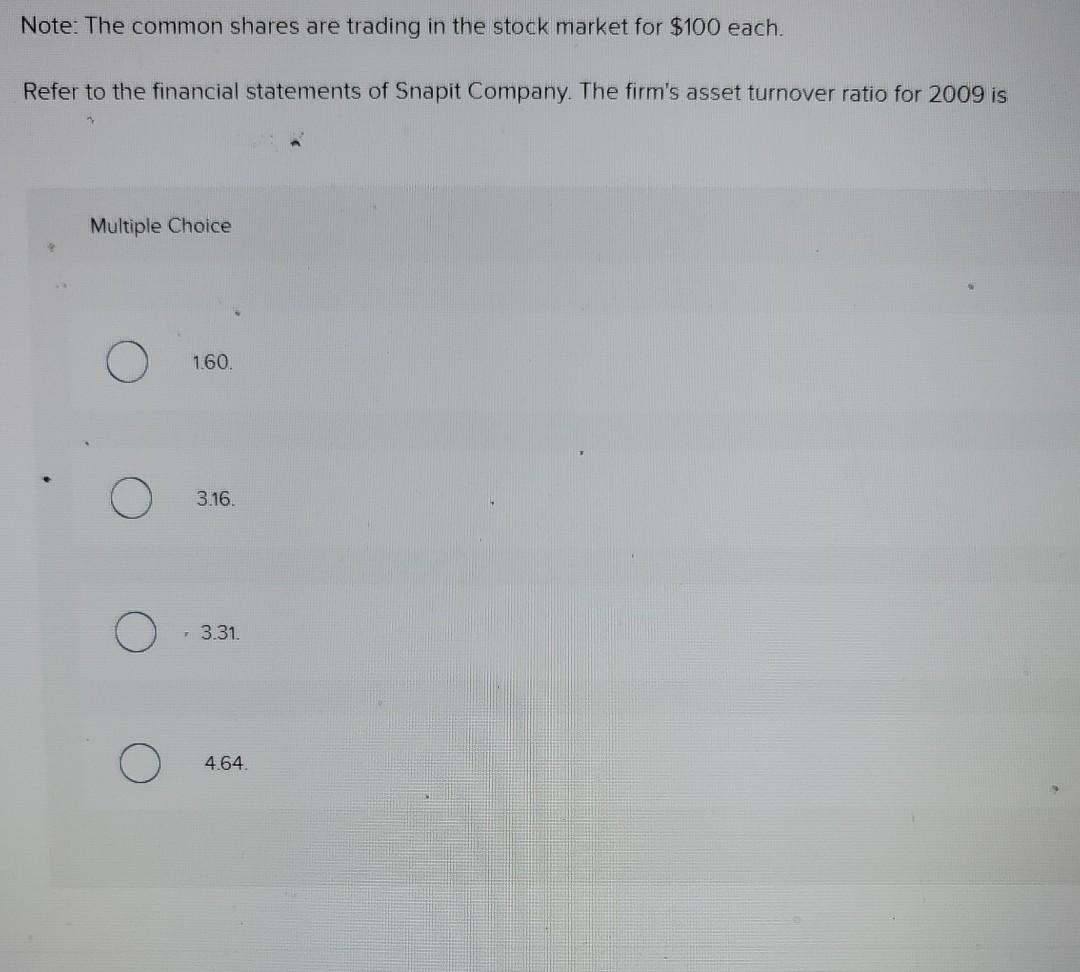

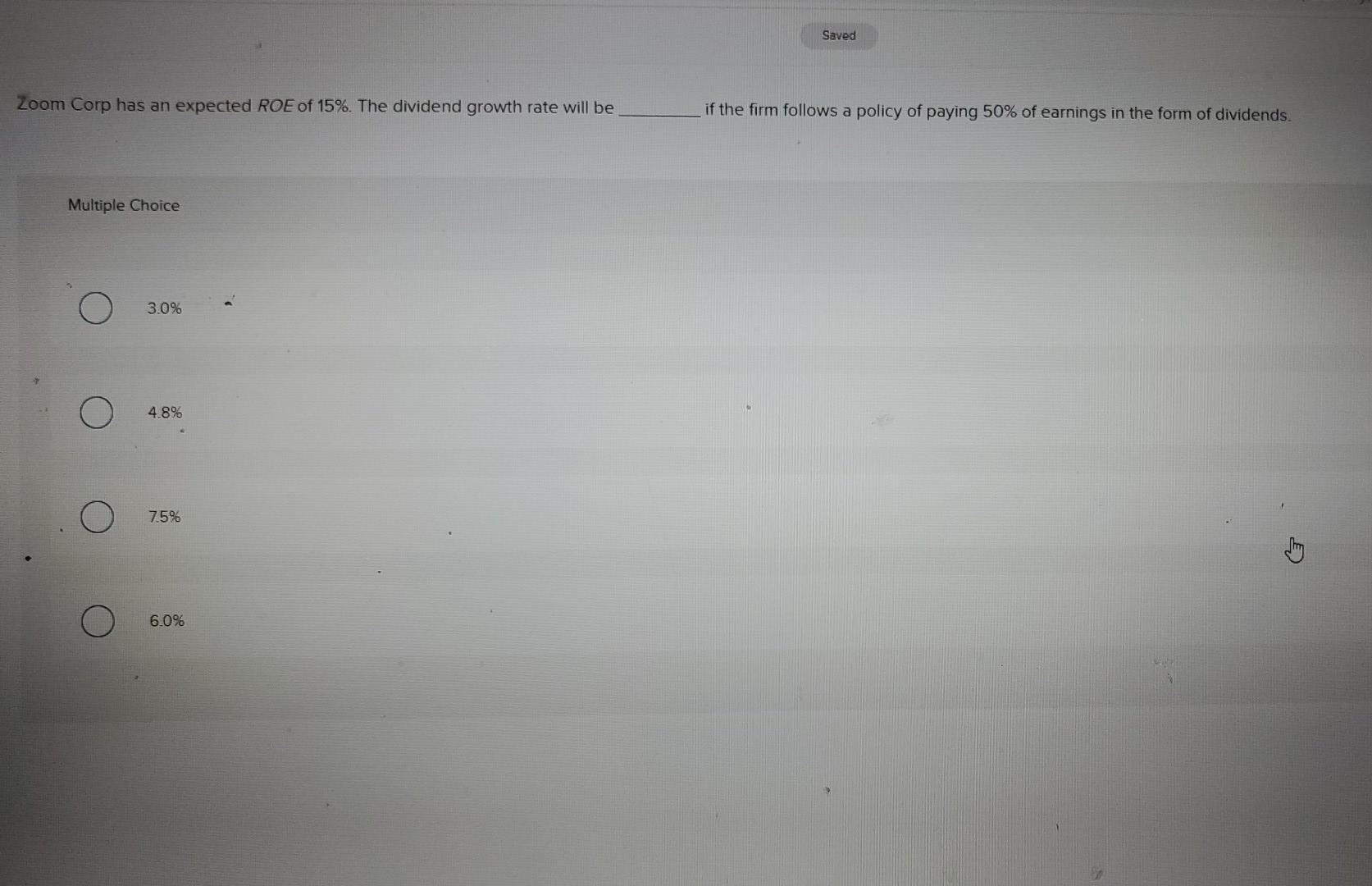

The financial statements of Snapit Company are given below. Snapit Company Income Statement (2009) Sales Cost of goods sold Gross profit Selling & administrative expenses Operating profit Interest expense Income before tax $4,000,000 3,040,000 960,000 430,000 530,000 160,000 370,000 148,000 222,000 Tax expense Net income Balance Sheet Cash Accounts receivable Inventory Total current assets Fixed assets 2009 60,000 550,000 690,000 $1,300,000 1,300,000 $2,600,000 2008 50,000 500,000 620,000 $1,170,000 1,230,000 $2,400,000 Total assets Accounts Payable Bank loan Total current liabilities Bond payable Total liabilities Common stock (130,000 shares) Retained earnings Total liabilities & equity $ 270,000 580,000 $ 850,000 900,000 $1,750,000 $ 250,000 600,000 $2,600,000 $ 250,000 500,000 $ 750,000 1,000,000 $1,750,000 $ 250,000 400,000 $2,400,000 Note: The common shares are trading in the stock market for $100 each. Refer to the financial statements of Snapit Company. The firm's asset turnover ratio for 2009 is Multiple Choice 1.60. 3.16. - 3.31 4.64 Saved Zoom Corp has an expected ROE of 15%. The dividend growth rate will be if the firm follows a policy of paying 50% of earnings in the form of dividends. Multiple Choice 3.0% 4.8% O 7.5% ) 6.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started