Please need help with this ASAP

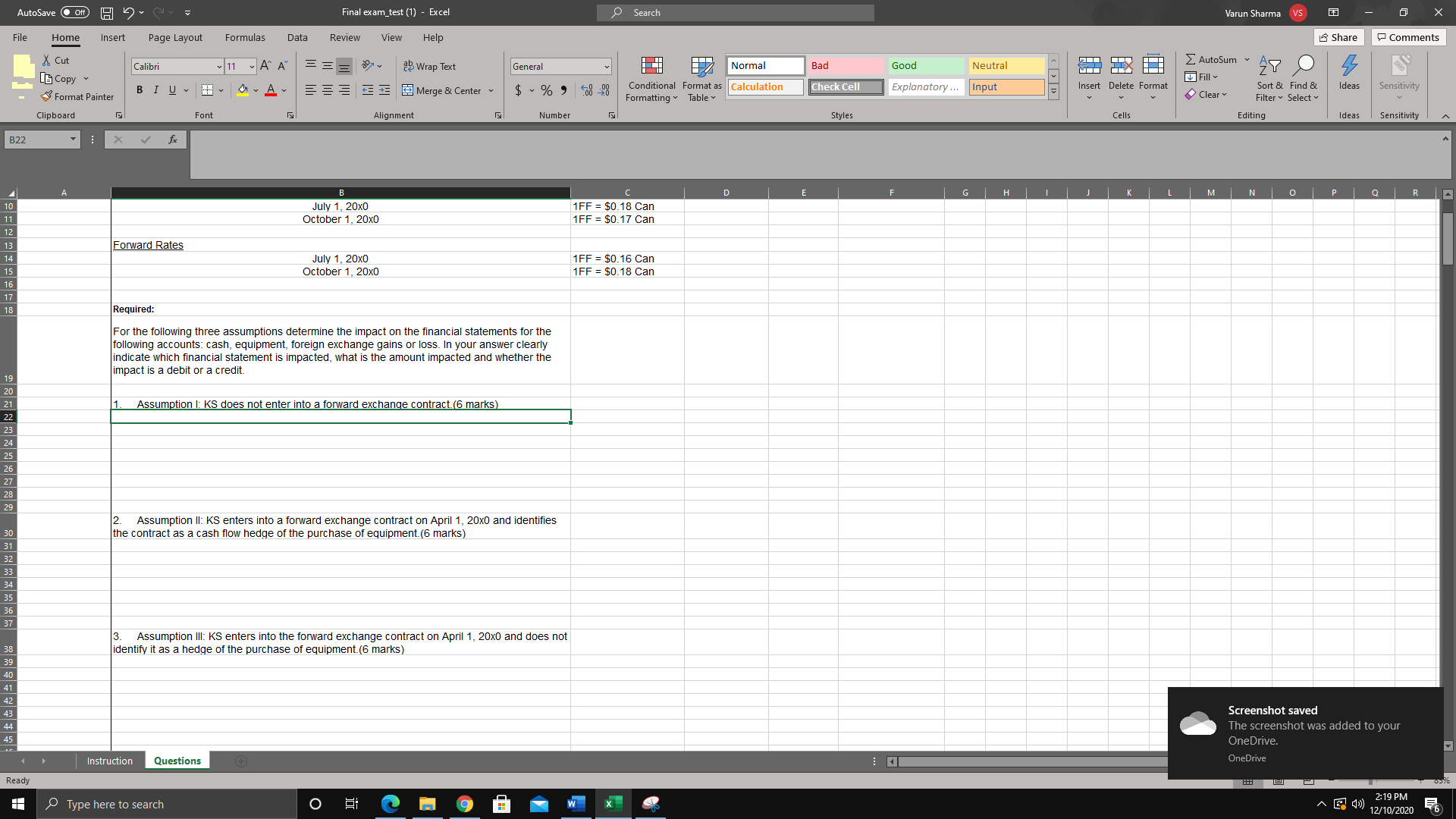

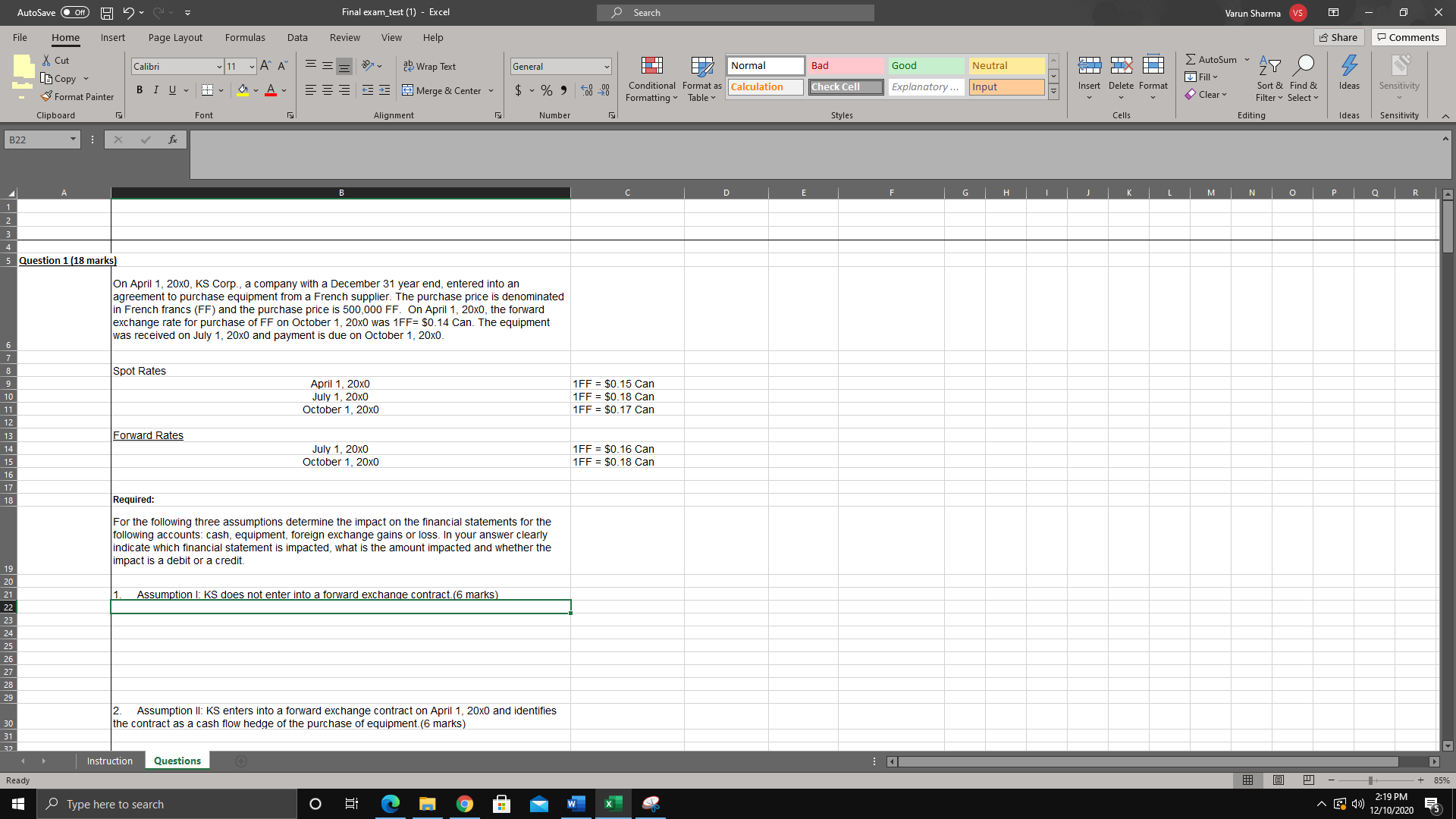

AutoSave . Off HD - Q Final exam_test (1) - Excel Search Varun Sharma V File Home Insert Page Layout Formulas Data Review View Help Share Comments & Cut Calibri 11 ~ A" A ab Wrap Text Normal Bad Good Neutral E AutoSum = = = General [G Copy Fill BIULA 1 = E Merge & Center $ ~ % 9 00 20 Conditional Format as Calculation Check Cell Explanatory ... Input nsert Delete Format Sort & Find & deas Sensitivity Format Painter Formatting * Table Clear Filter ~ Select v Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity B27 X V July 1, 20x0 1FF = $0.18 Can October 1, 20x0 1FF = $0.17 Can Forward Rates July 1, 20x0 1FF = $0.16 Can October 1, 20x0 1FF = $0.18 Can Required: For the following three assumptions determine the impact on the financial statements for the following accounts: cash, equipment, foreign exchange gains or loss. In your answer clearly indicate which financial statement is impacted, what is the amount impacted and whether the impact is a debit or a credit. Assumption I: KS does not enter into a forward exchange contract. (6 marks) 2. Assumption II: KS enters into a forward exchange contract on April 1, 20x0 and identifies the contract as a cash flow hedge of the purchase of equipment.(6 marks) Assumption III: KS enters into the forward exchange contract on April 1, 20x0 and does not dentify it as a hedge of the purchase of equipment.(6 marks) Screenshot saved The screenshot was added to your OneDrive. Instruction Questions OneDrive Ready Type here to search O HOW X 2:19 PM ~ [ ) 12/10/2020AutoSave . Off HD - Q Final exam_test (1) - Excel Search Varun Sharma VS File Home Insert Page Layout Formulas Data Review View Help 15 Share Comments & Cut Calibri * 11 ~ A" A = = = ab Wrap Text Normal Bad E AutoSum General Good Neutral [G Copy Fill BIULA E Merge & Center $ ~ % 9 00 20 Conditional Format as Calculation Check Cell Explanatory ... Input nsert Delete Format Sort & Find & deas Sensitivity Format Painter Formatting Table Clear Filter ~ Select v Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity B27 X Question 1 (18 marks) On April 1, 20x0, KS Corp., a company with a December 31 year end, entered into an agreement to purchase equipment from a French supplier. The purchase price is denominated in French francs (FF) and the purchase price is 500,000 FF. On April 1, 20x0, the forward exchange rate for purchase of FF on October 1, 20x0 was 1FF= $0.14 Can. The equipment was received on July 1, 20x0 and payment is due on October 1, 20x0. Spot Rates April 1, 20x0 1FF = $0.15 Can July 1, 20x0 1FF = $0.18 Can October 1, 20x0 1FF = $0.17 Can Forward Rates July 1, 20x0 1FF = $0.16 Can October 1, 20x0 1FF = $0.18 Can Required: For the following three assumptions determine the impact on the financial statements for the following accounts: cash, equipment, foreign exchange gains or loss. In your answer clearly indicate which financial statement is impacted, what is the amount impacted and whether the mpact is a debit or a credit. Assumption I: KS does not enter into a forward exchange contract.(6 marks) 2. Assumption II: KS enters into a forward exchange contract on April 1, 20x0 and identifies the contract as a cash flow hedge of the purchase of equipment. (6 marks) Instruction Questions Ready + 85% Type here to search O W X 2:19 PM ~ ) 12/10/2020