Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, need help with this exercise. I would appreciate, if you help me to solve the whole exercise. 3. Consider the Think-Big Development Co. problem

Please, need help with this exercise. I would appreciate, if you help me to solve the whole exercise.

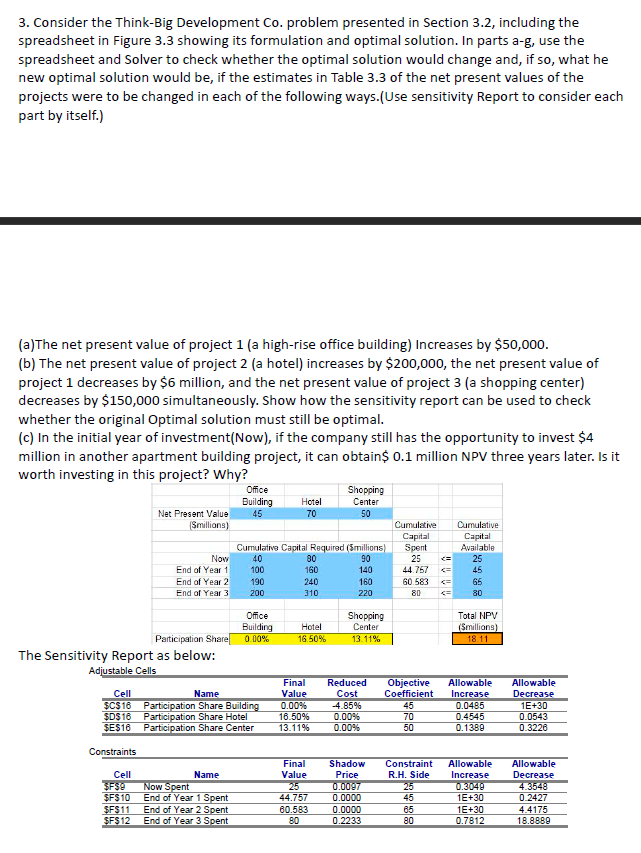

3. Consider the Think-Big Development Co. problem presented in Section 3.2, including the spreadsheet in Figure 3.3 showing its formulation and optimal solution. In parts a-g, use the spreadsheet and Solver to check whether the optimal solution would change and, if so, what he new optimal solution would be, if the estimates in Table 3.3 of the net present values of the projects were to be changed in each of the following ways.(Use sensitivity Report to consider each part by itself.) (a)The net present value of project 1 (a high-rise office building) Increases by $50,000. (b) The net present value of project 2 (a hotel) increases by $200,000, the net present value of project 1 decreases by $6 million, and the net present value of project 3 (a shopping center) decreases by $150,000 simultaneously. Show how the sensitivity report can be used to check whether the original Optimal solution must still be optimal. (c) In the initial year of investment(Now), if the company still has the opportunity to invest $4 million in another apartment building project, it can obtain $0.1 million NPV three years later. Is it worth investing in this proiect? Whv? The Sensitivity Report as below: Adiustable Colle 3. Consider the Think-Big Development Co. problem presented in Section 3.2, including the spreadsheet in Figure 3.3 showing its formulation and optimal solution. In parts a-g, use the spreadsheet and Solver to check whether the optimal solution would change and, if so, what he new optimal solution would be, if the estimates in Table 3.3 of the net present values of the projects were to be changed in each of the following ways.(Use sensitivity Report to consider each part by itself.) (a)The net present value of project 1 (a high-rise office building) Increases by $50,000. (b) The net present value of project 2 (a hotel) increases by $200,000, the net present value of project 1 decreases by $6 million, and the net present value of project 3 (a shopping center) decreases by $150,000 simultaneously. Show how the sensitivity report can be used to check whether the original Optimal solution must still be optimal. (c) In the initial year of investment(Now), if the company still has the opportunity to invest $4 million in another apartment building project, it can obtain $0.1 million NPV three years later. Is it worth investing in this proiect? Whv? The Sensitivity Report as below: Adiustable ColleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started