Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please need step by step calculation only Need combined projects solution please need don,t need simple calculation I solved just need to confirm my answers

please need step by step calculation

only Need combined projects solution please need don,t need simple calculation I solved just need to confirm my answers

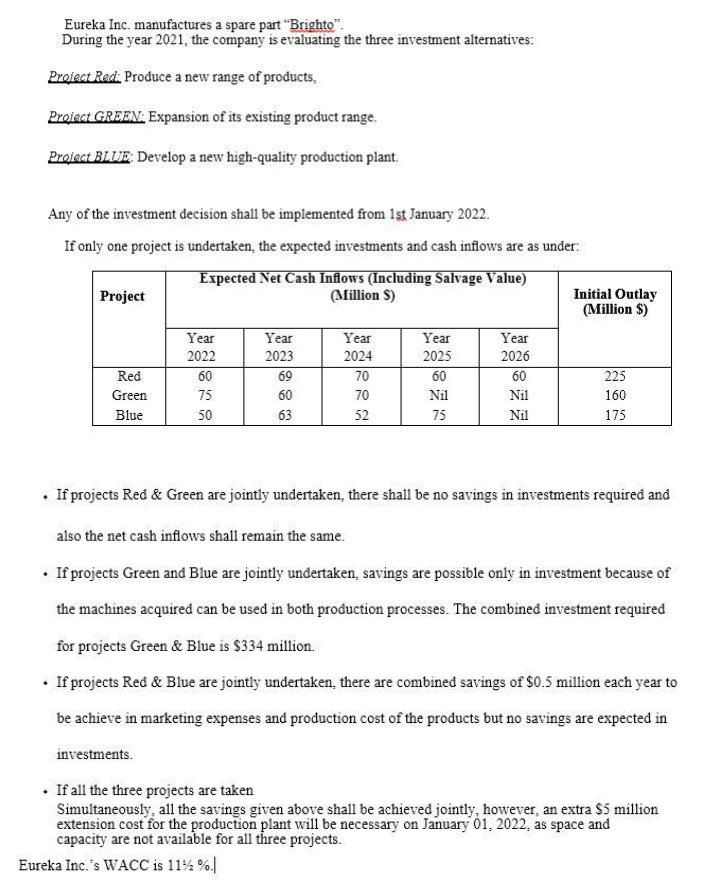

Eureka Inc. manufactures a spare part "Brighto". During the year 2021, the company is evaluating the three investment alternatives: Proiect Red: Produce a new range of products, Proiect GREEN: Expansion of its existing product range. Proiect BLUE: Develop a new high-quality production plant. Any of the investment decision shall be implemented from 1st January 2022. If only one project is undertaken, the expected investments and cash inflows are as under: Expected Net Cash Inflows (Including Salvage Value) Project (Million $) Initial Outlay (Million $) Year Year Year Year Year 2022 2023 2024 2026 Red 60 69 70 60 60 225 Green 75 60 70 Nil Nil 160 Blue 50 63 52 75 Nii 175 2025 If projects Red & Green are jointly undertaken, there shall be no savings in investments required and also the net cash inflows shall remain the same. If projects Green and Blue are jointly undertaken, savings are possible only in investment because of the machines acquired can be used in both production processes. The combined investment required for projects Green & Blue is $334 million. If projects Red & Blue are jointly undertaken, there are combined savings of $0.5 million each year to be achieve in marketing expenses and production cost of the products but no savings are expected in investments If all the three projects are taken Simultaneously, all the savings given above shall be achieved jointly, however, an extra $5 million extension cost for the production plant will be necessary on January 01, 2022, as space and capacity are not available for all three projects. Eureka Inc.'s WACC is 11% %. projects is more beneficial. REQUIREMENT (C): Calculate PBP, DPBP, NPV, Pl and IRR for each single project and for each combination of projects, if Tax Rate is 10% and salvage value is taxable. Salvage Values of Project Red, Green and Blue are 56, 54 and $2 (in millions), respectively. The Inflation Rate is Nil for all projects. Also, decide which single project or a combination of projects is more beneficial. Show all calculations in detail and clearly. Highlight the answers. Viva may be conducted as and when required. Eureka Inc. manufactures a spare part "Brighto". During the year 2021, the company is evaluating the three investment alternatives: Proiect Red: Produce a new range of products, Proiect GREEN: Expansion of its existing product range. Proiect BLUE: Develop a new high-quality production plant. Any of the investment decision shall be implemented from 1st January 2022. If only one project is undertaken, the expected investments and cash inflows are as under: Expected Net Cash Inflows (Including Salvage Value) Project (Million $) Initial Outlay (Million $) Year Year Year Year Year 2022 2023 2024 2026 Red 60 69 70 60 60 225 Green 75 60 70 Nil Nil 160 Blue 50 63 52 75 Nii 175 2025 If projects Red & Green are jointly undertaken, there shall be no savings in investments required and also the net cash inflows shall remain the same. If projects Green and Blue are jointly undertaken, savings are possible only in investment because of the machines acquired can be used in both production processes. The combined investment required for projects Green & Blue is $334 million. If projects Red & Blue are jointly undertaken, there are combined savings of $0.5 million each year to be achieve in marketing expenses and production cost of the products but no savings are expected in investments If all the three projects are taken Simultaneously, all the savings given above shall be achieved jointly, however, an extra $5 million extension cost for the production plant will be necessary on January 01, 2022, as space and capacity are not available for all three projects. Eureka Inc.'s WACC is 11% %. projects is more beneficial. REQUIREMENT (C): Calculate PBP, DPBP, NPV, Pl and IRR for each single project and for each combination of projects, if Tax Rate is 10% and salvage value is taxable. Salvage Values of Project Red, Green and Blue are 56, 54 and $2 (in millions), respectively. The Inflation Rate is Nil for all projects. Also, decide which single project or a combination of projects is more beneficial. Show all calculations in detail and clearly. Highlight the answers. Viva may be conducted as and when requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started