please note both snapshots below are related to one question.

please see full view of the document to provide management report as per questions below

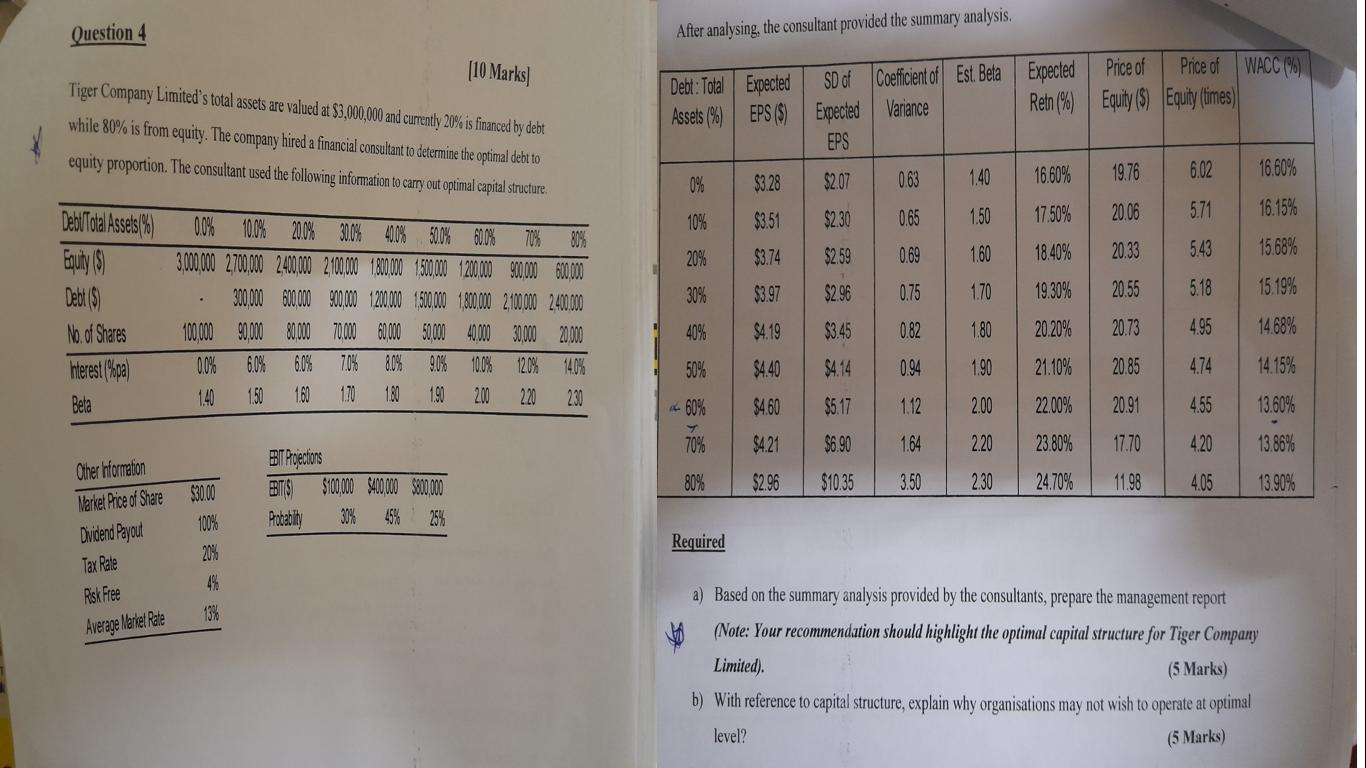

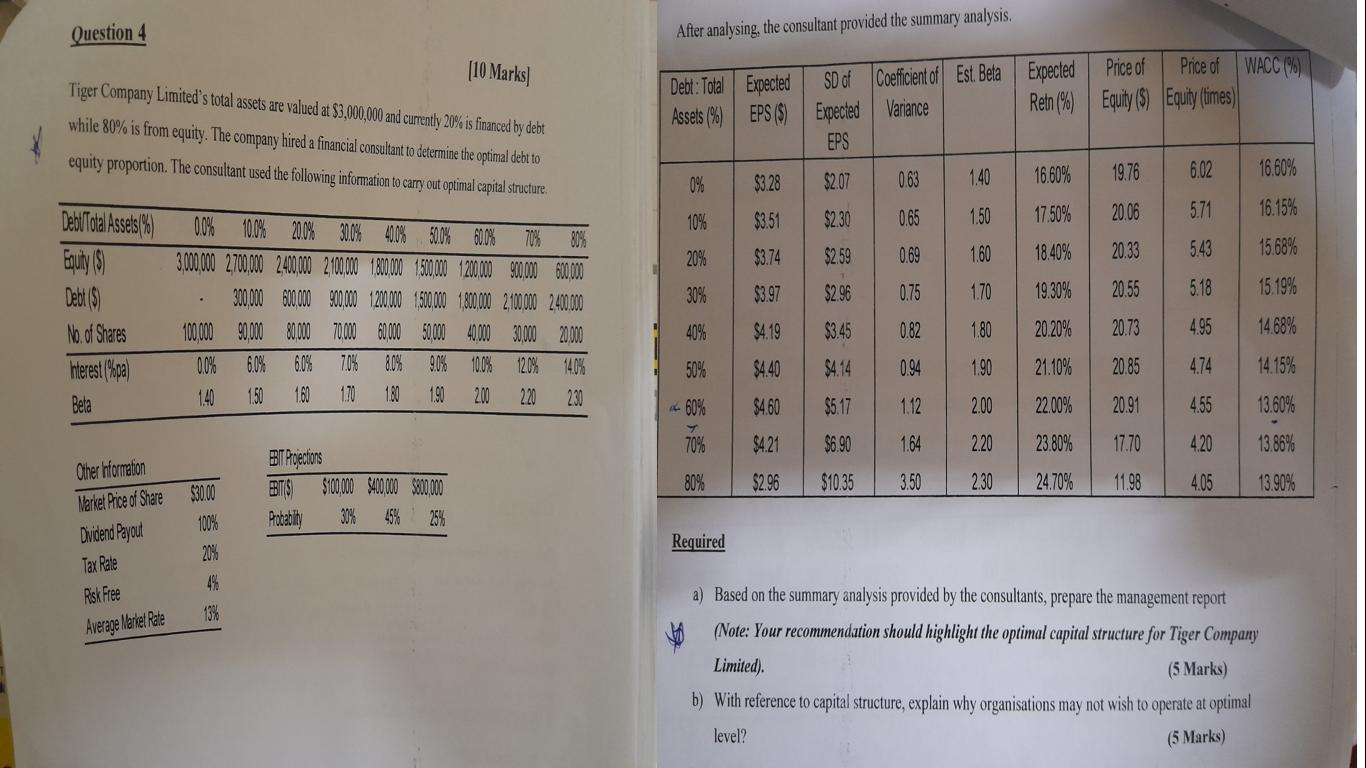

Question 4 After analysing, the consultant provided the summary analysis. [10 Marks) Tiger Company Limited's total assets are valued at $3,000,000 and currently 20% is financed by debt while 80% is from equity. The company hired a financial consultant to determine the optimal debt to equity proportion. The consultant used the following information to carry out optimal capital structure. DebiTotal Assets (%) Equity Debt ($ No. of Shares nterest (%pa Beta $3.74 0.0% 10.0% 20.0% 0.0% 400% 0.0% 60% 70% 80% 3,000,000 2700,000 2400,000 2100 000 1800,000 1500000 200 000 900000 600.000 300,000 600.000 900.000 200.000 1.500.000 1800,000 2,100,000 2400.000 100 000 90,000 80,000 70,000 60000 50000 40000 30,000 20.000 0,0% 6.0% 60% 70% 80% 90% 10.0% 20% 14,0% 140 1.50 160 1.70 180 1.90 200 220 230 Price of SD of Coefficient of Est. Beta Expected Price of WACC (%) Debt: Total Expected Assets (%) EPS($) Expected Variance Reto (%) Equity ($) Equity (times) EPS 0% $3.28 $2.07 0.63 1.40 16.60% 19.76 6.02 16.60% 10% $3.51 $2.30 0.65 1.50 17.50% 20.06 5.71 16.15% 20% $2.59 0.69 1.60 18.40% 20.33 5.43 15.68% 30% $3.97 $2.96 0.75 1.70 19.30% 20.55 5.18 15.19% 40% $4.19 $3.45 0.82 1.80 20.20% 20.73 4.95 14.68% 50% $4.40 $4.14 0.94 1.90 21.10% 20.85 4.74 14.15% -60% $4.60 $5.17 1.12 2.00 22.00% 20.91 4.55 13.60% 70% $4.21 $6.90 1.64 2.20 23.80% 17.70 4.20 13.86% BT Projections EBITIS $100,000 $400,000 $300,000 Probabilty 30% 45% 25% 80% $2.96 $10.35 3.50 2.30 24.70% 11.98 4.05 13.90% Other Wformation Market Price of Share Dividend Payout Tax Rate Risk Free $30,00 100% 20% Required 48 13% Average Market Rate a) Based on the summary analysis provided by the consultants, prepare the management report (Note: Your recommendation should highlight the optimal capital structure for Tiger Company Limited) (5 Marks) b) With reference to capital structure, explain why organisations may not wish to operate at optimal level? (5 Marks) Question 4 After analysing, the consultant provided the summary analysis. [10 Marks) Tiger Company Limited's total assets are valued at $3,000,000 and currently 20% is financed by debt while 80% is from equity. The company hired a financial consultant to determine the optimal debt to equity proportion. The consultant used the following information to carry out optimal capital structure. DebiTotal Assets (%) Equity Debt ($ No. of Shares nterest (%pa Beta $3.74 0.0% 10.0% 20.0% 0.0% 400% 0.0% 60% 70% 80% 3,000,000 2700,000 2400,000 2100 000 1800,000 1500000 200 000 900000 600.000 300,000 600.000 900.000 200.000 1.500.000 1800,000 2,100,000 2400.000 100 000 90,000 80,000 70,000 60000 50000 40000 30,000 20.000 0,0% 6.0% 60% 70% 80% 90% 10.0% 20% 14,0% 140 1.50 160 1.70 180 1.90 200 220 230 Price of SD of Coefficient of Est. Beta Expected Price of WACC (%) Debt: Total Expected Assets (%) EPS($) Expected Variance Reto (%) Equity ($) Equity (times) EPS 0% $3.28 $2.07 0.63 1.40 16.60% 19.76 6.02 16.60% 10% $3.51 $2.30 0.65 1.50 17.50% 20.06 5.71 16.15% 20% $2.59 0.69 1.60 18.40% 20.33 5.43 15.68% 30% $3.97 $2.96 0.75 1.70 19.30% 20.55 5.18 15.19% 40% $4.19 $3.45 0.82 1.80 20.20% 20.73 4.95 14.68% 50% $4.40 $4.14 0.94 1.90 21.10% 20.85 4.74 14.15% -60% $4.60 $5.17 1.12 2.00 22.00% 20.91 4.55 13.60% 70% $4.21 $6.90 1.64 2.20 23.80% 17.70 4.20 13.86% BT Projections EBITIS $100,000 $400,000 $300,000 Probabilty 30% 45% 25% 80% $2.96 $10.35 3.50 2.30 24.70% 11.98 4.05 13.90% Other Wformation Market Price of Share Dividend Payout Tax Rate Risk Free $30,00 100% 20% Required 48 13% Average Market Rate a) Based on the summary analysis provided by the consultants, prepare the management report (Note: Your recommendation should highlight the optimal capital structure for Tiger Company Limited) (5 Marks) b) With reference to capital structure, explain why organisations may not wish to operate at optimal level