Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Please note: Do answer fast as possible , try answer in 30 minutes and sent . It very urgent ) QUESTION 1 On 1 January

(Please note: Do answer fast as possible , try answer in 30 minutes and sent . It very urgent )

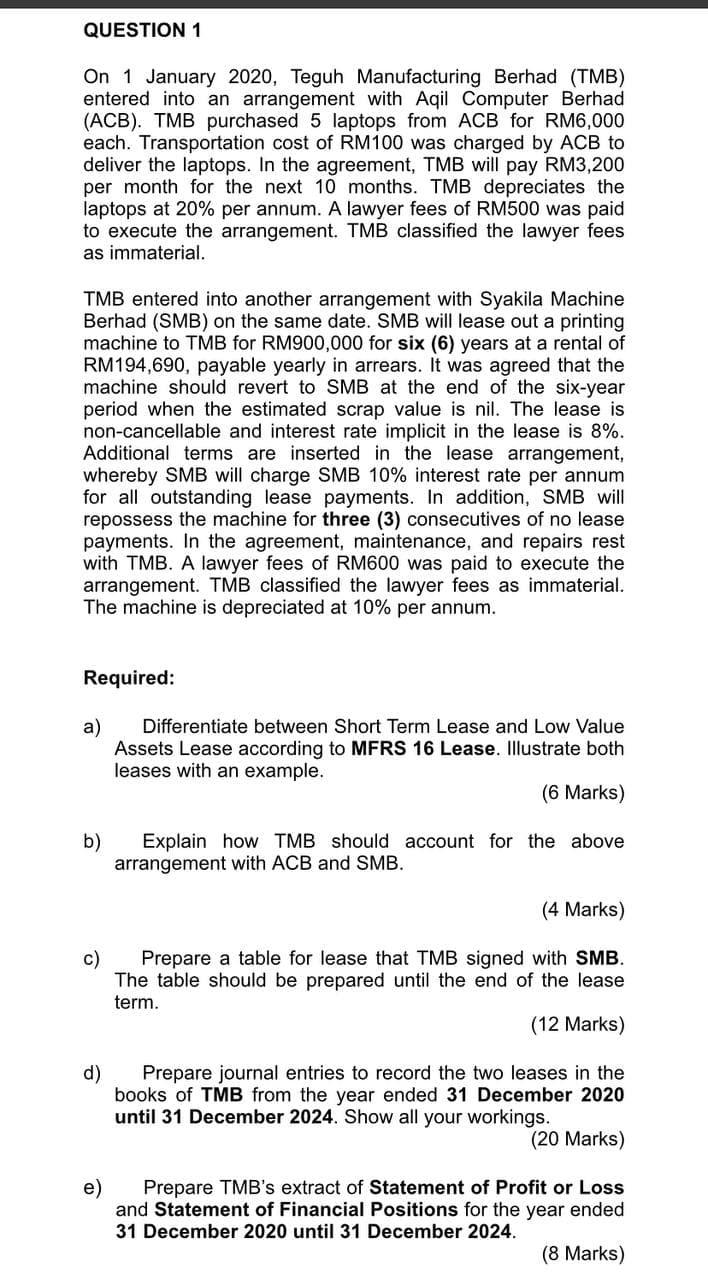

QUESTION 1 On 1 January 2020, Teguh Manufacturing Berhad (TMB) entered into an arrangement with Aqil Computer Berhad (ACB). TMB purchased 5 laptops from ACB for RM6,000 each. Transportation cost of RM100 was charged by ACB to deliver the laptops. In the agreement, TMB will pay RM3,200 per month for the next 10 months. TMB depreciates the laptops at 20% per annum. A lawyer fees RM500 was paid to execute the arrangement. TMB classified the lawyer fees as immaterial. TMB entered into another arrangement with Syakila Machine Berhad (SMB) on the same date. SMB will lease out a printing machine to TMB for RM900,000 for six (6) years at a rental of RM194,690, payable yearly in arrears. It was agreed that the machine should revert to SMB at the end of the six-year period when the estimated scrap value is nil. The lease is non-cancellable and interest rate implicit in the lease is 8%. Additional terms are inserted in the lease arrangement, whereby SMB will charge SMB 10% interest rate per annum for all outstanding lease payments. In addition, SMB will repossess the machine for three (3) consecutives of no lease payments. In the agreement, maintenance, and repairs rest with TMB. A lawyer fees of RM600 was paid to execute the arrangement. TMB classified the lawyer fees as immaterial. The machine is depreciated at 10% per annum. Required: a) Differentiate between Short Term Lease and Low Value Assets Lease according to MFRS 16 Lease. Illustrate both leases with an example. (6 Marks) b) Explain how TMB should account for the above arrangement with ACB and SMB. (4 Marks) C) Prepare a table for lease that TMB signed with SMB. The table should be prepared until the end of the lease term. (12 Marks) d) Prepare journal entries to record the two leases in the books of TMB from the year ended 31 December 2020 until 31 December 2024. Show all your workings. (20 Marks) e) Prepare TMB's extract of Statement of Profit or Loss and Statement of Financial Positions for the year ended 31 December 2020 until 31 December 2024. (8 Marks) QUESTION 1 On 1 January 2020, Teguh Manufacturing Berhad (TMB) entered into an arrangement with Aqil Computer Berhad (ACB). TMB purchased 5 laptops from ACB for RM6,000 each. Transportation cost of RM100 was charged by ACB to deliver the laptops. In the agreement, TMB will pay RM3,200 per month for the next 10 months. TMB depreciates the laptops at 20% per annum. A lawyer fees RM500 was paid to execute the arrangement. TMB classified the lawyer fees as immaterial. TMB entered into another arrangement with Syakila Machine Berhad (SMB) on the same date. SMB will lease out a printing machine to TMB for RM900,000 for six (6) years at a rental of RM194,690, payable yearly in arrears. It was agreed that the machine should revert to SMB at the end of the six-year period when the estimated scrap value is nil. The lease is non-cancellable and interest rate implicit in the lease is 8%. Additional terms are inserted in the lease arrangement, whereby SMB will charge SMB 10% interest rate per annum for all outstanding lease payments. In addition, SMB will repossess the machine for three (3) consecutives of no lease payments. In the agreement, maintenance, and repairs rest with TMB. A lawyer fees of RM600 was paid to execute the arrangement. TMB classified the lawyer fees as immaterial. The machine is depreciated at 10% per annum. Required: a) Differentiate between Short Term Lease and Low Value Assets Lease according to MFRS 16 Lease. Illustrate both leases with an example. (6 Marks) b) Explain how TMB should account for the above arrangement with ACB and SMB. (4 Marks) C) Prepare a table for lease that TMB signed with SMB. The table should be prepared until the end of the lease term. (12 Marks) d) Prepare journal entries to record the two leases in the books of TMB from the year ended 31 December 2020 until 31 December 2024. Show all your workings. (20 Marks) e) Prepare TMB's extract of Statement of Profit or Loss and Statement of Financial Positions for the year ended 31 December 2020 until 31 December 2024. (8 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started