Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE NOTE!!! Proposal 1 : Book Value and Avg invested assets should BOTH be $150,000 Proposal 2 : IGNORE Salaries and Wages would decrease by

PLEASE NOTE!!!

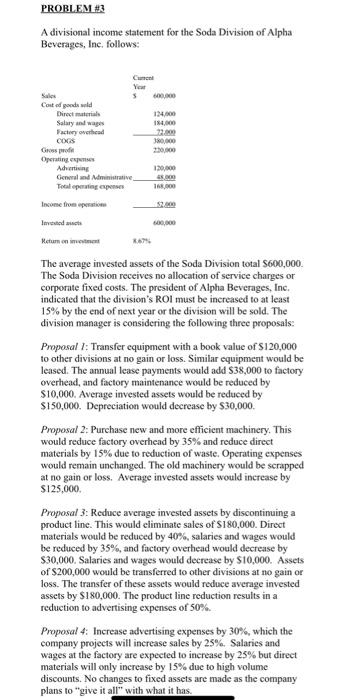

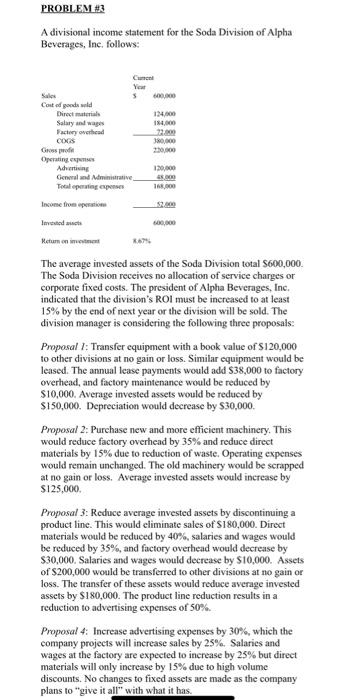

PROBLEM #3 A divisional income statement for the Soda Division of Alpha Beverages, Inc. follows: Cancel Year Sales 3 Costed and wild Direct materials 14.00 Salary and was 184.000 Factory overhad COES 380,000 Grossprode 230.000 Operating Aditing General and Ministrive Telewings 168,000 Income from Imed 600.000 The average invested assets of the Soda Division total $600,000 The Soda Division receives no allocation of service charges or corporate fixed costs. The president of Alpha Beverages, Inc. indicated that the division's ROI must be increased to at least 15% by the end of next year or the division will be sold. The division manager is considering the following three proposals. Proposal 1: Transfer equipment with a book value of $120,000 to other divisions at no gain or loss. Similar equipment would be leased. The annual lease payments would add $38,000 to factory overhead, and factory maintenance would be reduced by $10,000. Average invested assets would be reduced by S150,000. Depreciation would decrease by $30,000. Proposal 2: Purchase new and more efficient machinery. This would reduce factory overhead by 35% and reduce direct materials by 15% due to reduction of waste. Operating expenses would remain unchanged. The old machinery would be scrapped at no gain or loss. Average invested assets would increase by $125,000 Proposal 3: Reduce average invested assets by discontinuing a product line. This would eliminate sales of S180,000. Direct materials would be reduced by 40%, salaries and wages would be reduced by 35%, and factory overhead would decrease by $30,000. Salaries and wages would decrease by S10,000. Assets of $200,000 would be transferred to other divisions at no gain or loss. The transfer of these assets would reduce average invested assets by $180,000. The product line reduction results in a reduction to advertising expenses of 50% Proposal 4: Increase advertising expenses by 30%, which the company projects will increase sales by 25%. Salaries and wages at the factory are expected to increase by 25% but direct materials will only increase by 15% due to high volume discounts. No changes to fixed assets are made as the company plans to give it all with what it has. Required: 1. Compute the return on investment for the current year. 2. Prepare forecasted income statements and compute average invested assets for each proposal. Each proposal is independent of the other three proposals. 3. Compute the return on investment for each proposal. 4. Which of the four proposals should the Beverage Division pursue Proposal 1 : Book Value and Avg invested assets should BOTH be $150,000

Proposal 2 : IGNORE "Salaries and Wages would decrease by 10,000" instead, just use the 35% reduction to salaries and wages.

Thank you!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started